Trade Results

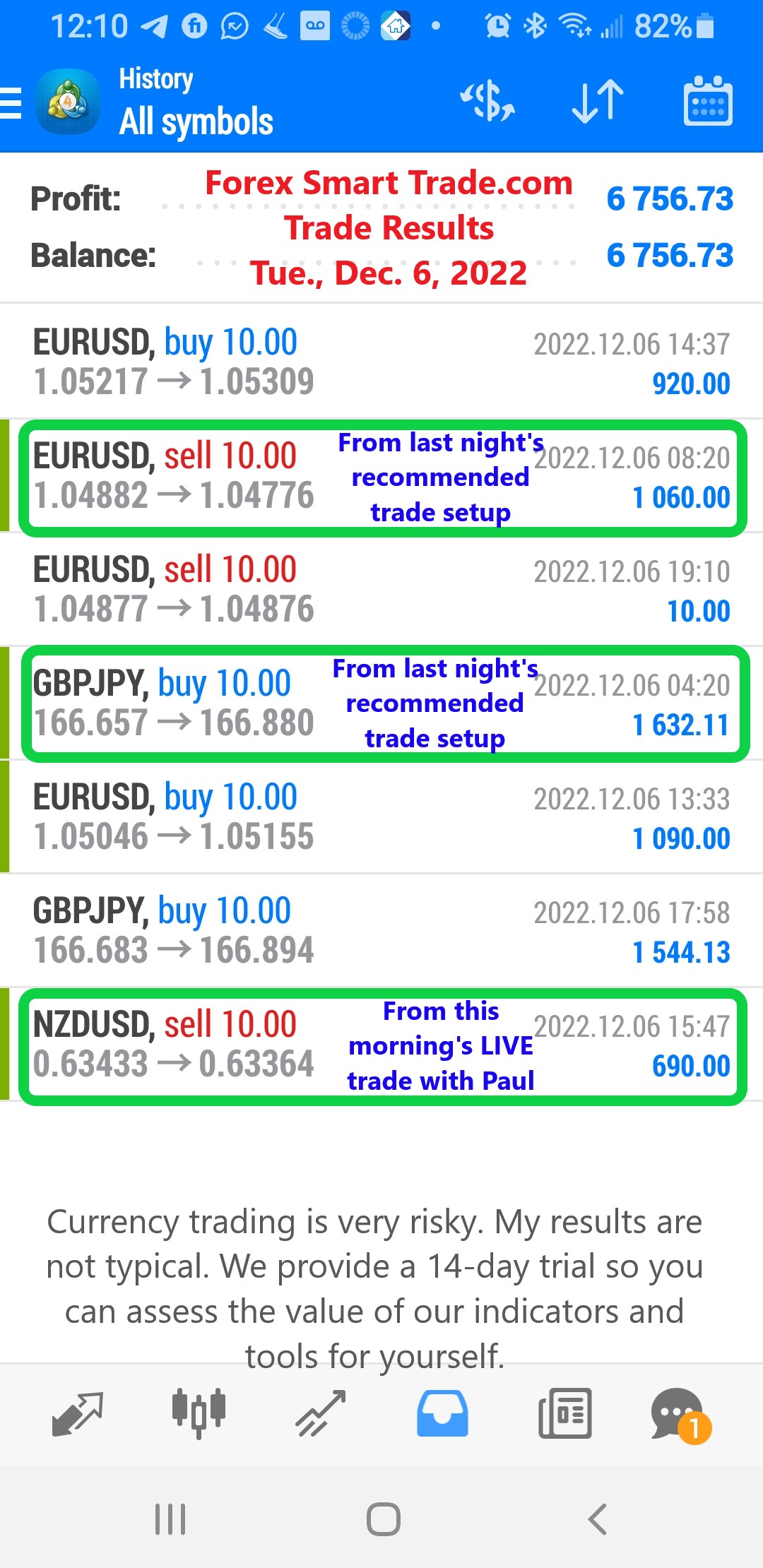

Forex Smart Trade Results Tuesday, Dec. 6, 2022 – $6,756

Be Careful of Price Manipulation. Potential conflicts of interest arise from the lack of transparency in the pricing of FX contracts. It is not always clear whether someone […]

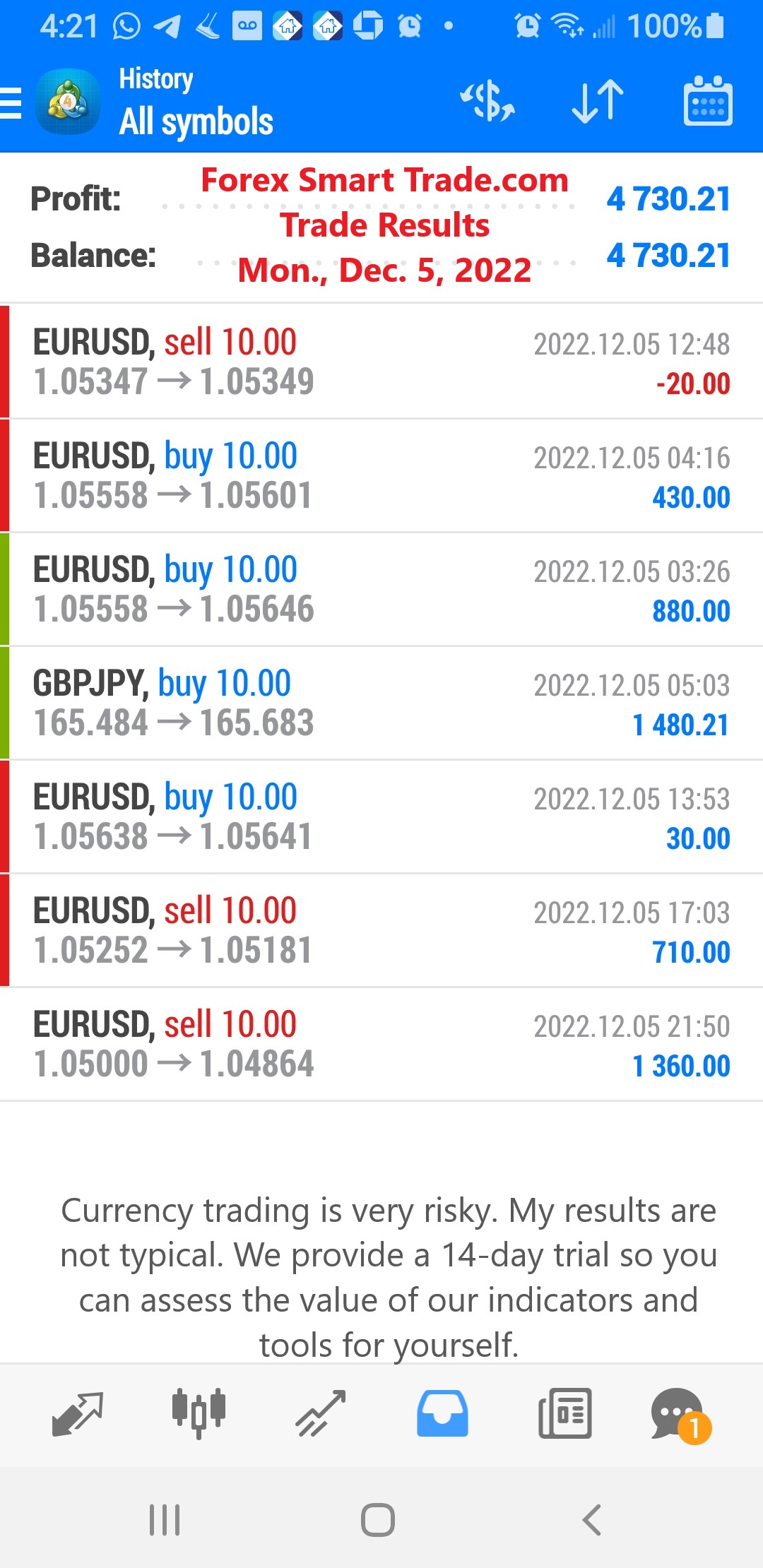

Forex Smart Trade Results Monday, Dec. 5, 2022 – $4,730

Liquidity Providers Every reputable forex broker displays to YOU “their” price based on what liquidity they have access to. What liquidity they have access to depends on […]

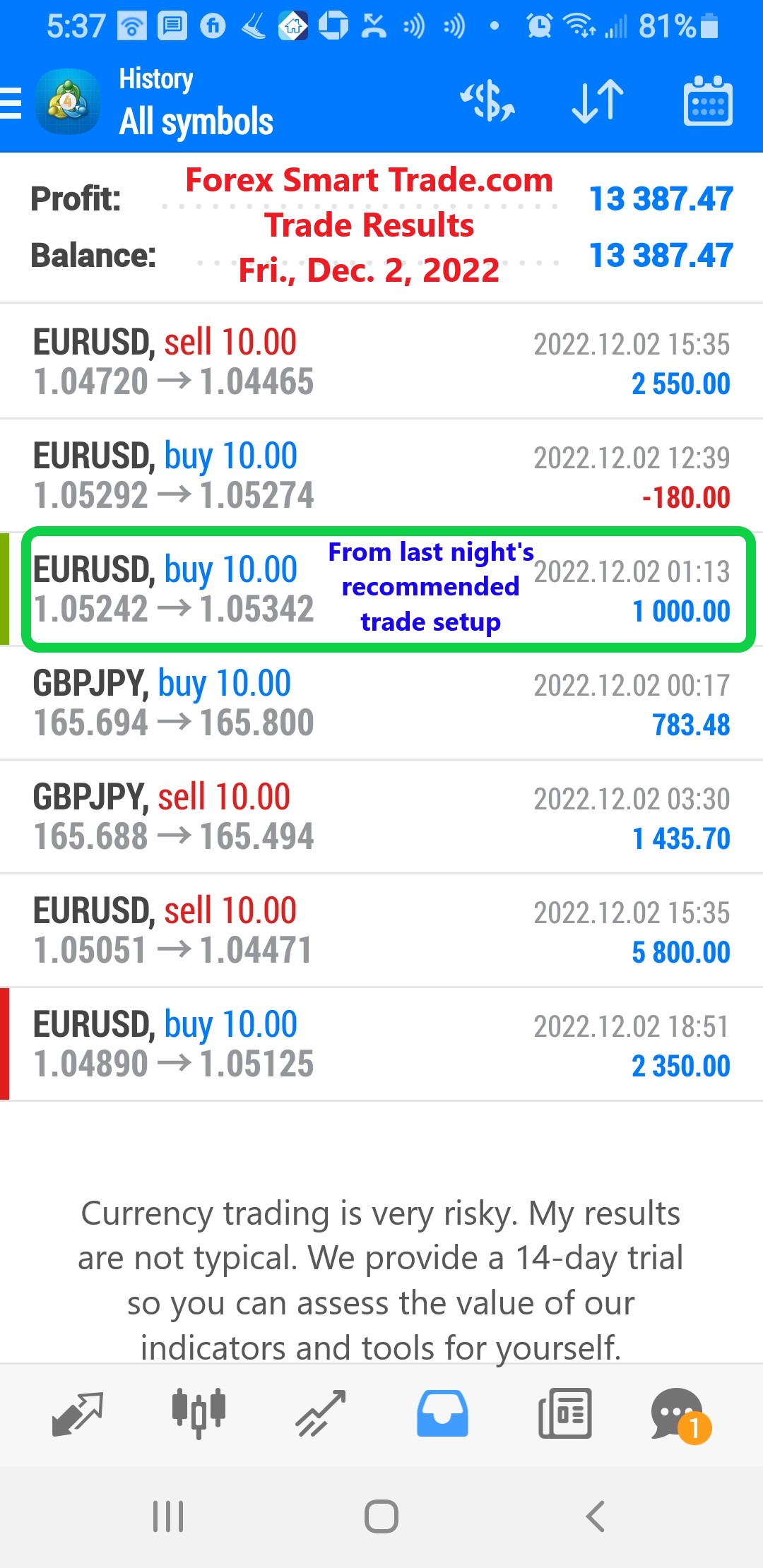

Forex Smart Trade Results Friday, December 2, 2022 – $13,387

How Retail Forex Brokers Source Their Prices. Let’s take a look at how retail forex brokers source their prices. Reputable forex brokers will base their prices […]

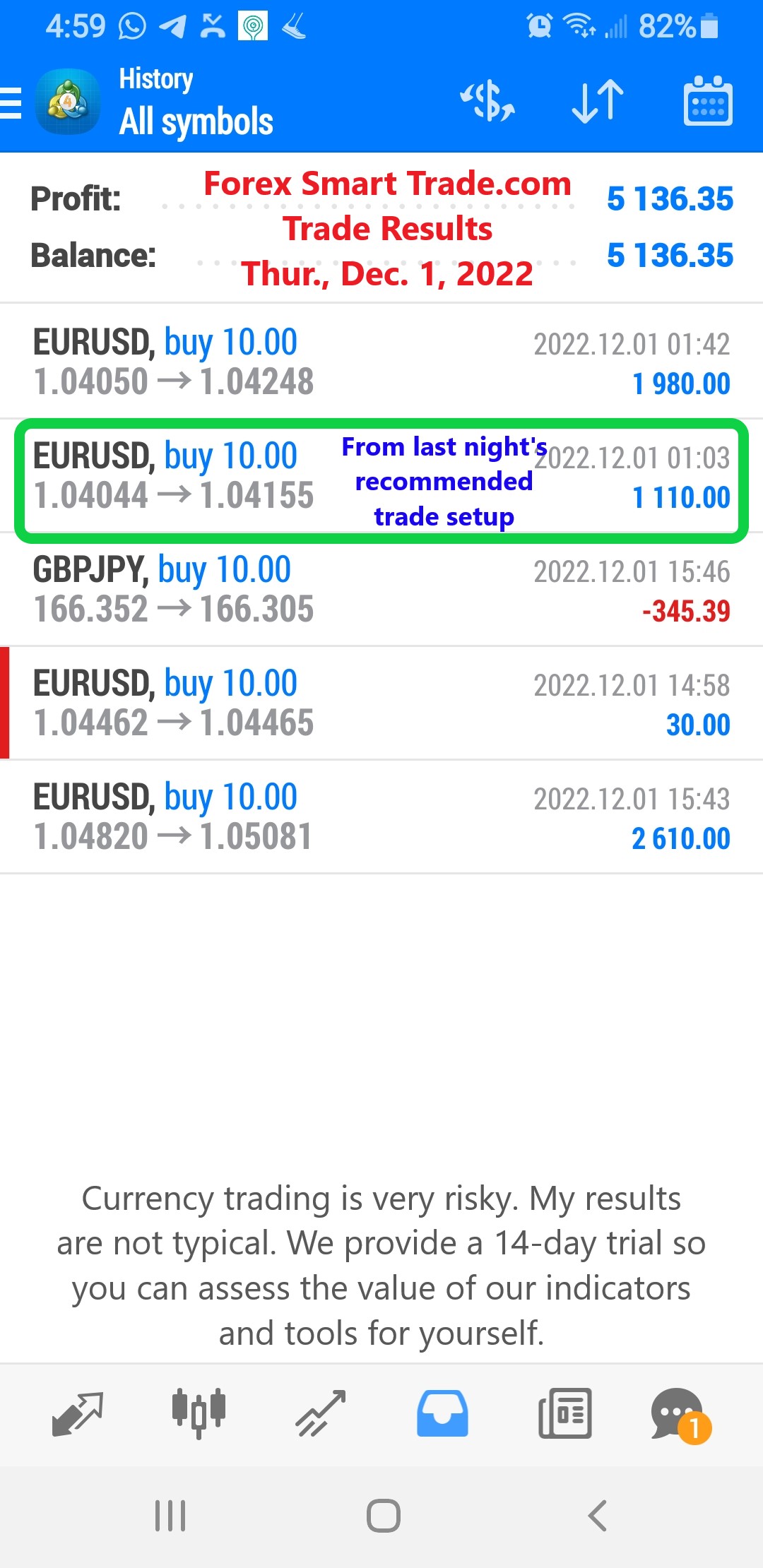

Forex Smart Trade Results Thursday, December 1, 2022 – $5,136

How Pricing Works in the Forex Market. Let’s look at how pricing works in the forex market. In an exchange-based market, there is a “single market” […]

Forex Smart Trade Results Wednesday, Nov. 30, 2022 – $10,027

How Pricing Works on Exchanges. To help you better understand why it’s important to understand the significance of the FX market being an OTC market, let’s […]

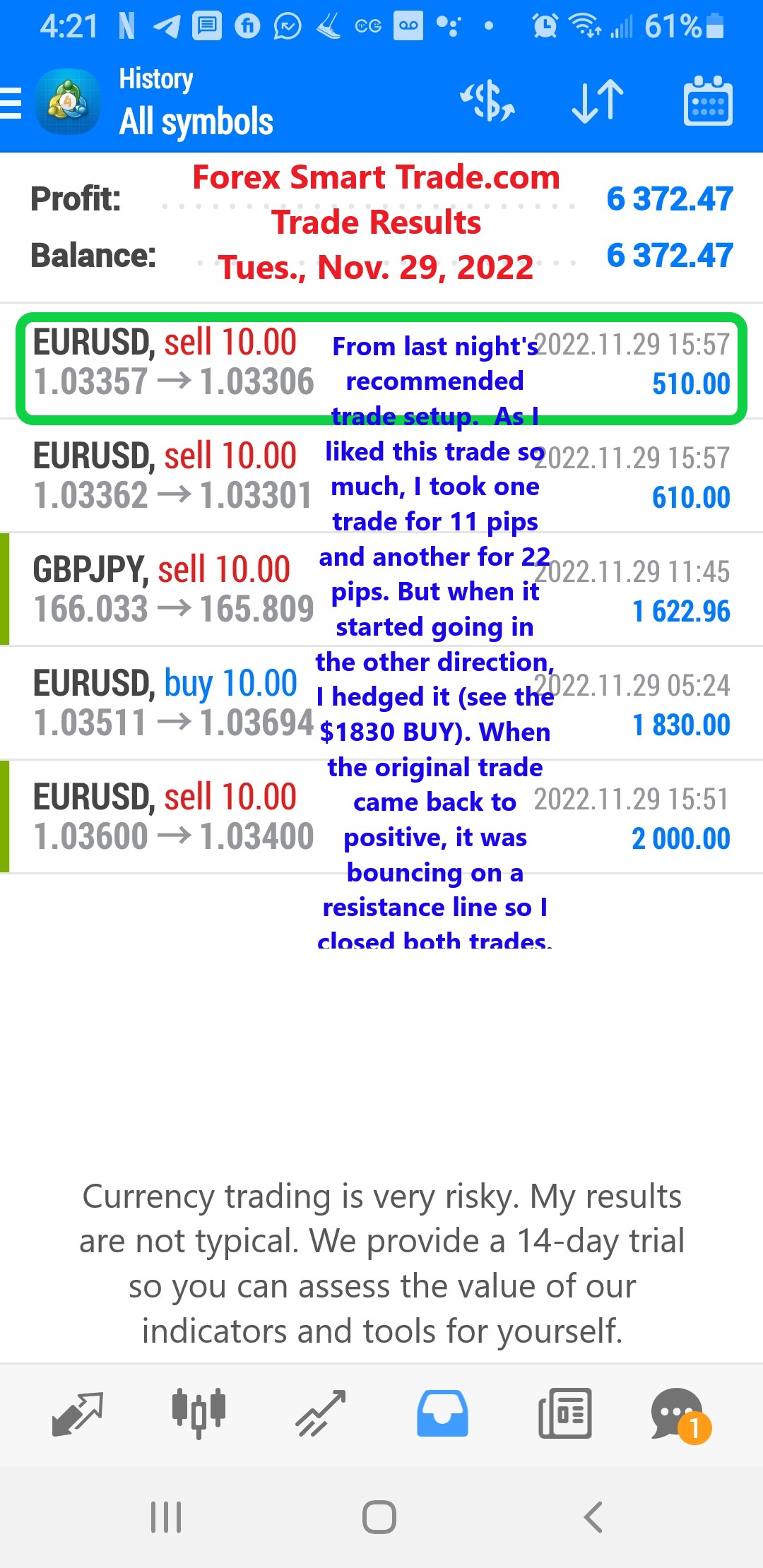

Forex Smart Trade Results Tuesday, Nov. 29, 2022 – $6,372

Where Does the Forex Broker’s Price Come From? Now let’s take a look at where does the forex broker’s price come from. When trading forex, you […]

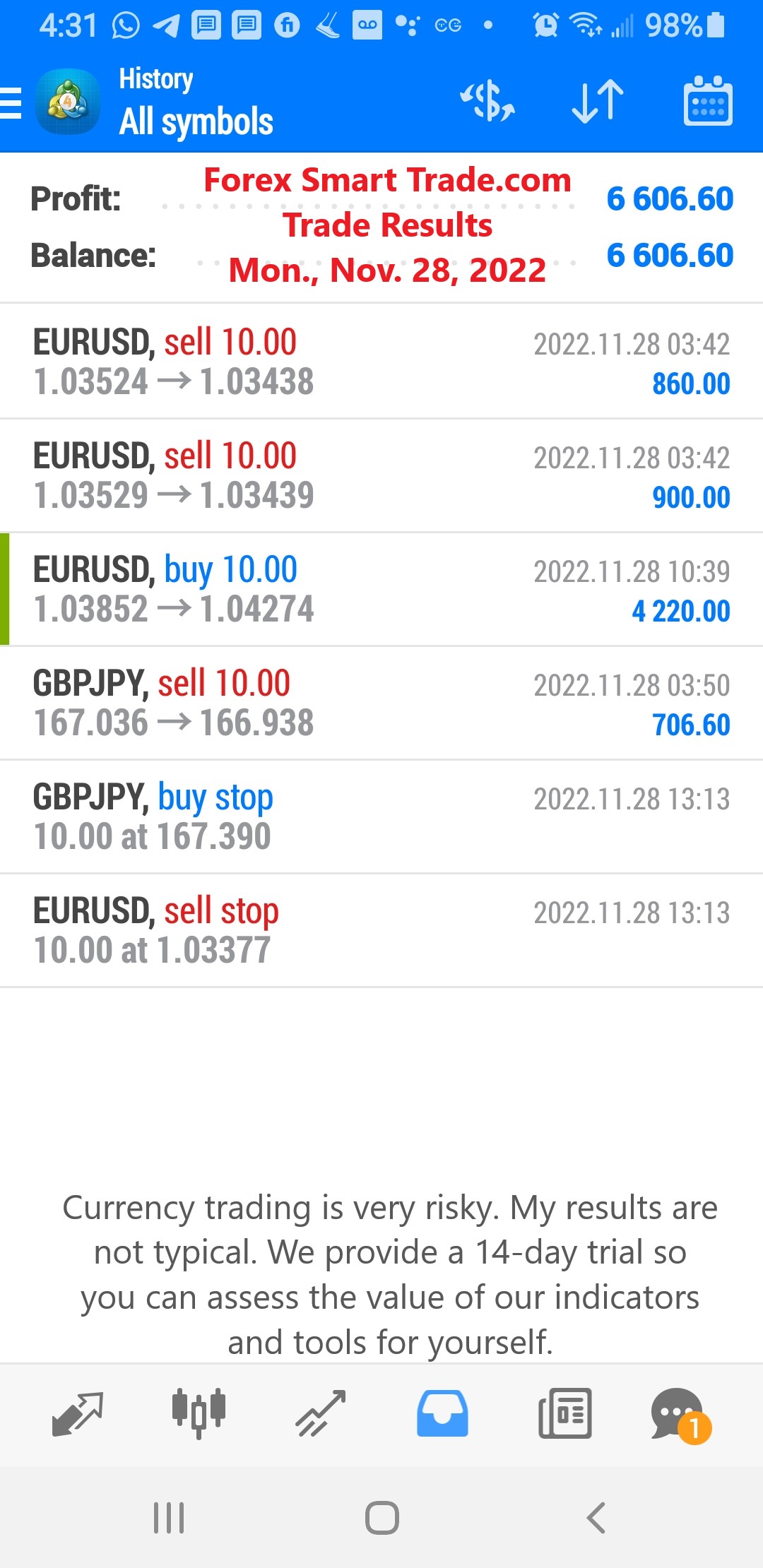

Forex Smart Trade Results Monday, Nov. 28, 2022 – $6,606

Your Broker’s Hedging Policy. What is your broker’s hedging policy? Ask your broker for a written copy of its hedging policy. The hedging policy outlines the […]

Forex Smart Trade Results Friday, Nov. 25, 2022 – DAY AFTER THANKSGIVING – NO TRADES

Know Your Forex Broker’s Hedging Policy Do you know your forex broker’s hedging policy? For every forex broker, each and every trade entered into by its customers […]

Forex Smart Trade Results Thurs., Nov. 24, 2022 – THANKSGIVING Holiday – Didn’t Trade

Reverse Hedge. Another variant of C-Booking is the reverse hedge which is when a customer’s trades are either partially or completely reverse hedged. This practice is […]

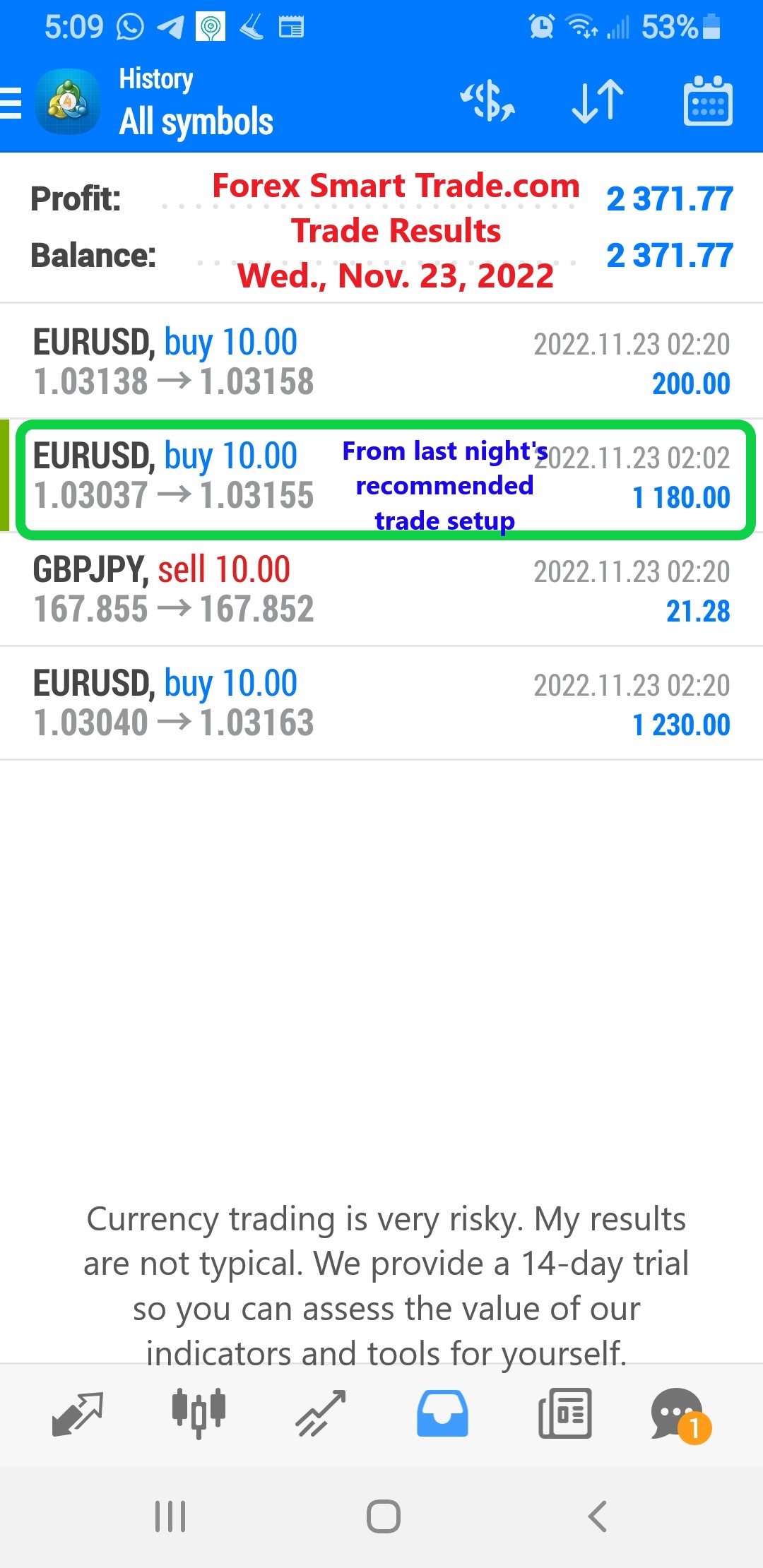

Forex Smart Trade Results, Wednesday, Nov. 23, 2022 – $2,371

Over-hedge. Let’s take a look at what an over-hedge is. C-Booking is not limited to partial hedging. Another variant of C-Booking is when a broker can […]

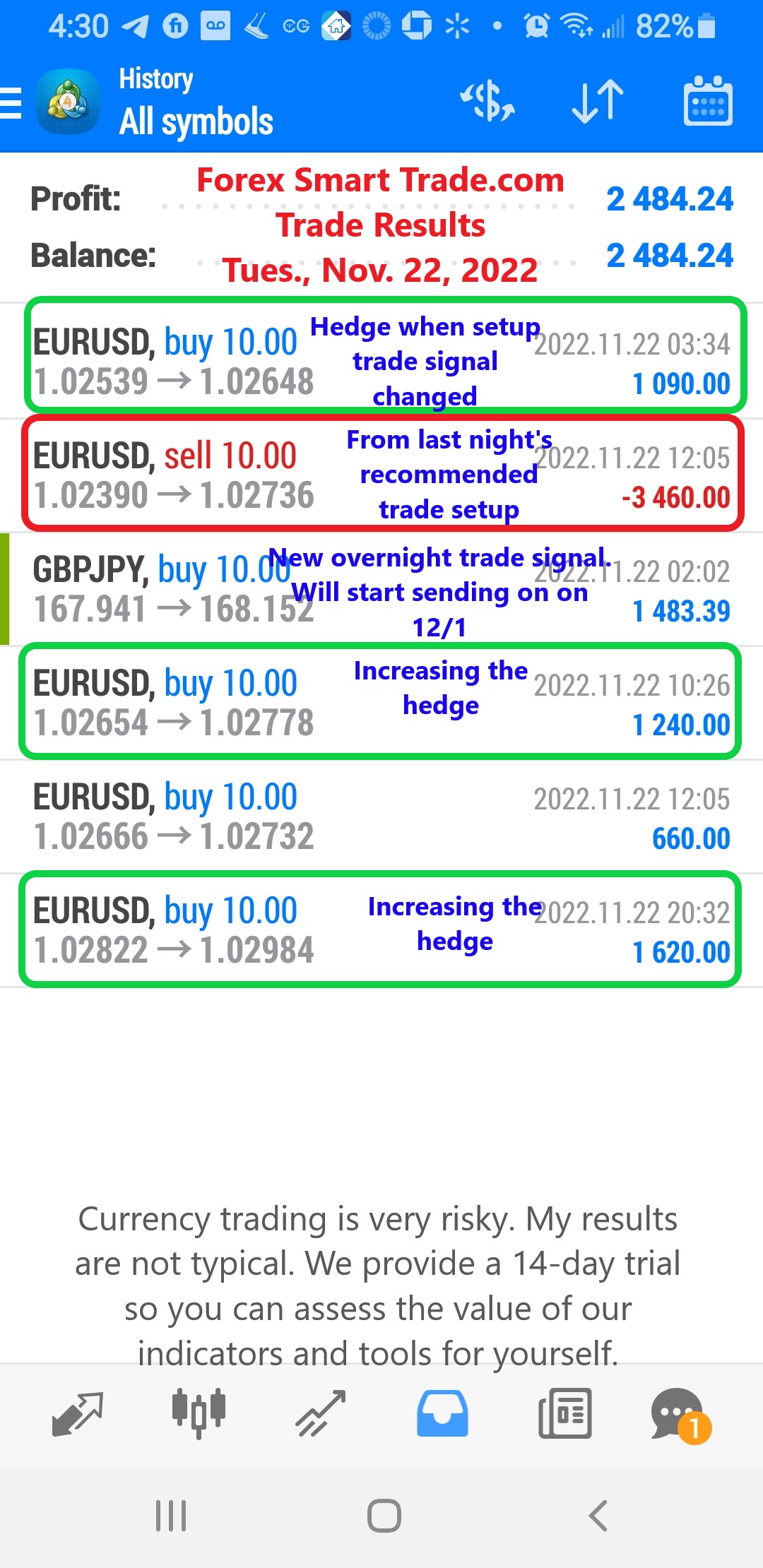

Forex Smart Trade Results Tuesday, Nov. 22, 2022 – $2,484

Partial Hedge. The most common form of “C-Book execution” is the partial hedge of a customer’s order. A broker can hedge market risk in part and not […]

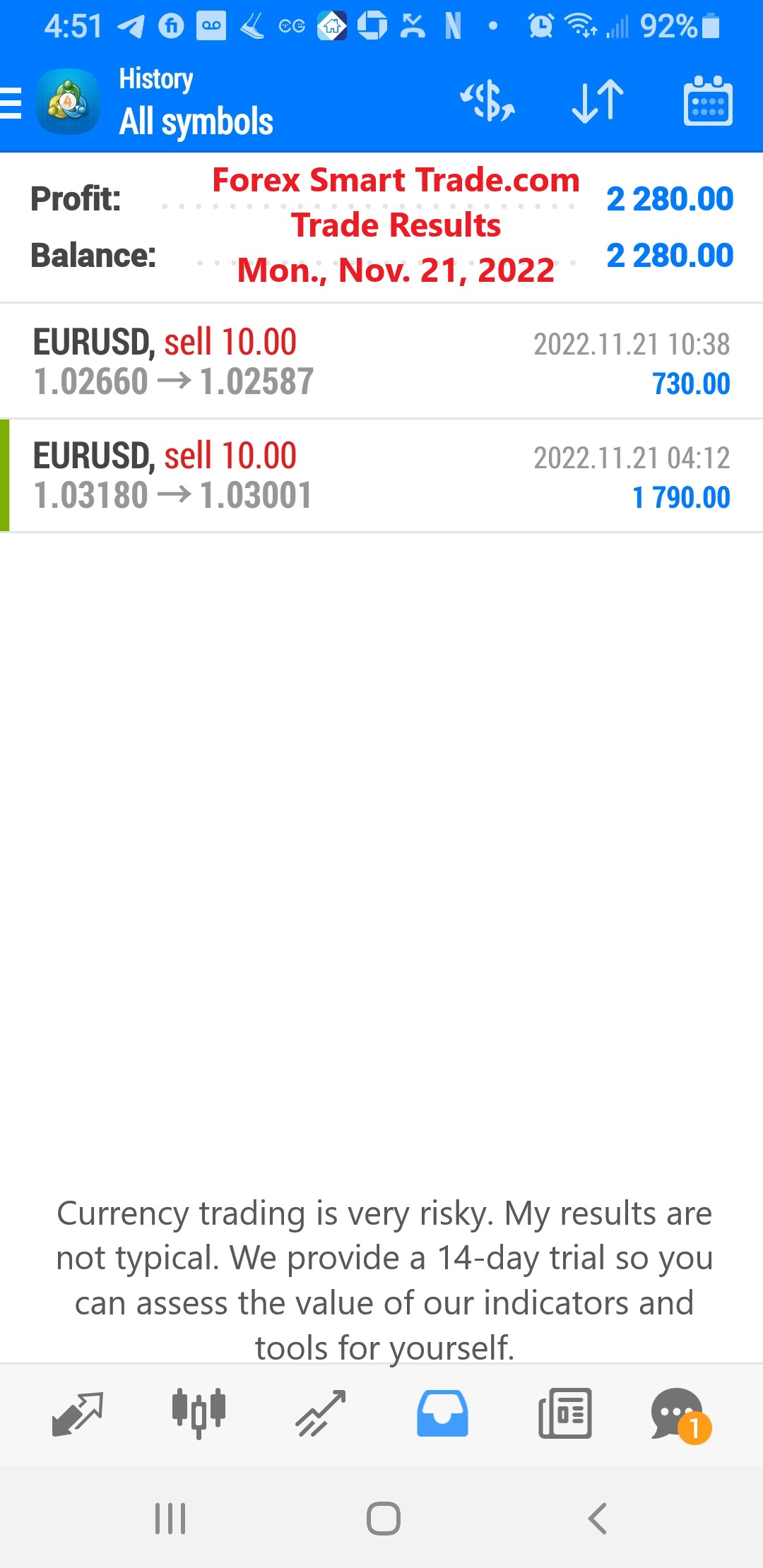

Forex Smart Trade Results November 21, 2022 – $2,280

C-Book and How Forex Brokers Manage Their Risk. Now let’s take a look at C-Book and how forex brokers manage their risk using it. Aside from […]

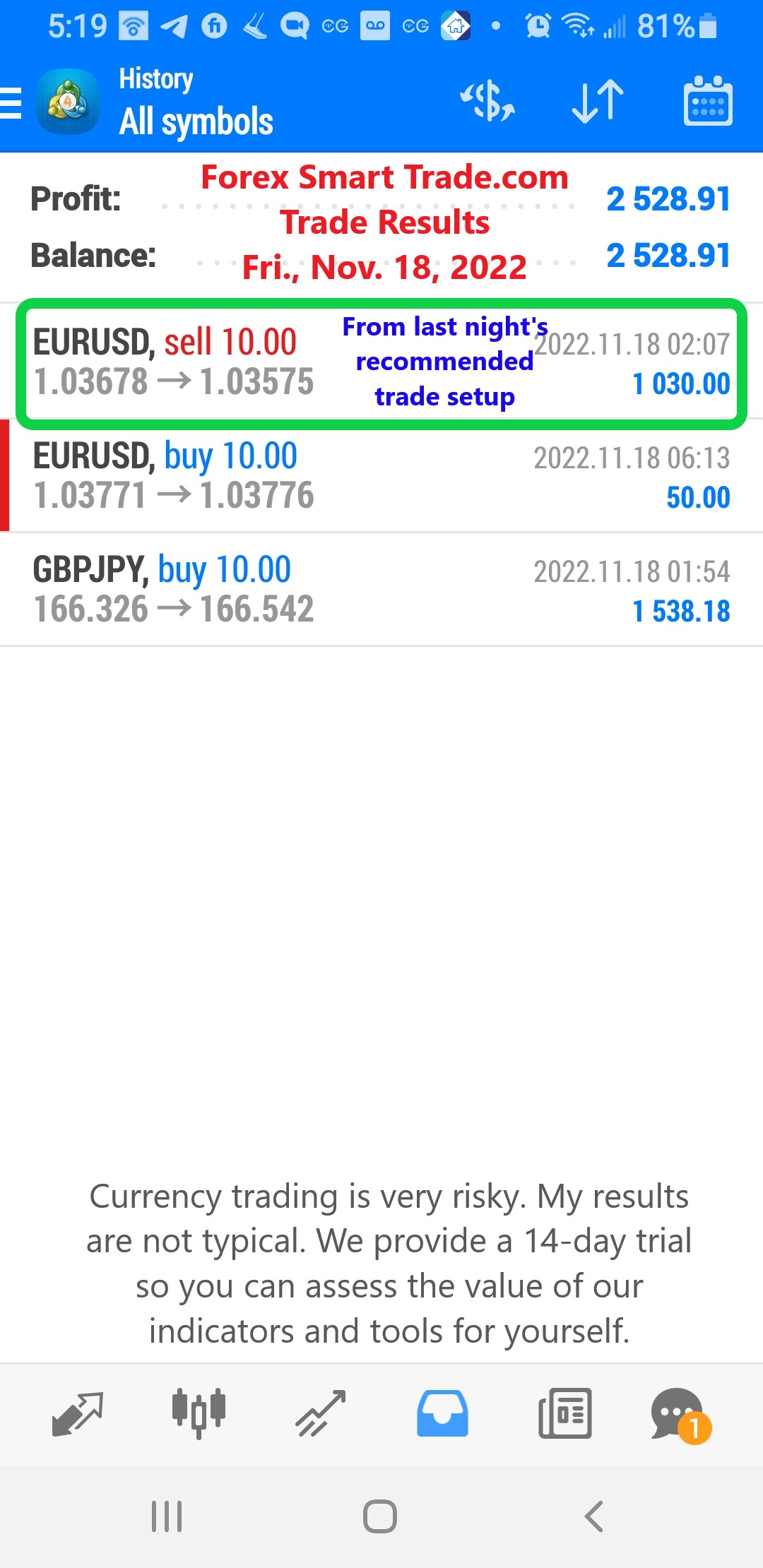

Forex Smart Trade Results November 18, 2022 – $2,528

Most Forex Brokers Use a Hybrid Approach. Most forex brokers use a hybrid approach. We don’t see anything wrong with a broker operating both A-Book and […]

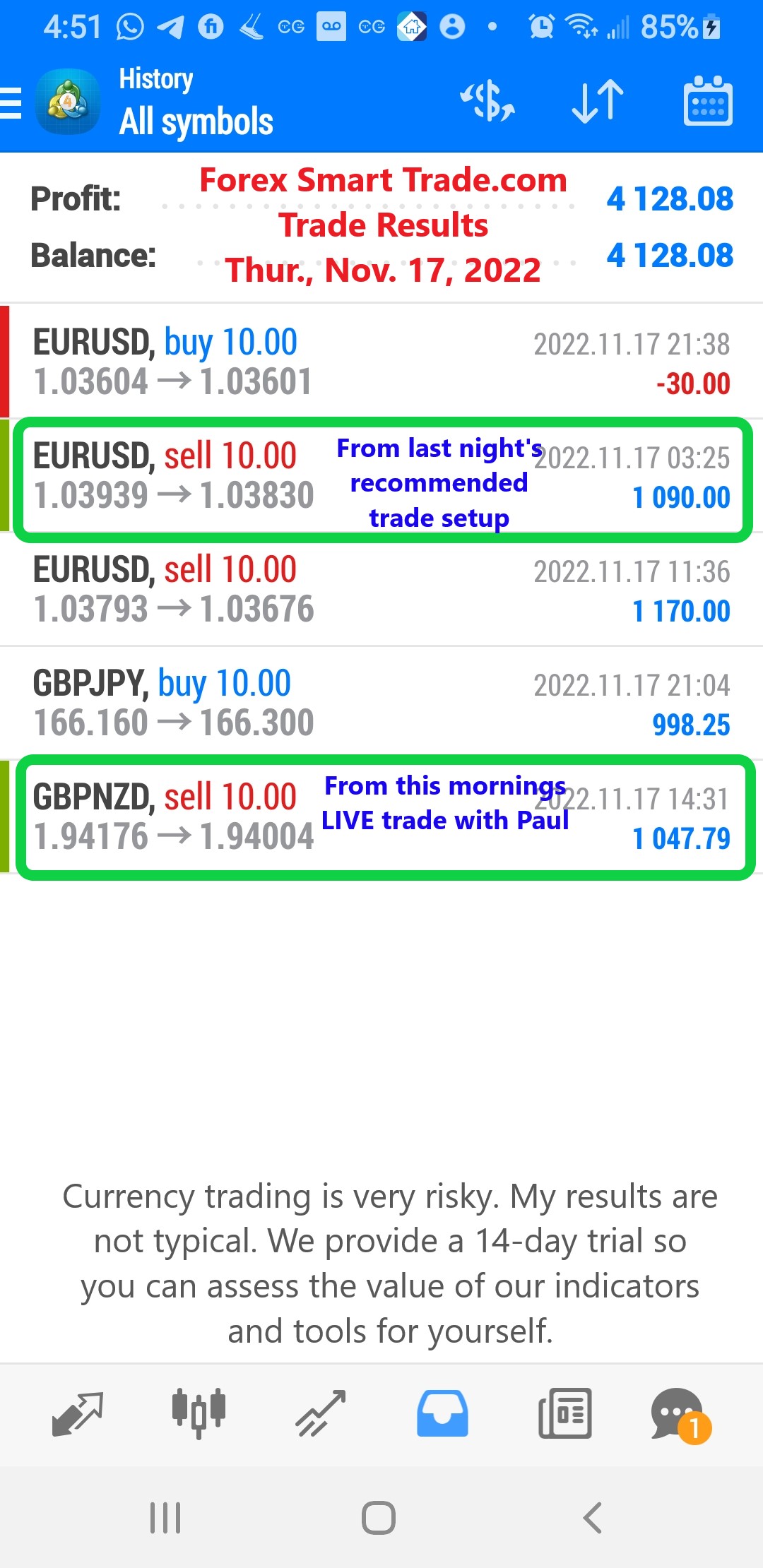

Forex Smart Trade Results November 17, 2022 – $4,128

Large Forex Brokers. For larger forex brokers, because they have many customers opening trades in both (long and short) directions, they are able to internally offset […]

Forex Smart Trade Results November 16, 2022 – TRAVELING NO TRADES TODAY

Customer Profiling in the Hybrid Model. Let’s look at customer profiling in the hybrid model. The forex broker has to decide which customers go to A-book […]

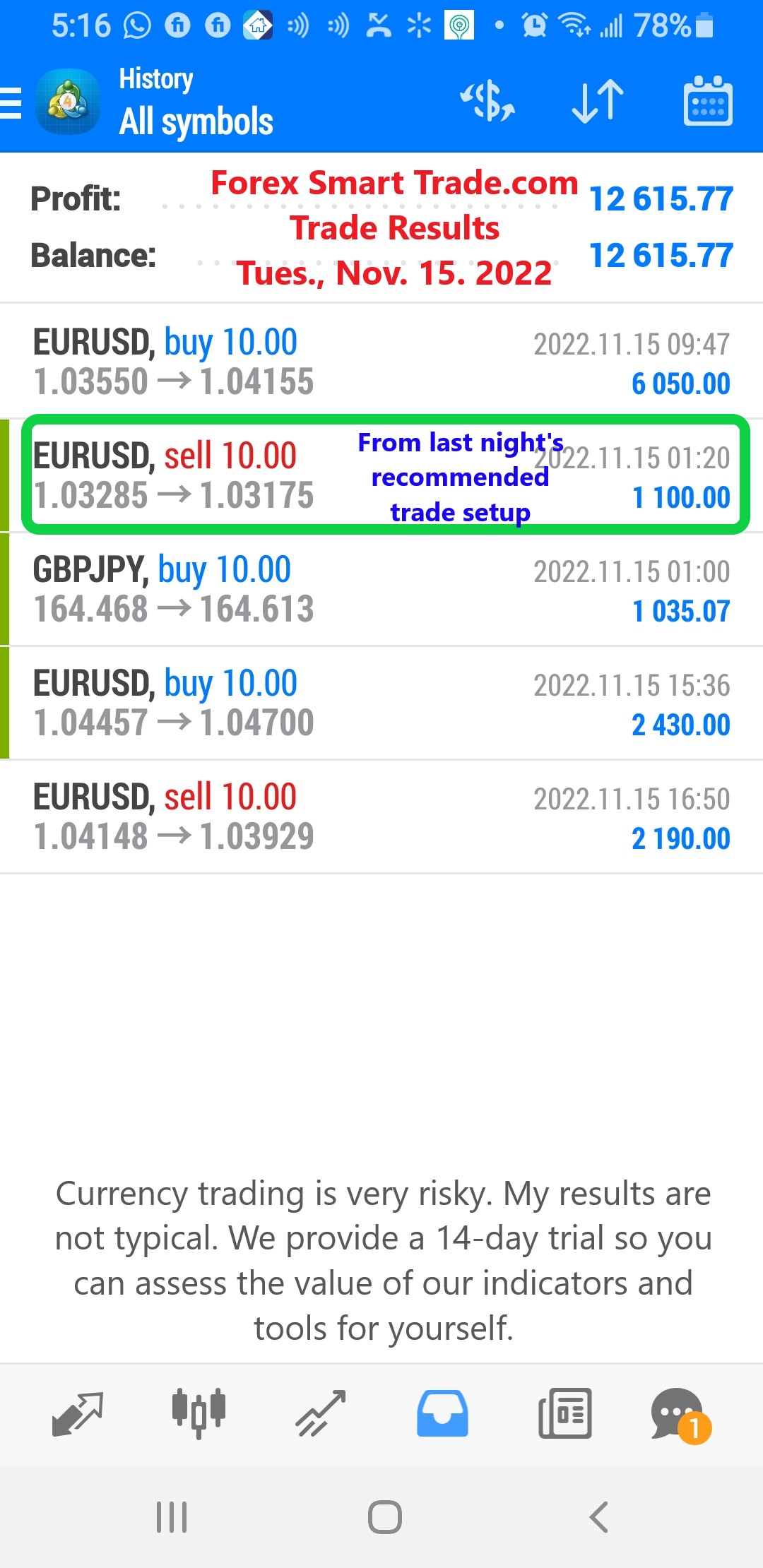

Forex Smart Trade Results November 15, 2022 – $12,615

The “Hybrid Model” Used By Forex Brokers. Let’s review the hybrid model used by forex brokers. In the previous lesson, we talked about why forex brokers are […]

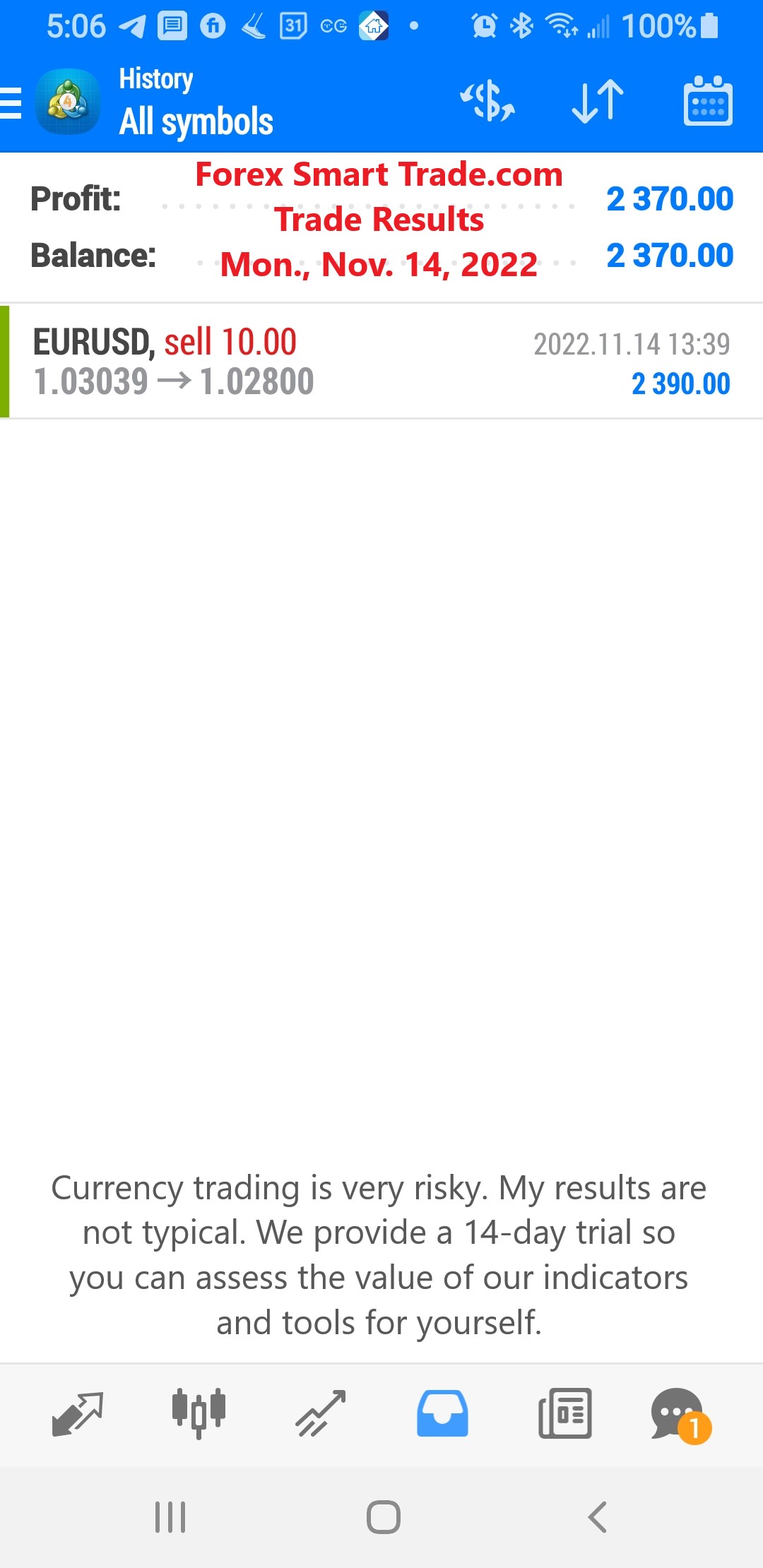

Forex Smart Trade Results November 14, 2022 – $2,370

What B-Book Brokers Don’t Like. Customers Who Win Consistently B-Book brokers don’t necessarily like customers who win consistently. These customers will grow their account balance over time. […]

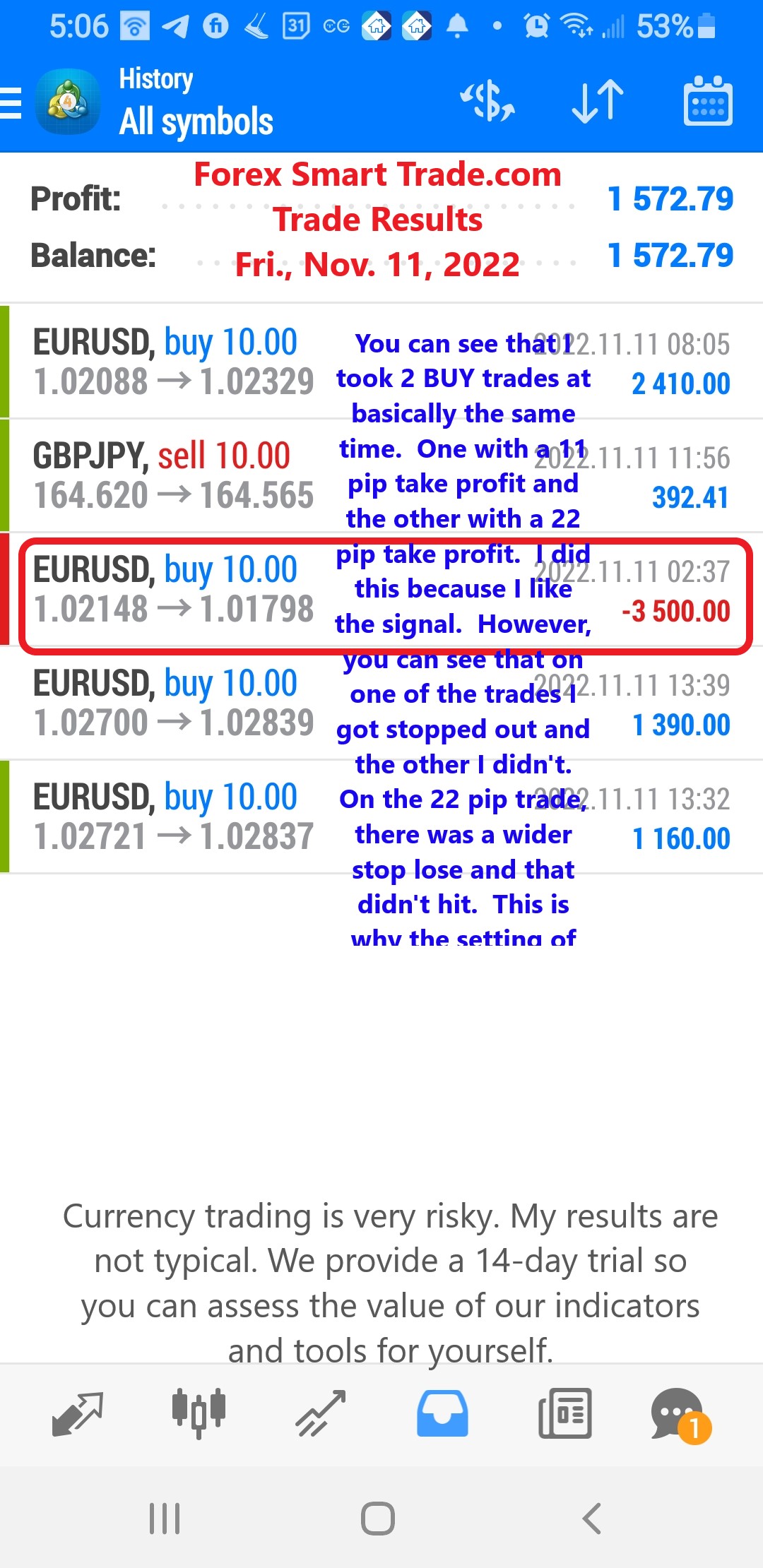

Forex Smart Trade Results November 11, 2022 – $1,572

What B-Book Brokers Like. A large number of similarly sized customers. B-Book brokers prefer to have a lot of similarly sized customers who trade as frequently as […]

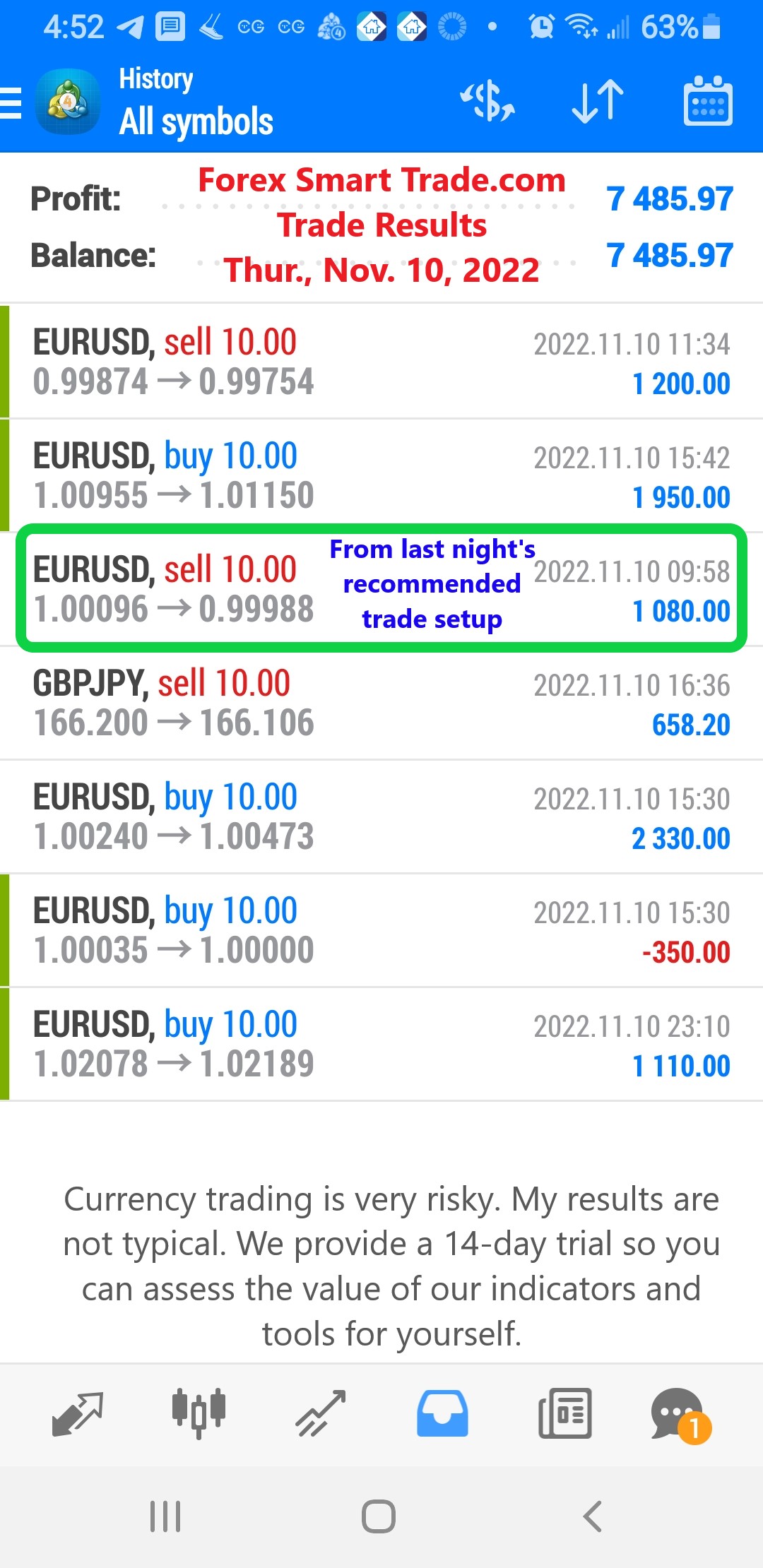

Forex Smart Trade Results November 10, 2022 – $7,485

How B-Book Brokers Make Money. You buy from the broker and sell to the broker. If you make money, the broker loses money, and vice versa. […]

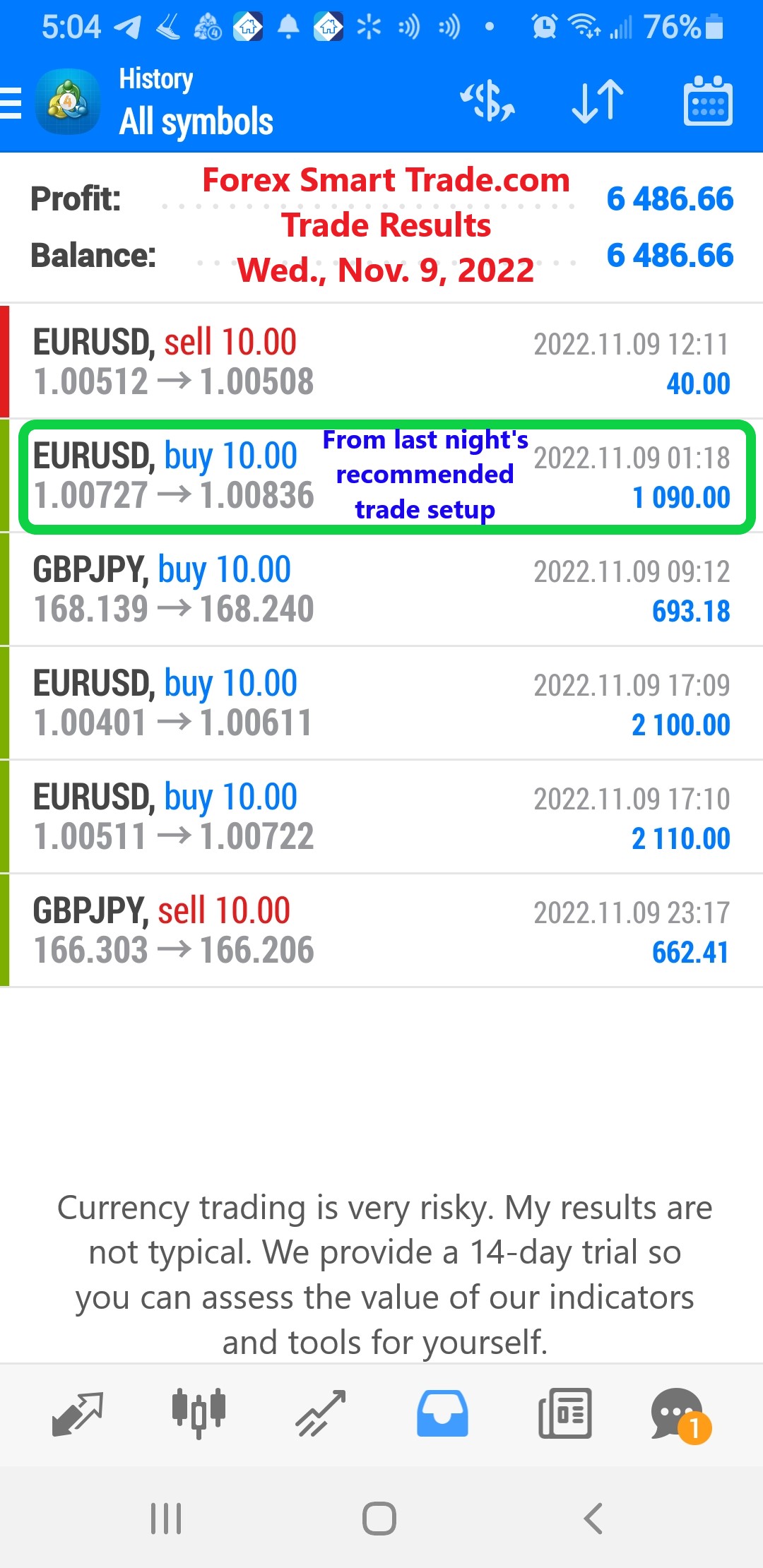

Forex Smart Trade Results November 9, 2022 – $6,486

Why Do Forex Brokers B-Book? Let’s take a look at why do forex brokers B-Book? And let’s start with the question, what is a B-Book broker? […]

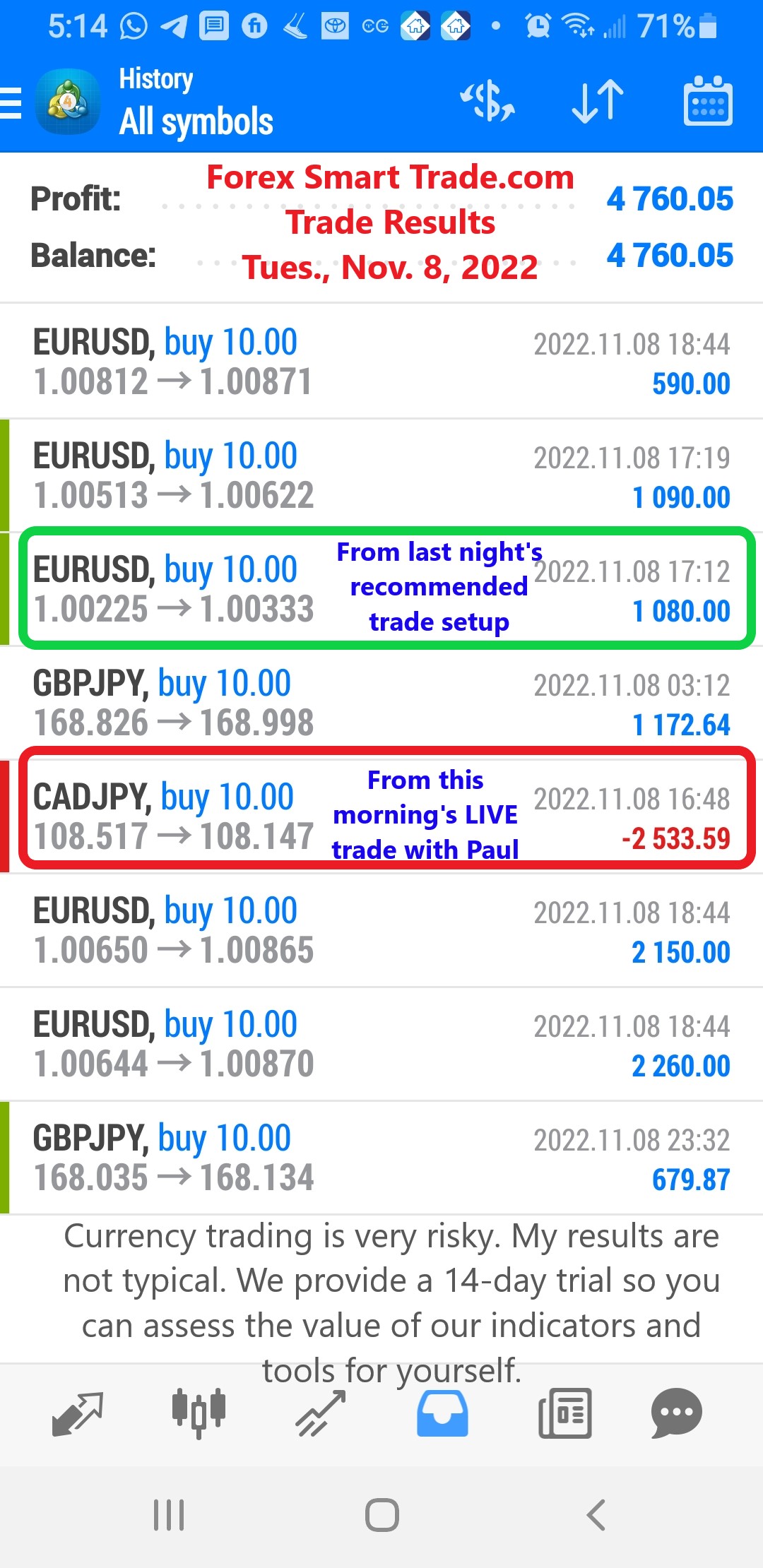

Forex Smart Trade Results November 8, 2022 – $4,760

Managing Residual Risk. Let’s look at managing residual risk from a forex broker’s perspective. They can manage it in two ways: The broker can transfer this […]