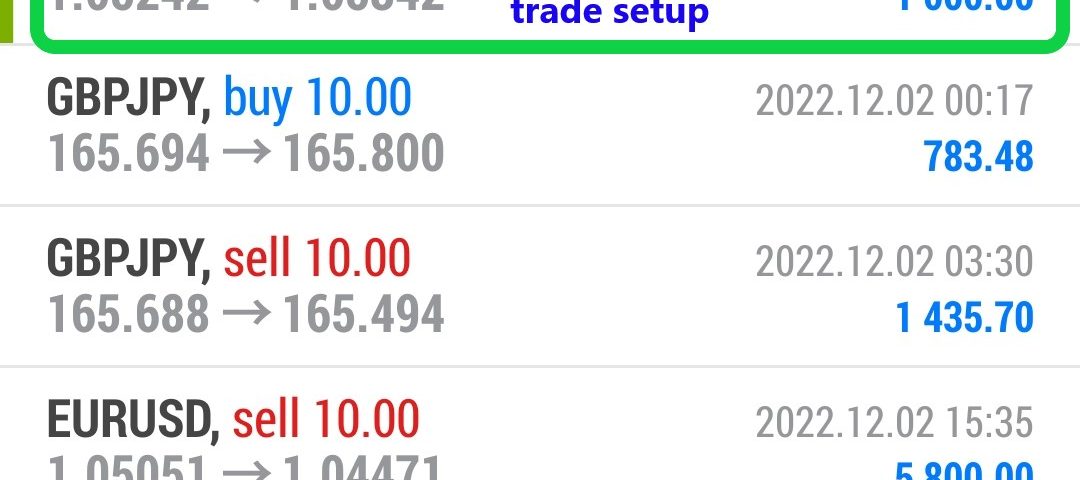

Forex Smart Trade Results Friday, December 2, 2022 – $13,387

Forex Smart Trade Results Thursday, December 1, 2022 – $5,136

December 5, 2022

Forex Smart Trade Results Monday, Dec. 5, 2022 – $4,730

December 15, 2022How Retail Forex Brokers Source Their Prices.

Let’s take a look at how retail forex brokers source their prices.

Reputable forex brokers will base their prices on the prices of other FX participants, usually banks and other non-bank financial institutions (NBFIs) from the institutional FX market.

We know these market participants as liquidity providers (LPs).

Liquidity Pool

A group of liquidity providers (LPs) is known as a liquidity pool.

It is these prices that the forex broker uses as a REFERENCE price of an underlying currency pair. Or at least, should be used.

As mentioned earlier, a forex broker will quote you two different prices for a currency pair: the bid and ask price.

You see these quotes on your trading platform (or “customer terminal”). We know these quotes arriving as a “price stream”.

The price that YOU see is based on prices that your broker obtains from these liquidity providers.

The broker has a pool of multiple LPs from which it receives pricing for the various currency pair it offers.

The forex broker aggregates or collects these prices in real-time to find the best available bid and ask price.

Both prices do not necessarily have to come from the same LP. For example, the best available bid price may come from one LP, while the best available ask price may come from another LP.

Pricing Engine

They fed the aggregated prices into a “pricing engine” that streams prices (your “price stream“) to your trading platform.

The price that YOU see will usually have a markup added (unless you’re paying commission).

Theoretically, this should all be an automated process where the broker has neither control over the selection of the best price from the pool of liquidity providers (LPs) nor can it manually intervene to alter any prices streamed to the trading platform (aside from adding a markup).

Just because two traders use the same broker, it doesn’t automatically mean they both see the same bid and ask prices in their price stream. We may quote different customers different prices. It depends on how brokers profile their customers and if they configured the price engine to vary pricing by profile. We know this as “price discrimination“. Ask your broker if it price discriminates between customers.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.