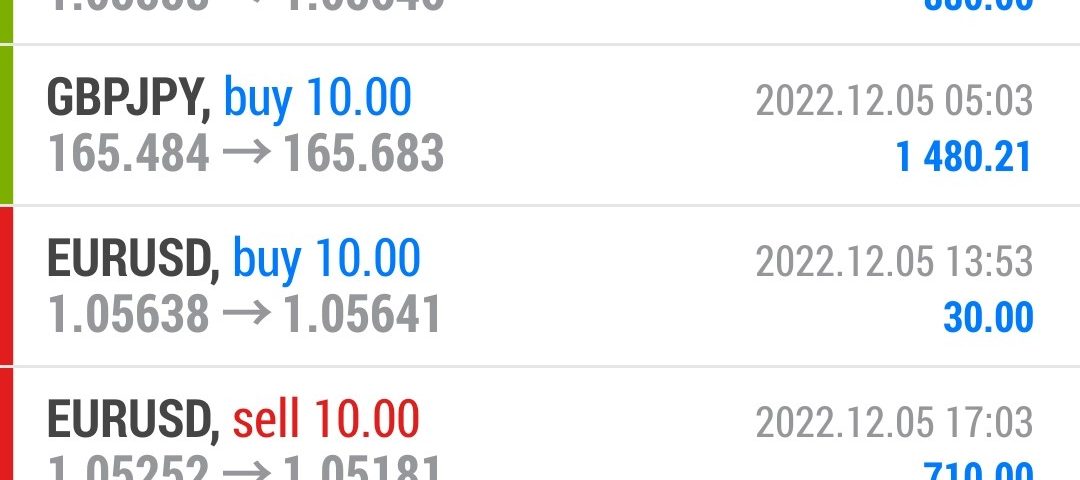

Forex Smart Trade Results Monday, Dec. 5, 2022 – $4,730

Forex Smart Trade Results Friday, December 2, 2022 – $13,387

December 5, 2022

Forex Smart Trade Results Tuesday, Dec. 6, 2022 – $6,756

December 15, 2022Liquidity Providers

Every reputable forex broker displays to YOU “their” price based on what liquidity they have access to.

What liquidity they have access to depends on their liquidity providers (LPs).

Forex brokers who are large enough to have a prime broker (PB) can access a mix of different liquidity providers such as Tier-1 banks, ECNs, and aggregators.

Most of the global FX liquidity is provided by large banks with dedicated FX departments and are referred to as “Tier-1” liquidity providers.

This “Tier 1” group of liquidity providers is made up of names such as:

Bank of America, Barclays, BNP Paribas, Citi, Commerzbank, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, J.P Morgan, Nomura, Société Générale, and UBS.

By connecting themselves to multiple LPs, these larger forex brokers can improve their prices and offer their customers the best available bid and best ask prices from among the LPs.

How?

Streaming Bid & Ask Prices

When multiple liquidity providers stream their bid and ask prices, the broker’s “price engine” selects the best bid and ask price.

This results in the best available spread.

Theoretically, the collective trading volume of the broker’s customers encourages price competition among the LPs.

Each LP is competing to be the forex broker’s hedging counterparty, so this provides the leverage to demand better pricing.

Having multiple liquidity providers is also important, especially during abnormal market conditions,

These include times of extreme volatility.

Or when some liquidity providers may decide to widen the spreads or stop quoting prices altogether.

For A-Book brokers, this is crucial since their execution model totally depends on liquidity providers being available to provide quality liquidity even during volatile or illiquid market conditions.

Available Liquidity

Smaller forex brokers source their pricing by connecting to an aggregated liquidity feed provided by a Prime of Prime (“PoP”).

And sometimes they do this in conjunction with other non-bank liquidity providers (“NBLPs”) who are known as “electronic market makers”.

Examples of electronic market makers that are active in the FX markets are:

XTX Markets, Citadel Securities, Virtu Financial, Global Trading Systems, HC Technologies, and Jump Trading.

PoP providers have prime broker (PB) relationships with major banks which give them the ability to aggregate prices from multiple LPs and distribute them to smaller forex brokers.

Do you see bank logos on a forex broker’s website?

If you see the logos of the big banks (Barclays, Citi, UBS, etc.) displayed on a retail forex broker’s website, don’t believe the hype.

Due to their small size, most retail forex brokers don’t have direct relationships with these “Tier 1” liquidity providers.

Only the largest forex brokers with PB relationships can claim this.

The rest have to rely on a PoP and it is the PoP, not the broker, who should be displaying the bank logos.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.