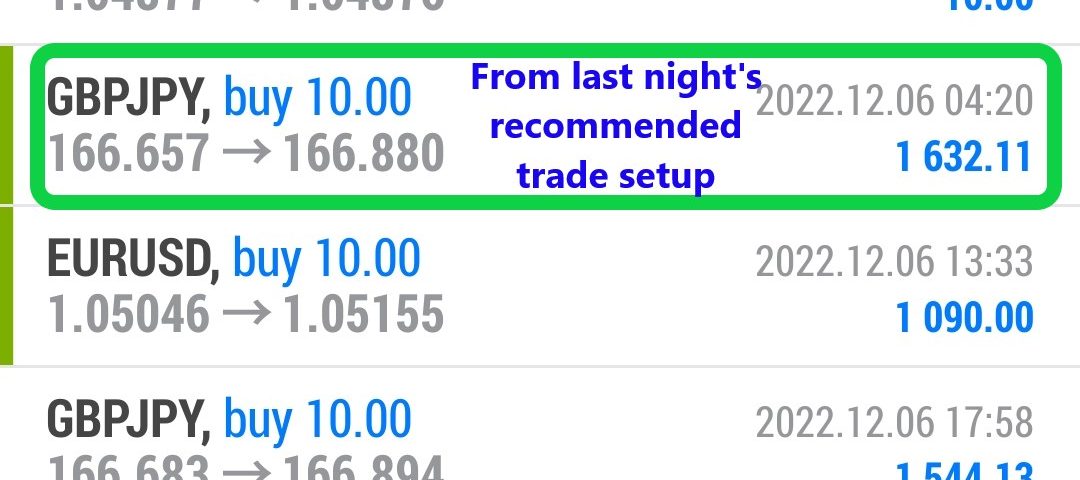

Forex Smart Trade Results Tuesday, Dec. 6, 2022 – $6,756

Forex Smart Trade Results Monday, Dec. 5, 2022 – $4,730

December 15, 2022

Forex Smart Trade Results Wednesday, Dec. 7, 2022 – $9,243

December 15, 2022Be Careful of Price Manipulation.

Potential conflicts of interest arise from the lack of transparency in the pricing of FX contracts.

It is not always clear whether someone actually linked the pricing to an underlying market and it’s hard to verify.

Your forex broker may establish its prices by offering quotes from third-party prices.

But the broker is under no obligation to do so or to continue to do so.

Some forex brokers may even require their customers to acknowledge that the reference prices used to determine the value of the underlying asset (e.g. currency pairs) may differ from the price available in the market.

As a consequence, traders often find it difficult to verify the accuracy of the prices shown to them on the broker’s trading platform.

For example, you can see the prices on your trading platform that your broker quotes.

But unless you also have other trading platforms open from other brokers, it’s hard to compare quotes.

This makes any open or pending positions vulnerable to price manipulation.

Price Manipulation

For example, traders have complained of forex brokers altering prices at their own discretion to either cancel a winning trade to avoid payout or close trades to realize customer losses.

Volatile market conditions provide the perfect opportunities for price manipulation and “stop hunting”.

This is where a broker closes a trader’s position to make a profit for himself.

If you place stop-loss or take-profit orders, the broker knows exactly where these orders are.

With that, it can manipulate its so-called “market price” to hit your stop-loss or miss your take-profit price.

This means the broker wins or avoids a loss.

Shady Practices

While this practice is not as common as it once was, it still continues with shady brokers who operate in unregulated or minimally regulated jurisdictions.

If a broker is under a regulatory jurisdiction with minimal (or no) transaction reporting requirements, it can be very hard to prove, which is why it still continues today.

Another complaint involves brokers engaging in asymmetric slippage practices.

“Slippage” refers to instances where the price at which they executed the order differs from the price quoted (for a market order) or the price requested (for stop-loss or take-profit orders).

A huge amount of slippage can occur during breaking news or when a major economic data report is released.

A broker can introduce “asymmetric” slippage into the order execution where if the price benefits the broker, it’ll execute.

But if it doesn’t, then the price is slipped and requoted with another price that favors the broker.

And if the market moves where it benefits you, the broker won’t execute your order with the price improvement.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.