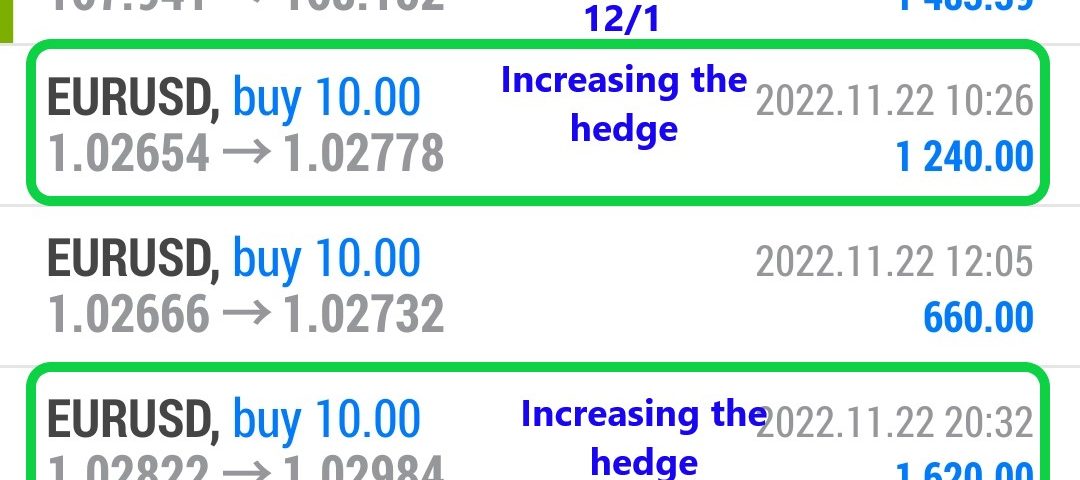

Forex Smart Trade Results Tuesday, Nov. 22, 2022 – $2,484

Forex Smart Trade Results November 21, 2022 – $2,280

December 3, 2022

Forex Smart Trade Results, Wednesday, Nov. 23, 2022 – $2,371

December 3, 2022Partial Hedge.

The most common form of “C-Book execution” is the partial hedge of a customer’s order.

A broker can hedge market risk in part and not in its entirety.

This will reduce, but not eliminate, adverse price movements to the position being hedged.

The risk that remains unhedged, also known as residual risk, gives the broker the opportunity to profit IF the price moves in its favor.

Think of this risk management strategy as a “partial A-Book” and “partial B-Book”.

Basically, the broker has A-Booked a certain percentage of its risk and has B-Booked the rest.

Partial Hedge Example 1

Let’s look at an example where a broker hedges 50% of a customer’s position.

Elsa opens a long EUR/USD position at 1.2001.

Her position size is 1,000,000 units or 10 standard lots. This means a 1-pip move equals $100.

The broker hedges 50% of the risk by opening a long 500,000 EUR/USD position with an LP at 1.2000.

(If it had gone long the entire 1,000,000 units, this would be considered A-Book, since 100% of the position is hedged.)

EUR/USD rises in price.

Elsa wants to take a profit and exits her trade at 1.2101, resulting in a gain of 100 pips or $10,000 ($100 x 100 pips).

For the broker, this means a $10,000 loss.

If the broker had just B-Booked Elsa’s trade, it would’ve had to eat the entire loss.

But fortunately, it hedged part of Elsa’s trade.

While the hedge trade resulted in a gain of 102 pips, since the position size was 500,000 (half of the 1,000,000), the profit was $5,100.

This profit made from the LP helped reduce some losses from Elsa’s trade, so the net loss was $4,900 (instead of the full $10,000).

Partial Hedge Example 2

Conversely, if the EUR/USD fell, the losses incurred from hedging would reduce the profits of the broker against Elsa.

In this example, Elsa opens a long EUR/USD position at 1.2001.

The broker hedges 50% of the risk by opening a long 500,000 EUR/USD position with an LP at 1.2000.

EUR/USD falls in price.

Elsa’s stop-loss is hit and her trade is exited at 1.1951, resulting in a loss of 50 pips or $5,000.

For the broker, this means a $5,000 gain.

If the broker had just B-Booked Elsa’s trade, it would’ve kept all this profit.

But it didn’t. It hedged part of Elsa’s trade.

The hedge trade resulted in a loss of 48 pips. Since the position size was 500,000 (half of the 1,000,000), the loss was $2,400.

This loss suffered from the LP helped reduce some of the profit from Elsa’s trade, so the net profit was $2,600 (instead of the full $5,000).

So far, you’ve seen how a broker can fully hedge (=100%) against a customer’s position, known as A-Book.

And you’ve seen how a broker can partially hedge (>100%) against a customer’s position, known as C-Book.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.