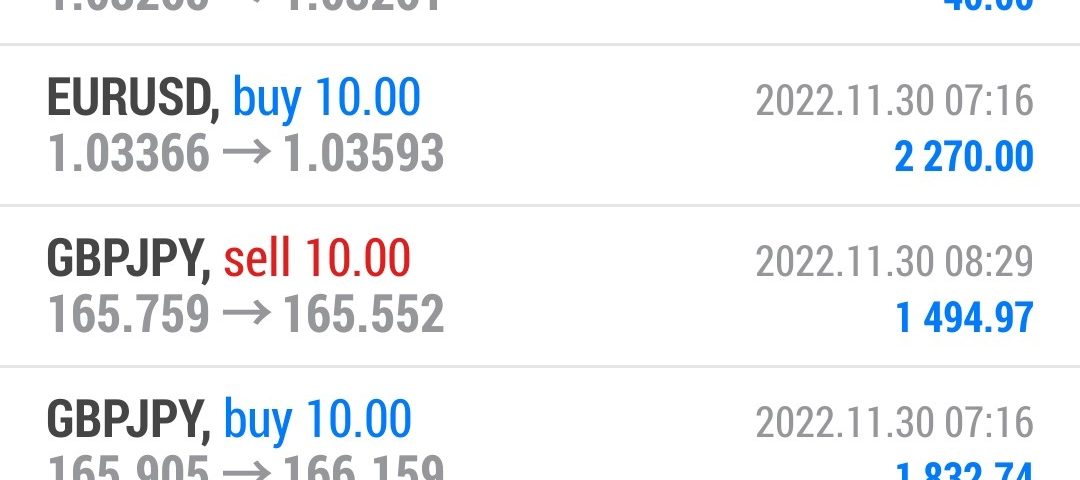

Forex Smart Trade Results Wednesday, Nov. 30, 2022 – $10,027

Forex Smart Trade Results Tuesday, Nov. 29, 2022 – $6,372

December 4, 2022

Forex Smart Trade Results Thursday, December 1, 2022 – $5,136

December 5, 2022How Pricing Works on Exchanges.

To help you better understand why it’s important to understand the significance of the FX market being an OTC market, let’s compare this to an exchange-based market like the U.S. stock market.

One of the founding principles of an exchange-based market is it must offer fair and equal access to all participants.

Exchanges publish quotes for everyone to see and trade.

To understand this better, let’s glance at how pricing works in the U.S. stock exchanges:

When a trade occurs, an exchange reports the trade to a merged data feed called the SIP (Securities Information Processor), which disseminates the data.

For example, when the NYSE executes a trade to buy Apple shares, it reports the trade to a SIP.

Besides trades, they shared the best bid and ask prices at different trading venues with the public to the SIP.

National Best Bid and Offer

The SIP then combines all quotes to determine the National Best Bid and Offer (NBBO).

This data consolidation takes place quickly. The average time it takes for SIPs to gather, consolidate, and disseminate a trade report is around 17 microseconds (millionths of a second).

To put that in perspective, a human blink of an eye takes 100 milliseconds (a tenth of a second) or 100,000 microseconds! This means that pricing data updates in less than 0.017% of the time it takes to blink an eye!

The NBBO is extremely important as it tells traders the price at which they can buy and sell at that moment.

In 2005, the SEC passed the Regulation National Market System, known as RegNMS, requiring brokers to obtain “best execution” for all orders within the NBBO. Basically, RegNMS obligates brokers to route orders to the venue, offering the best price (which is based on NBBO).

Fair Pricing

The advantage of having consolidated data in the U.S. stock market is that the NBBO provides unambiguous “reference” prices that allow all traders to assess whether they got fair pricing.

The NBBO allows everyone to know the best bid and offer for every exchange-listed stock regardless of what venue it posted them on, all less than a millisecond after the quotes change.

This provides fair and equal pricing for all traders, both large and small.

The prices that the exchange shows protect all traders because EVERY trade must occur at prices no worse than the NBBO at the time they executed the trade.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.