Let’s review the hybrid model used by forex brokers.

In the previous lesson, we talked about why forex brokers are attracted to B-Book execution more than A-Book execution, even though it’s riskier because the broker can blow up if it doesn’t know WTH it’s doing has poor risk management.

But what if brokers could get the best of both worlds?

So far, we’ve learned that when a broker executes your order, it can choose to fill the order:

- Before hedging (A-Book)

- By not hedging at all (B-Book)

- Or by internalizing first and then choosing one of the above

- By hedging first (STP)

But a forex broker is not limited to just one form of hedging.

It can choose any of the above depending on the order and/or customer.

How a broker determines who to choose for which model depends on different factors like trade size and a customer’s profitability profile.

A broker can generate independent price streams and hedging models for social traders, news traders, API traders, or screen traders.

Most brokers operate at least an A and B-Book, selecting which trades are internalized vs. hedged with an LP.

We know this as the “hybrid model“.

The Hybrid Model

Your forex broker is always the counterparty to your trades.

In a hybrid approach, the broker may decide to execute your trades internally OR offset your trades externally to a liquidity provider.

A “hybrid” approach allows a broker to:

- Offset orders with other customers

- Hedge orders with an external counterparty (liquidity providers)

- Or not hedge and accept full market risk

Market risk is the risk of a loss in a position caused by adverse price movements.

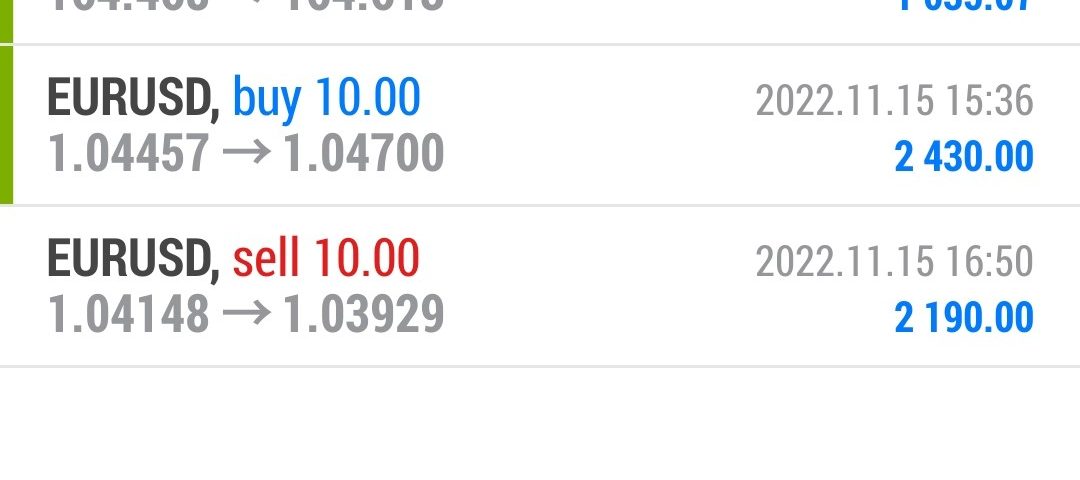

Here are two examples of how a broker operates when taking the hybrid approach:

- The broker can divide its customers and hedge the trades of some of the customers to an LP (A-Book or STP) and keep the rest “in-house” (B-Book).

- The broker can decide to hedge all trades of a certain size or larger to a liquidity provider and keep the rest “in-house” (B-Book).