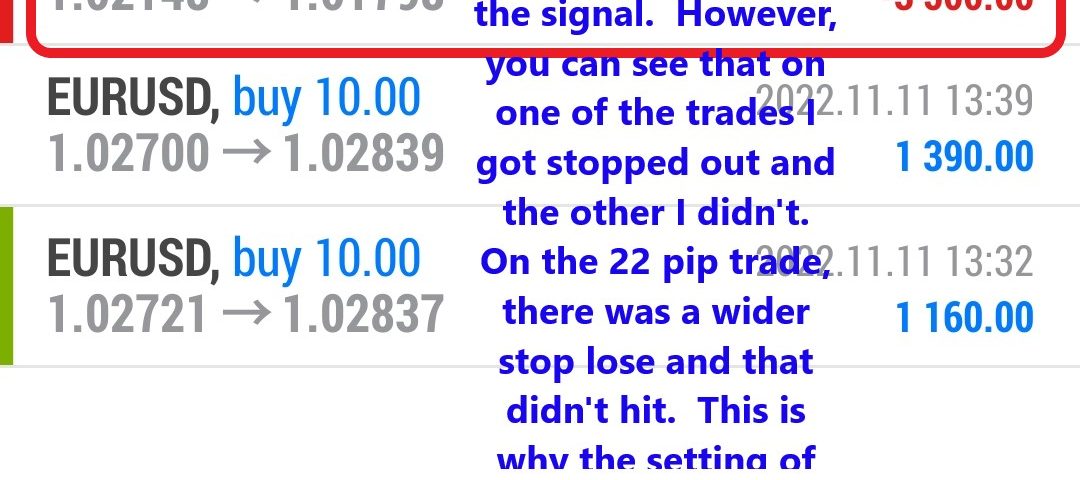

Forex Smart Trade Results November 11, 2022 – $1,572

Forex Smart Trade Results November 10, 2022 – $7,485

November 14, 2022

Forex Smart Trade Results November 14, 2022 – $2,370

November 14, 2022What B-Book Brokers Like.

A large number of similarly sized customers.

B-Book brokers prefer to have a lot of similarly sized customers who trade as frequently as possible and open long and short positions in equal amounts.

With this, the broker can take the opposite side of each of their trades.

This allows the broker to pocket the spread on both sides without taking on any market risk because they net positions out.

For example, a retail trader A wants to buy 10,000 units of GBP/USD, so the broker offers a 1.4105 ask price.

At the same time, retail trader B wants to sell 10,000 units of GBP/USD, so the broker offers a 1.4103 bid price.

So the broker buys GBP/USD for 1.4103 from retail trader B and sells GBP/USD for 1.4105 to retail trader A.

Thus pocketing 0.0002 or 2 pips from the spread.

Since both orders are the same size (10,000 units), they offset each other.

This means they do not expose the broker to any market risk!

The broker would love to do this a gazillion times a day.

Loves fishes, but not whales.

B-Book brokers aren’t fond of high rollers or “whales”.

In gambling lingo, a high roller is also referred to as a whale.

A whale is a gambler who consistently wagers large amounts of money at a casino.

Think of a B-Book broker as a casino.

It doesn’t want a customer that trades so big that any individual bet exposes the broker to so much market risk that it could cause it to “go bust” or “take the house down”.

What B-Book brokers prefer is that their customers trade in similar position sizes AND trade frequently.

For example, it’d prefer to have 100 customers all trade, on average, 5 mini lots than have 98 customers who trade 3 mini lots and then have 2 whale customers who trade 20 standard lots at a time.

This allows the broker to offset trades with each other rather than exposing itself to market risk.

Also, this reduces the capital that a broker needs to set aside (which would be used to pay out winning trades).

This is because its customers are essentially “making a market” for each other.

What B-Book brokers love the most is when their customers are constantly trading and are not winning too much, or losing too much.

The ideal scenario for a B-Book broker is where half its customers open long positions and the other half open short positions.

And that their customers trade these opposing views frequently.

This would mean that all positions offset each other.

And the broker is not exposed to any market risk so little capital is required by the broker.

This is because any gains it’d have to pay to winning traders would be paid with the losses from the losing traders.

The broker would just constantly make money from the spread (and overnight financing charges).

And would therefore not have to worry about going bust.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.