Trade Results

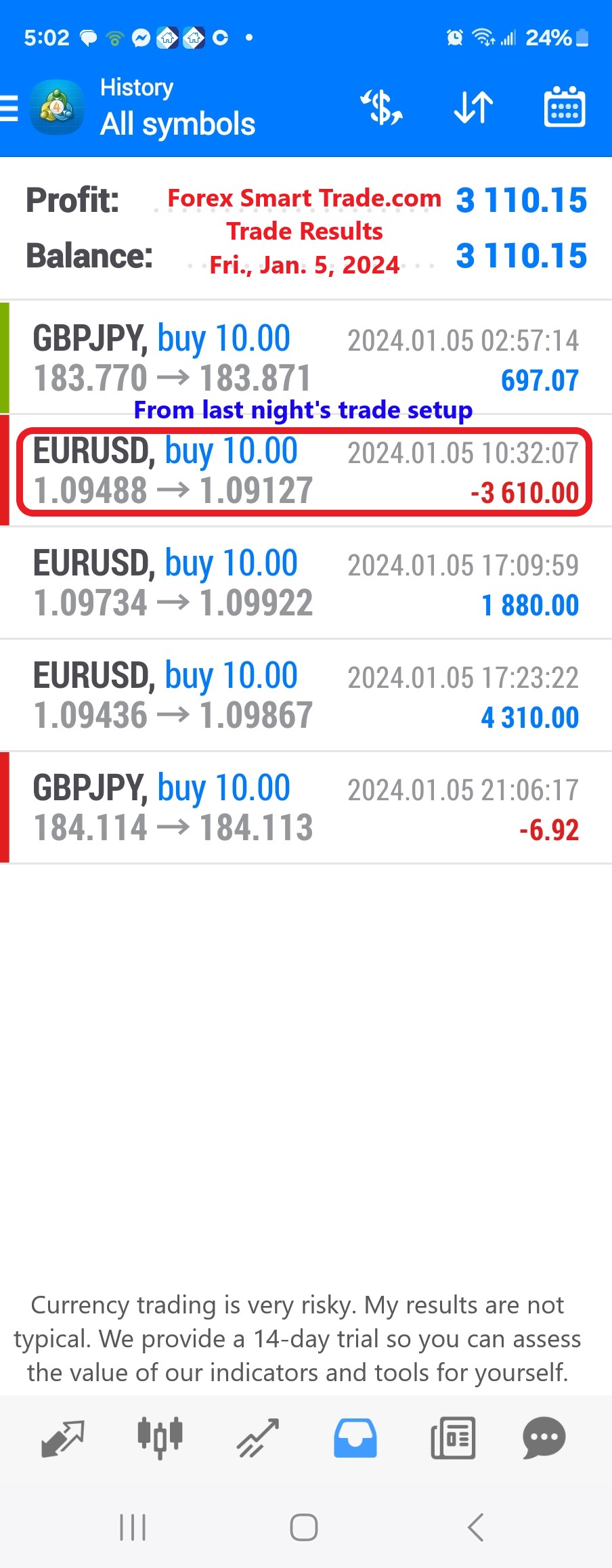

Forex Smart Trade Results, Friday, January 5, 2024 – $3,110

What does hawkish and dovish mean? Here’s a cheat sheet that summarizes the difference between hawkish and dovish monetary policies: Hawkish Dovish Objective Decrease inflation Stimulate […]

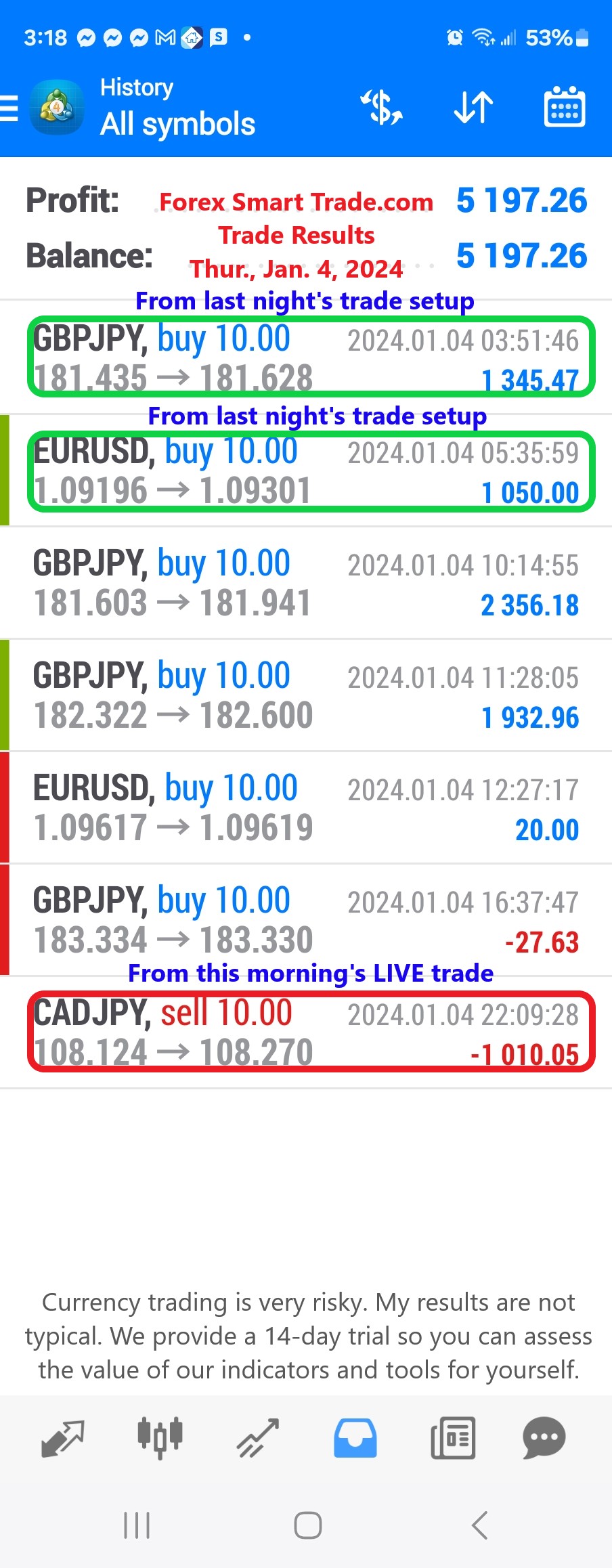

Forex Smart Trade Results, Thursday, January 4, 2024 – $5,197

Hawkish vs. Dovish Central Banks. Yes, you’re in the right place. Tonight’s match puts the L.A. Hawks up against the N.Y. Doves. You’re in for a […]

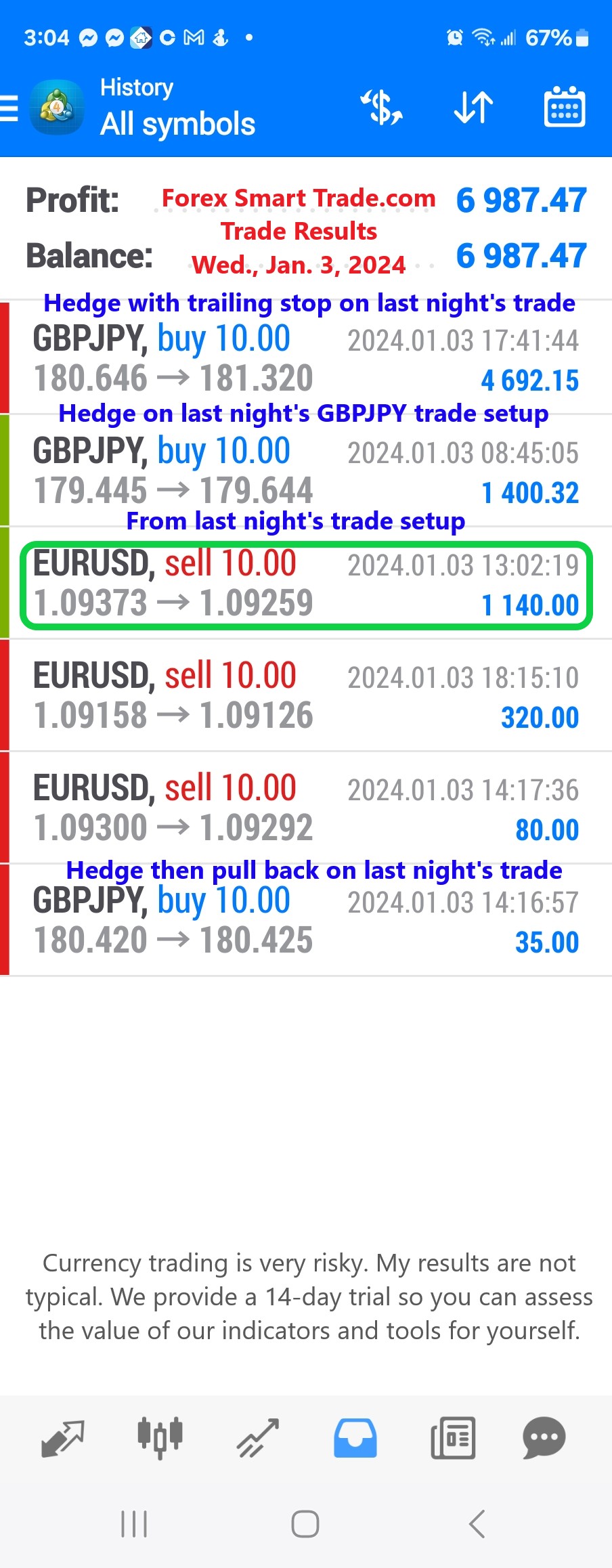

Forex Smart Trade Results, Wednesday, January 3, 2024 – $6,987

Hawkish vs Dovish: Differences Between Monetary Policies. We just learned that currency prices are affected a great deal by changes in a country’s interest rates. We […]

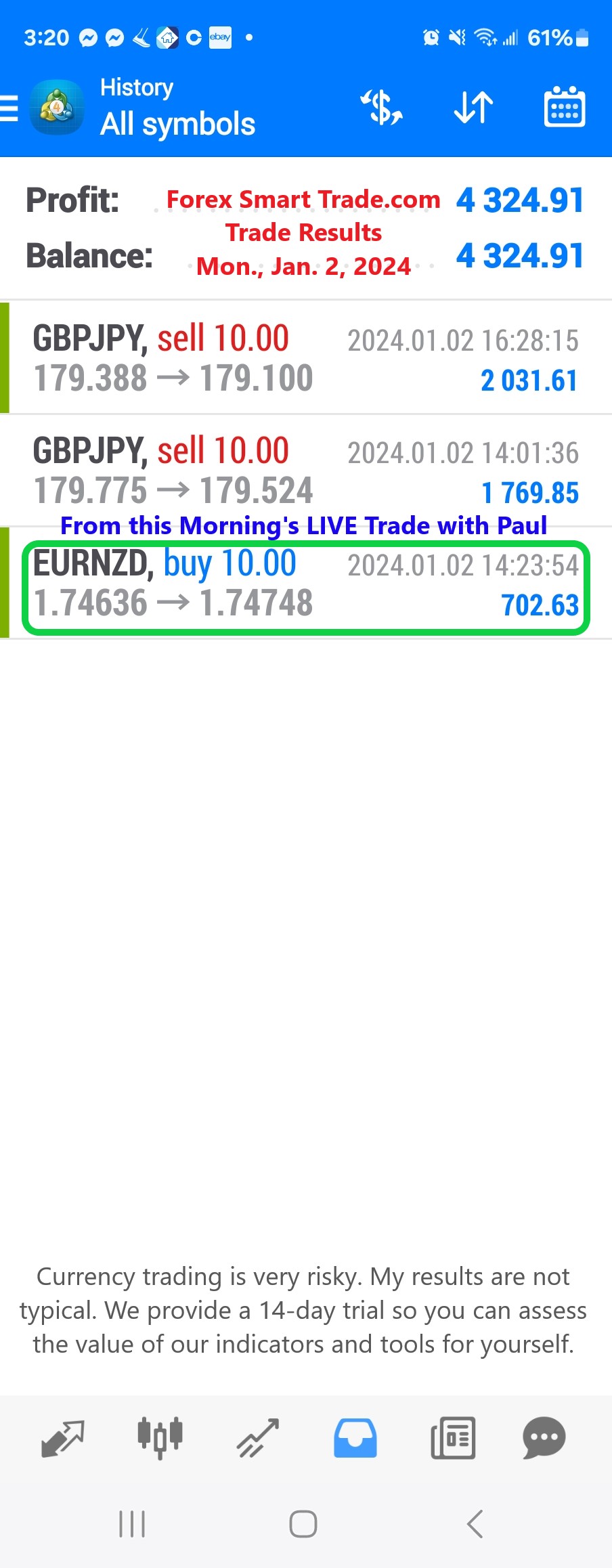

Forex Smart Trade Results, Tuesday, January 2, 2024 – $4,324

Round and Round with Monetary Policy Cycles. For those of you that follow the U.S. dollar and economy (and that should be all of you!), remember […]

Forex Smart Trade Results, Monday, January 1, 2024 – $0 – Did Not Trade – New Years Day

How Monetary Policy Affects the Forex Market. As we mentioned earlier, national governments and their corresponding central banking authorities formulate monetary policy to achieve certain economic […]

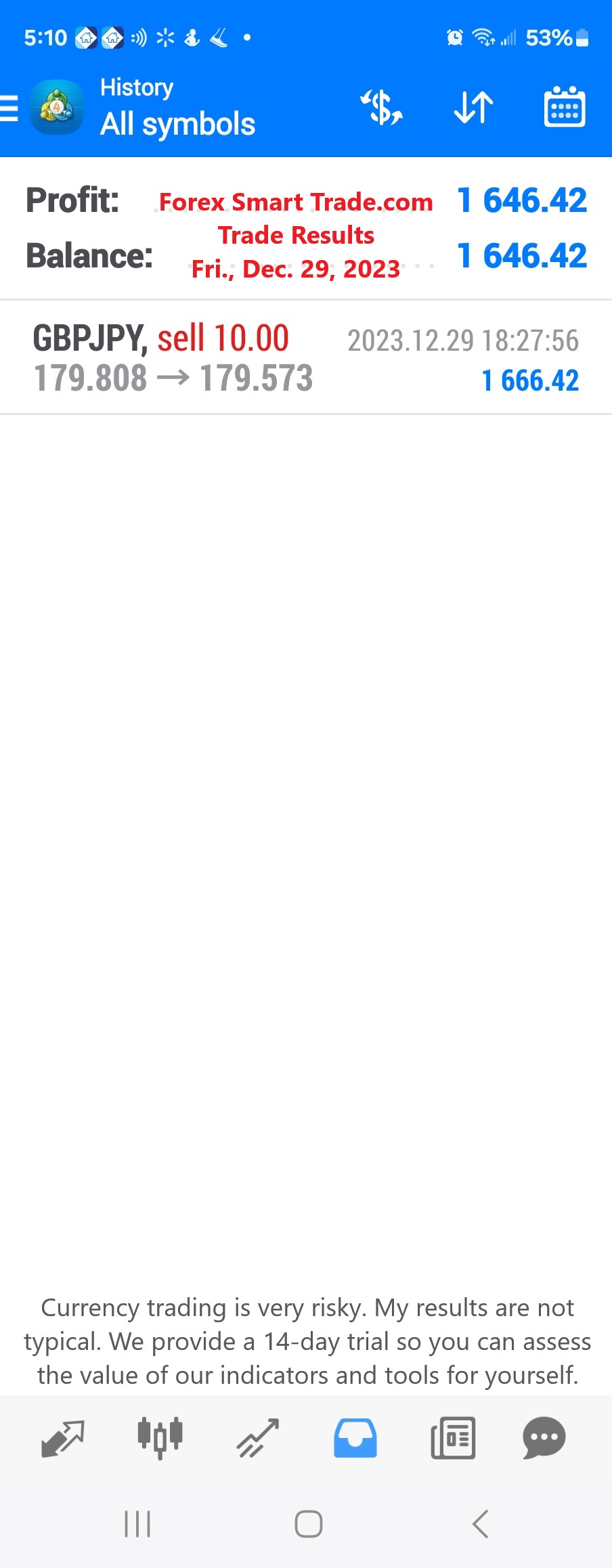

Forex Smart Trade Results, Friday, December 29, 2023 – $1,646

Interest Rate Differentials. Pick a pair, any pair. Many forex traders use the technique of comparing one currency’s interest rate to another currency’s interest rate as […]

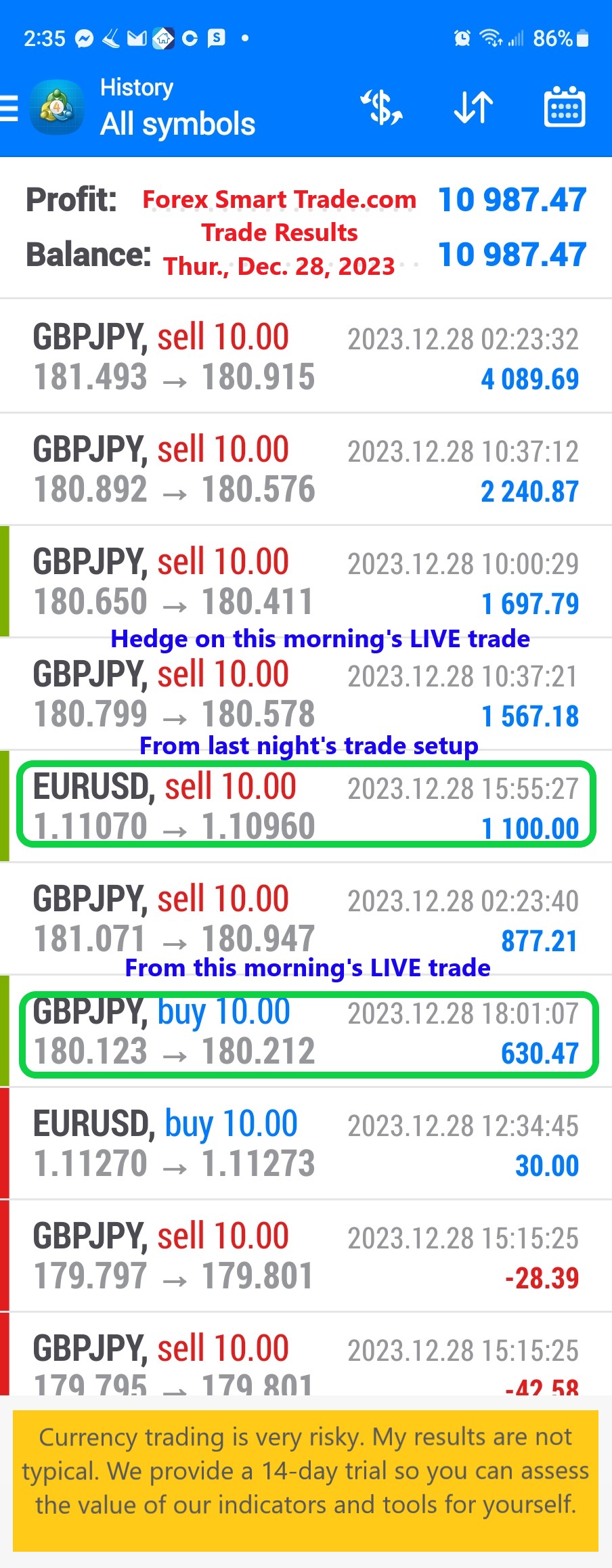

Forex Smart Trade Results, Thursday, December 28, 2023 – $10,987

Interest Rate Expectations. Markets are ever-changing with the anticipation of different events and situations. Interest rates do the same thing – they change – but they […]

Forex Smart Trade Results, Wednesday, December 27, 2023 – $8,250

Why Interest Rates Matter to Forex Traders. Interest rates make the forex world go ’round! In other words, the forex market is ruled by global interest rates. A currency’s […]

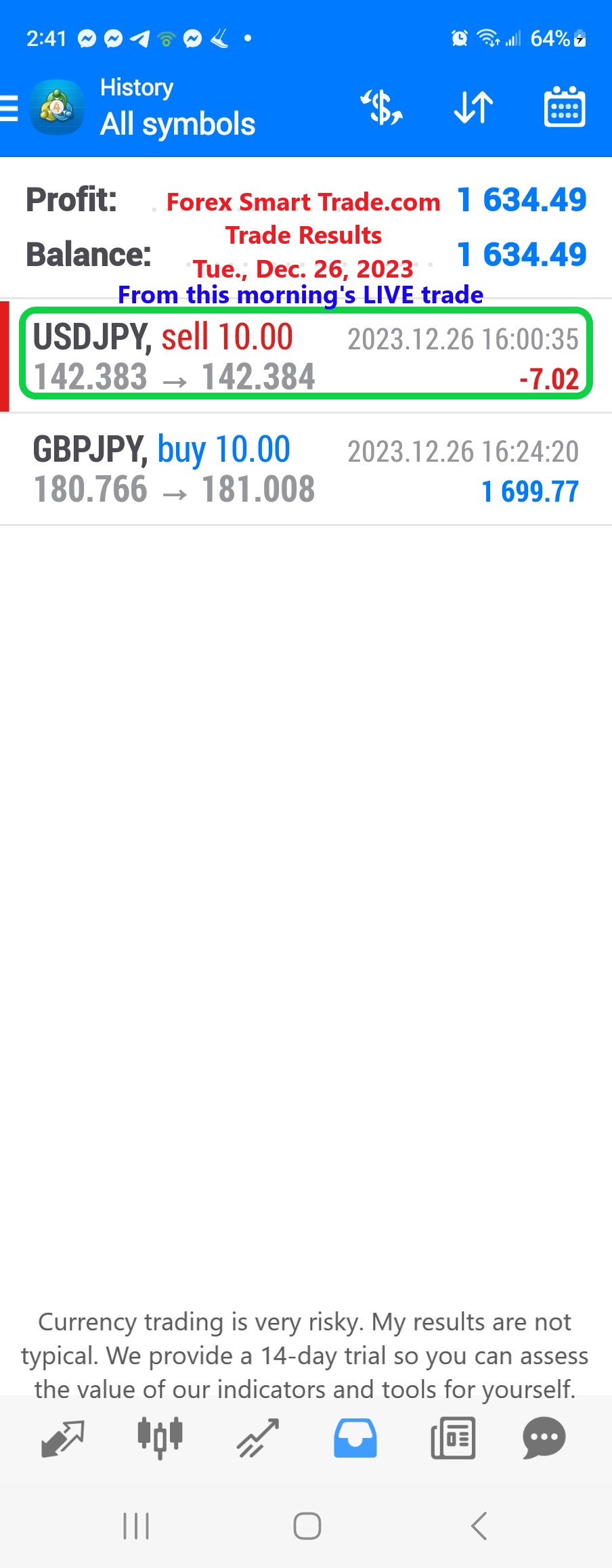

Forex Smart Trade Results, Tuesday, December 26, 2023 – $1,634

Here’s an Economic Report, Now What? The market has a tendency to react based on how people feel. These feelings can be based on their reaction […]

Forex Smart Trade Results, Monday, December 25, 2023 – $0 – No Trading Christmas Day

Fundamental Data and Its Many Forms. Fundamental analysis involves studying data known as economic indicators. Economic indicators are statistical data points or metrics that provide insights into the […]

Forex Smart Trade Results, Friday, December 22, 2023 – $1,070

What is Fundamental Analysis? Along your travels, you’ve undoubtedly come across Gulliver, Frodo, and the topic of fundamental analysis. Wait a minute… We’ve already given you […]

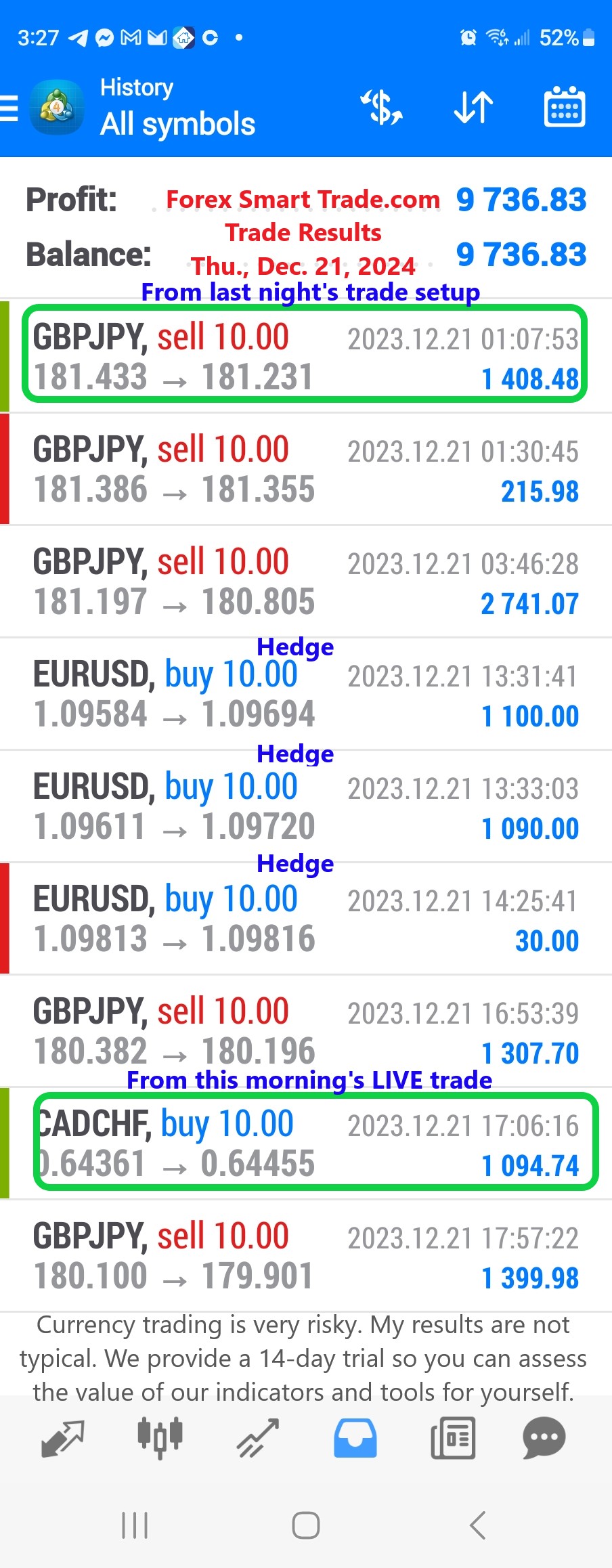

Forex Smart Trade Results, Thursday, December 21, 2024 – $9,736

Trading Fakeouts. Institutional traders like to fade breakouts. So we must like to fade breakouts also. Are you going to follow the crowd, or are you […]

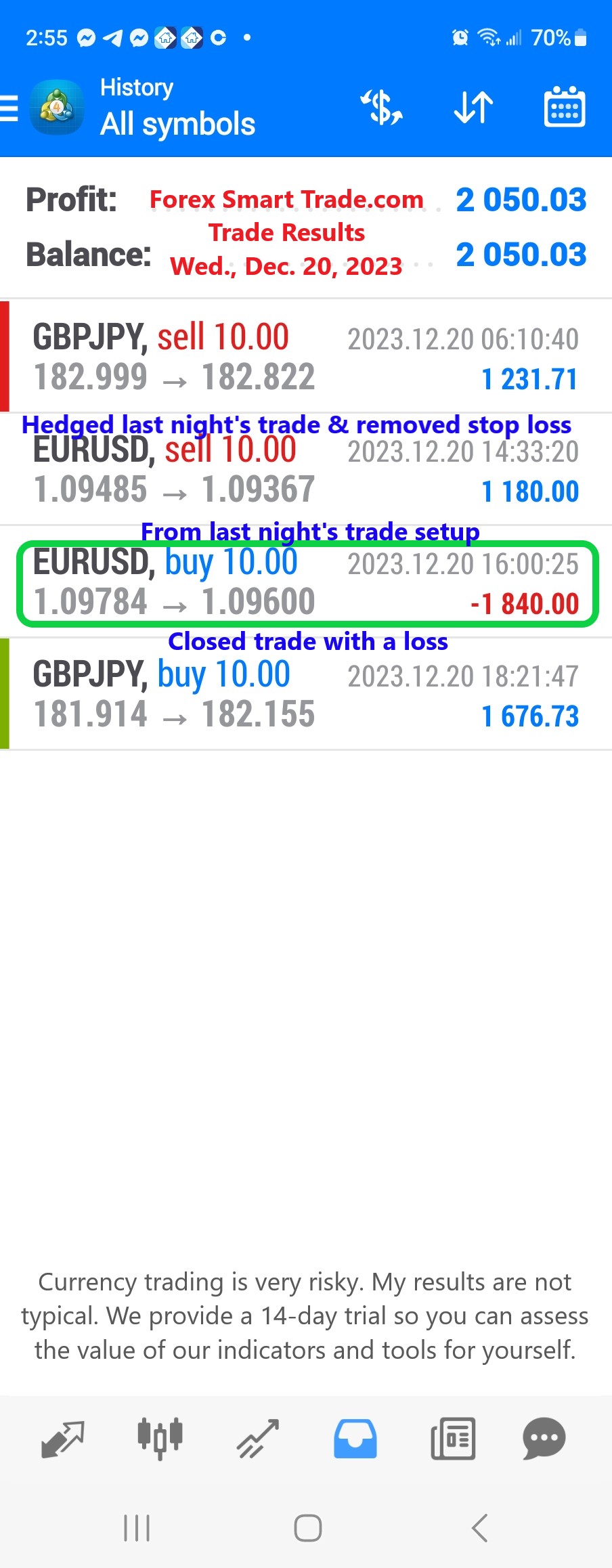

Forex Smart Trade Results, Wednesday, December 20, 2023 – $2,050

Trading Breakouts. With breakout trades, the goal is to enter the market right when the price makes a breakout and then continue to ride the trade […]

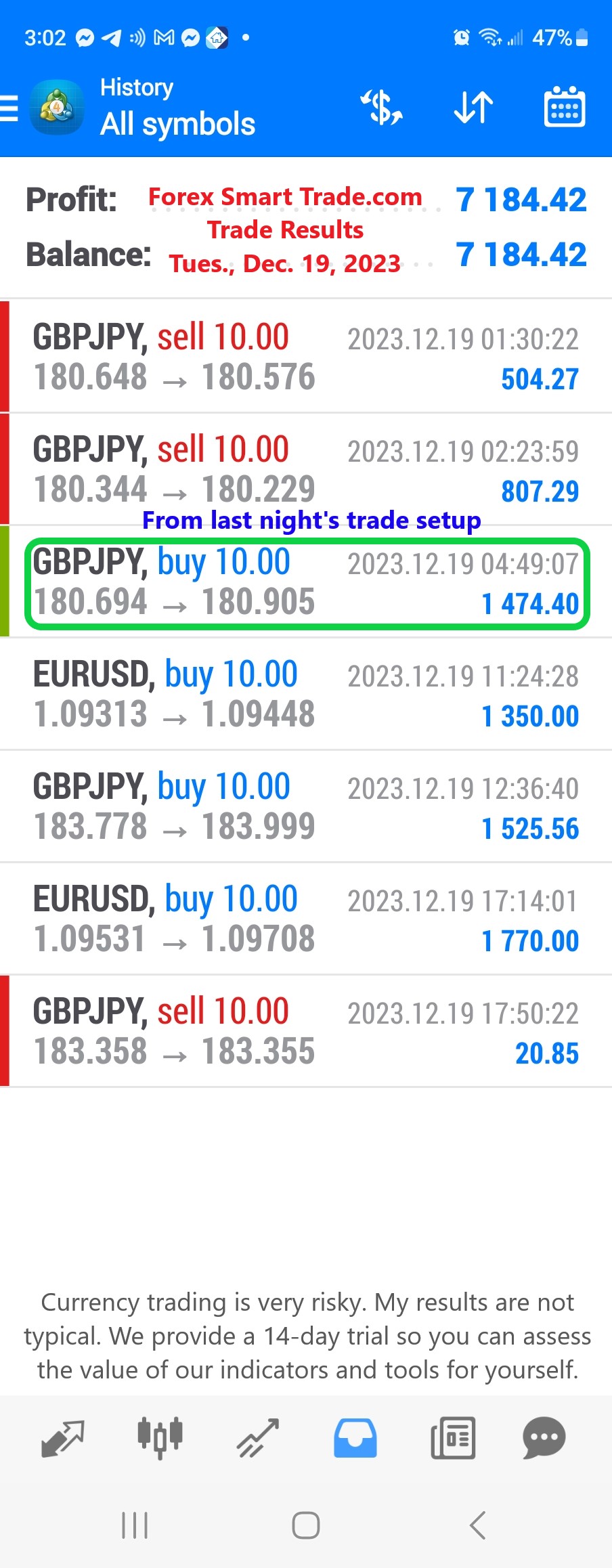

Forex Smart Trade Results, Tuesday, December 19, 2023 – $7,184

Chart Patterns. Chart patterns are physical groupings of the price you can actually see with your own eyes. They are an important part of technical analysis […]

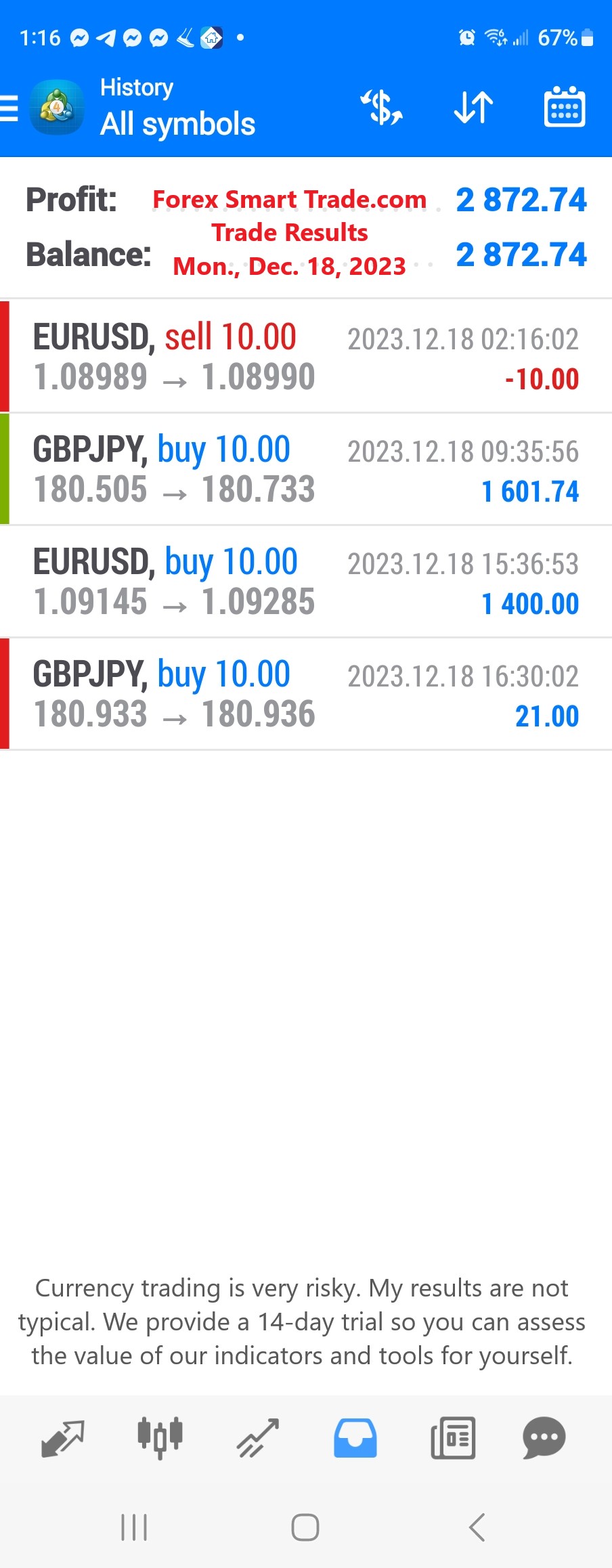

Forex Smart Trade Results, Monday, December 18, 2023 – $2,872

How to Trade Fakeouts. In order to fade breakouts, you need to know where potential fakeouts can occur. Potential fakeouts are usually found at support and resistance […]

Forex Smart Trade Results, Friday, December 15, 2023 – $9,994

Fade the Breakout. Fade the breakout you say? Was that just a typo? Did you mean to say, “trade the breakout”? Nope! Fading breakouts simply means […]

Forex Smart Trade Results, Thursday, December 14, 2023 – $8,437

Support and Resistance Levels Are Tricky. One thing you should remember to note about support and resistance levels is that they are areas in which a predictable price […]

Forex Smart Trade Results, Wednesday, December 13, 2023 – $14,924

How to Detect Fakeouts. Breakouts are popular among forex traders. It makes sense, right? When the price finally “breaks” out of that support or resistance level, one […]

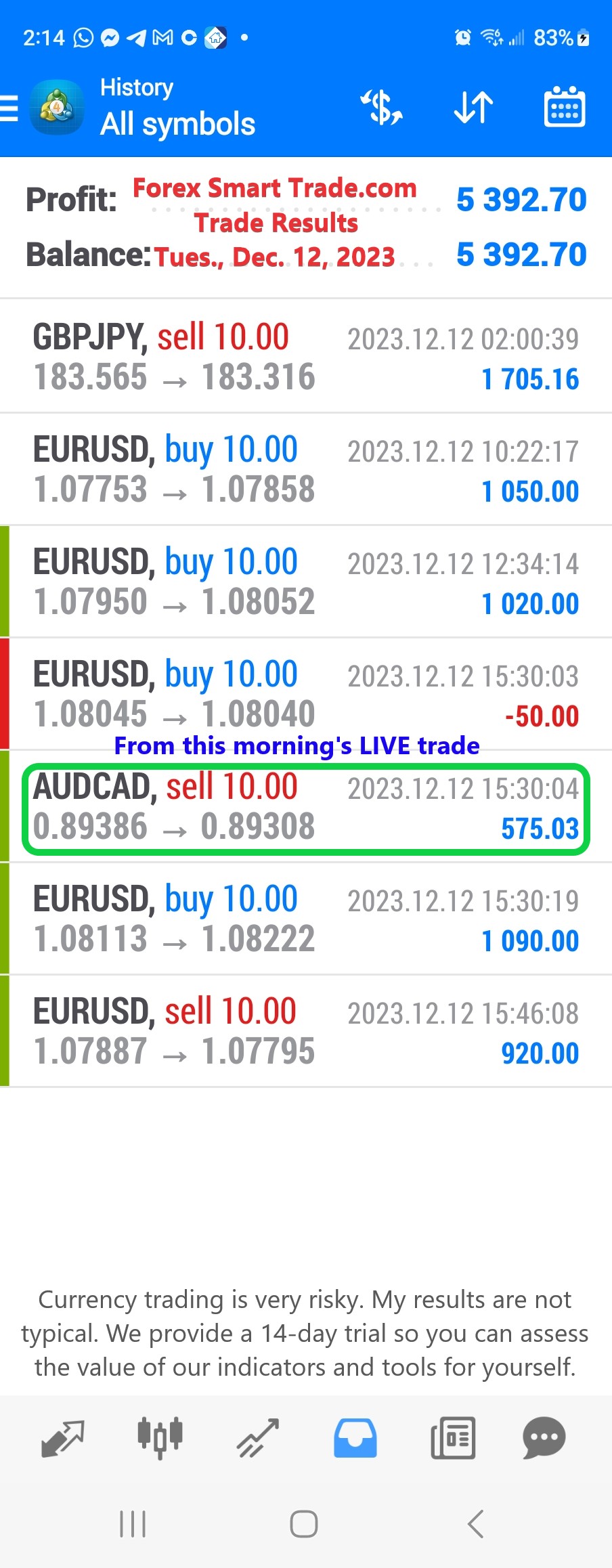

Forex Smart Trade Results, Tuesday, December 12, 2023 – $5,392

Measuring the Strength of a Breakout. Let’s take a look at more on measuring the strength of a breakout with the relative strength index. Relative Strength […]

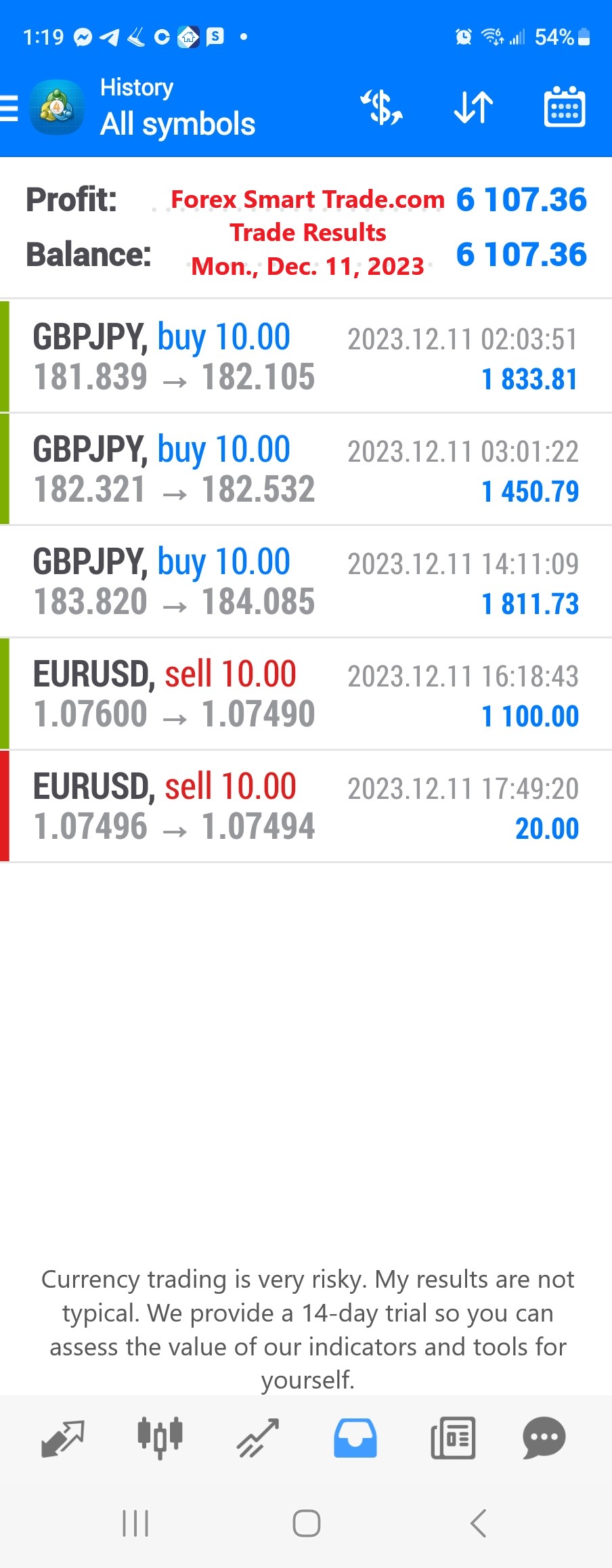

Forex Smart Trade Results, Monday, December 11, 2023 – $6,107

How to Measure the Strength of a Breakout. As you learned earlier, when a trend moves for an extended period of time and it starts to consolidate, […]

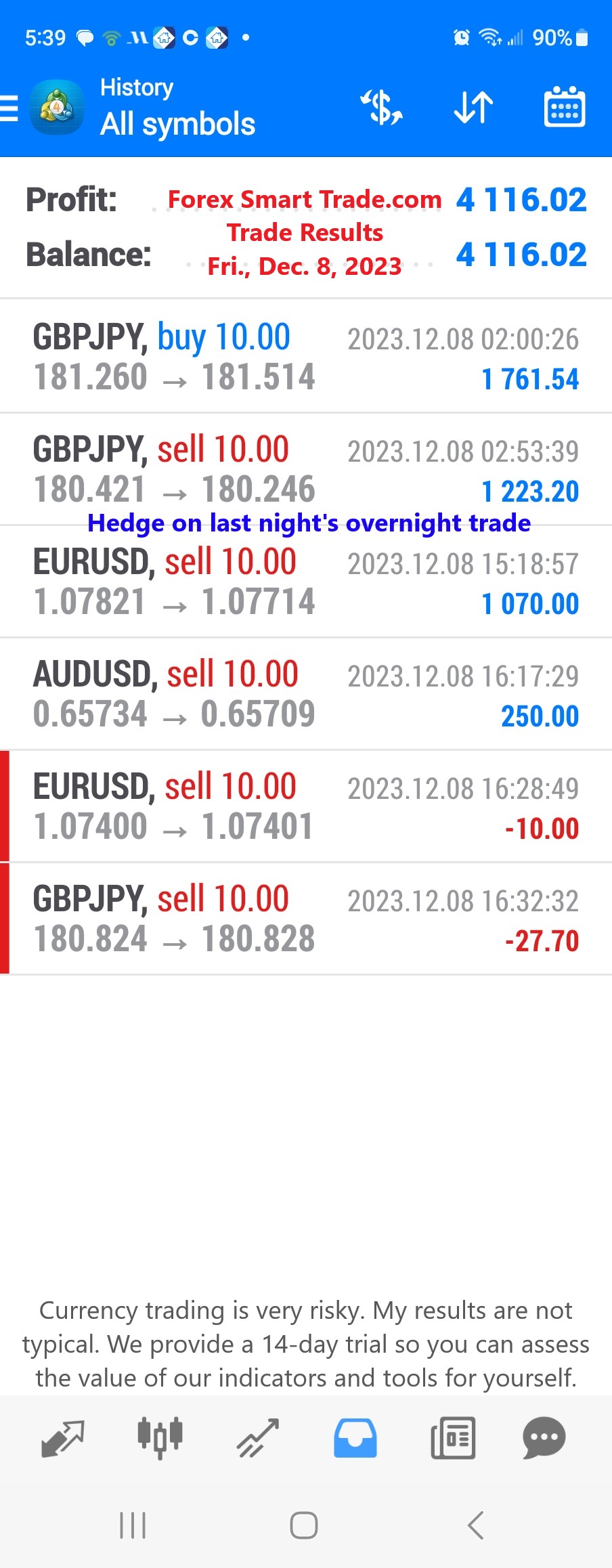

Forex Smart Trade Results, Friday, December 8, 2023 – $4,116

More on Different Triangles. Descending Triangles Descending triangles are basically the opposite of ascending triangles. Sellers are continuing to put pressure on the buyers, and as a […]