Forex Smart Trade Results, Thursday, December 21, 2024 – $9,736

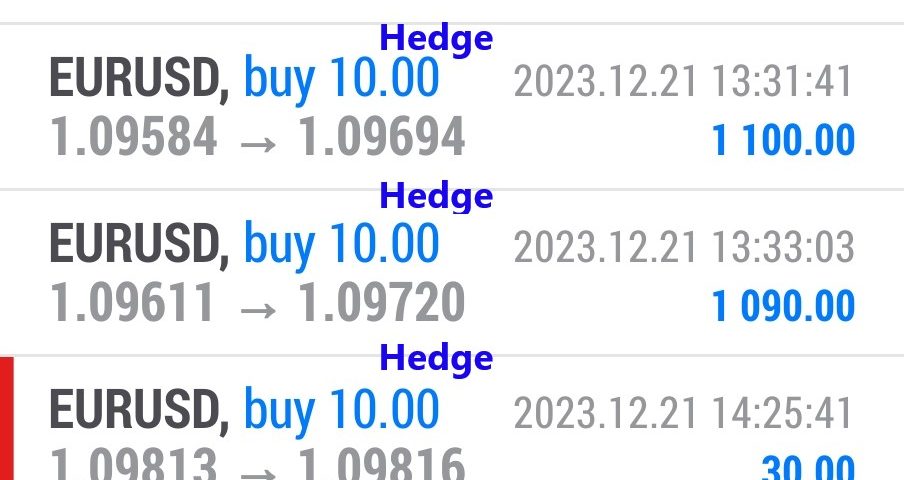

Forex Smart Trade Results, Wednesday, December 20, 2023 – $2,050

December 26, 2023

Forex Smart Trade Results, Friday, December 22, 2023 – $1,070

December 26, 2023Trading Fakeouts.

Institutional traders like to fade breakouts. So we must like to fade breakouts also.

Are you going to follow the crowd, or are you going to follow the money?

Think, act, eat, sleep, and watch the same movies as these guys do.

If we can trade in the same way the institutional players do, success is just a glimpse away.

Fading breakouts simply means trading in the opposite direction as the breakout.

You would fade a breakout if you believe that a breakout from a support or resistance level is false and unable to keep moving in the same direction.

In cases in which the support or resistance level broken is significant, fading breakouts may prove to be smarter than trading the breakout.

Potential fakeouts are usually found at support and resistance levels.

And are created through trend lines, chart patterns, or previous daily highs or lows.

The best results tend to occur in a range-bound market.

However, you cannot ignore market sentiment, common sense, and other types of market analysis.

Financial markets spend a lot of time bouncing back and forth between a range of prices

These do not deviate much from these highs and lows.

Finally, the odds of a fakeout are higher when there is no major economic event or news catalyst to shift traders’ sentiment in the direction of the break.

Learn to Trade Currency

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.