Trade Results

Forex Smart Trade Results, Friday, May 31, 2024 – $6,148

The Trade-Weighted U.S. Dollar Index. The Federal Reserve Bank of St. Louis provides “weighted averages of the foreign exchange value of the U.S. dollar against the currencies […]

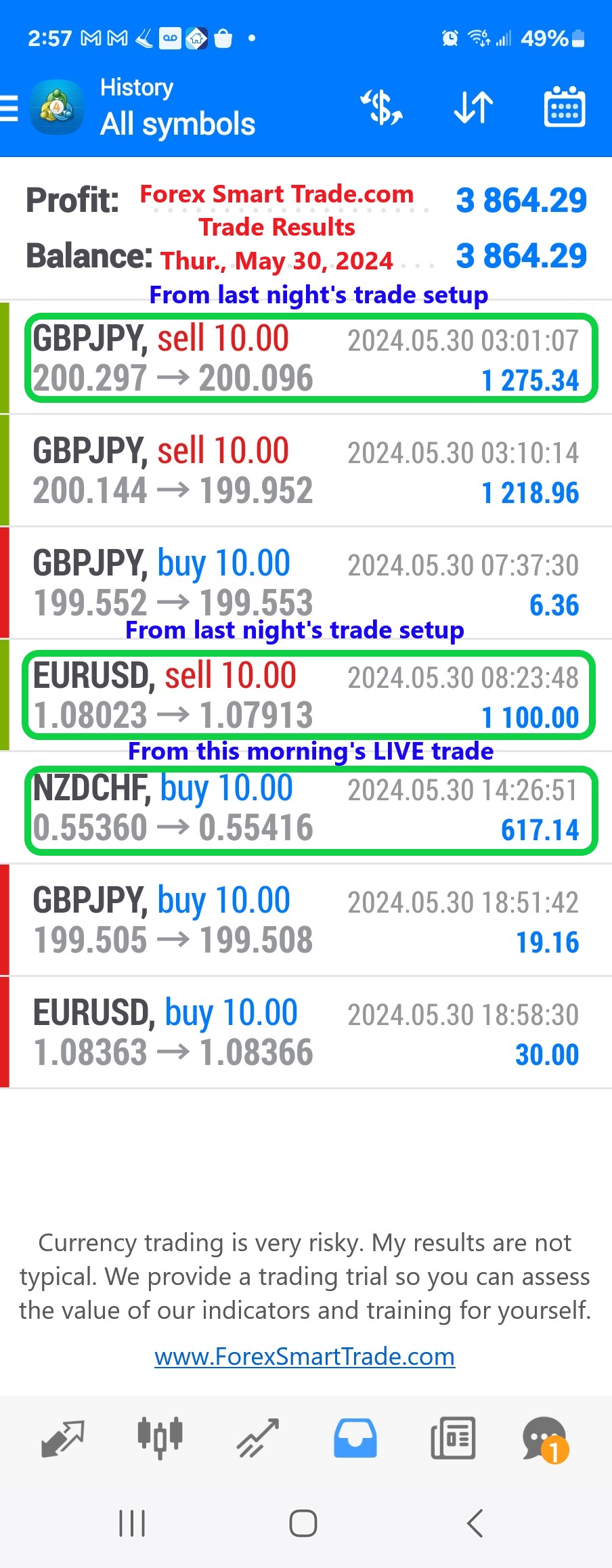

Forex Smart Trade Results, Thursday, May 30, 2024 – $3,864

Trade Weighted Dollar Index. There is also another kind of U.S. dollar index. It was created by the Federal Reserve and is now used widely by lots of […]

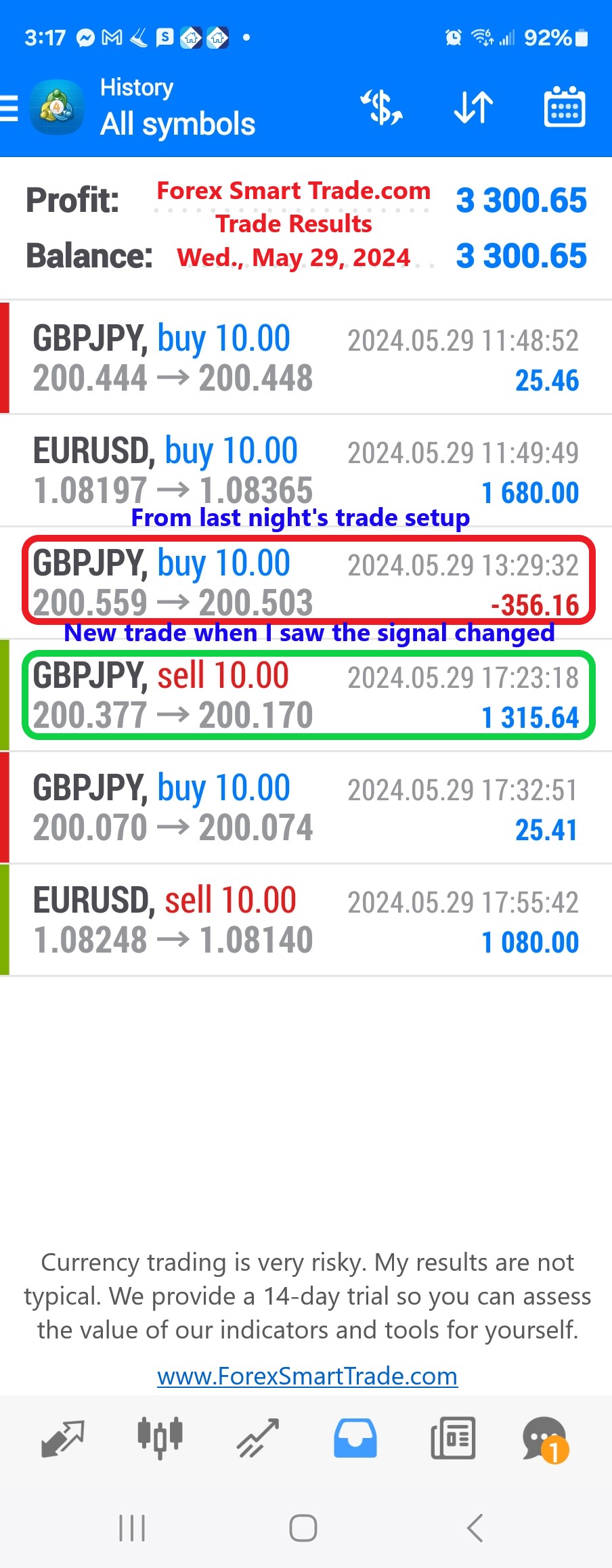

Forex Smart Trade Results, Wednesday, May 29, 2024 – $3,300

How to Use the USDX for Forex Trading. I bet you’re wondering, “How do I use this USDX in my forex trading arsenal?” Well, hold your trigger finger […]

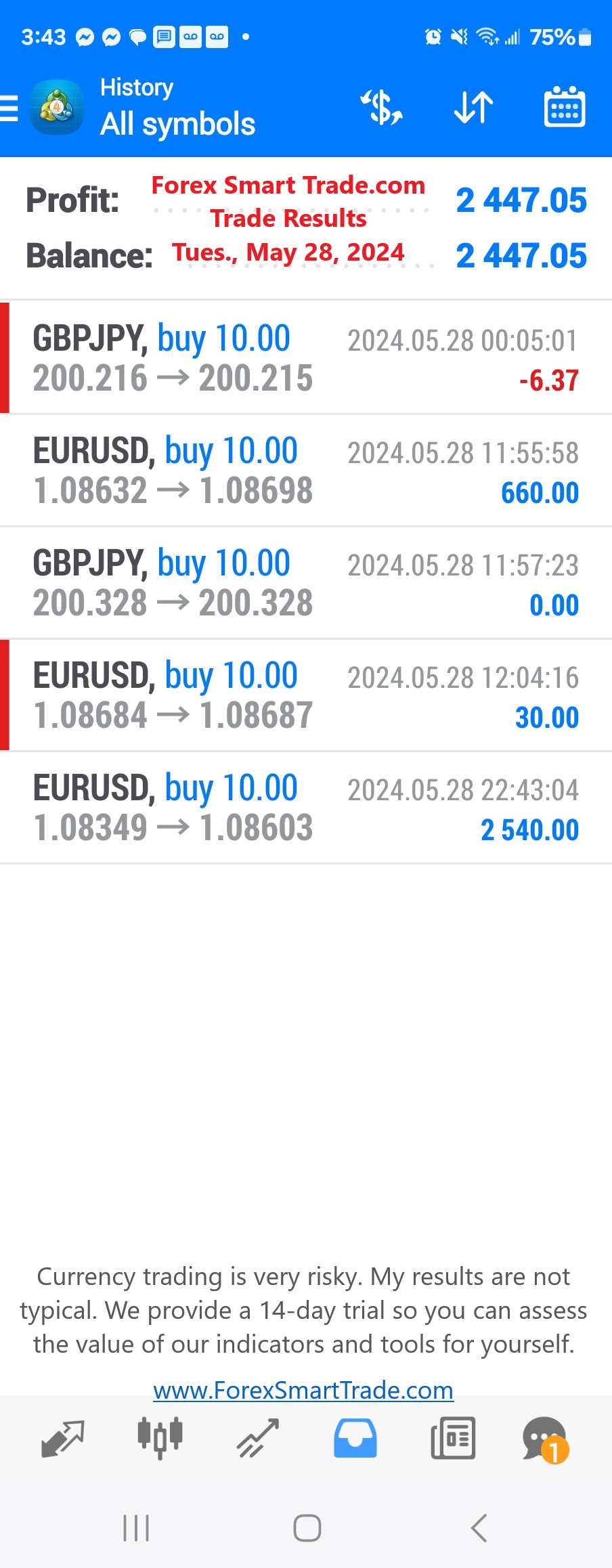

Forex Smart Trade Results, Tuesday, May 28, 2024 – $2,447

How to Read the US Dollar Index. Just like any currency pair, the US Dollar Index (USDX) even has its own chart. Holler at the U.S. Dollar […]

Forex Smart Trade Results, Monday, May 27, 2024 – $1,679

Is the ICE U.S. Dollar Index adjusted or rebalanced? There are no regularly scheduled adjustments or rebalancings of the ICE U.S. Dollar Index. The Index was […]

Forex Smart Trade Results, Friday, May 24, 2024 – $1,470

US Dollar Index (USDX) Components. Now that we know what the basket of currencies is composed of, let’s get back to that “geometric weighted average” part. Because not […]

Forex Smart Trade Results, Thursday, May 23, 2024 – $1,489

USDX vs. DX vs. DXY. If you’ve Googled “U.S. Dollar Index”, you might’ve seen three acronyms associated with the phrase: USDX, DX, and DXY and wondered, “What the heck is […]

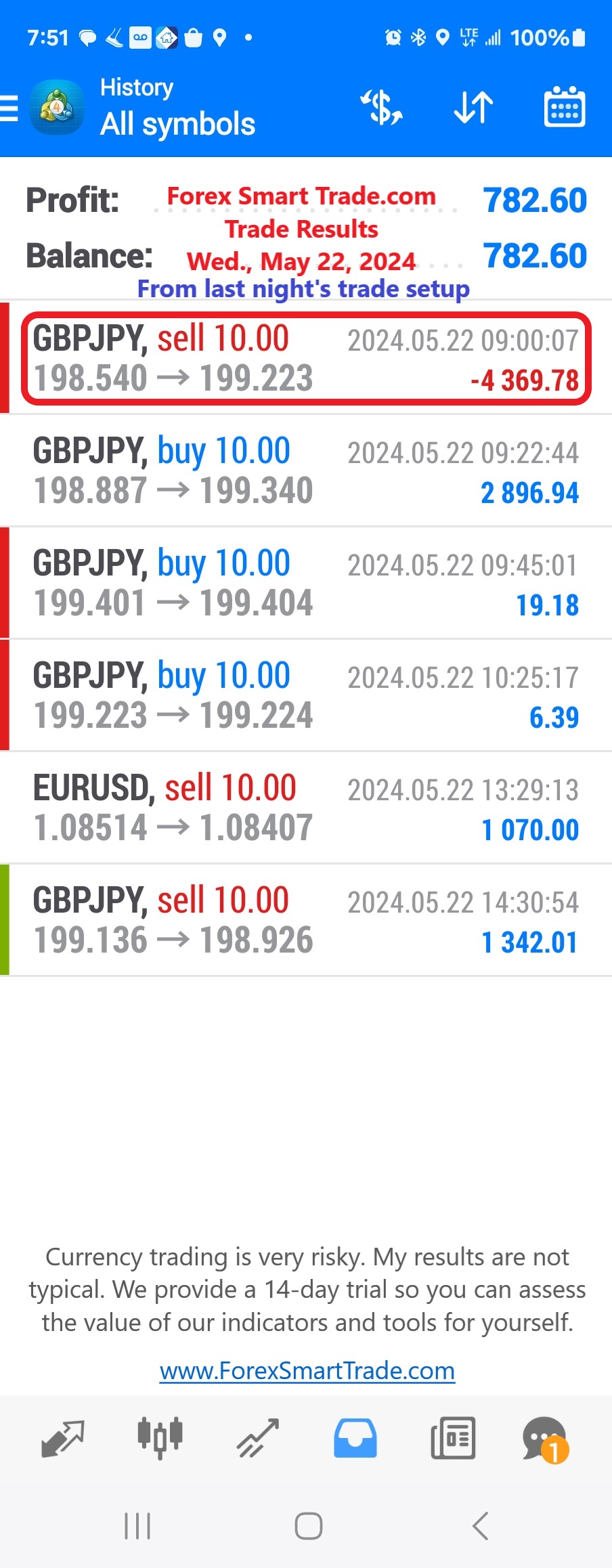

Forex Smart Trade Results, Wednesday, May 22, 2024 – $782

ICE U.S. Dollar Index®. From a legal perspective, the designations “U.S. Dollar Index,” “Dollar Index” and “USDX” are trademarks and service marks of ICE Futures U.S., […]

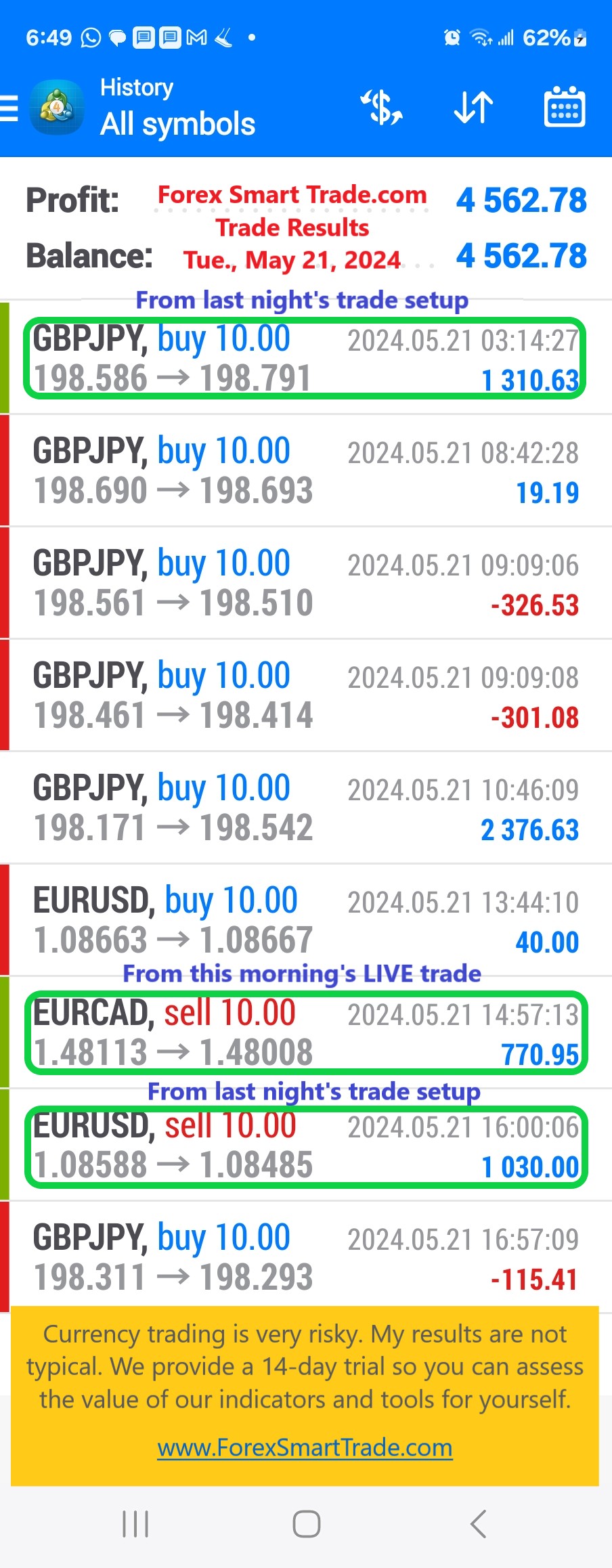

Forex Smart Trade Results, Tuesday, May 21 2024 – $4,562

The US Dollar Index Currency Basket. The U.S. Dollar Index consists of SIX foreign currencies. They are the: Euro (EUR) Japanese Yen (JPY) British Pound (GBP) […]

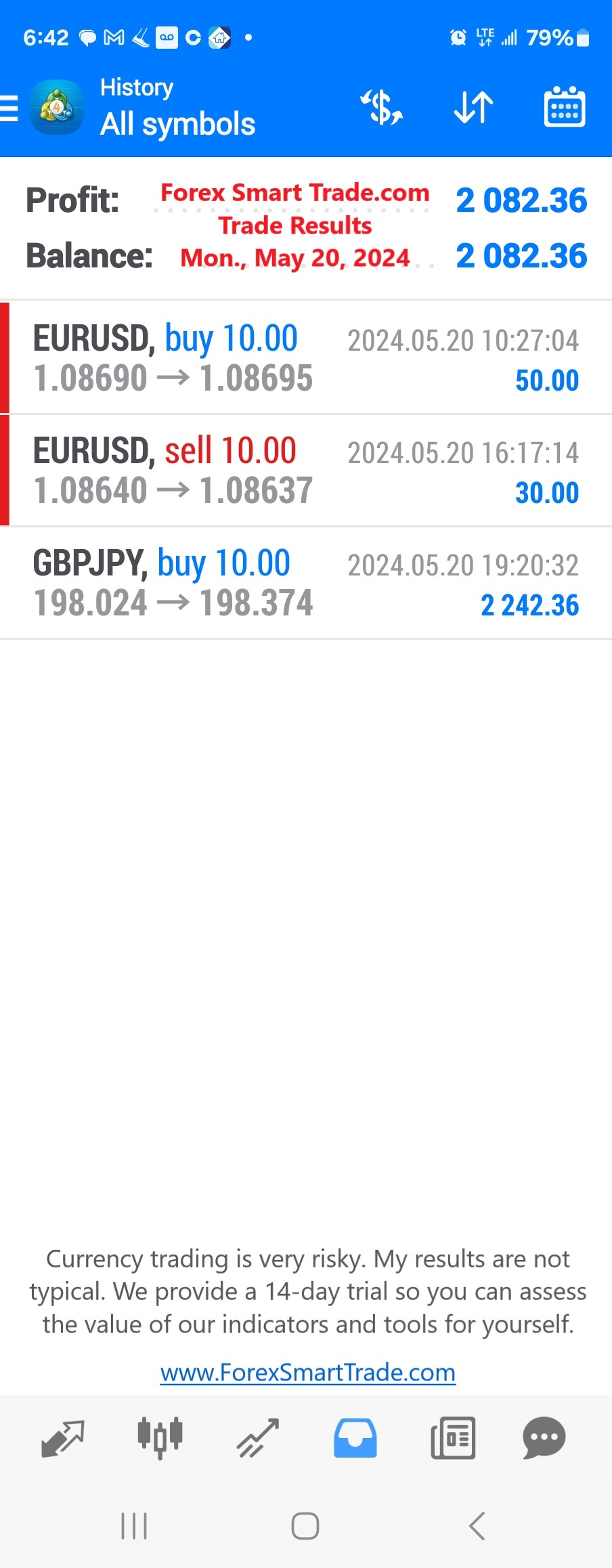

Forex Smart Trade Results, Monday, May 20, 2024 – $2,082

What is the US Dollar Index (USDX)? If you’ve traded stocks, you’re probably familiar with all the indices available such as the Dow Jones Industrial Average […]

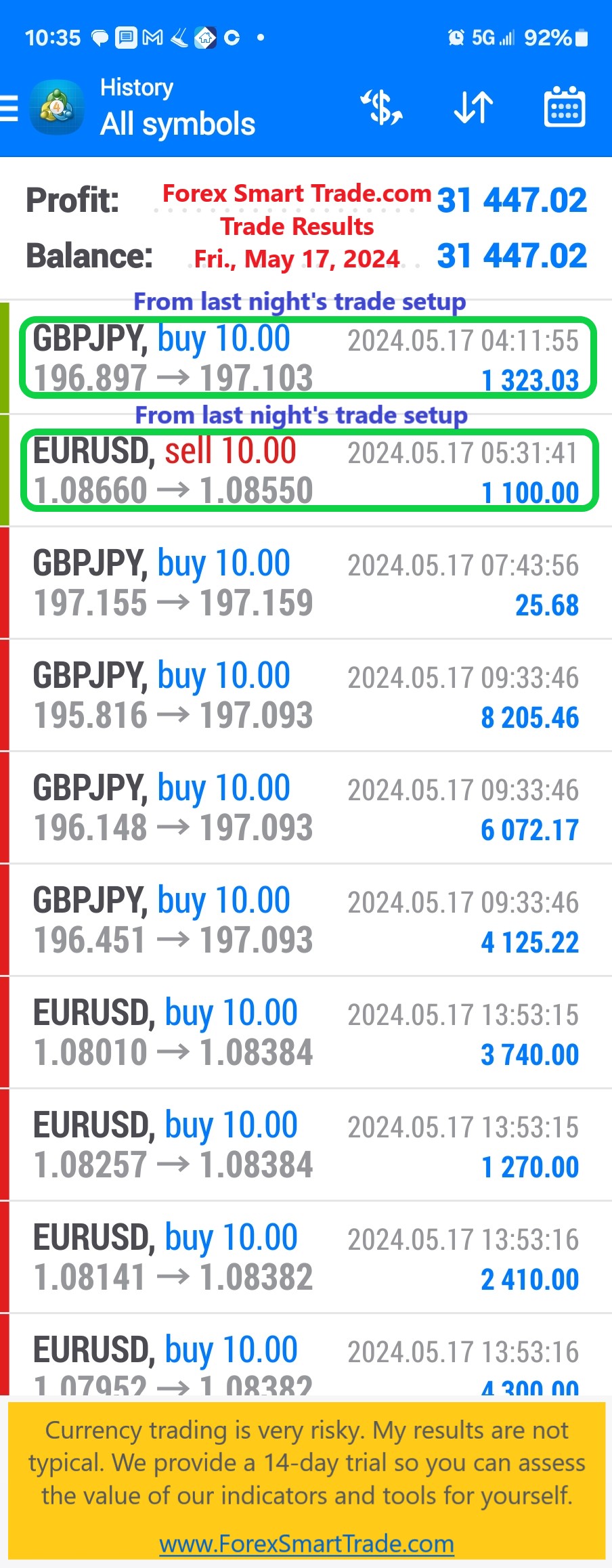

Forex Smart Trade Results, Friday, May 17, 2024 – $31,447

Is the ICE U.S. Dollar Index adjusted or rebalanced? There are no regularly scheduled adjustments or rebalances of the ICE U.S. Dollar Index. The Index was […]

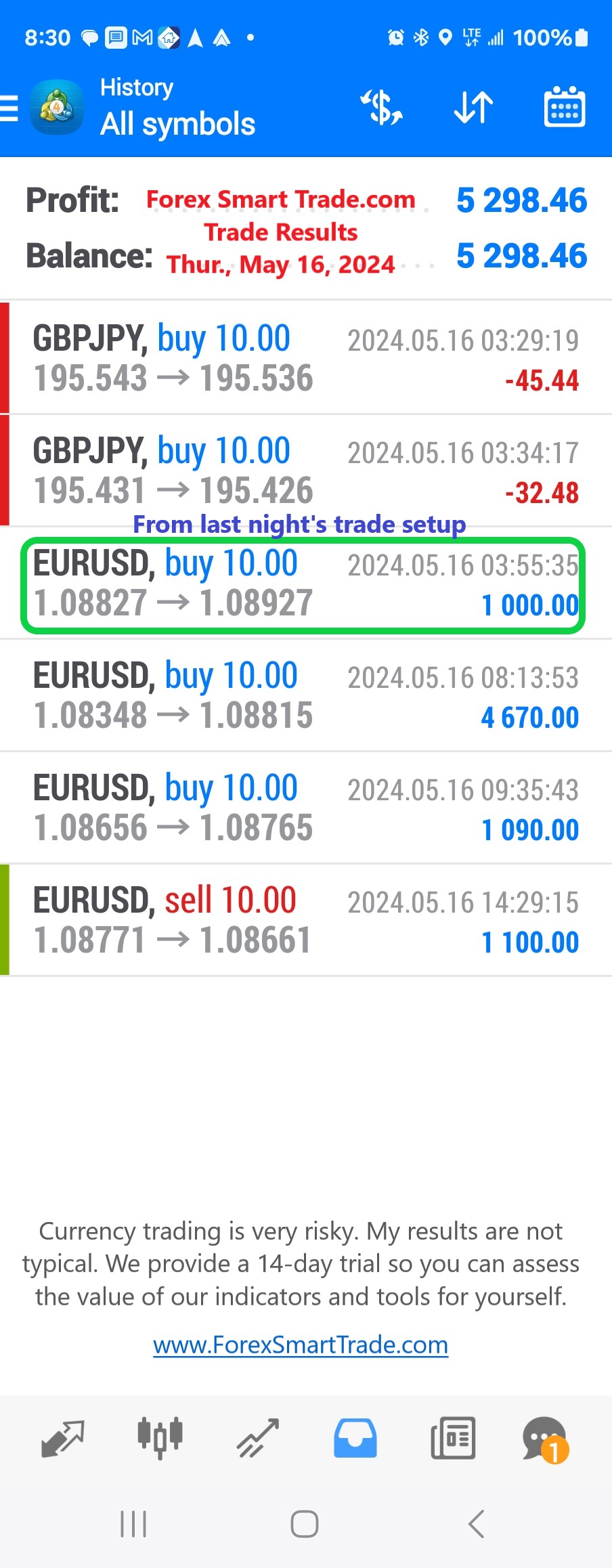

Forex Smart Trade Results, Thursday, May 16, 2024 – $5,298

USDX vs. DX vs. DXY If you’ve Googled “U.S. Dollar Index”, you might’ve seen three acronyms associated with the phrase: USDX, DX, and DXY and wondered, “What the heck is […]

Forex Smart Trade Results, Wednesday, May 15, 2024 – $1,530

ICE U.S. Dollar Index®. From a legal perspective, the designations “U.S. Dollar Index,” “Dollar Index” and “USDX” are trademarks and service marks of ICE Futures U.S., […]

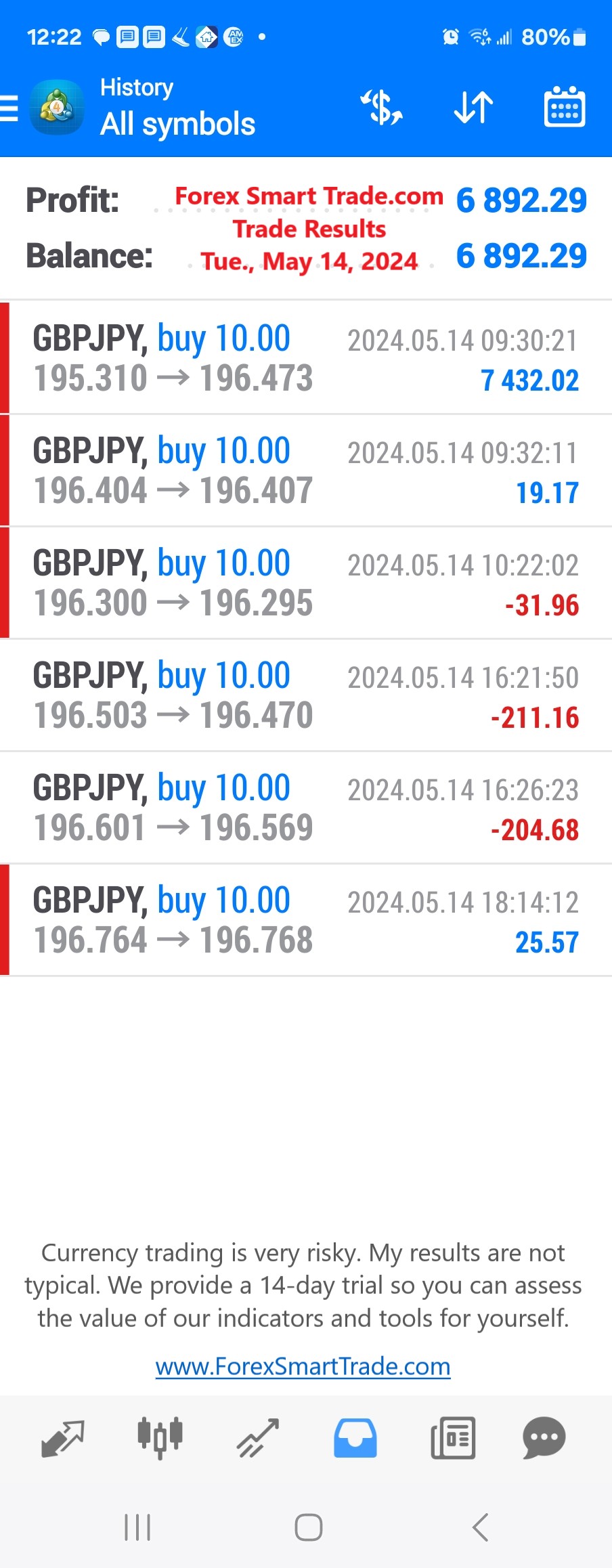

Forex Smart Trade Results, Tuesday, May 14, 2024 – $6,892

The US Dollar Index Currency Basket. The U.S. Dollar Index consists of SIX foreign currencies. They are the: Euro (EUR) Japanese Yen (JPY) British Pound (GBP) […]

Forex Smart Trade Results, Monday, May 13, 2024 – $5,805

What is the US Dollar Index (USDX)? If you’ve traded stocks, you’re probably familiar with all the indices available such as the Dow Jones Industrial Average […]

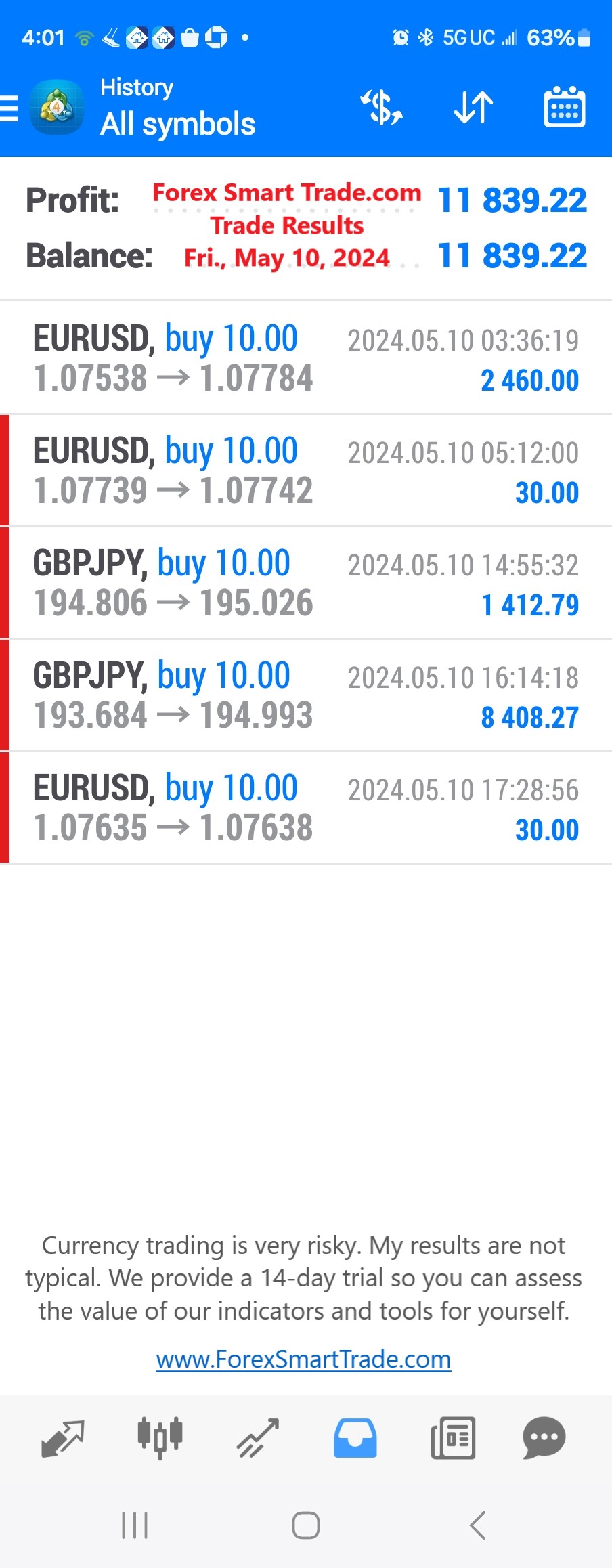

Forex Smart Trade Results, Friday, May 10, 2024, $11,839

De-dollarization. De-dollarization or “dedollarization” is the process of reducing the reliance on the U.S. dollar (USD) as a reserve currency. As the reserve currency, the dollar […]

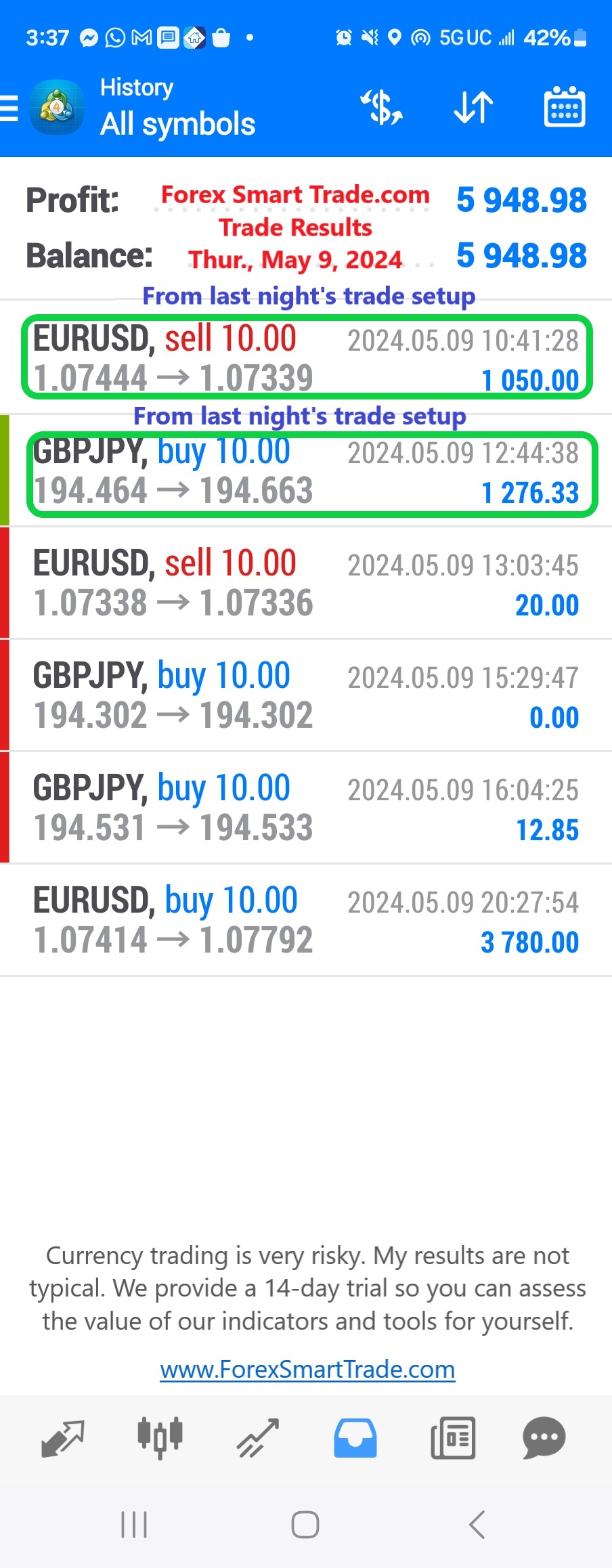

Forex Smart Trade Results, Thursday, May 9, 2024 – $5,948

How the U.S. Benefits From the Dollar’s Global Role. As you’ve learned so far, rumors of the dollar’s death are way overblown! The dollar’s global role […]

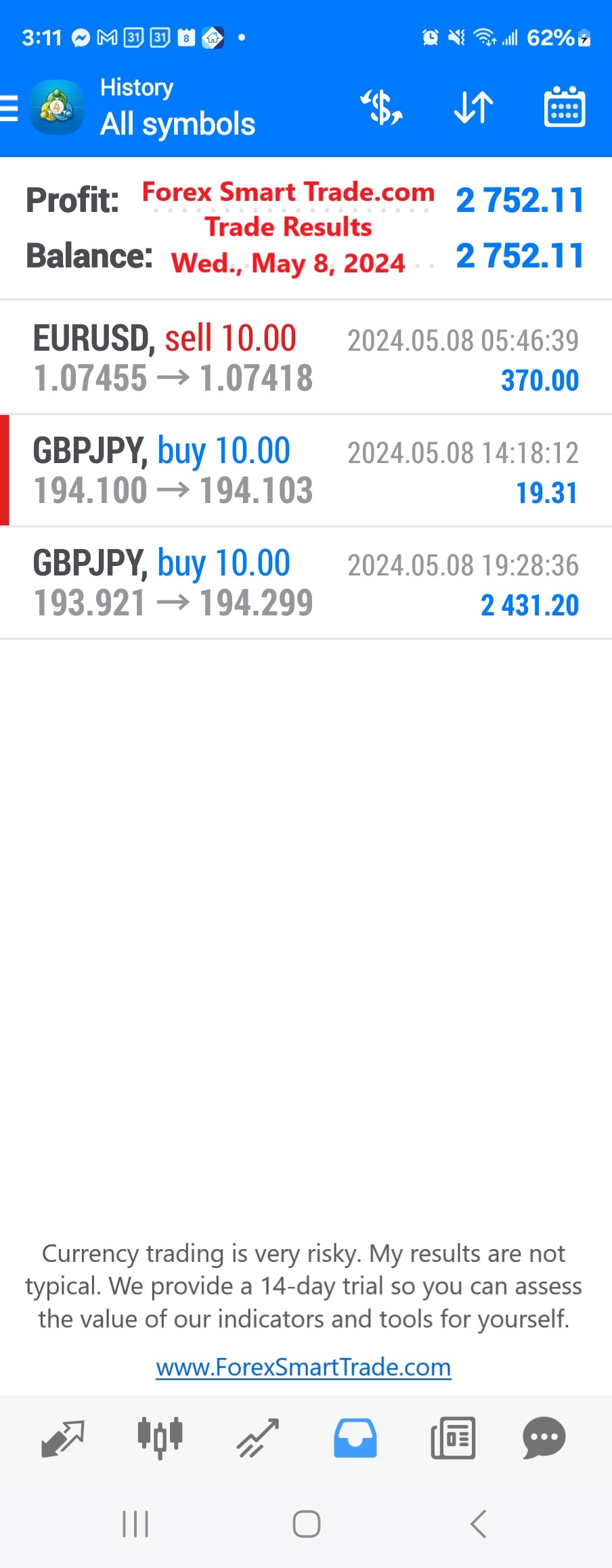

Forex Smart Trade Results, Wednesday, May 8, 2024 – $2,752

Commodities Pricing and the U.S. Dollar. The U.S. dollar also plays a crucial role in global commodities markets, as many commodities, such as oil and gold, are […]

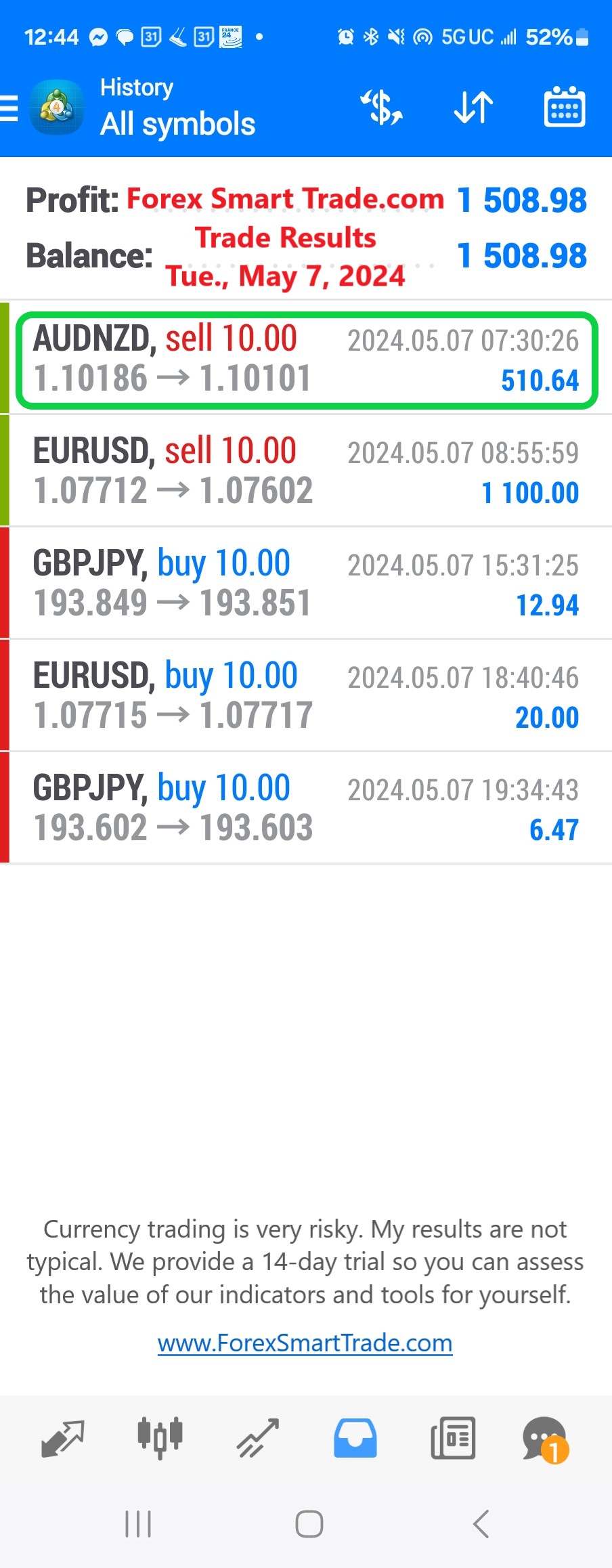

Forex Smart Trade Results, Tuesday, May 7, 2024 – $1,508

Why the Dollar Remains Popular in the Post-Bretton Woods Era. Although the Bretton Woods system collapsed in the 1970s, the U.S. dollar retained its status as the world’s […]

Forex Smart Trade Results, Monday, May 6, 2024 – $17,867

The Global Role of the U.S. Dollar. The U.S. dollar holds a unique position in the world of finance and trade, serving as a cornerstone of […]

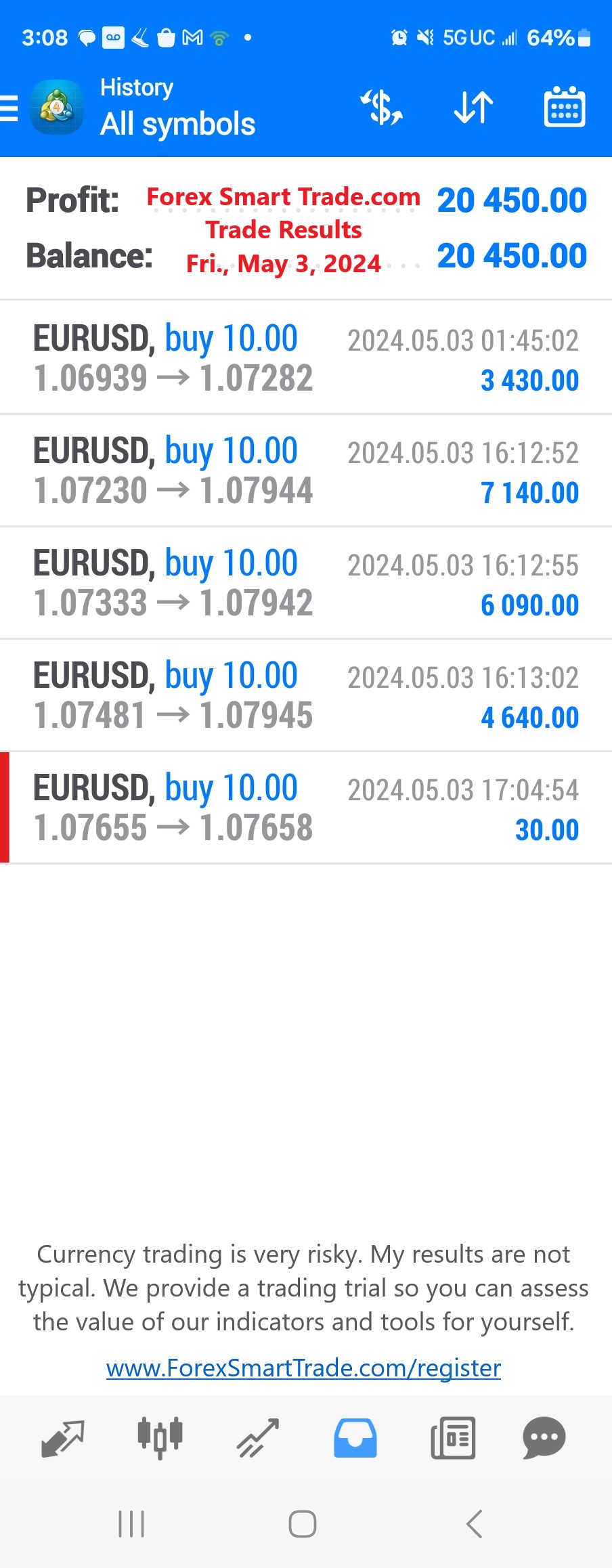

Forex Smart Trade Results, Friday, May 3, 2024 – $20,450

Summary: Carry Trade. A carry trade is when you borrow one financial instrument (like USD currency) and use that to buy another financial instrument (like JPY currency). […]