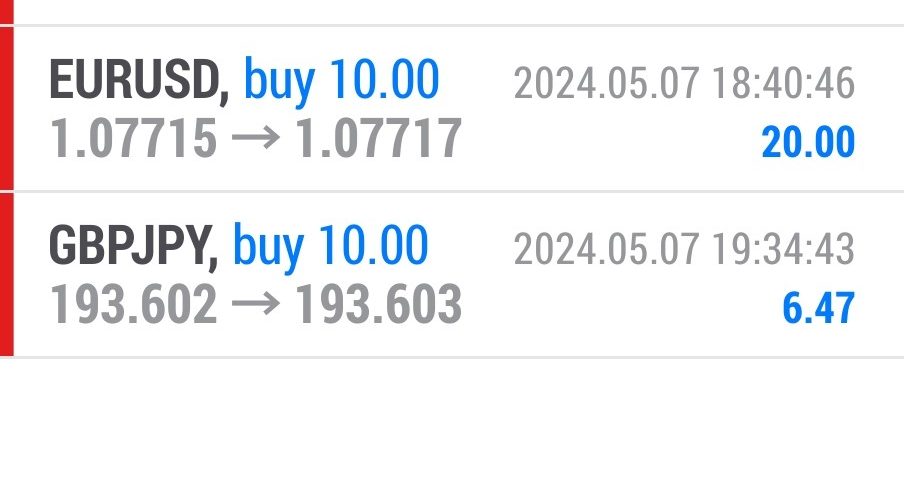

Forex Smart Trade Results, Tuesday, May 7, 2024 – $1,508

Forex Smart Trade Results, Monday, May 6, 2024 – $17,867

May 12, 2024

Forex Smart Trade Results, Wednesday, May 8, 2024 – $2,752

May 12, 2024Why the Dollar Remains Popular in the Post-Bretton Woods Era.

Although the Bretton Woods system collapsed in the 1970s, the U.S. dollar retained its status as the world’s premier currency.

This enduring appeal can be attributed to several factors:

- Economic stability: The Federal Reserve’s efforts to control inflation have contributed to the dollar’s stability. This makes the dollar an attractive store of value and medium of exchange.

- Network effects: The widespread use of the dollar in international transactions has created a self-reinforcing cycle. More individuals and businesses choosing to use the currency because of its widespread acceptance.

- Size and openness of U.S. financial markets: No other market comes even close! The depth and liquidity of U.S. financial markets enable large transactions that smaller markets might struggle to accommodate, further enhancing the dollar’s attractiveness.

At the end of the day, people want to keep dollar assets because the economic, political, and institutional fundamentals of the United States provide confidence and credibility.

The U.S. Dollar as a Reserve Currency

One of the most critical aspects of the U.S. dollar’s global role is its function as a reserve currency.

A reserve currency is a currency held by central banks in significant quantities.

It is widely used to conduct international trade and financial transactions, eliminating the costs of settling transactions involving different currencies.

Central banks around the world hold a significant portion of their foreign exchange reserves in dollars. They central banks use this to stabilize their own currencies, finance international trade, and provide a cushion against economic shocks.

Today, central banks hold about 60% of their foreign exchange reserves in dollars.

Even though the dollar’s share of central banks’ foreign exchange reserves has gone down over the years, it is still almost twice as much as the euro, yen, pound, and yuan COMBINED, which is the same as it was a decade ago.

The euro, which is its closest rival for the role of world currency, makes up about 20% of central bank reserves.

The dollar’s stability and widespread acceptance make it an ideal choice for this purpose.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.