Trade Results

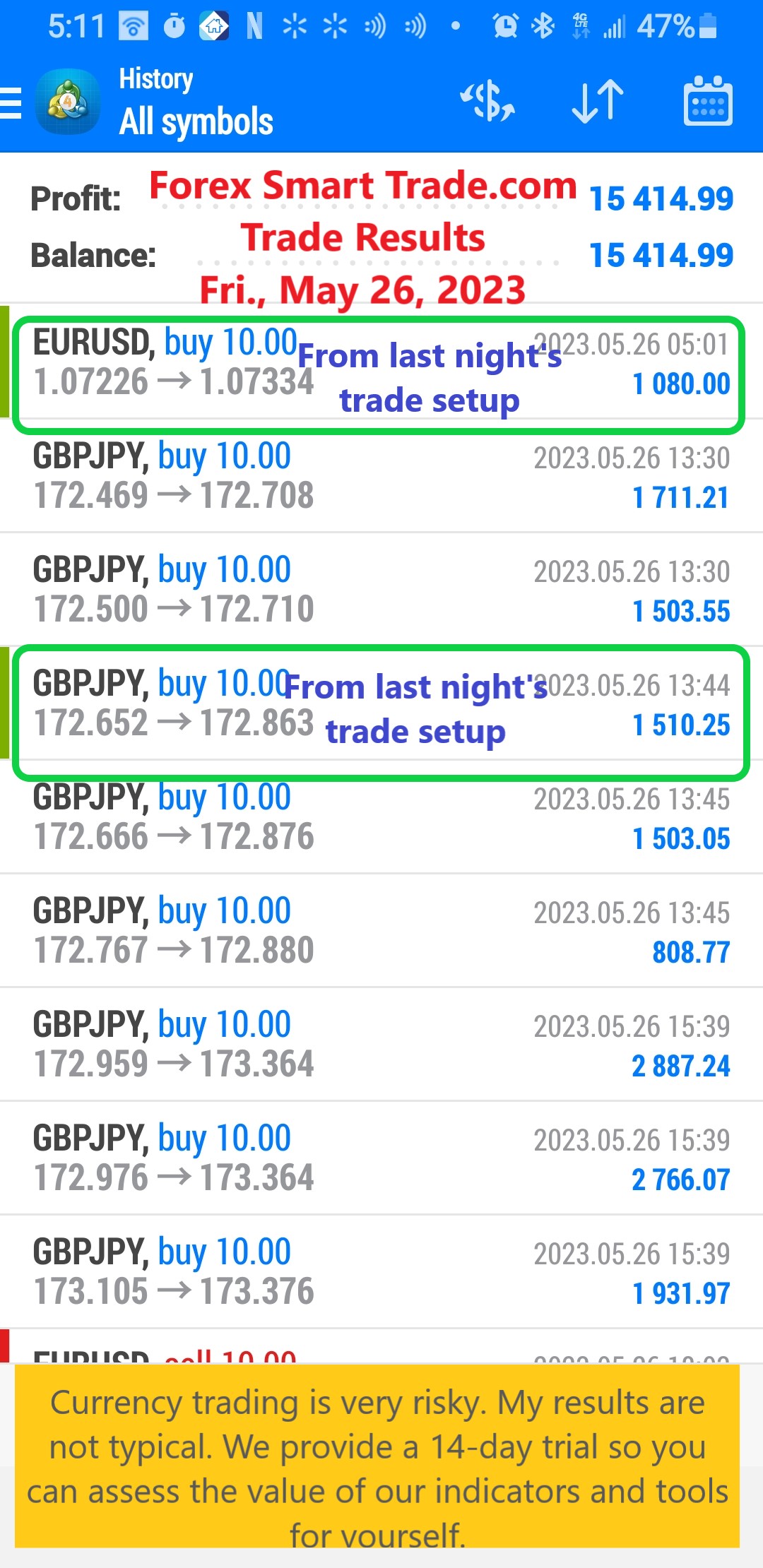

Forex Smart Trade Results, Friday, May 26, 2023 – $15,414

How to Use Keltner Channels. Let’s examine how to use Keltner channels. Keltner Channels is a volatility indicator introduced by a grain trader named Chester Keltner. […]

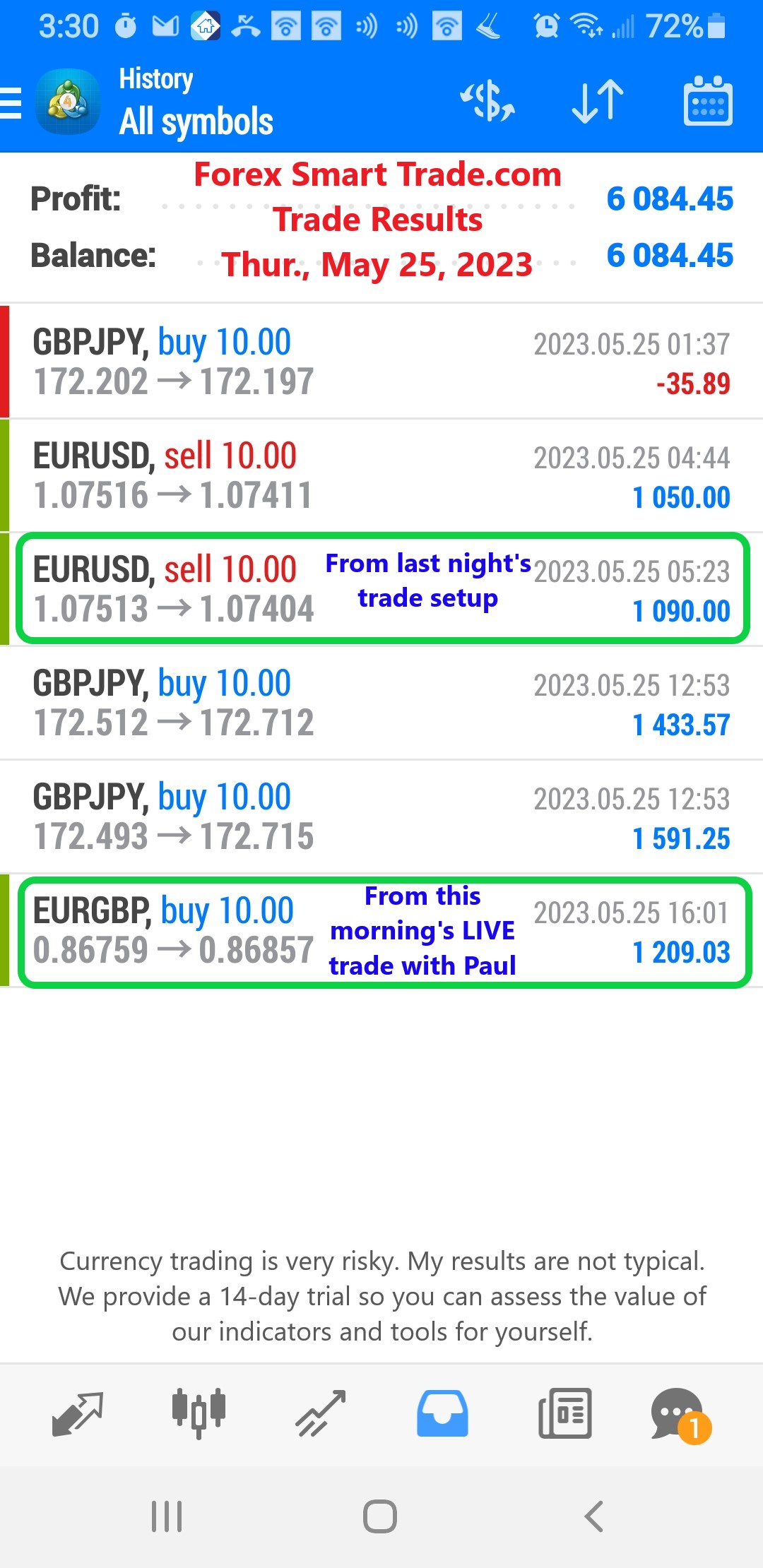

Forex Smart Trade Results, Thursday, May 25, 2023 – $6,084

Bollinger Squeeze. The “Bollinger Squeeze” is pretty self-explanatory. When the bands squeeze together, it usually means that a breakout is getting ready to happen. If the […]

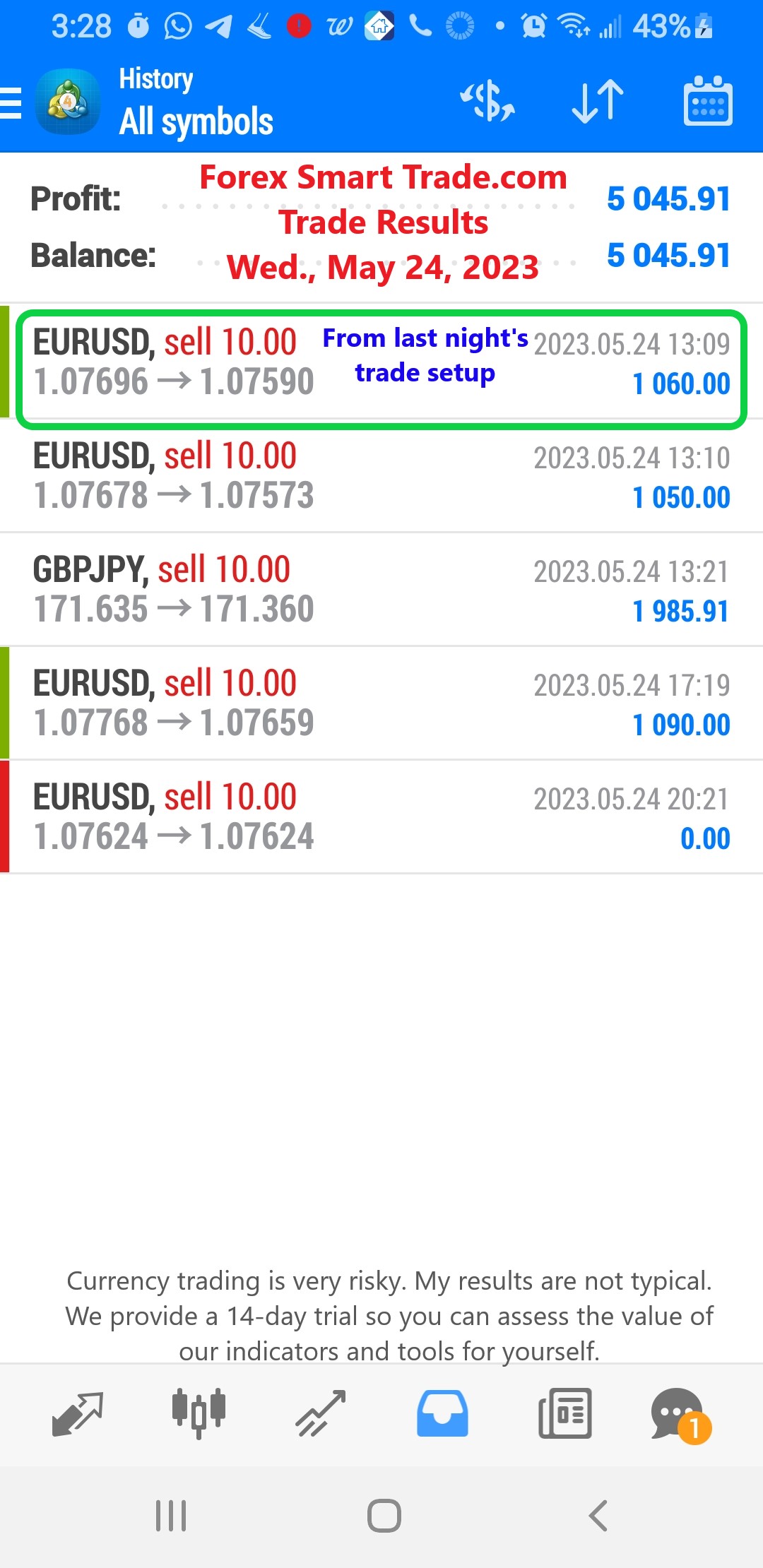

Forex Smart Trade Results, Wednesday, May 24, 2023 – $5,045

The Bollinger Bounce. Now let’s take a look at the Bollinger Bounce. One thing you should know about Bollinger Bands is that the price tends to return […]

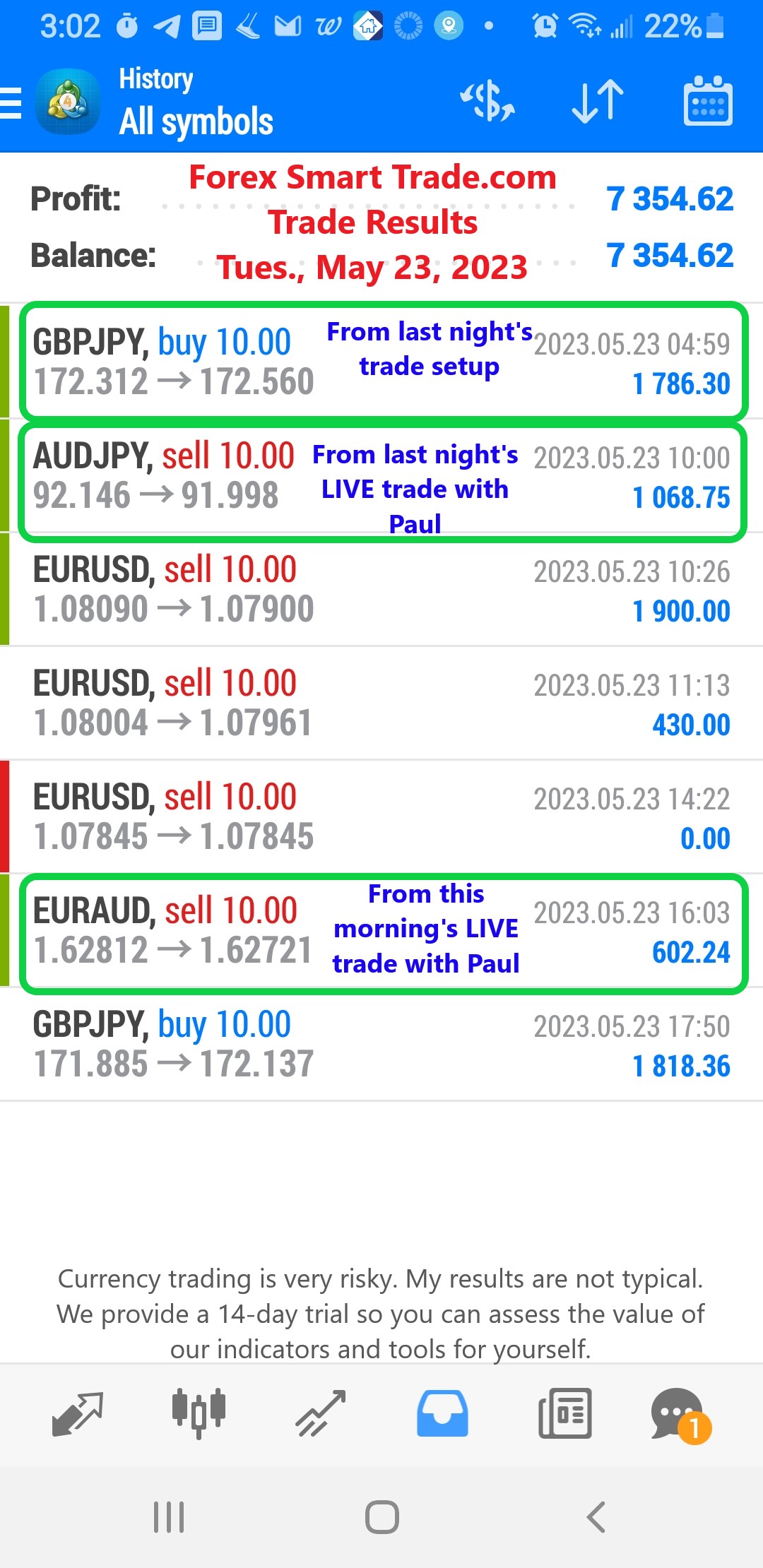

Forex Smart Trade Results, Tuesday, May 23, 2023 – $7,354

What are Bollinger Bands? Let’s take a look at what are Bollinger Bands. We typically plotted Bollinger Bands as three lines: An upper band A middle […]

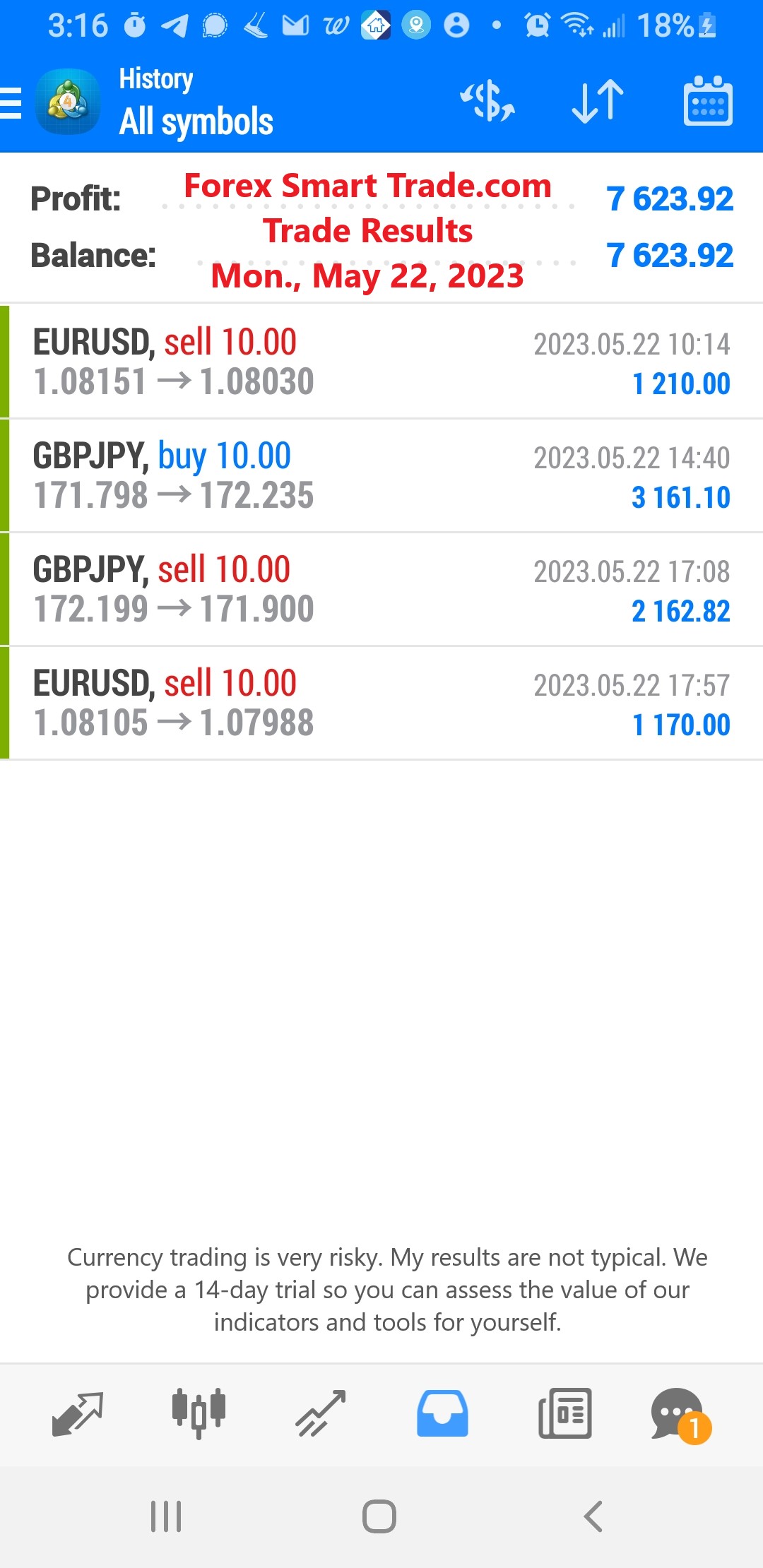

Forex Smart Trade Results, Monday, May 22, 2023 – $7,623

Bollinger Bands. Bollinger Bands, a technical indicator developed by John Bollinger. They are used to measure a market’s volatility and identify “overbought” or “oversold” conditions. John Bollinger […]

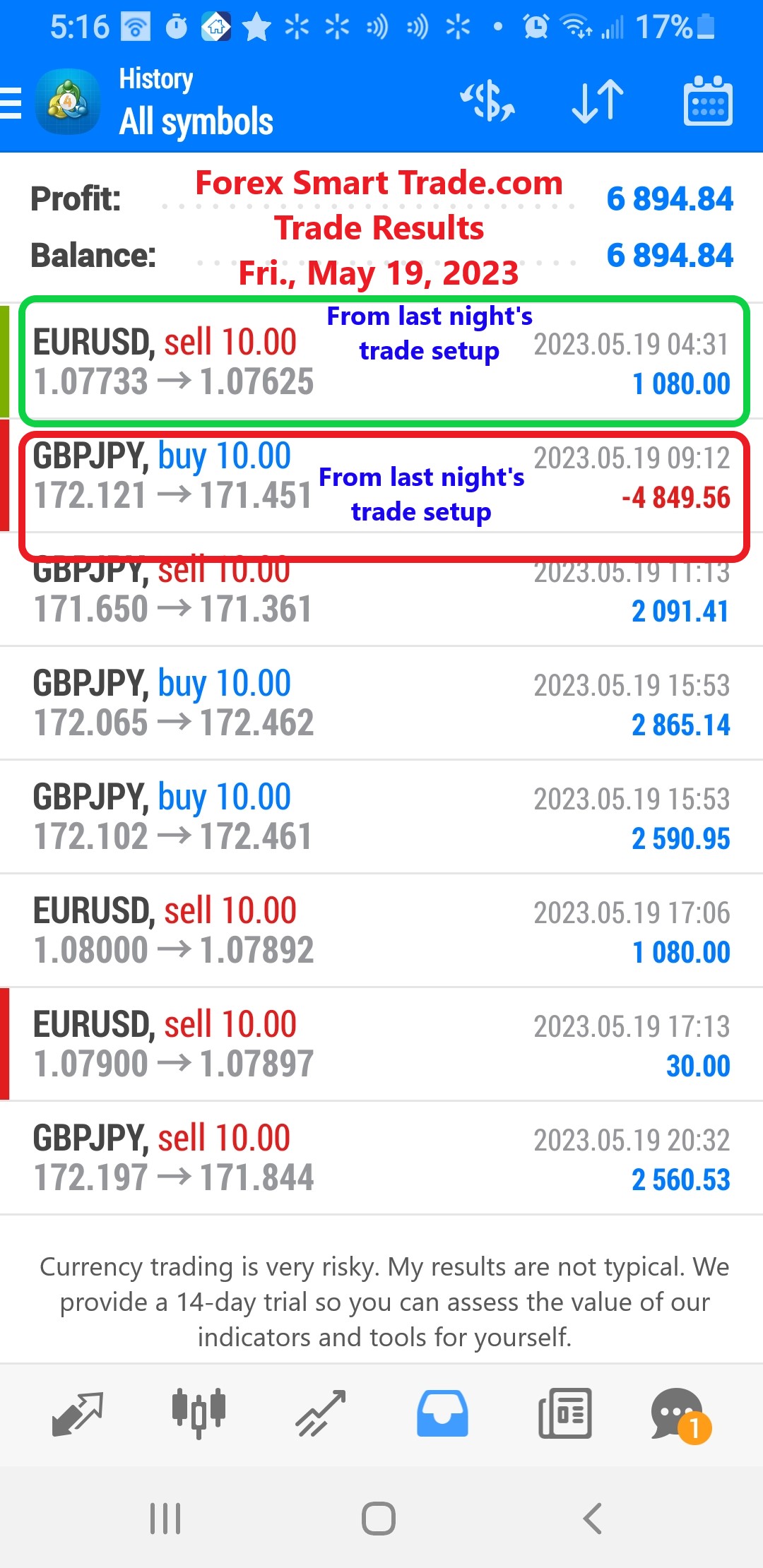

Forex Smart Trade Results, Friday, May 19, 2023 – $6,894

How to Use Bollinger Bands. Let’s take a look at how to use Bollinger Bands and continue to add tools to your trader’s technical analysis (TA) […]

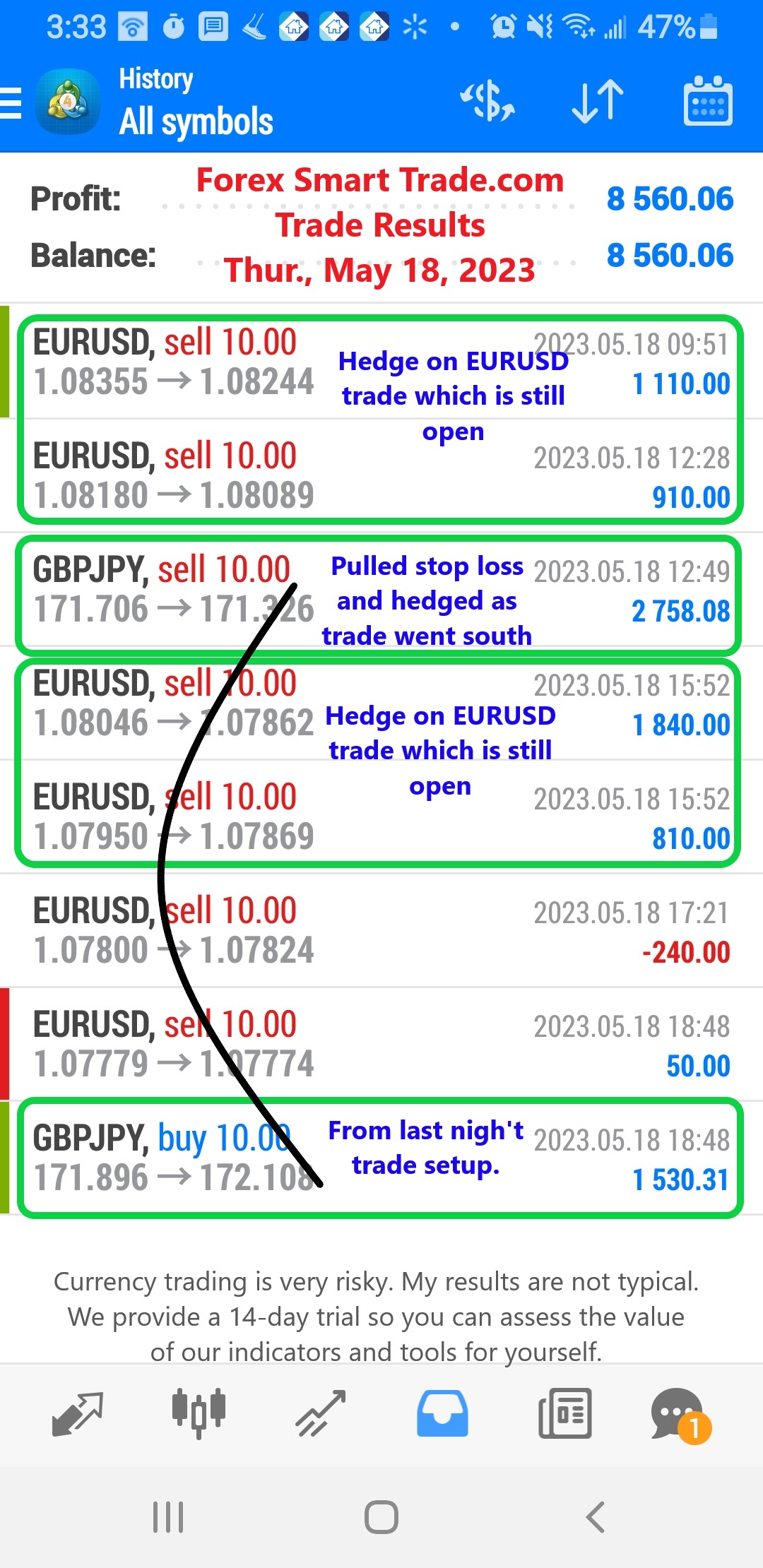

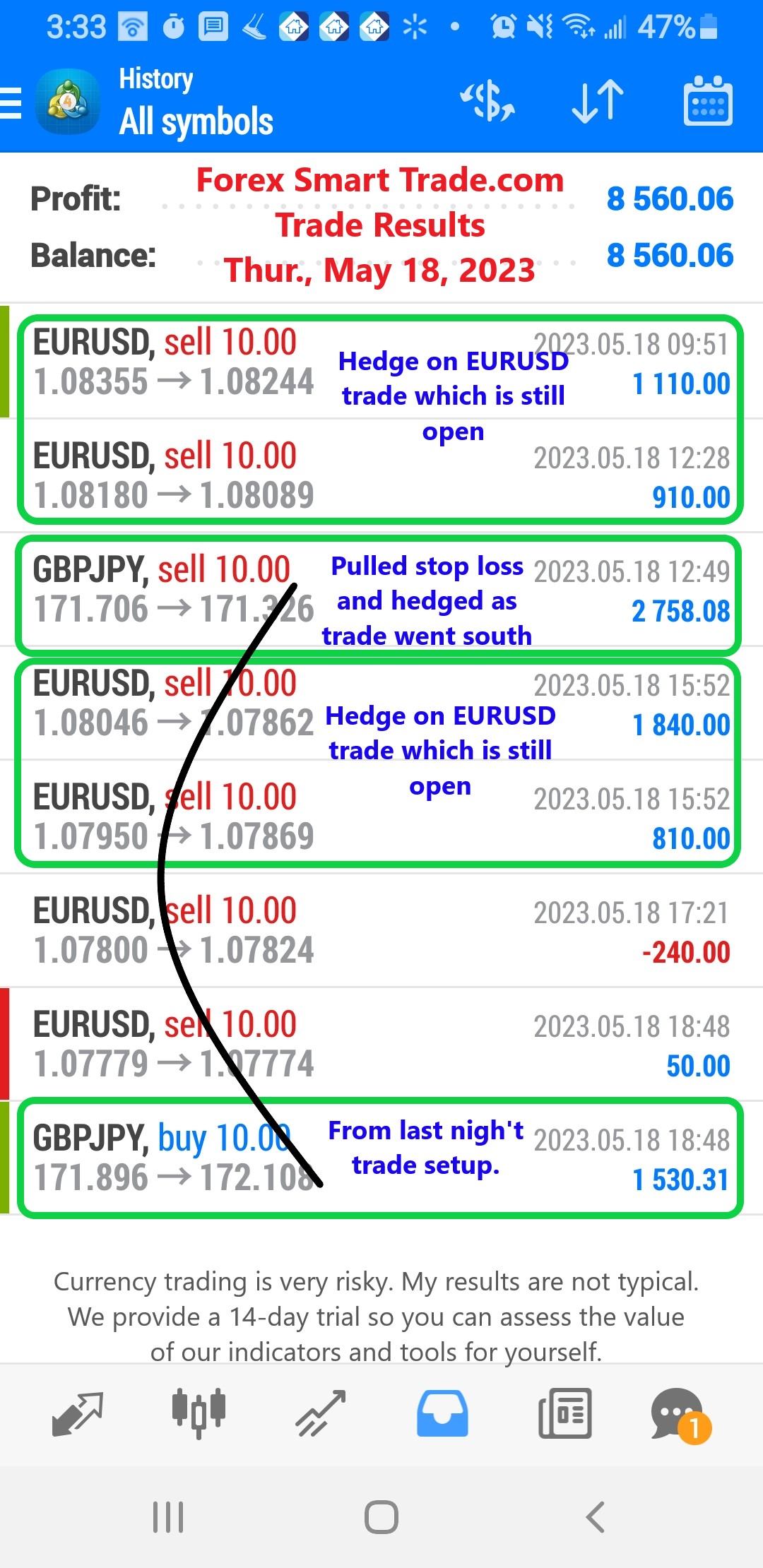

Forex Smart Trade Results, Thursday, May 18, 2023 – $8,560

Summary: Using Moving Averages. There are many types of moving averages. The two most common types are a simple moving average and an exponential moving average. Simple […]

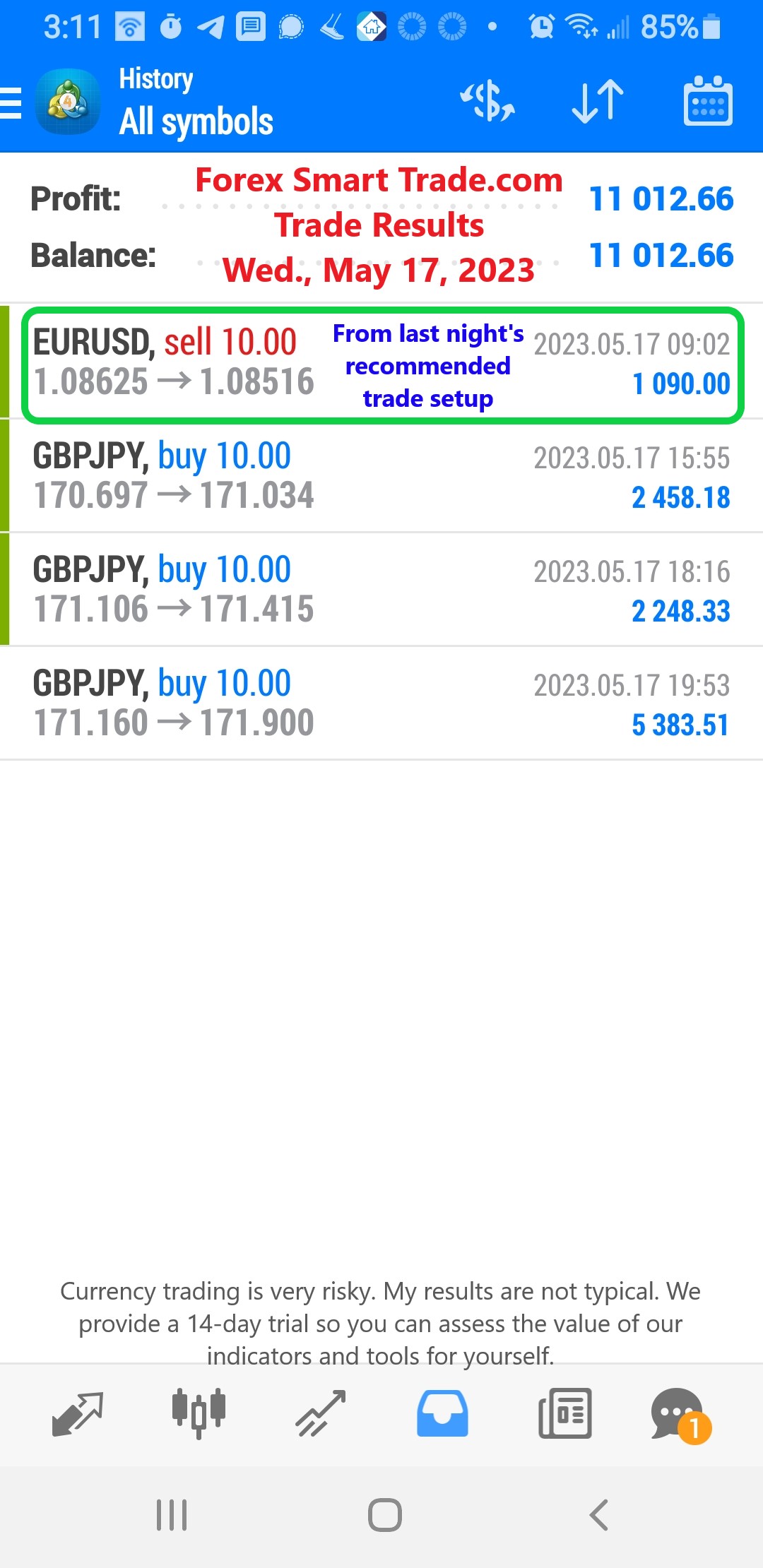

Forex Smart Trade Results, Wednesday, May 17, 2023 – $11,012

Summary of the Guppy Multiple Moving Average. Let’s review what we’ve learned with a summary of the Guppy Multiple Moving Average. The Guppy Multiple Moving Average […]

Forex Smart Trade Results, Tuesday, May 16, 2023 – $4,591

Limitations of the Guppy Multiple Moving Average (GMMA). Let’s review some limitations of the Guppy multiple moving average (GMMA). The main limitation of the Guppy is […]

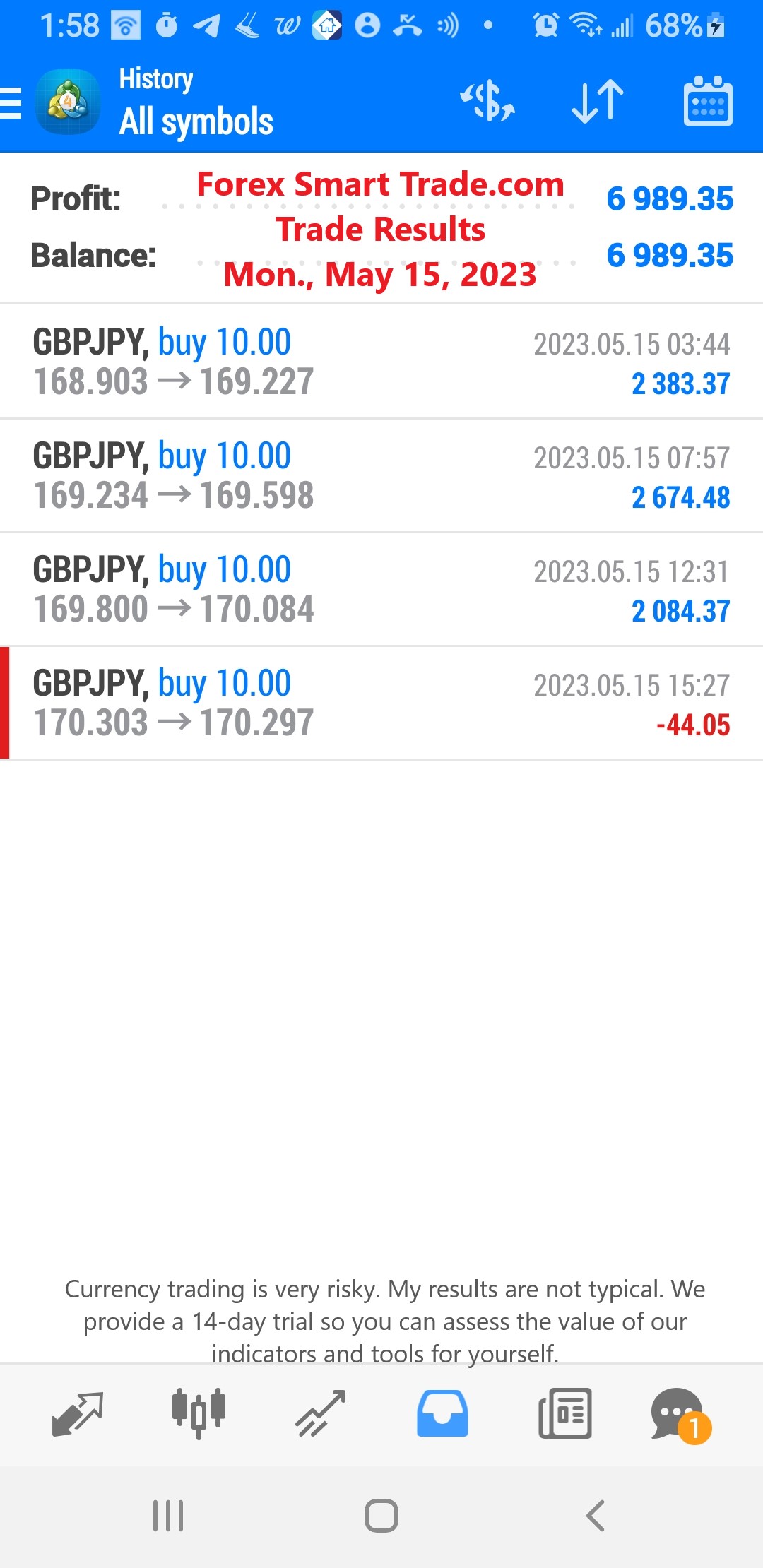

Forex Smart Trade Results, Monday, May 15, 2023 – $6,989

GMMA Compression Breakout Strategy. Let’s look at a GMMA compression breakout strategy. The moving averages also act as support and resistance levels. When compression of both groups of moving […]

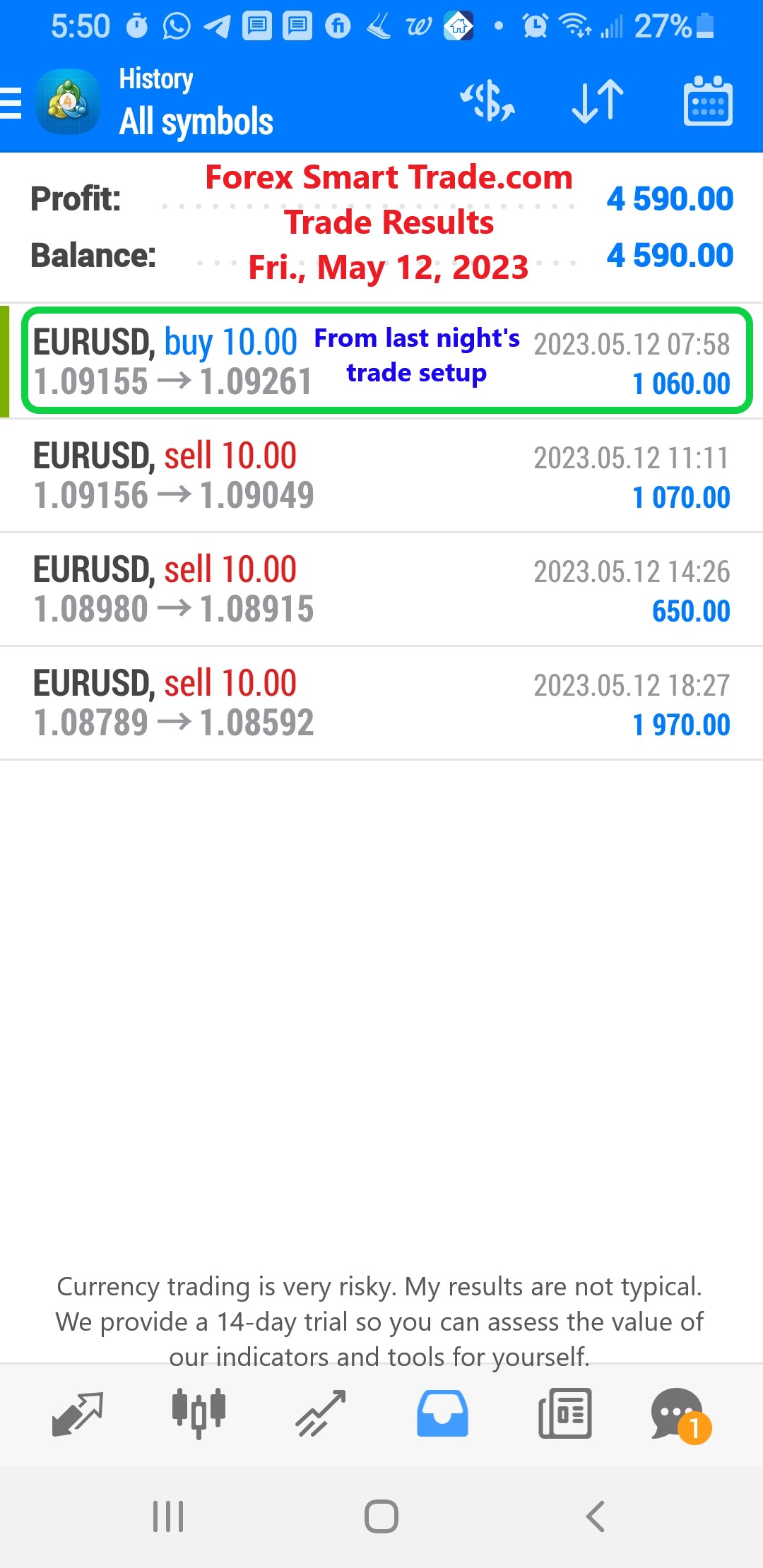

Forex Smart Trade Results, Friday, May 12, 2023 – $4,590

How to Trade Currencies with the Guppy Multiple Moving Average. Let’s examine how to trade currencies with the Guppy multiple moving average. The GMMA indicator can […]

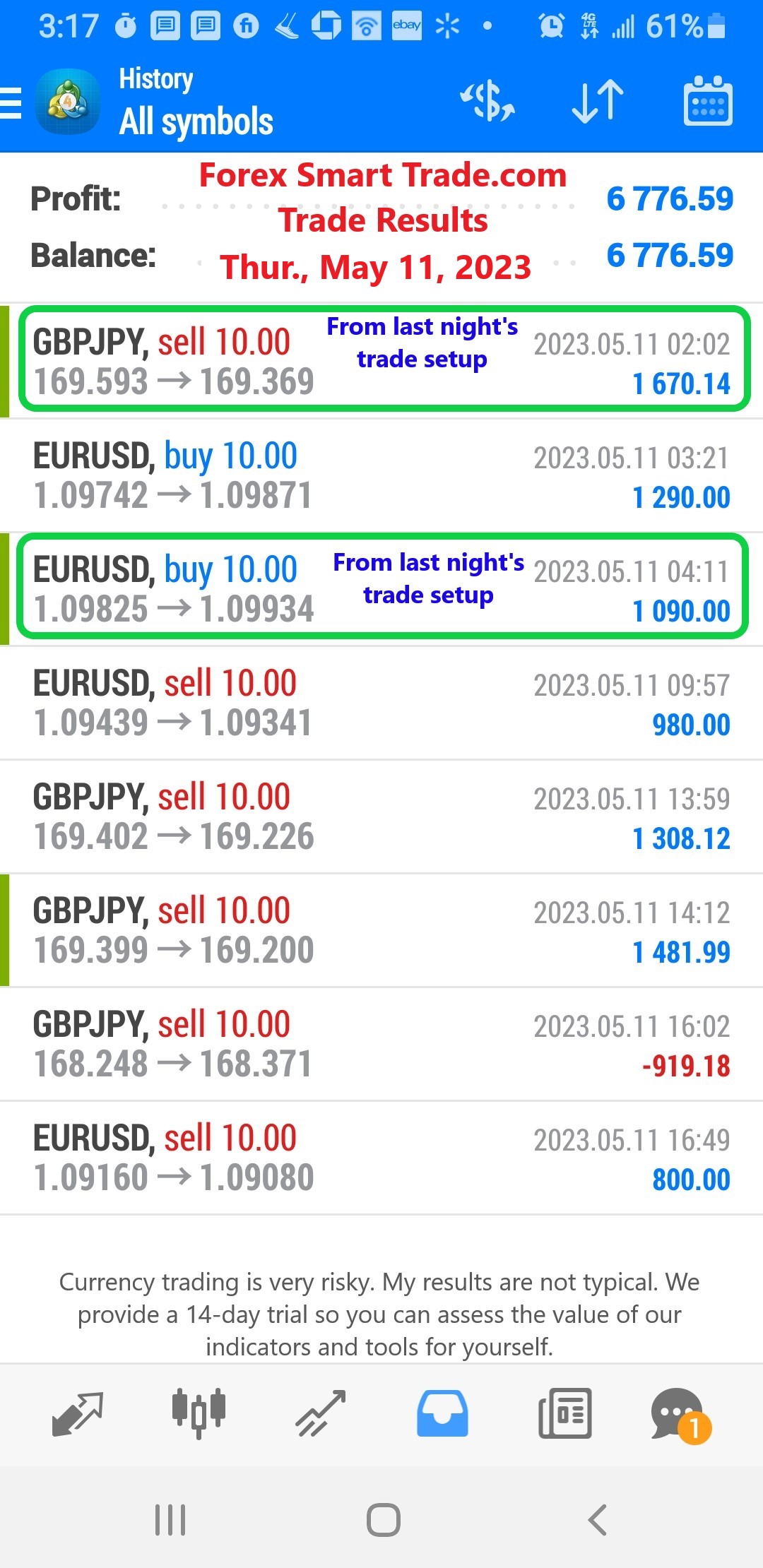

Forex Smart Trade Results, Thursday, May 11, 2023 – $6,776

How to Identify Trend Reversals Using Guppy Moving Averages. Let’s examine how to identify trend reversals using Guppy moving averages. The crossover of the short- and long-term […]

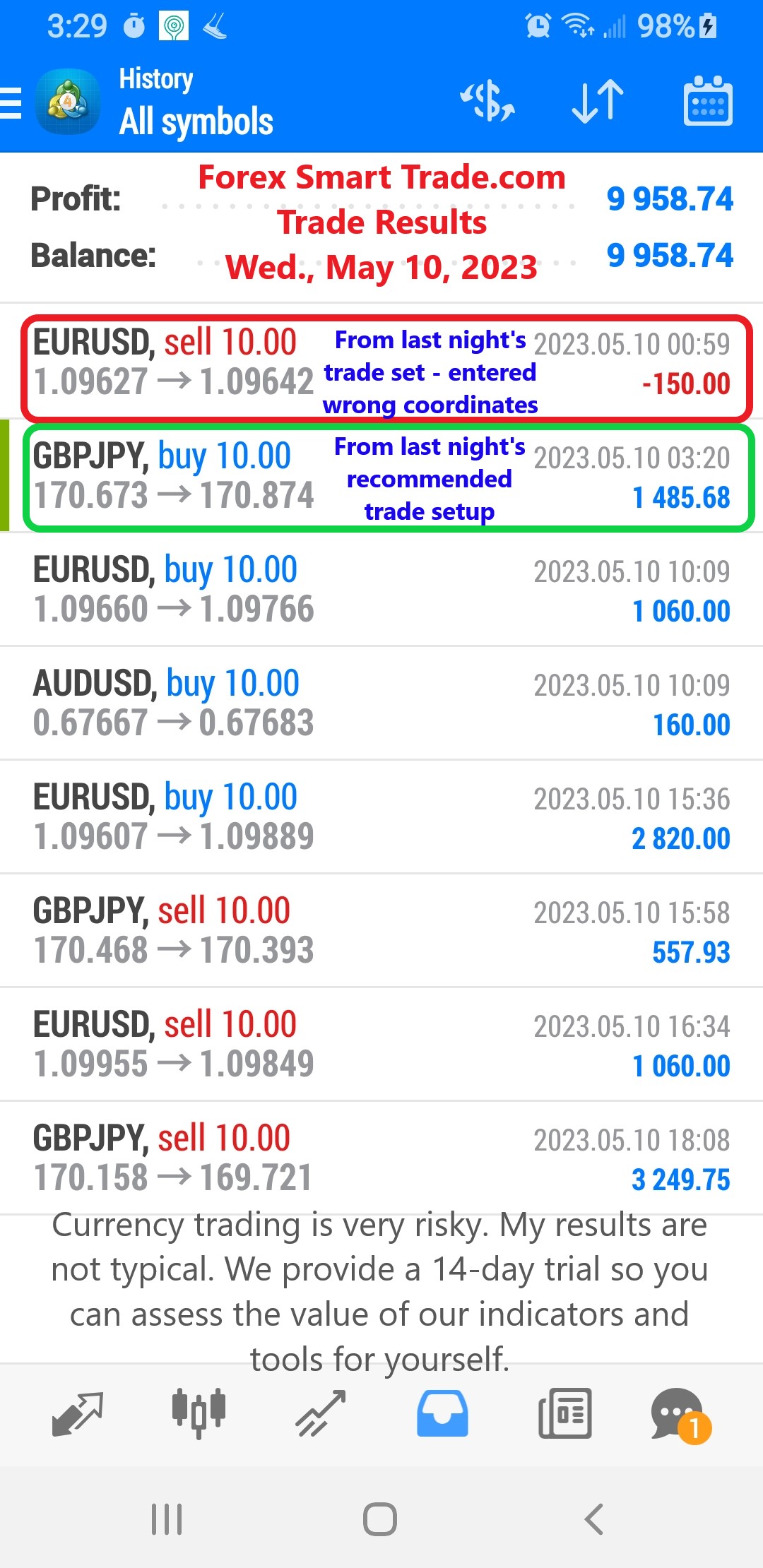

Forex Smart Trade Results – Wednesday, May 10, 2023 – $9,958

How to Set Up the Guppy Multiple Moving Average. Let’s take a look at how to set up the Guppy multiple moving average. This technique consists […]

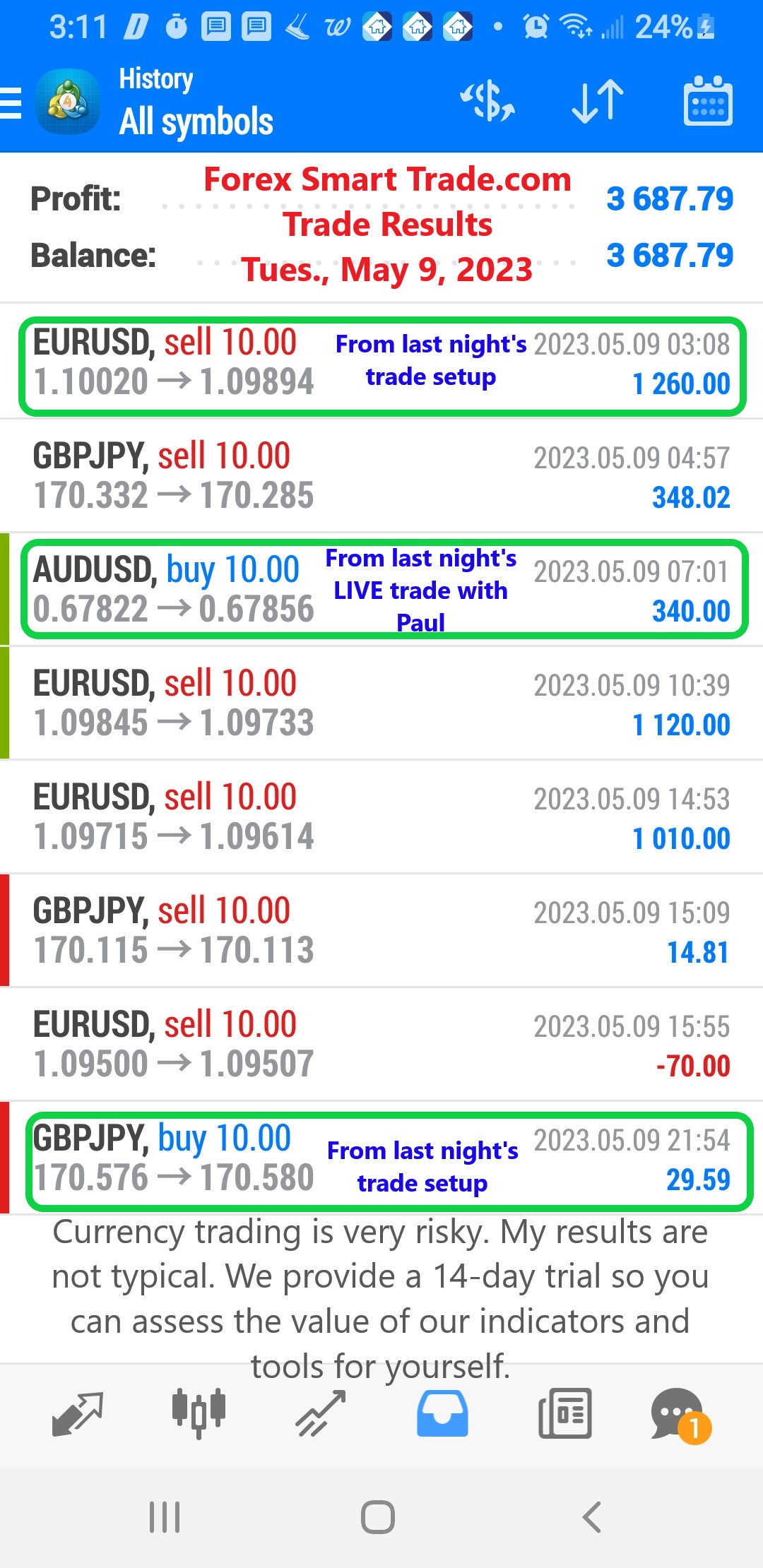

Forex Smart Trade Results, Tuesday, May 9, 2023 – $3,687

The GMMA. Daryl introduced GMMA in his book, Trend Trading. The Guppy is a trend-following technique composed of 12 EMAs (or exponential moving averages). The multiple lines of the Guppy help traders […]

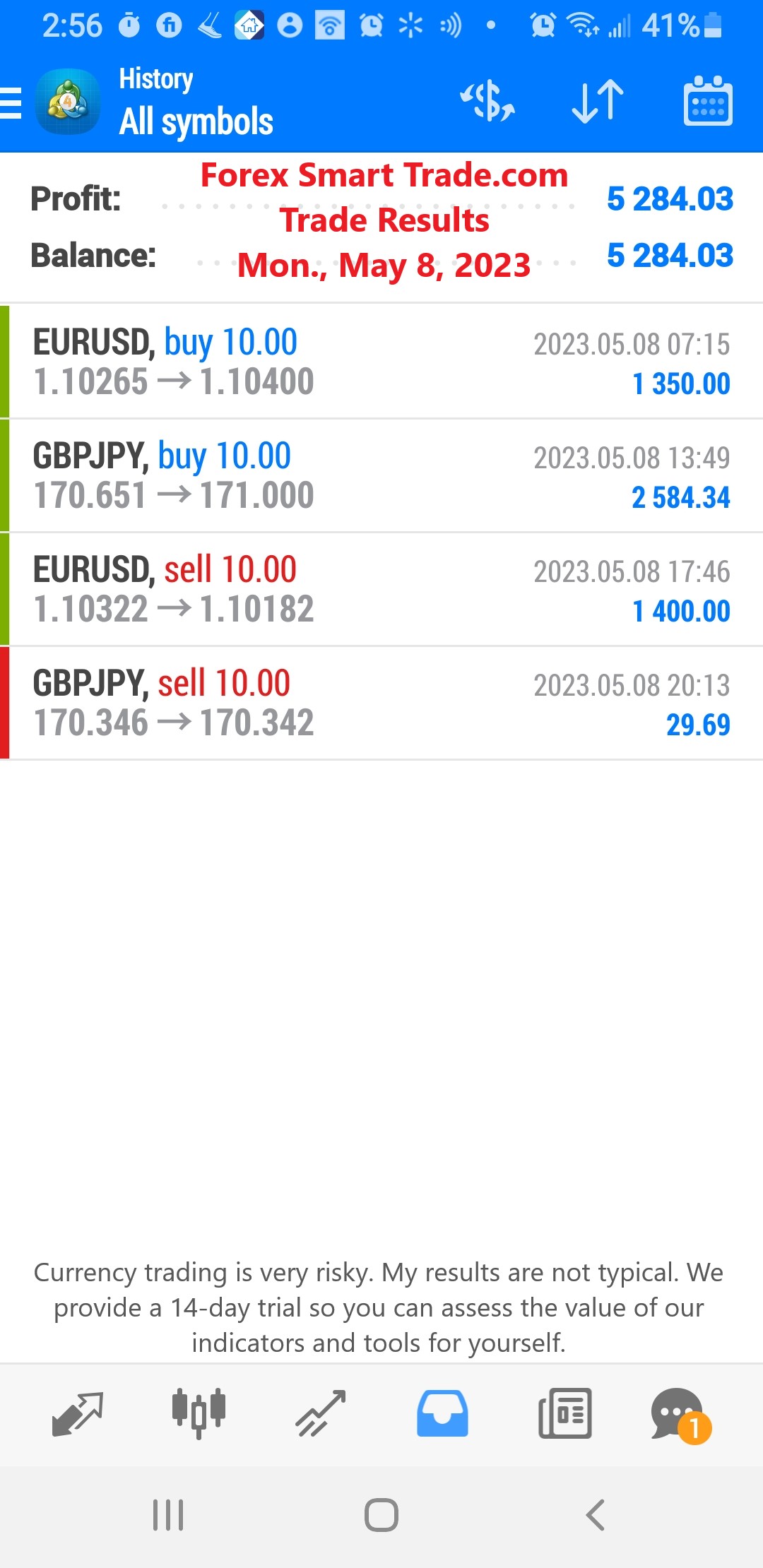

Forex Smart Trade Results, Monday, May 8, 2023 – $5,284

How to Trend Trade with Guppy Multiple Moving Average (GMMA). Let’s look at how to trend trade with Guppy multiple moving averages (GMMA). The Guppy Multiple […]

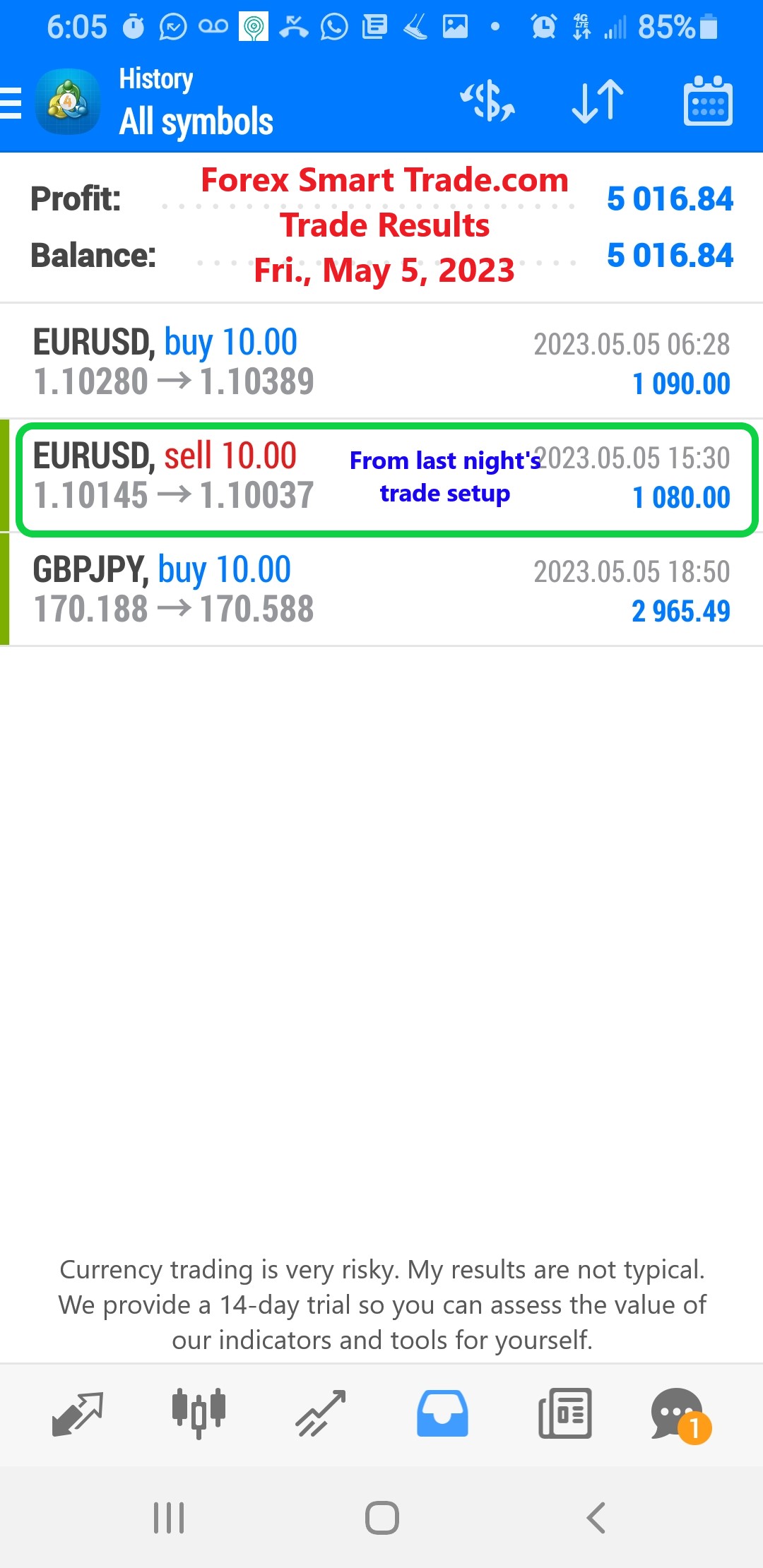

Forex Smart Trade Results, Friday, May 5, 2023 – $5,016

Moving Average Ribbon Example. Continuing our discussion, let’s take a look at a moving average ribbon example. Let’s take a look at a moving average ribbon […]

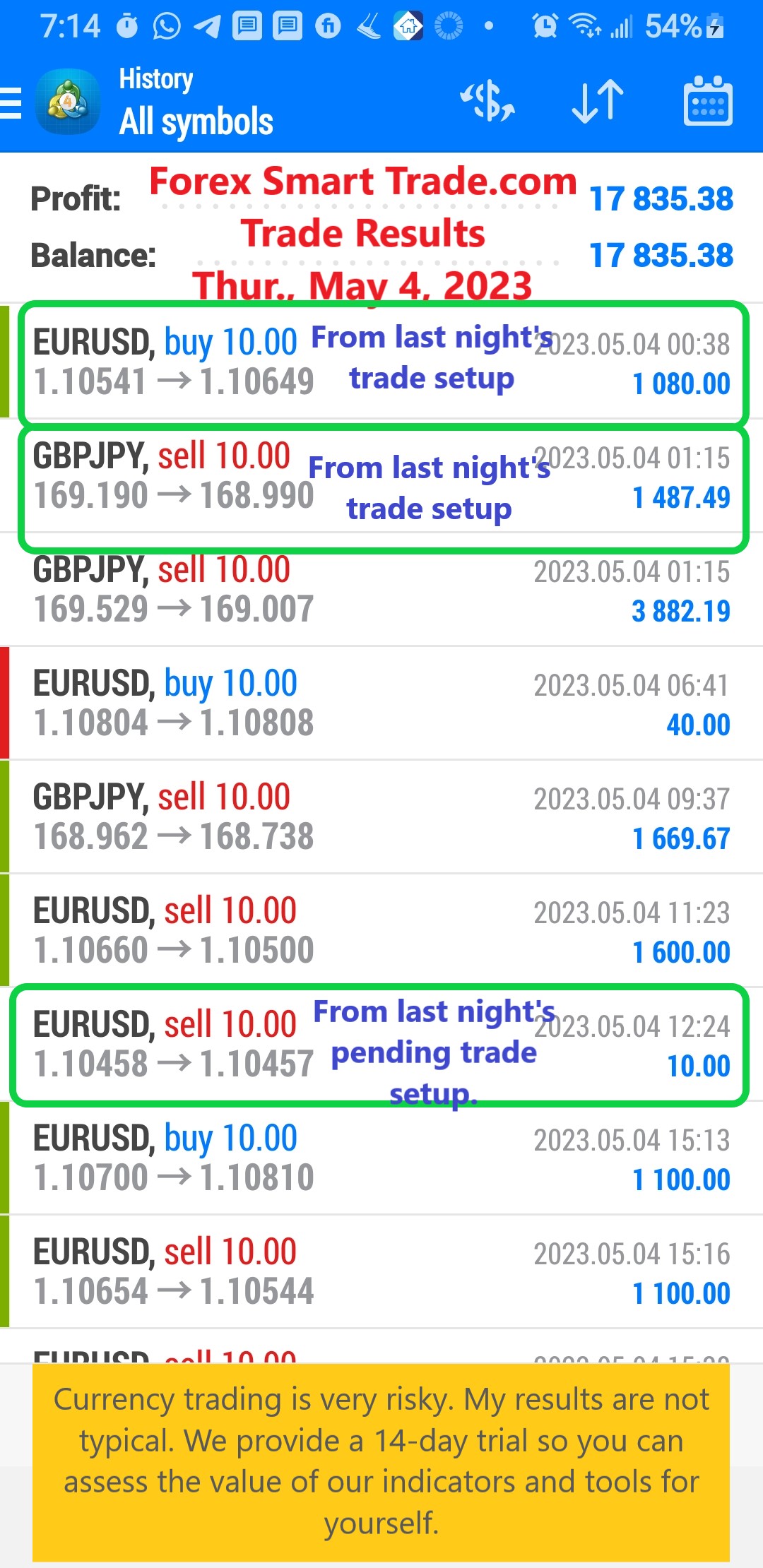

Forex Smart Trade Results, Thursday, May 4, 2023 – $17,835

How to Trade with Moving Average Ribbons. Now, let’s look at how to trade with moving average ribbons. 1. An EXPANDING moving average ribbon signals the […]

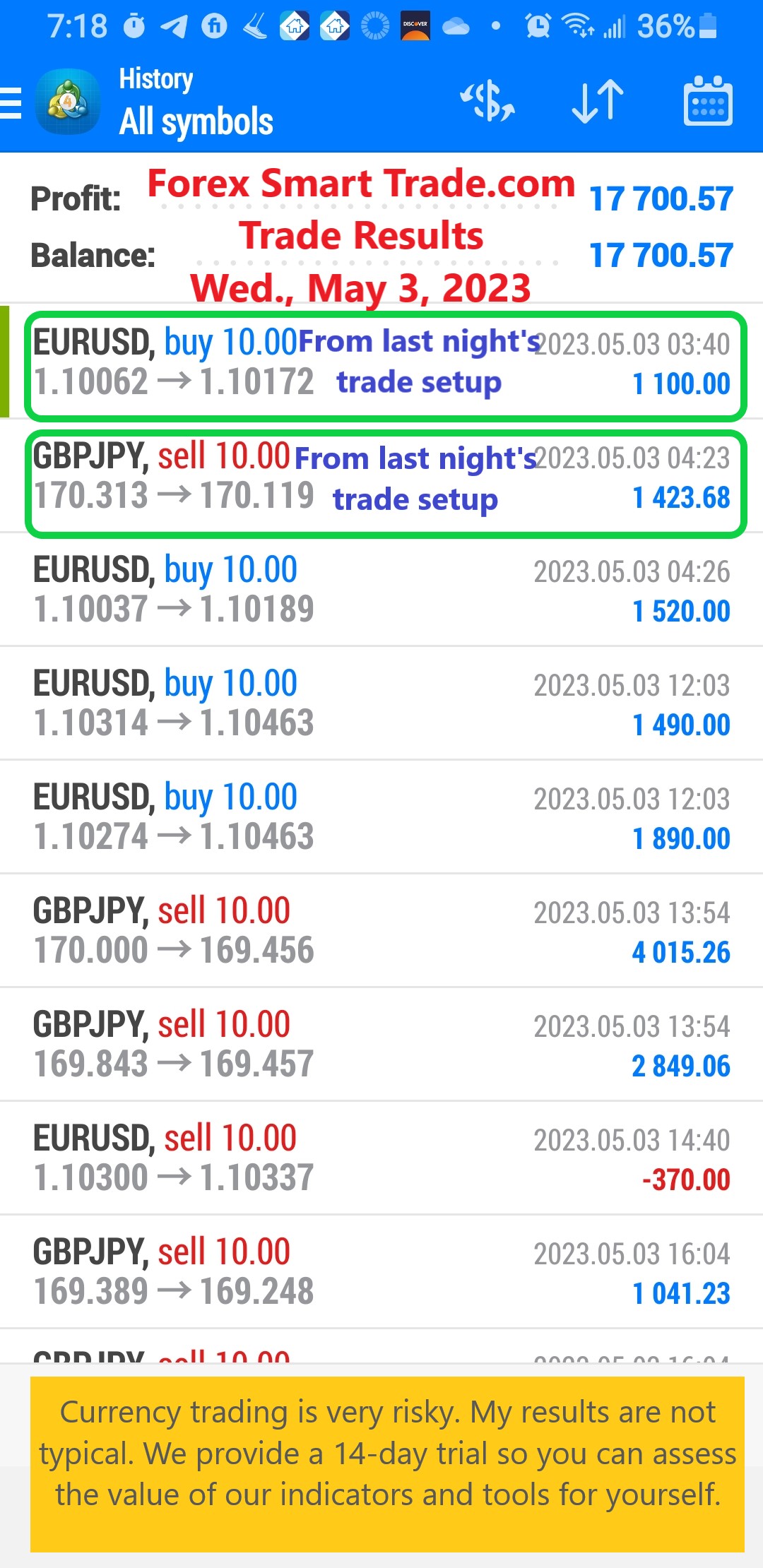

Forex Smart Trade Results, Wednesday, May 3, 2023 – $17,700

How to Analyze Trends With Moving Average Ribbons. Let’s take a look at how to analyze trends with moving average ribbons. What is a moving average ribbon? […]

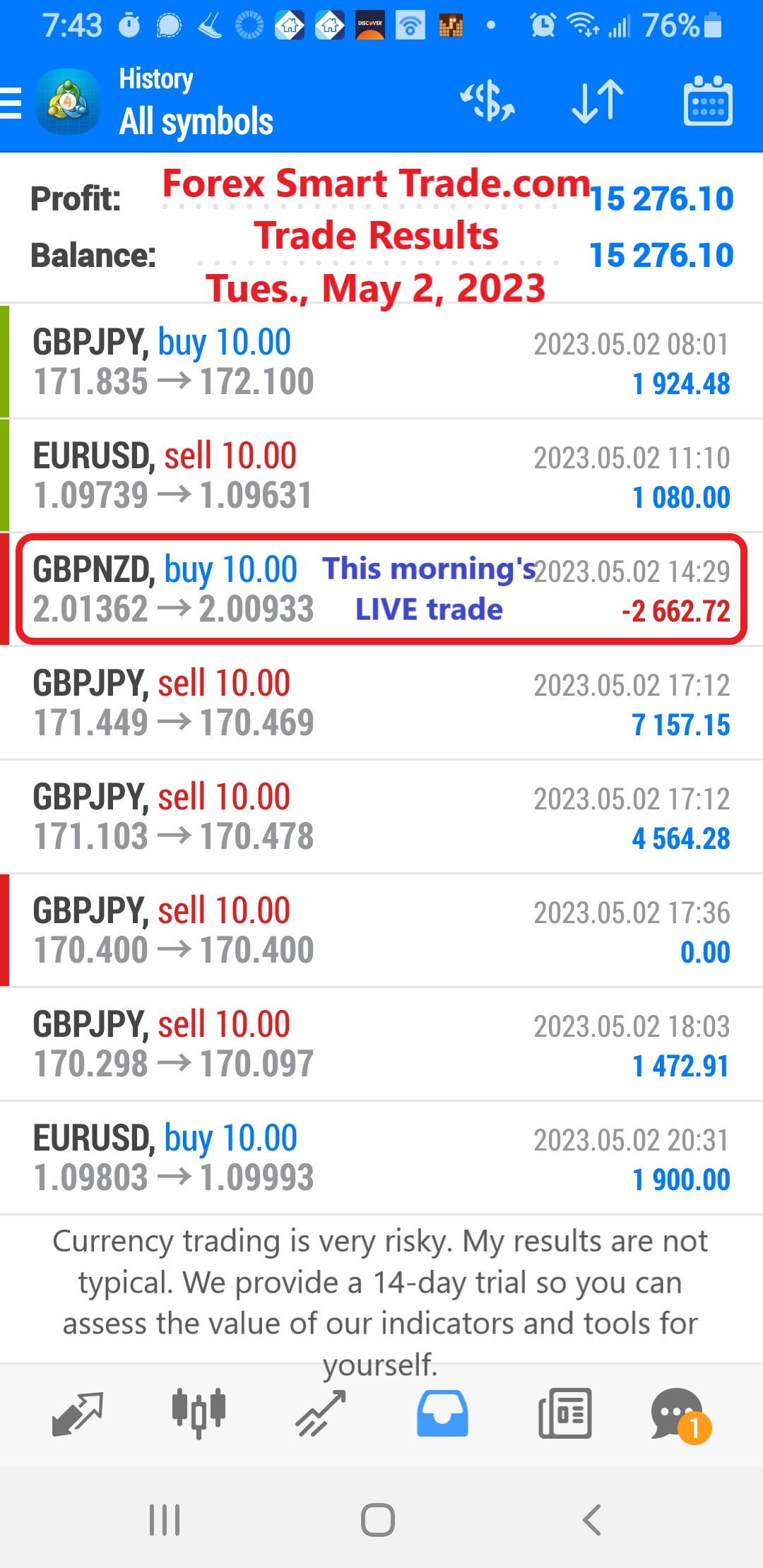

Forex Smart Trade Results, Tuesday, May 2, 2023 – $15,276

How to Identify Overbought and Oversold Levels with Moving Average Envelopes. Let’s review how to identify overbought and oversold levels with moving average envelopes. There will […]

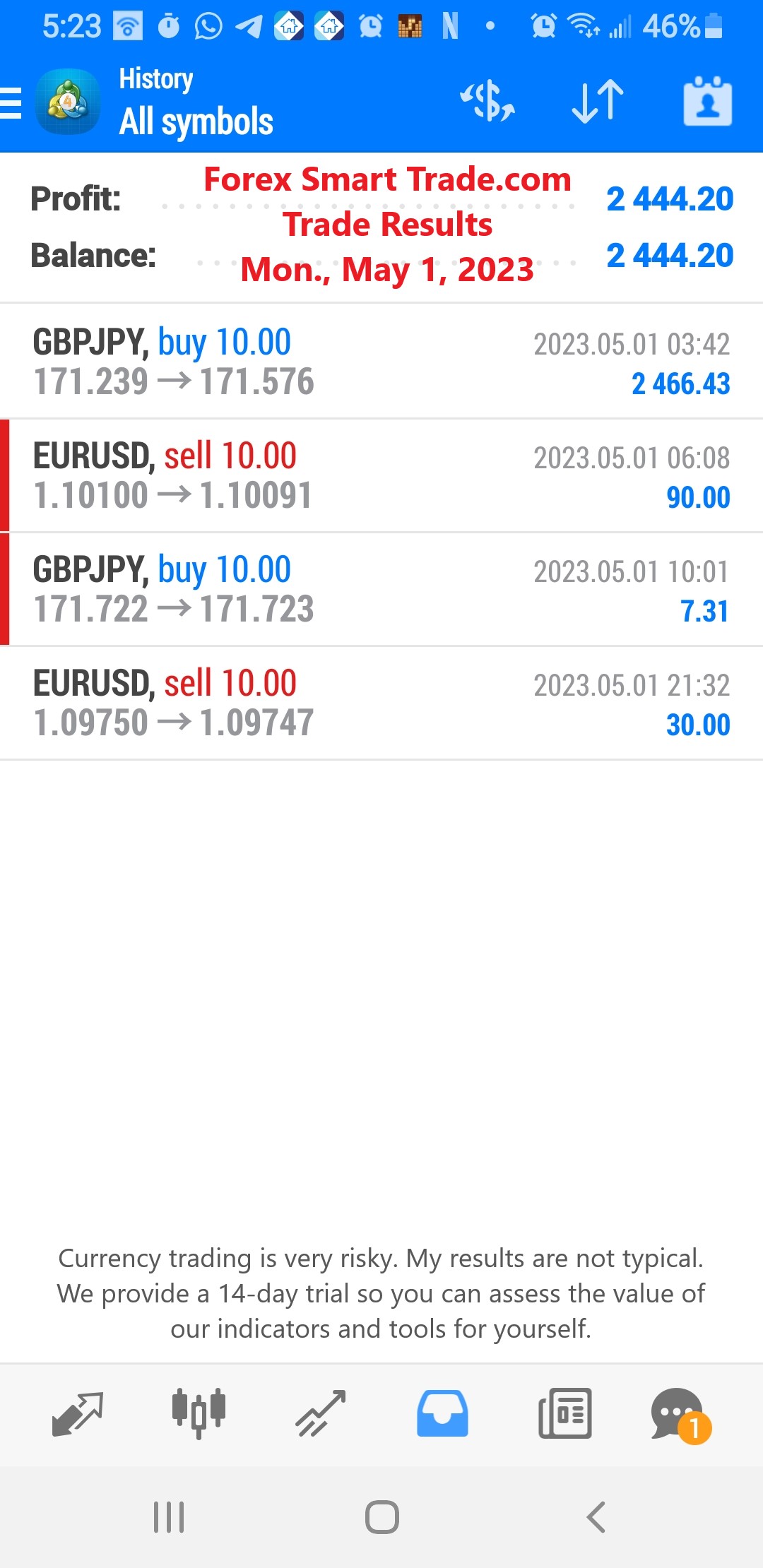

Forex Smart Trade Results, Monday, May 1, 2023 – $2,444

How to Confirm Trend Direction with Moving Average Envelopes. Let’s examine how to confirm trend direction with moving average envelopes. The foundation of moving average envelopes […]

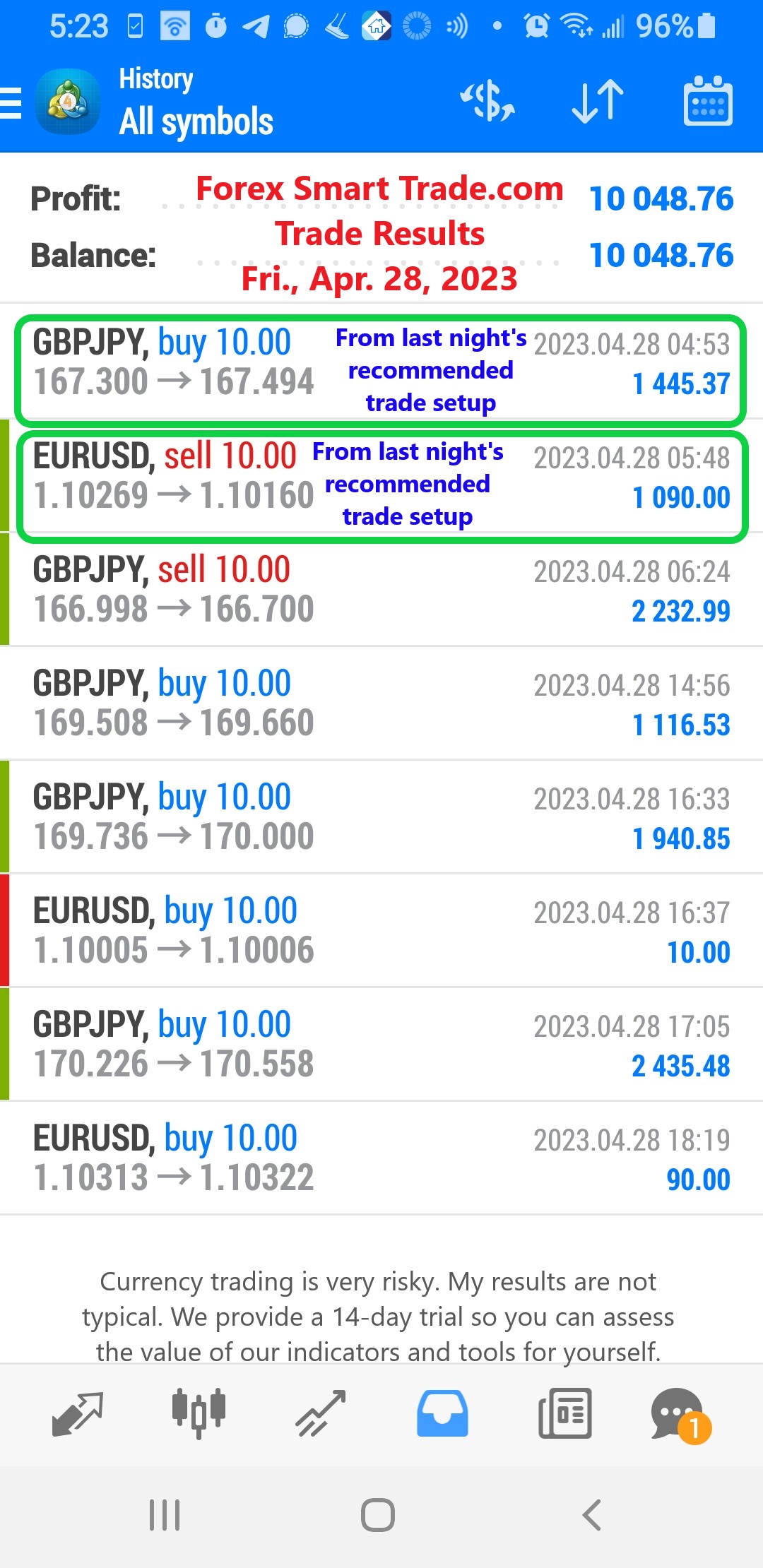

Forex Smart Trade Results, Friday, April 28, 2023 – $10,048

What are Moving Average Envelopes? A moving average envelope consists of a moving average AND two other lines. One line is ABOVE the moving average and the […]