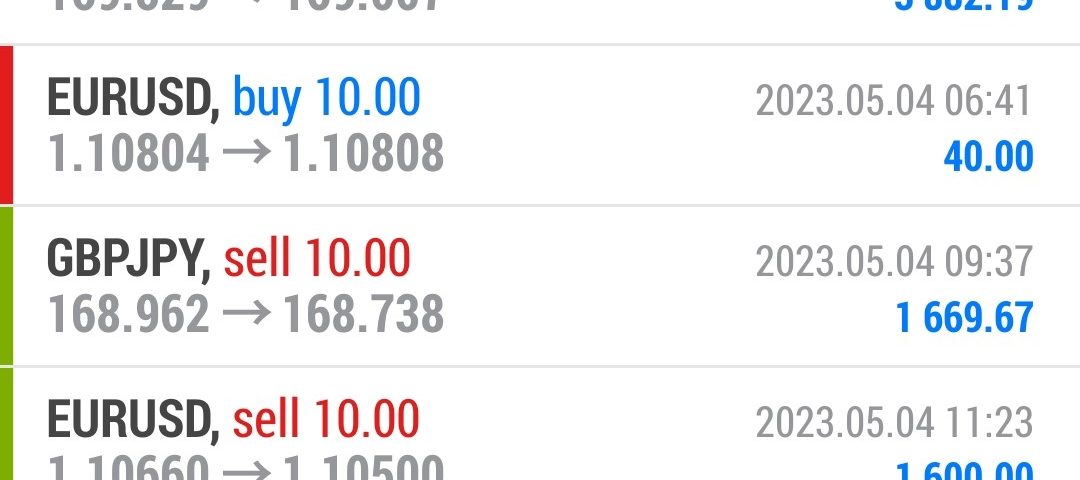

Forex Smart Trade Results, Thursday, May 4, 2023 – $17,835

Forex Smart Trade Results, Wednesday, May 3, 2023 – $17,700

May 20, 2023

Forex Smart Trade Results, Friday, May 5, 2023 – $5,016

May 20, 2023How to Trade with Moving Average Ribbons.

Now, let’s look at how to trade with moving average ribbons.

1. An EXPANDING moving average ribbon signals the potential end of a trend.

When the moving averages start widening out and separating, also known as ribbon “expansion”, this signals that the recent price direction has reached an extreme and could be the end of a trend.

Think of each moving average as a magnet and they’re attracted to each other.

They do not want to be too far apart from each other for too long. So when they are, they will want to close that distance.

2. A CONTRACTING moving average ribbon signals a possible change in trend.

When the moving averages start to converge and get closer to each other, also known as ribbon “contraction”, a trend change has possibly started.

After an extreme move in price in one direction, you will notice shorter-term moving averages converge first. The longer-term moving averages will slowly converge.

3. A PARALLEL moving average ribbon signals a strong trend.

When the moving average ribbons are parallel and evenly spaced, this means that the current trend is strong.

All the moving averages are in “agreement” since they are moving together.

Keep an Eye on the Spacing Between the Moving Averages

Some traders make the mistake of only paying attention when the moving averages “cross over” or “twist”.

While it is important to monitor when the short-term moving averages cross above (or below) the long-term moving averages, it’s also important to monitor the SPACING between the moving averages.

The positioning of short-term moving averages relative to long-term moving averages shows the DIRECTION of the trend (down, neutral, up).

The spacing between the moving averages shows the STRENGTH of the trend (weak, neutral, strong).

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.