Trade Results

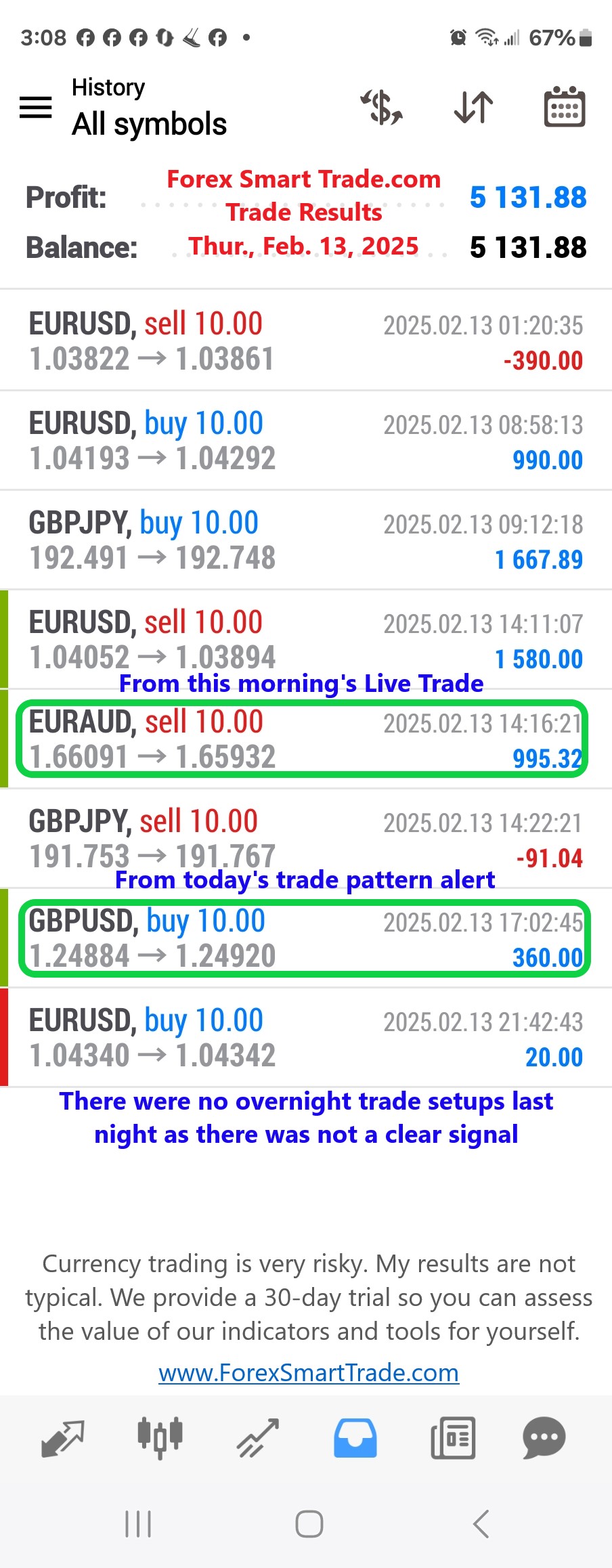

Forex Smart Trade Results, Thur., Feb. 13, 2025: $5,131

The “So Easy It’s Ridiculous” Trading System. As you can see, we have all the components of a good forex trading system. First, we’ve decided that […]

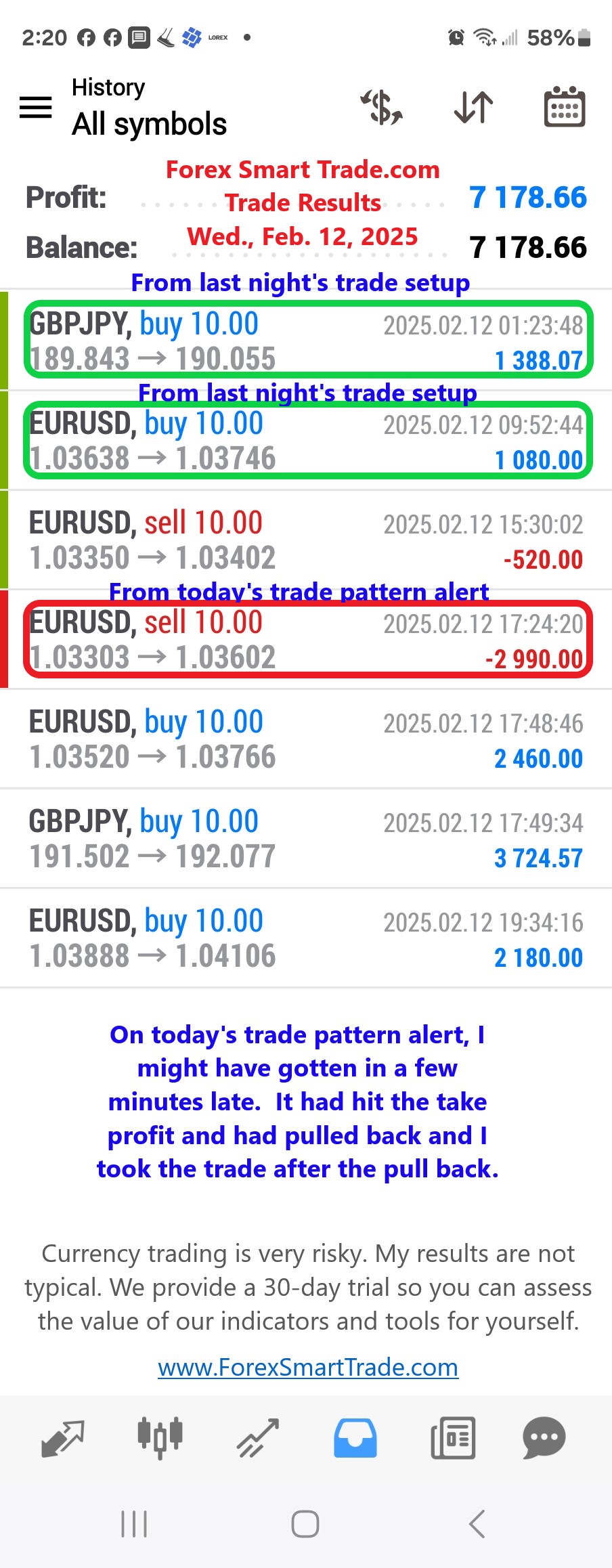

Forex Smart Trade Results, Wed., Feb. 12, 2025: $7,178

Mastering Your Mindset in Trading and Life: The Power of “Preferred Indifferents” There’s a fundamental truth about success — whether in trading, business, or life — that most people never […]

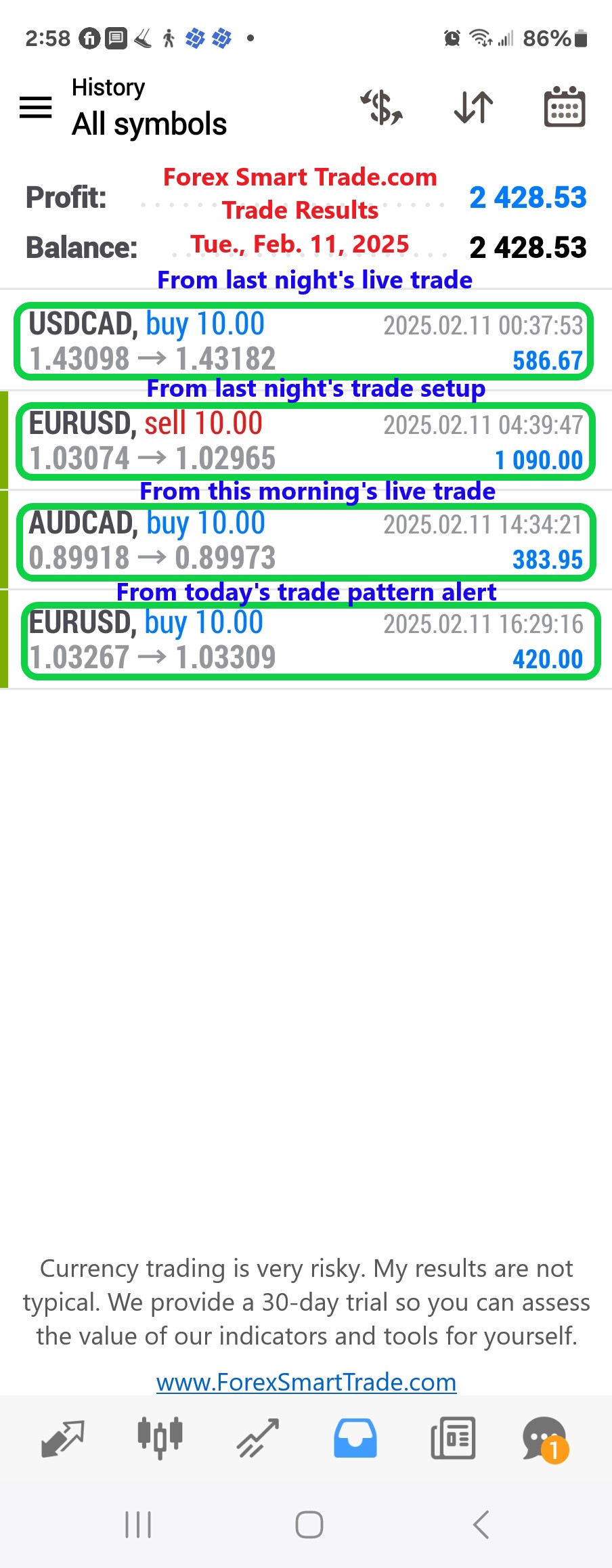

Forex Smart Trade Results, Tue., Feb. 11, 2025: $2,428

Mastering Your 24 Hours: A Lesson from Arnold Bennett. Even if you’re deep into personal development, chances are you haven’t studied How to Live on 24 […]

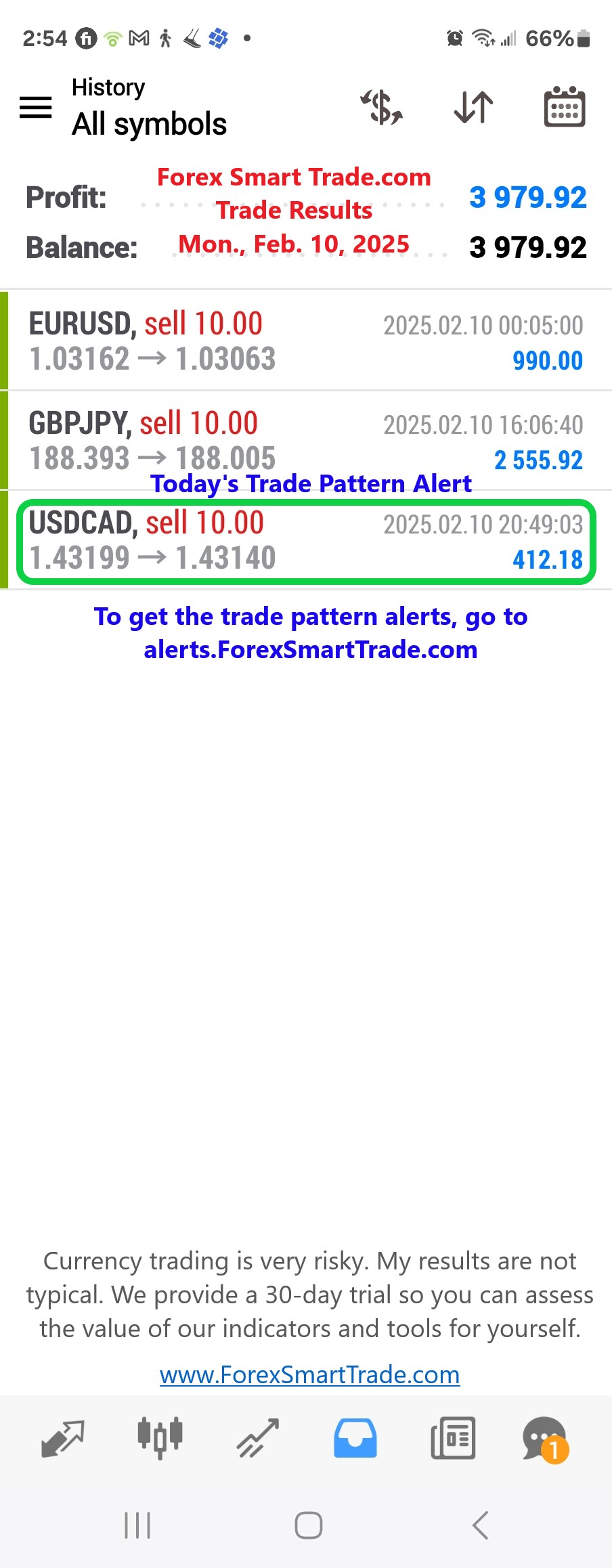

Forex Smart Trade Results, Mon., Feb. 10, 2025: $3,979

A Tiny Habit That Leads to Big Success… Even in Trading. What if I told you a simple thing like taking off your socks the right […]

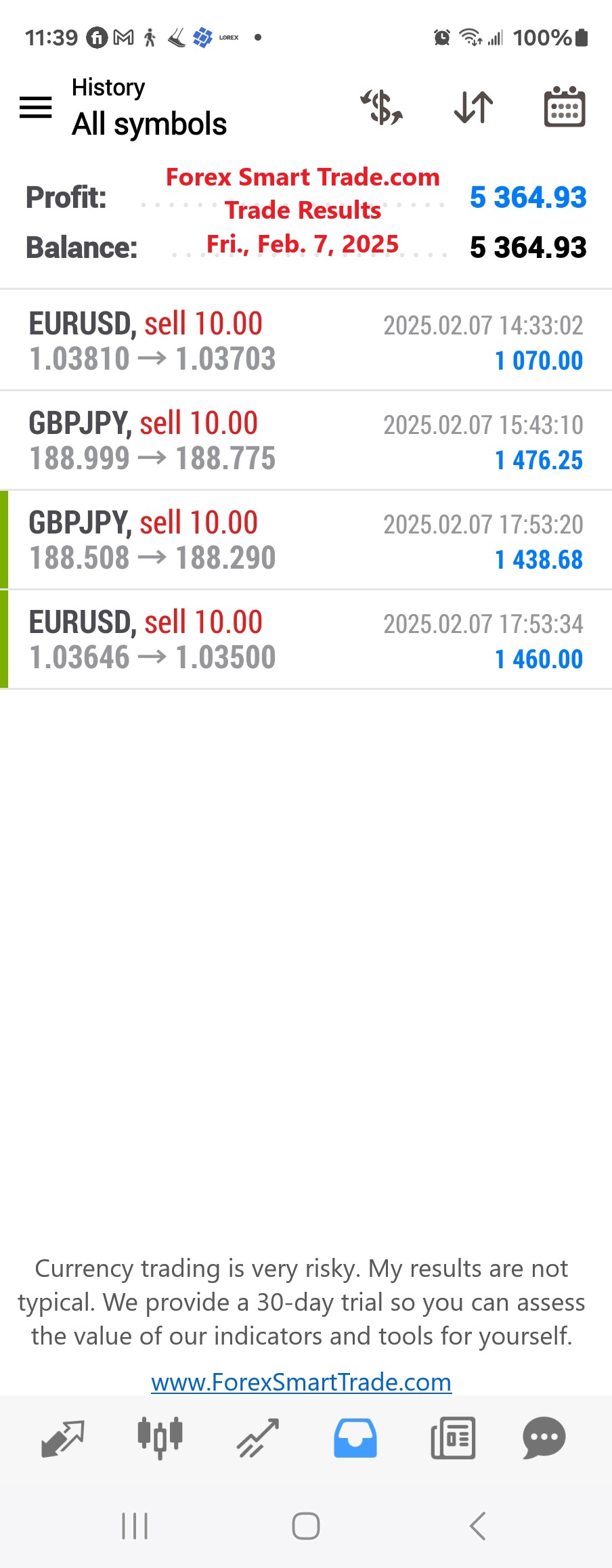

Forex Smart Trade Results, Fri., Feb. 7, 2025: $5,364

Should you scalp? Scalping is something that intrigues many system traders. The challenge of taking small, consistent trades from the market daily while risking very little […]

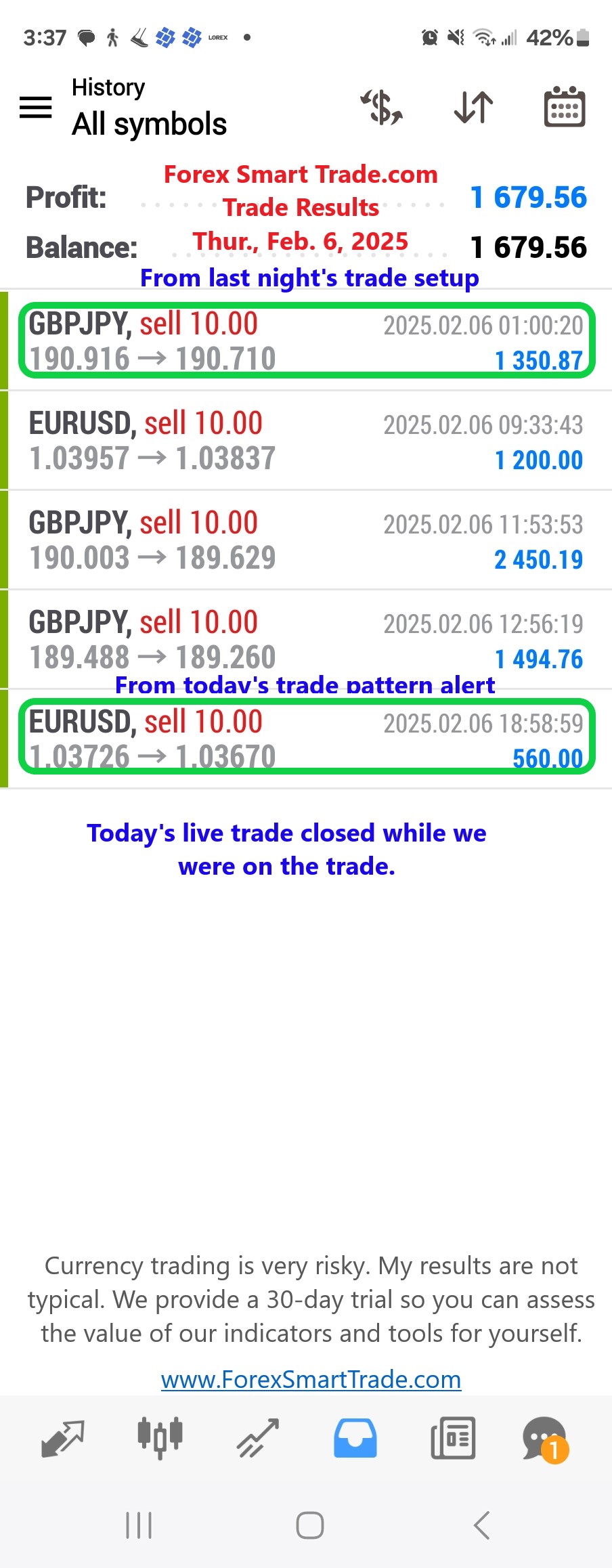

Forex Smart Trade Results, Thur., Feb. 6, 2025: $1,679

What If Fear Is the Only Thing Holding You Back? In the Roman Republic, Lucius Crassus was one of the greatest public speakers of his time. […]

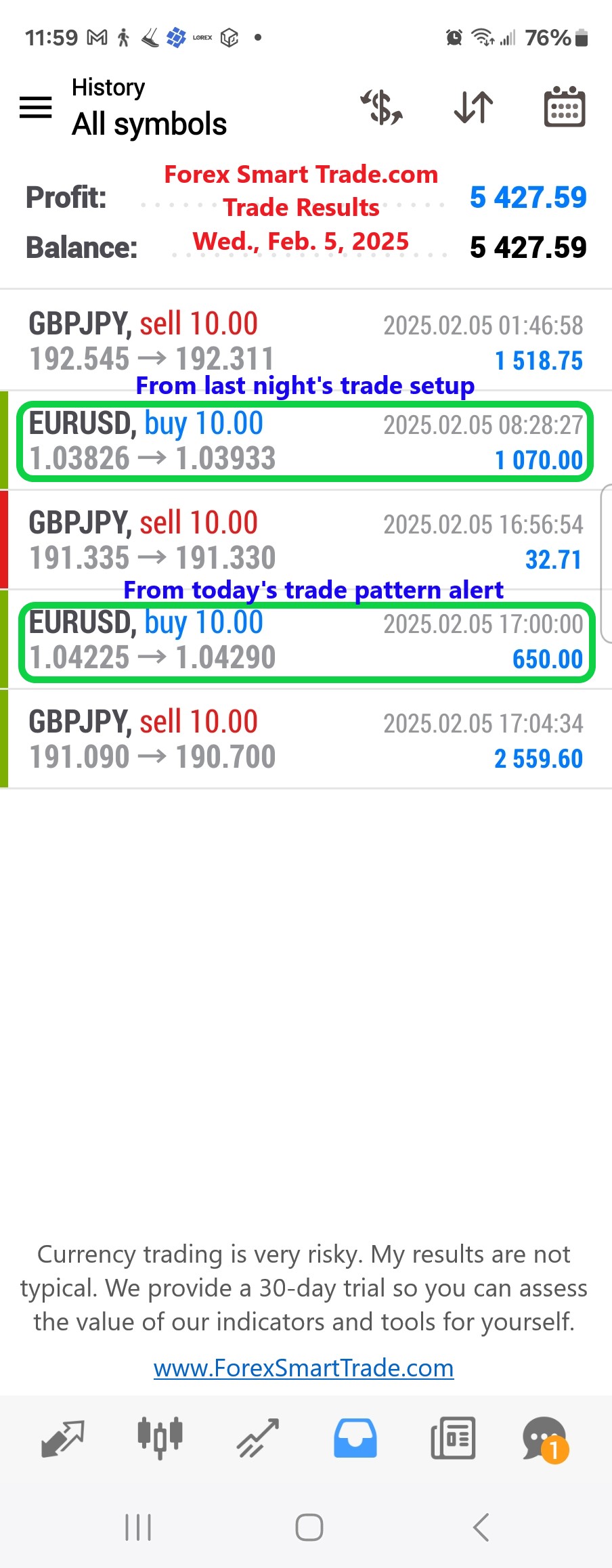

Forex Smart Trade Results, Wed., Feb. 5, 2025: $5,427

The Role You Choose to Play in Life… Epictetus once said: “Remember that thou art an actor in a play of such a kind as the […]

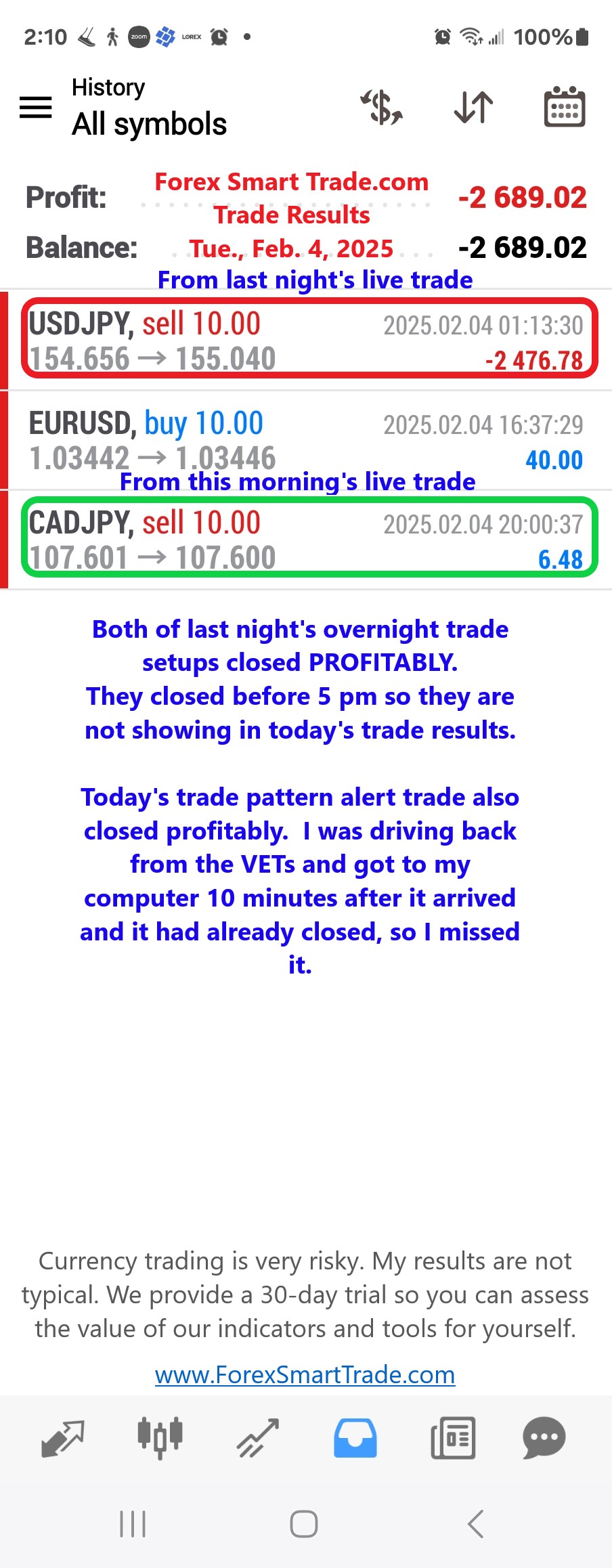

Forex Smart Trade Results, Tue., Feb. 4, 2025: ($2,689)

The Hard Truth About Your Trading Dreams. We all have things we want to change. Bad habits to break. Good habits to build. Goals that have […]

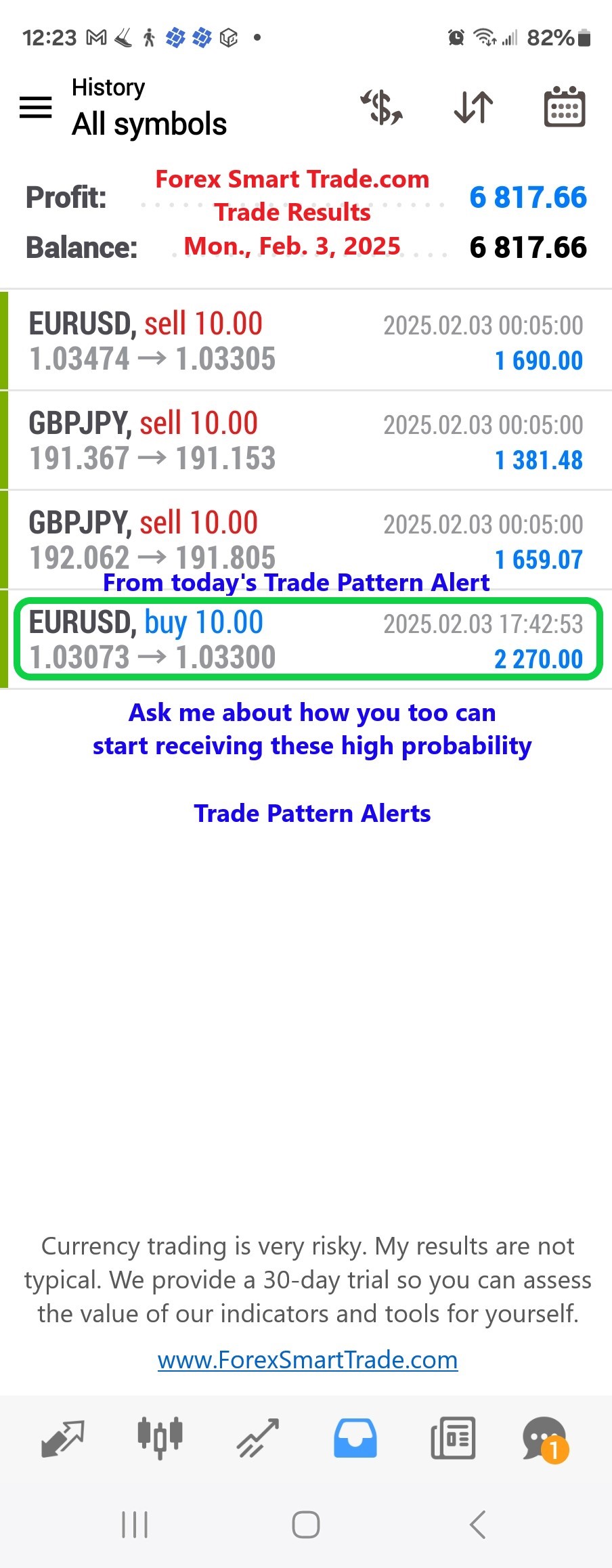

Forex Smart Trade Results, Mon. Feb. 3, 2025: $6,817

The One Asset Even Billionaires Can’t Buy Back. It feels like you have time. You’re young. You’re healthy. The future is bright. But that feeling won’t […]

Forex Smart Trade Results, Fri., Jan. 31, 2025 – $1,050

What Time Frame Should You Trade? What time frame should you trade your system on? The smaller the timeframe, the more difficult it is to develop […]

Forex Smart Trade Results, Thur., Jan. 30, 2025: $4,307

When Edmund Hillary Reached Everest’s Peak, He Didn’t Look Down. He Looked for His Next Mountain. What’s your next mountain to climb? Think about it — […]

Forex Smart Trade Results, Wed., Jan. 29, 2025: $5,303

The Secret to Success? A Plan You Actually Believe In. I’ve been diving into Principles by Ray Dalio, the billionaire investor behind Bridgewater Associates, the largest […]

Forex Smart Trade Results, Tue., Jan. 28, 2025: $9,132

Build Your Unstoppable Mindset and Transform Your Financial Future. Ever feel like you’re stuck in place — knowing you can do more, but unsure how to […]

Forex Smart Trade Results, Mon., Jan. 27, 2025: $12,066

Your Gifts Aren’t Just Luck—They’re Earned Through Work. Did you ever look at someone at the top of their game and think, “Must be nice to […]

Forex Smart Trade Results, Fri., Jan. 24, 2025: $4,548

What Time Frame Should You Trade? What time frame should you trade your system on? The smaller the timeframe, the more difficult it is to develop […]

Forex Smart Trade Results, Thur., Jan. 23, 2025: $2,790

The Price of Your Dreams Is Higher Than You Think (And That’s Good News). Let me ask you something that might make your palms sweat: What […]

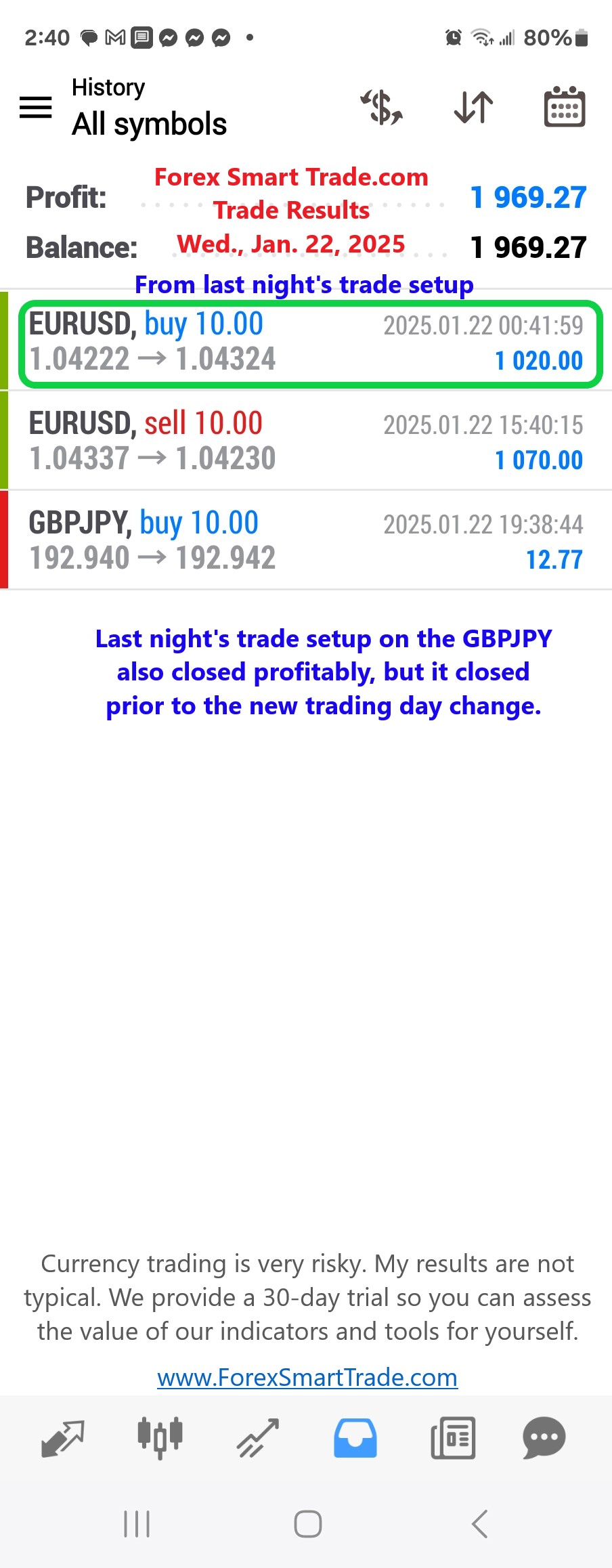

Forex Smart Trade Results, Wed., Jan. 22, 2025: $1,969

What’s the Best Thing You’ll Actually Do? If you’ve ever tried to change your life — whether it’s hitting the gym, starting a new habit, or […]

Forex Smart Trade Results, Tues., Jan. 21. 2025: $1,429

Are You Ready to Grow? Life is growth. But let’s be honest — growth isn’t always easy. It’s uncomfortable, inconvenient, and sometimes downright painful. Life’s biggest […]

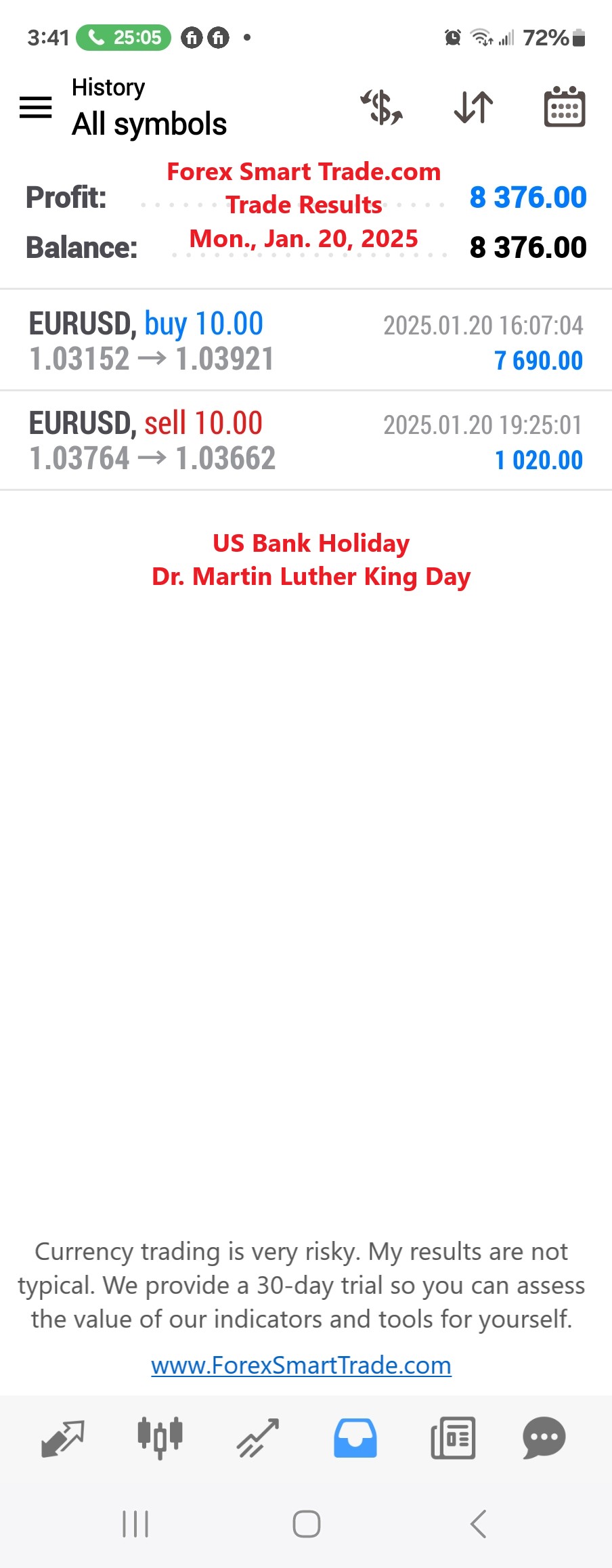

Forex Smart Trade Results, Mon., Jan. 20, 2025: $8,376

What Time Frame Should You Trade? What time frame should you trade your system on? The smaller the timeframe, the more difficult it is to develop […]

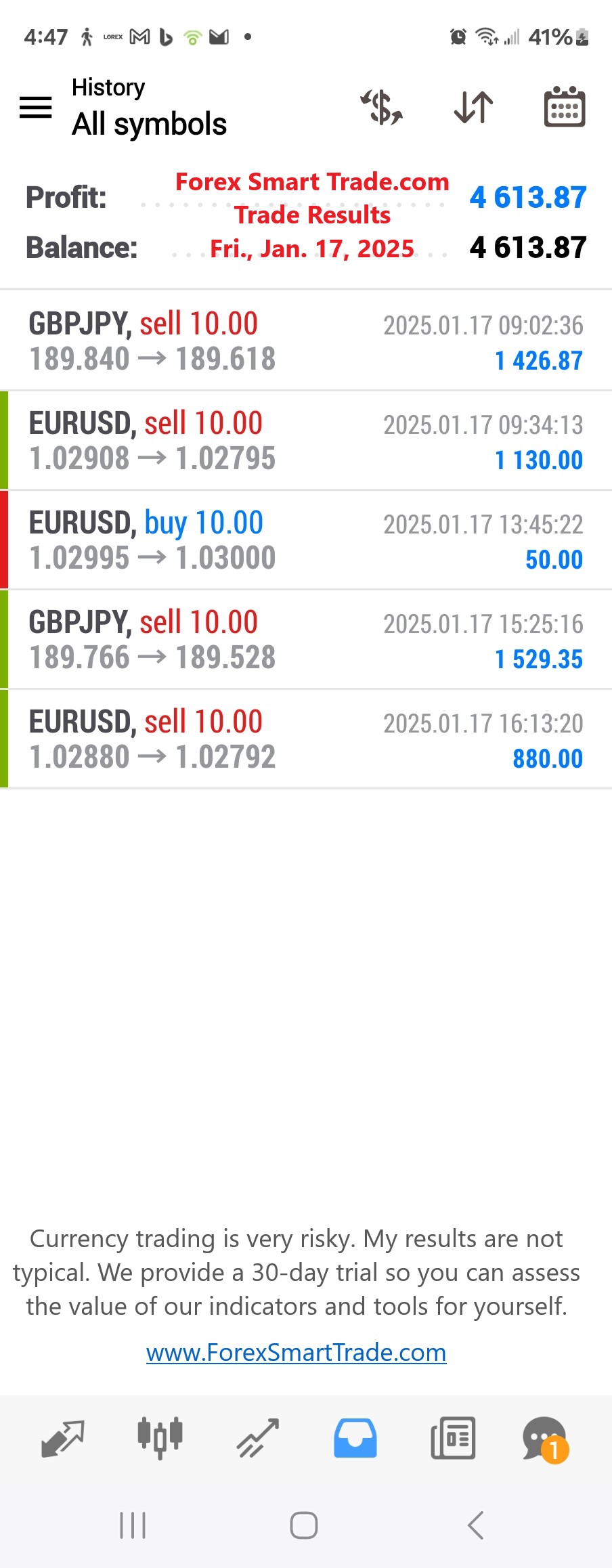

Forex Smart Trade Results, Fri., Jan. 17, 2025: $4,613

Build Your Trading System in 3 Steps. Now that you’ve learned the basics of technical analysis. Let’s now combine all this information and build a simple […]

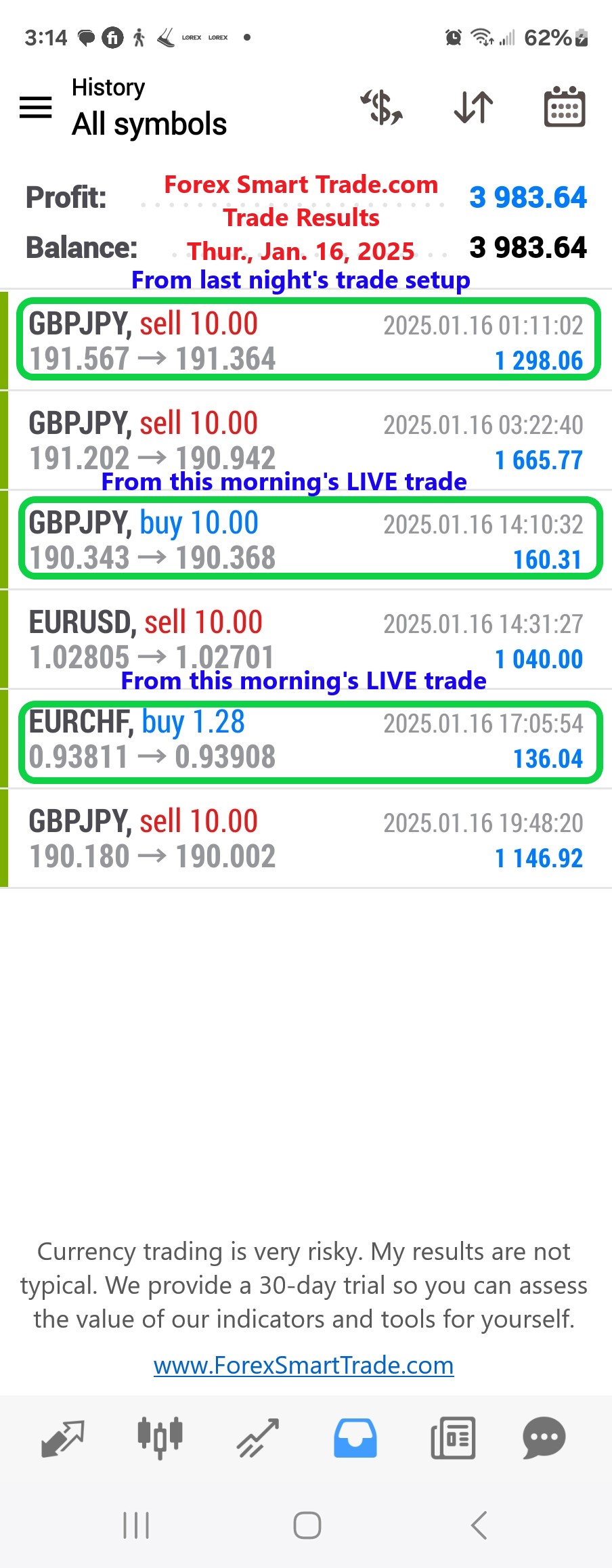

Forex Smart Trade Results, Thur., Jan. 16, 2025: $3,983

Are You Ready to Get Serious About Your Success? Let me ask you something: Are you truly qualified for the success you dream about? It’s a […]