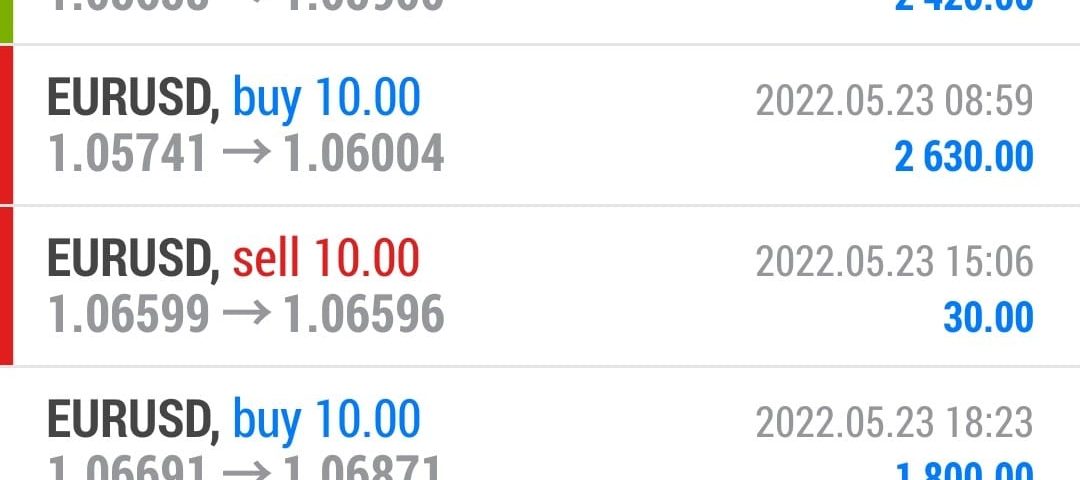

Forex Trade Results May 23, 2022 – $8,700

Forex Trade Results May 20, 2022 – $1,120

May 23, 2022

Forex Trade Results May 24, 2022 – $6,890

May 24, 2022Basic Forex Order Types.

The basic forex order types (market, limit entry, stop entry, stop loss, and trailing stop) are usually all that most traders ever need.

Pending Orders

To open a position, the following pending orders may be used:

- “Buy stop” to open a long position at the price higher than the current price

- “Sell stop” to open a short position at the price lower than the current price

- “Buy Limit” to open a long position at the price lower than the current price

- “Sell Limit” to open a short position at the price higher than the current price

Here’s a cheat sheet (current price is the blue dot):

Unless you are a veteran trader (don’t worry, with practice and time you will be), don’t get fancy and design a system of trading requiring a large number of forex orders sandwiched in the market at all times.

This is always a tradeoff when using a limit order instead of a market order.

- For example, if you want to buy “right now,” you’ll have to pay the higher ask price. This is called a “market order” as it will trade at whatever the market price is.

- If you prefer to save some money, you’ll need to use a “limit order”.

- The problem with being patient is sometimes the price continues to go up and your limit order is never filled.

- If you still want to get in a trade, you have to either enter a market order or update your limit order. This now means you’ll end up paying (even) more than the original ask price.

Stick With the Basics First

Stick with the basic stuff first.

Make sure you fully understand and are comfortable with your broker’s order entry system before executing a trade.

Also, always check with your broker for specific order information and to see if any rollover fees will be applied if a position is held longer than one day.

Keeping your ordering rules simple is the best strategy.

Please note that a market order is an instruction to execute your order at ANY price available in the market. A market order is NOT guaranteed a specific execution price and may execute at an undesirable price. If you would like greater control over the execution prices you receive, submit your order using a limit order, which is an instruction to execute your order at or better than the specified limit price.

DO NOT trade with real money until you have an extremely high comfort level with the trading platform you are using and its order entry system. Erroneous trades are more common than you think!

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.