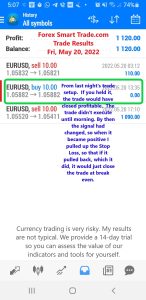

Forex Trade Results May 20, 2022 – $1,120

Forex Trade Results May 19, 2022 – $4,570

May 19, 2022

Forex Trade Results May 23, 2022 – $8,700

May 23, 2022Weird Forex Orders.

Here are some weird forex orders.

Good ‘Till Cancelled (GTC)

A GTC order remains active in the market until you decide to cancel it. Your broker will not cancel the order at any time. Therefore, it is your responsibility to remember that you have the order scheduled.

Good for the Day (GFD)

A GFD order remains active in the market until the end of the trading day.

Because foreign exchange is a 24-hour market, this is 5:00 pm EST since that’s the time U.S. markets close.

GFC and GTC are known as “time in force” orders.

The “time in force” or TIF for an order defines the length of time over which an order will continue working before it is canceled. Think of it as a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires.

One-Cancels-the-Other (OCO)

An OCO order is a combination of two entry and/or stop loss orders.

Two orders are placed above and below the current price. When one of the orders is executed the other order is canceled.

An OCO order allows you to place two orders at the same time. But only one of the two will be executed.

Let’s say the price of EUR/USD is 1.2040. You want to either buy at 1.2095 over the resistance level in anticipation of a breakout or initiate a selling position if the price falls below 1.1985.

The understanding is that if 1.2095 is reached, your buy order will be triggered and the 1.1985 sell order will be automatically canceled.

One-Triggers-the-Other (OTO)

An OTO is the opposite of the OCO, as it only puts on orders when the parent order is triggered.

You set an OTO order when you want to set profit taking and stop loss levels ahead of time, even before you get in a trade.

For example, USD/CHF is currently trading at 1.2000. You believe that once it hits 1.2100, it will reverse and head downwards but only up to 1.1900.

The problem is that you will be gone for an entire week because you have to join a basket weaving competition at the top of Mt. Fuji where there is no internet.

In order to catch the move while you are away, you set a sell limit at 1.2000 and at the same time, place a related buy limit at 1.1900, and just in case, place a stop-loss at 1.2100.

As an OTO, both the buy limit and the stop-loss orders will only be placed if your initial sell order at 1.2000 gets triggered.

An OTO and OTC order are known as conditional orders. A conditional order is an order that includes one or more specified criteria.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.