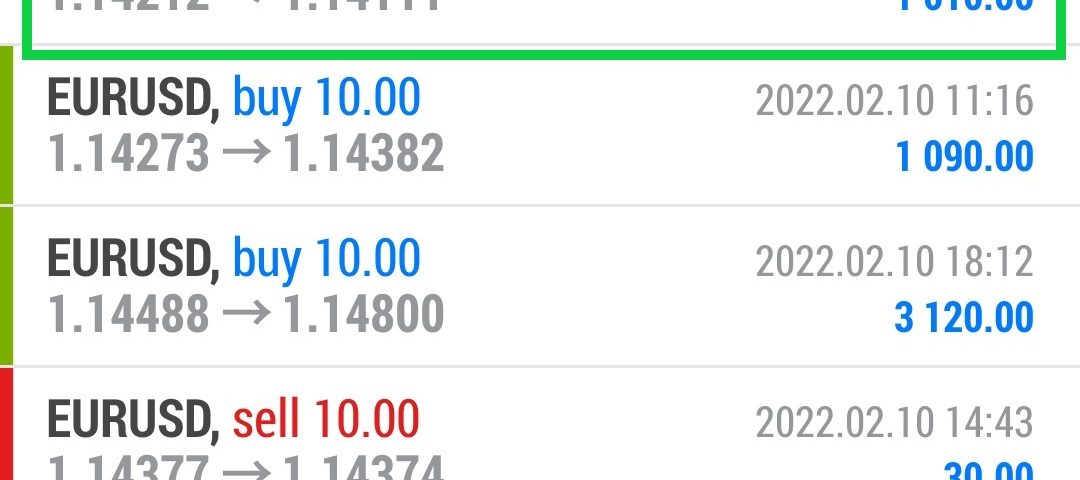

Forex Trade Results February 10, 2022

Forex Trade Results February 9, 2022

February 9, 2022

Forex Trade Results February 11, 2022

February 14, 2022Forex and Slippage

The Futures market is also a little more unreliable in terms of liquidity. For example, take the S&P 500 vs. Silver Futures. The S&P involves many more traders. This means there is more opportunity in the market to make profits without “slippage.”

“Slippage” is defined as a change in price that occurs due to a lack of participant reaction instead of an abundance of it. When these markets slip and there aren’t enough traders taking part, your trade must wait until the prices move far enough to pull you out completely. This creates a more likely result of huge losses and/or little profit.

Okay, so how do you make money day trading?

Well, while Futures markets remain a great place to trade, please make sure you possess the correct knowledge and experience to correctly navigate the practice. A good place to start is to make sure you know about specific trade times and overnight margin requirements.

The best type of educator in a trading system will understand which market personally fits your individual financial situation and the leverage at which you should be trading. Find an educator that will work with you and not leave you scrambling to figure out the best situation to fit your financial needs!

Forex and Slippage

Learn How To Currency Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar that shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just TEN dollars.