What this means is that you can tell whether traders are more inclined to buy or sell the currency pair.

All you would need to do is to keep an eye on the pivot point. You could treat it like the 50-yard line of an American football field.

Depending on which side the ball (in this case, price) is on, you can tell whether buyers or sellers have the upper hand.

If the price breaks through the pivot point to the top, it’s a sign that traders are bullish on the pair.

You should start buying the pair like it’s a Krispy Kreme donut.

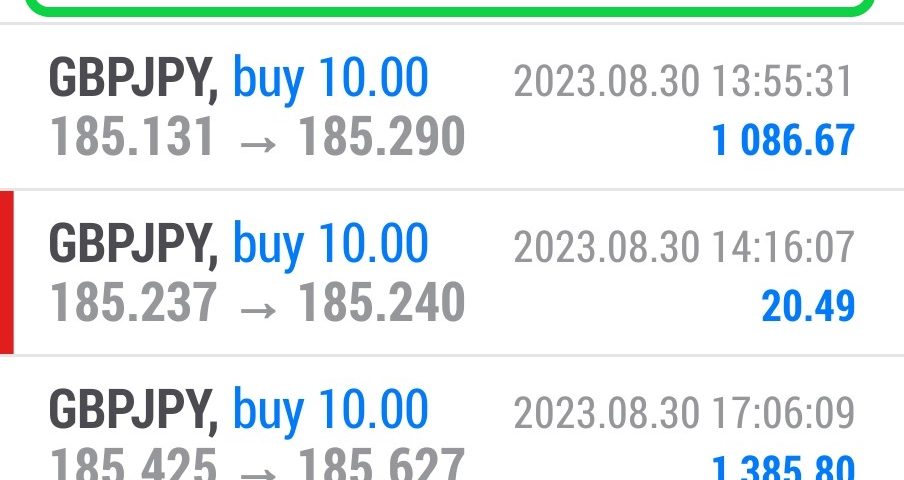

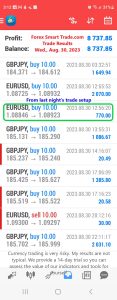

Example

Here’s an example of what happened when the price stayed above the pivot point.

In this example, we see that EUR/USD gapped up and opened above the pivot point.

The price then rose higher and higher, breaking through all the resistance levels.

Now, if the price breaks through the pivot point to the bottom.

When this happens you should start selling the currency pair like it’s Enron or Theranos stock.

The price being below the pivot point would signal bearish sentiment and that sellers could have the upper hand for the trading session.