Let’s examine the 3 main groups of chart patterns.

In this section, we’ll discuss a bit more about how to use these chart patterns to your advantage.

It’s not enough to just know how the tools work, we’ve got to learn how to use them.

And with all these new weapons in your arsenal, we’d better get those profits fired up!

Let’s summarize the chart patterns we just learned and categorize them according to the signals they give.

Reversal Chart Patterns

Reversal patterns are those chart formations that signal that the ongoing trend is about to change course.

If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon.

Conversely, if a reversal chart pattern is seen during a downtrend, it suggests that the price will move up later on.

In this lesson, we covered six chart patterns that give reversal signals.

Can you name all six of them?

- Double Top

- Double Bottom

- Head and Shoulders

- Inverse Head and Shoulders

- Rising Wedge

- Falling Wedge

If you got all six right, brownie points for you!

Trading the Chart Patterns

To trade these chart patterns, simply place an order beyond the neckline and in the direction of the new trend.

Then go for a target that’s almost the same as the height of the formation.

For instance, if you see a double bottom, place a long order at the top of the formation’s neckline.

Then go for a target that’s just as high as the distance from the bottoms to the neckline.

In the interest of proper risk management, don’t forget to place your stops!

A reasonable stop loss can be set around the middle of the chart formation.

For example, you can measure the distance of the double bottoms from the neckline, divide that by two, and use that as the size of your stop.

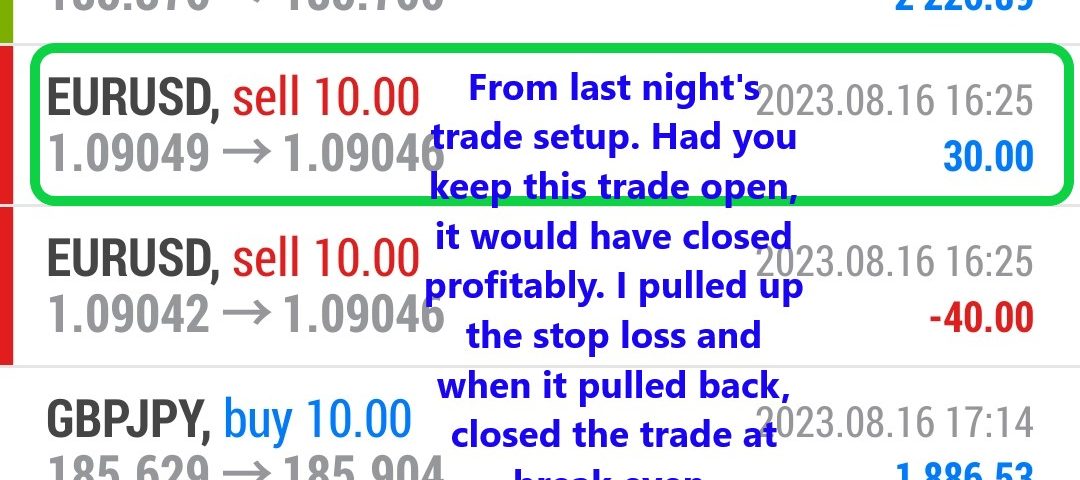

Learn How to Trade Forex From a Professional Trader

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.