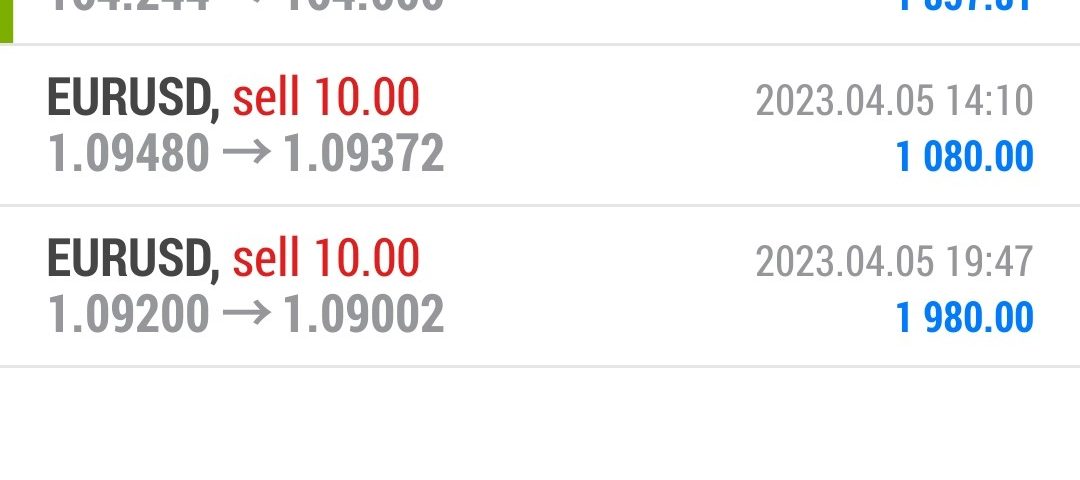

Forex Smart Trade Results, Wednesday, April 5, 2023 – $7,401

Forex Smart Trade Results, Tuesday, April 4, 2023 – $4,833

April 11, 2023

Forex Smart Trade Results, Thursday, April 6, 2023 – $5,627

April 11, 2023Using Fibonacci to Place Your Stop so You Lose Less Money.

Let’s continue our examination of using Fibonacci to place your stop so you lose less money.

Method #2: Place Stop Past Recent Swing High/Low

Now, if you want to be a little safer, another way to set your stops would be to place them past the recent Swing High or Swing Low.

For example, when the price is in an uptrend and you’re in a long position, you can place a stop loss just below the latest Swing Low, which acts as a potential support level.

When the price is in a downtrend and you’re in a short position, you can place a stop loss just above the Swing High, which acts as a potential resistance level.

This type of stop loss placement would give your trade more room to breathe and give you a better chance for the market to move in favor of your trade.

Price Surpasses Swing High or Low

If the market price were to surpass the Swing High or Swing Low, it may indicate that a reversal of the trend is already in place.

This means that your trade idea or setup is already invalidated and that you’re too late to jump in.

Setting larger stop losses would probably be best used for longer-term, swing-type trades, and you can also incorporate this into a “scaling in” method, which you will learn later on in this course.

Of course, with a larger stop, you also have to remember to adjust your position size accordingly.

If you tend to trade the same position size, you may incur large losses, especially if you enter at one of the earlier Fib levels.

This can also lead to some unfavorable reward-to-risk ratios, as you may have a wide stop that isn’t proportional to your potential reward.

Learn to Forex Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.