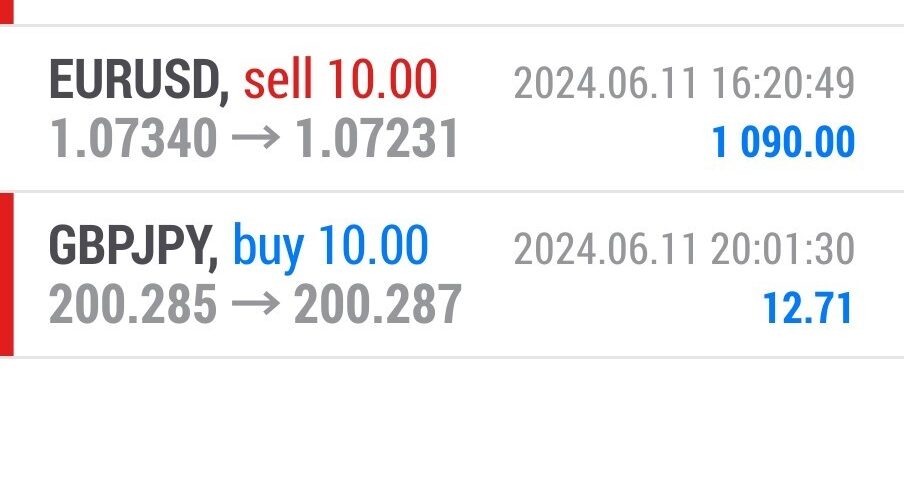

Forex Smart Trade Results, Tuesday, June 11, 2024 – $2,153

Forex Smart Trade Results, Monday, June 10, 2024 – $6,743

June 30, 2024

Forex Smart Trade Results, Wednesday, June 12, 2024 – $8,256

June 30, 2024The Dollar Smile Theory Explained – Continued.

Scenario #3: USD Strengthens Due to Economic Growth

The dollar appreciates due to economic growth.

Lastly, a smile begins to form as the U.S. economy sees the light at the end of the tunnel.

As optimism picks up and signs of economic recovery appear, sentiment toward the U.S. dollar begins to pick up.

In other words, the Greenback begins to appreciate as the U.S. economy enjoys stronger GDP growth and expectations of interest rate hikes increase (relative to other countries).

Let’s take a look at the Dollar Smile Theory in reality…

As you can see, due to the global pandemic which has caused a lot of economies all over the world to suffer, the U.S. dollar is acting as a safe haven currency. All countries, including the U.S., aren’t doing so great.

But if the economies from the “rest of the world” (RoW) can improve and start to grow faster than the U.S. economy, then expect the U.S. dollar to weaken.

The key is relative economic growth.

If growth from other countries is growing, but the U.S. economy is growing even faster, then the U.S. dollar will swing upward to the right side.

So will the Dollar Smile Theory hold true?

Only time will tell.

In any case, this is an important theory to keep in mind. Remember, all economies are cyclical.

They strengthen, then they weaken, they strengthen, then they weaken, and repeat.

The key part is determining which part of the cycle the U.S. economy is in and then comparing how it’s doing against the rest of the world (RoW).

A Strong Dollar’s Pros and Cons

When the dollar is strong, this makes traveling for Americans to other countries less expensive.

And given how loud and obnoxious some American tourists can get, might not be a good thing.

Also, the price for imported goods into the U.S. also declines.

So for U.S. consumers, it’s great. Traveling to other countries and buying imported goods at home is cheaper.

But for non-U.S. consumers, it’s not so great. It’s more expensive to visit the U.S. (like going to Disney World).

And they have to pay more for imported U.S. goods or commodities priced in USD (like oil).

Also, multinational corporations generate a sizeable percentage of their revenue outside the U.S.

This means that they’ll experience a decline in profits when their revenue is exchanged from local currencies to U.S. dollars.

Learn to Trade Currency

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade Introductory Day Trading Trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and training for yourself.