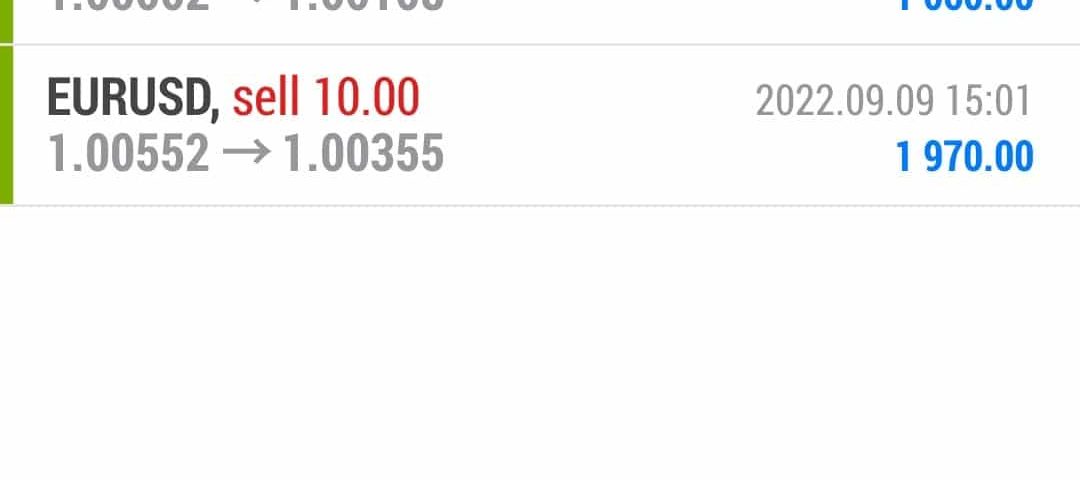

Forex Smart Trade Results September 9, 2022 – $5,860

Forex Smart Trade Results September 8, 2022 – $955

September 8, 2022

Forex Smart Trade Results September 12, 2022 – $2,110

September 12, 2022Regulation of Forex Brokers.

Let’s continue our discussion regarding the regulation of forex brokers.

Aside from paper tigers, not all regulatory agencies are credible.

Some of the regulatory agencies in so-called “offshore” jurisdictions.

These are essentially nothing more than “rubber stamping” offices.

Regarding jurisdictions, there are different levels of “strictness”.

For example, the U.S. and Japan are considered to have the most stringent regulatory agencies.

Essentially, the “stricter” the jurisdiction, the more protections that individual traders have.

But with the additional regulation, it is more costly for the broker to operate in that jurisdiction.

This is due to stricter requirements, such as:

- Having a local physical office and staff.

- Requiring a large amount of money upfront just to even start the business.

- Plus, they set aside additional money to avoid going bust and be able to pay out when their customers win.

- Regularly submitting reports to verify compliance with all license requirements.

Not only is there usually a huge upfront cost, but licensing costs also have to be maintained annually.

Even with all the added compliance costs and headaches, reputable brokers still choose to register and be regulated in stricter jurisdictions.

Doing this improves their credibility and builds trust with their customers.

Let’s be clear, though.

A broker that is regulated doesn’t automatically mean you can blindly trust it.

“Strict” Forex Jurisdictions

Here’s a map showing jurisdictions that are supervised by regulatory agencies that are generally considered strict:

| Jurisdiction | Regulatory Agency |

| United States | Commodity Futures Trading Commission (CFTC) National Futures Association (NFA) |

| Japan | Financial Services Agency (FSA) |

| United Kingdom | Financial Conduct Authority (FCA) |

| Canada | Investment Industry Regulatory Organization of Canada (IIROC) |

| EU | Cyprus Securities and Exchange Commission (CySEC) |

| EU | Malta Financial Services Authority (MFSA) |

| Singapore | Monetary Authority of Singapore (MAS) |

| Hong Kong | Securities and Futures Commission (SFC) |

| Australia | Australian Securities and Investments Commission (ASIC) |

| New Zealand | Financial Markets Authority (FMA) |

Most forex brokers regulated in strict jurisdictions are less prone to scams.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.