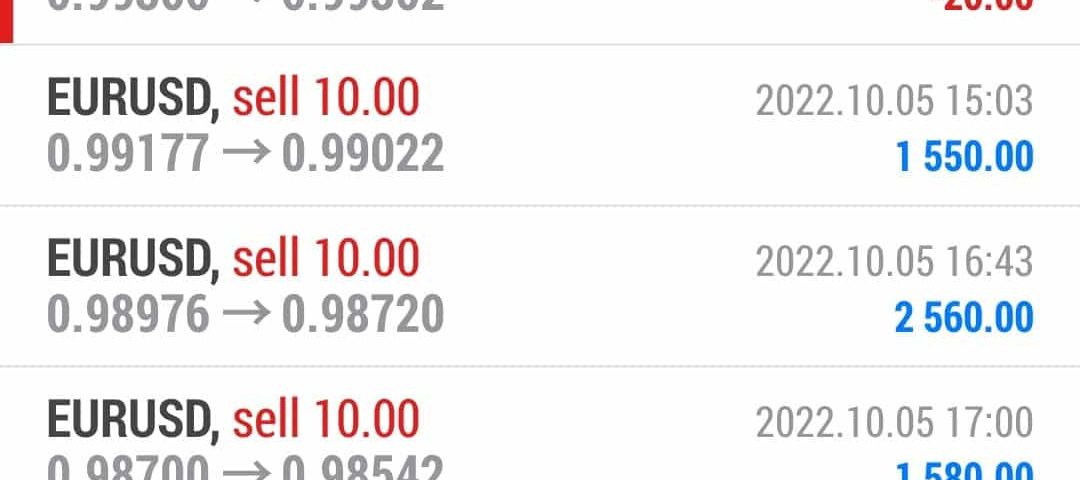

Forex Smart Trade Results October 5, 2022 – $1,710

Forex Smart Trade Results October 4, 2022 – $7, 533

October 4, 2022

Forex Smart Trade Results October 6, 2022 – $1,940

October 10, 2022FOREX CLIENT or CUSTOMER?

Are you a client of a forex broker? Or are you a customer of a forex broker?“

“Client” and “customer” are words that are often used interchangeably.

For our purposes, we think there’s a distinction between being a client and being a customer.

Being a client of a company means there is a fiduciary relationship between you and the company.

This means that the company acts on your behalf and is obligated by law to act in your best interest.

But a forex broker does not act on your behalf, nor is it obligated to act in your best interest.

So if we go by the definition that being a client means there is a fiduciary relationship, then this means that you are NOT a client of your “forex broker”.

You are a customer.

Forex Customer

If you want to buy, the service it provides isn’t to act on your befall and find you a seller. It’s the one selling to you.

How can you be a “client” when it is the broker itself selling to or buying from you?

You are a customer of your “forex broker” who provides a service that enables you to speculate (make bets) on the price movements of currency pairs.

Since you can’t trade directly in the (institutional) FX market, it “makes” a trading market for you.

It provides you a way to make bets on currency prices by always taking the opposite of your bets whenever you want to make one.

It’s not trying to find someone to take the other side of the bet, it simply takes the bet on itself.

But the “forex broker” does not have the fiduciary duty to act for your benefit.

That said, even though there is NOT a fiduciary relationship with the customer, the forex broker should act honestly and fairly with all of its customers.

Going forward, we will use the term “customers” when referring to traders using the services of a retail forex broker or CFD provider.

All orders and trades entered through your broker’s trading platform are NOT executed on an external trading venue but are executed by the broker itself.

Your “broker” is taking the opposite side of your trade.

We know this as being the counterparty.

Think about it. If you want to buy, someone has to sell. And if you want to sell, someone has to buy.

Pairing

They must pair every buyer with a seller and vice versa.

You need a counterparty.

When you trade with a broker, both you and the “broker” hold positions against each other.

You are each other’s counterparties.

You are your broker’s counterparty. Your broker is your counterparty.

This means that if you want to buy or “go long”, the broker will take the opposite side of your trade and sell to you or “go short”.

The same thing happens if you want to sell or “go short”, the broker will take the opposite side of your trade and buy from you or “go long”.

We know your order as a bilateral transaction with your broker.

“Bilateral” is just a fancy word that just means “involving two parties”.

All retail forex trades are bilateral since your retail forex “broker “is the counterparty to ALL of your trades.

Learn to Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.