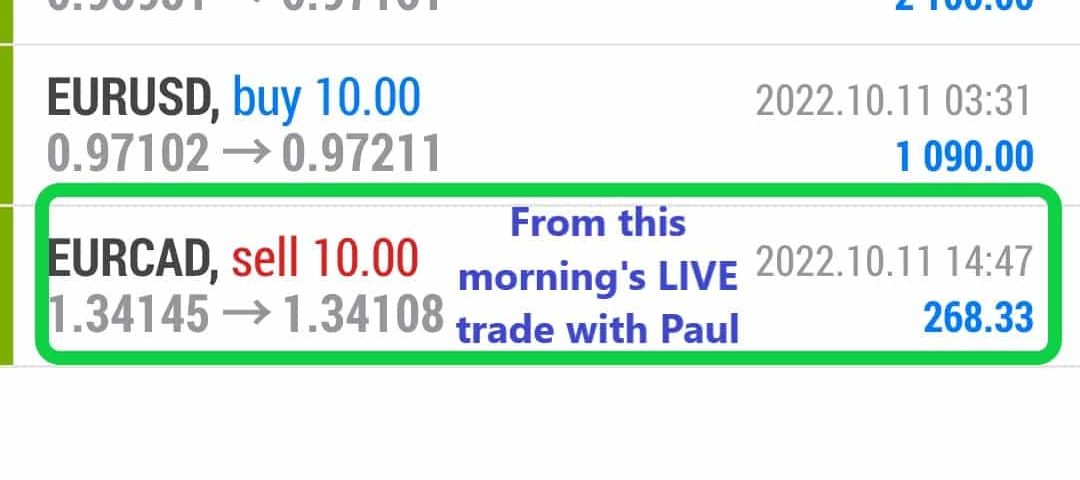

Forex Smart Trade Results October 11, 2022 – $4,308

Forex Smart Trade Results October 10, 2022 – $2,160

October 10, 2022

Forex Smart Trade Results October 12, 2022 – $1,437

October 13, 2022How Forex Brokers Manage Risk.

Let’s continue our discussion on how forex brokers manage risk.

It’s important to know how your broker manages the risk on the other side of your trade.

There are three ways for the broker to manage market risk:

- They can offset opposing trades from their customers.

- It can transfer or “offload” the risk to another market participant.

- The broker can accept or “warehouse” the risk.

HOW a forex broker manages market risk determines what type of broker it is and how it operates as a business.

Understanding the concept of your broker “taking a risk” on your order is critical to your success as a trader.

If your broker is taking the other side of your order and not passing it onto an external counterparty, your broker is taking 100% of the market risk associated with your order.

So if you can understand how your broker manages its risk when it takes the opposite of your trade, you’ll know what type of broker you’re actually dealing with and if there are any potential conflicts of interest.

Let’s now go into further detail on the different ways that brokers manage their risk and make money.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.