Trade Results

Forex Smart Trade Results, Thursday, August 29, 2024 – $5,178

Switzerland. Switzerland was founded in 1291 and is located in the middle of western Europe and shares much of its history and culture with Germany, Austria, […]

Forex Smart Trade Results, Wednesday, August 28, 2024 – $5,680

NZD/USD Trade Tactics. Strong economic reports from New Zealand result in an appreciation of the NZD so if there’s a good chance that an economic release […]

Forex Smart Trade Results, Tuesday, August 27, 2024 – $7,747

What Moves the NZD? Economic Growth Positive GDP growth reflects the strong economic standing of New Zealand, boosting demand for its currency. Negative GDP growth highlights […]

Forex Smart Trade Results, Monday, August 26, 2024 – $1,150

Important Economic Indicators for the NZD. Gross Domestic Product – Just like any other nation, the gross domestic product (GDP) serves as an economic report card for […]

Forex Smart Trade Results, Friday, August 23, 2024 – (1,730)

Getting to Know the NZD. The New Zealand dollar is nicknamed “Kiwi.”It’s a bird! It’s a plane! No, wait, it’s really a bird. The Kiwi […]

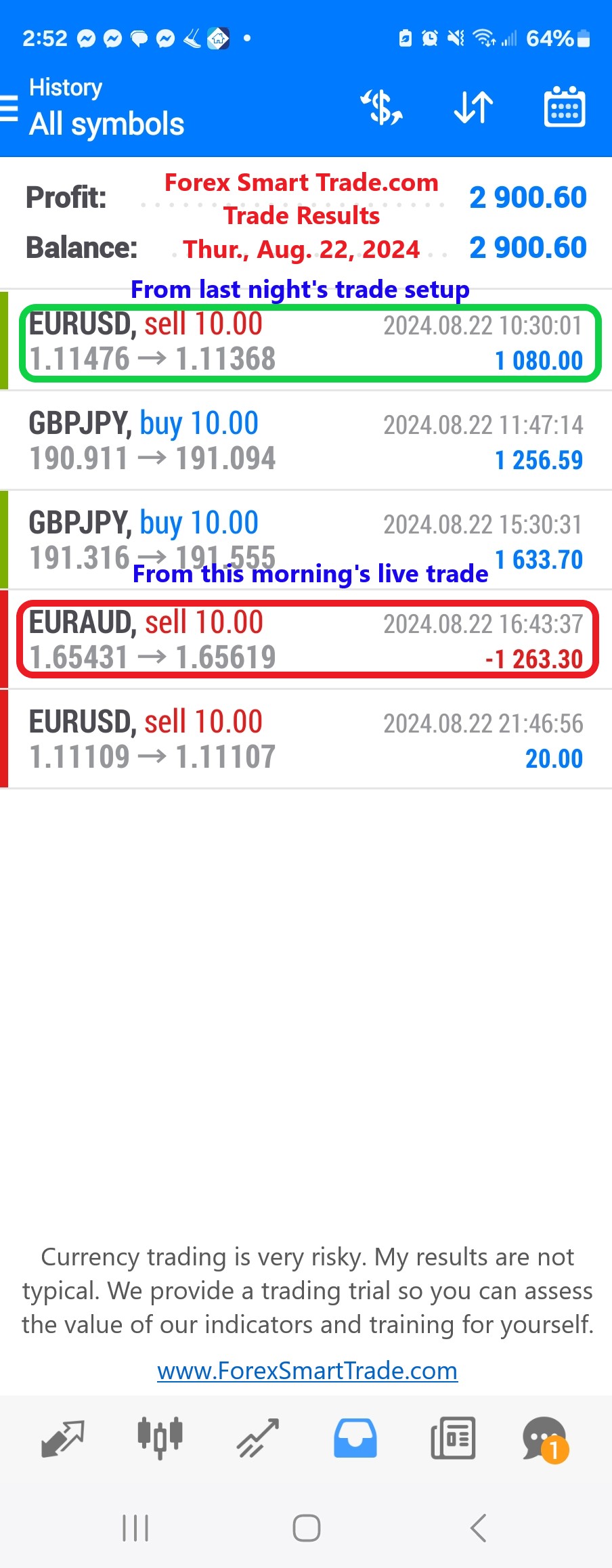

Forex Smart Trade Results, Thursday, August 22, 2024 – $2,900

New Zealand: Monetary & Fiscal Policy. The Reserve Bank of New Zealand (RBNZ) is in charge of the monetary and fiscal policy of the nation. Currently headed by […]

Forex Smart Trade Results, Wednesday, August 21, 2024 – $2,998

New Zealand: Economic Overview. With its teeny-tiny population, New Zealand’s economy is also relatively small. Its GDP, which is valued at 203 billion USD in 2018, […]

Forex Smart Trade Results, Tuesday, August 20, 2024 – ($3,643)

New Zealand. If you’ve seen the Lord of the Rings, then you probably know that Middle Earth is located somewhere along the hills of New Zealand. […]

Forex Smart Trade Results, Monday, August 19, 2024 – $3,276

Trading AUD/USD. AUD/USD is traded in amounts denominated in AUD. Standard lot sizes are 100,000 AUD and mini lot sizes are 10,000 AUD. The pip value, […]

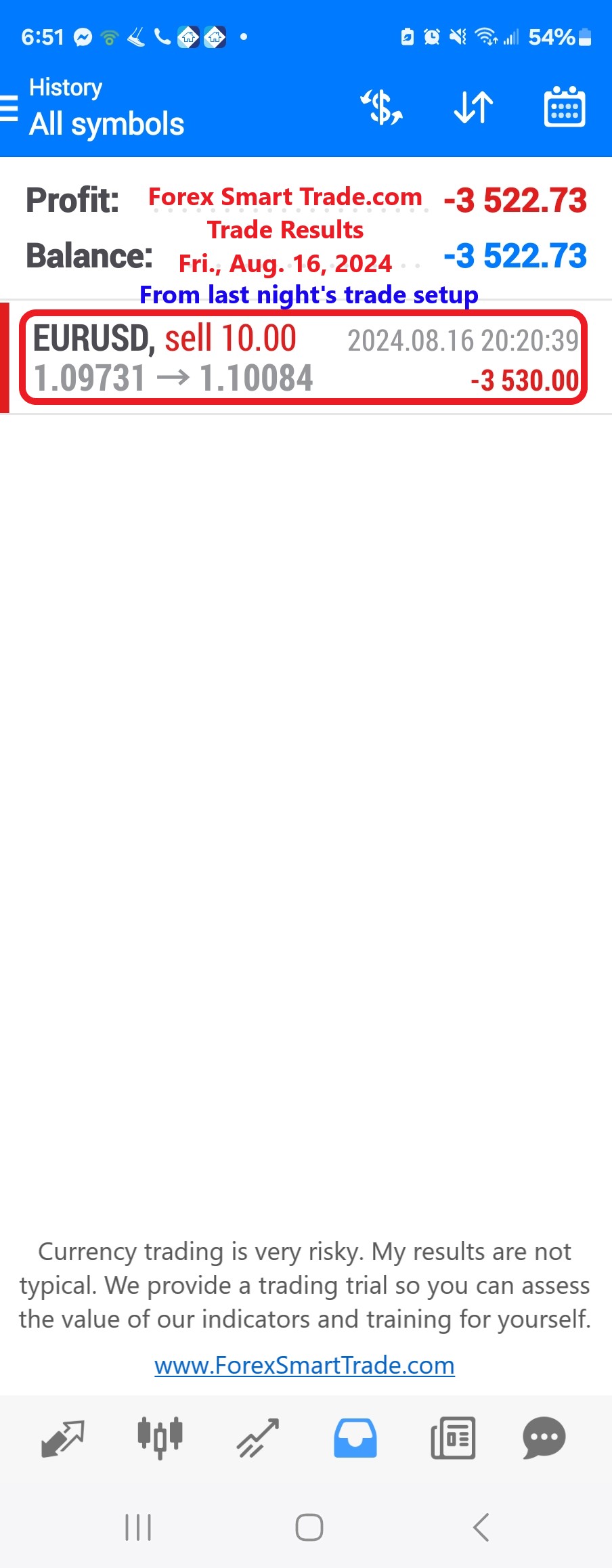

Forex Smart Trade Results, Friday, August 16, 2024 – ($3,530)

Important Economic Indicators for Australia. Consumer Price Index – Because the RBA’s primary goal is controlling inflation, the CPI, which measures the overall change in the price […]

Forex Smart Trade Results, Thursday, August 15, 2024 – $6,261

Australia: Getting to Know the AUD. Even though they’ve got their seasons mixed up, the Australians are always up bright and early to play. Well, this […]

Forex Smart Trade Results, Wednesday, August 14, 2024 – $2,025

Australia: Monetary & Fiscal Policy. The Reserve Bank of Australia (RBA) is the main governing body of Australia when it comes to monetary and fiscal policy. […]

Forex Smart Trade Results, Tuesday, August 13, 2024 – $3,755

Australia: Economic Overview. Compared to G7 nations, Australia’s overall economy is relatively small. According to the World Bank, however, on a per-person basis, its GDP is […]

Forex Smart Trade Results, Monday, August 12, 2024 -$7,393

Australia. Officially known as the Commonwealth of Australia, Australia could be found somewhere in the Southern Hemisphere, just southeast of Asia. Considered the world’s biggest island, […]

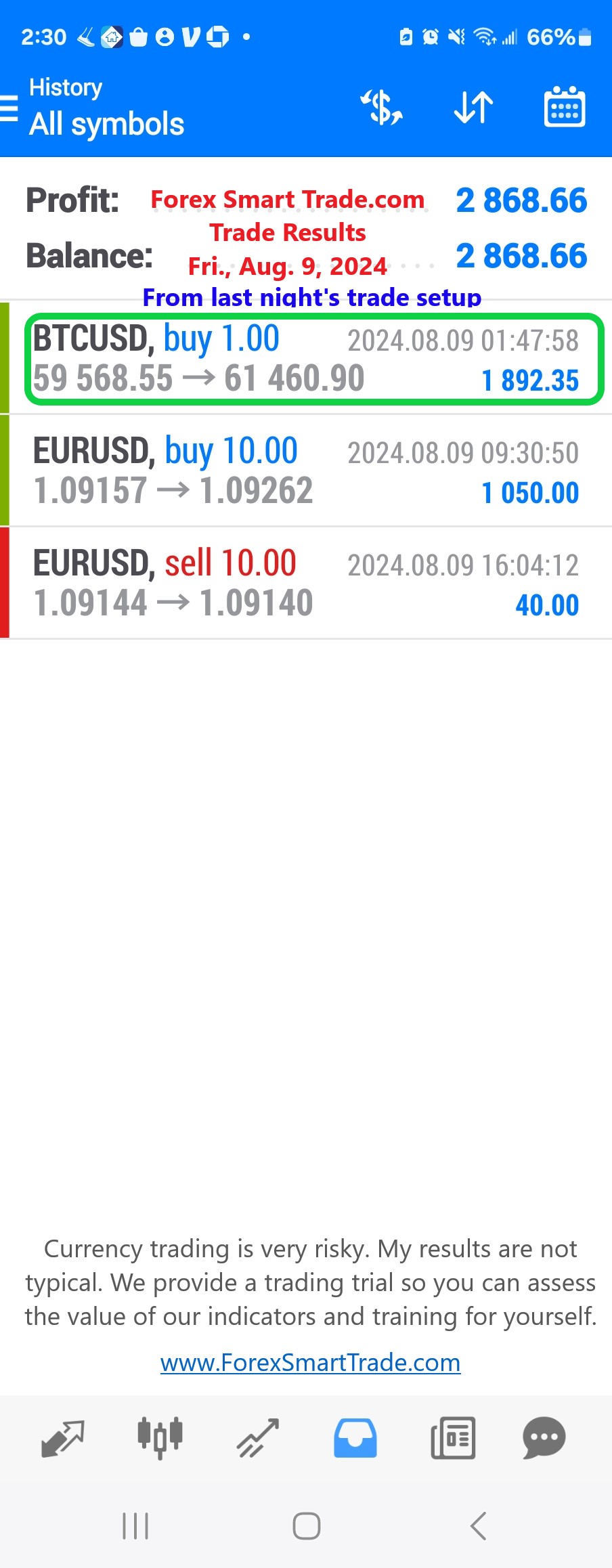

Forex Smart Trade Results, Friday, August 9, 2024 – $2,868

USD/CAD Trading Tactics. Since USD/CAD is only active during the U.S. trading session, the pair is highly susceptible to fakeouts during the other two trading sessions. This means […]

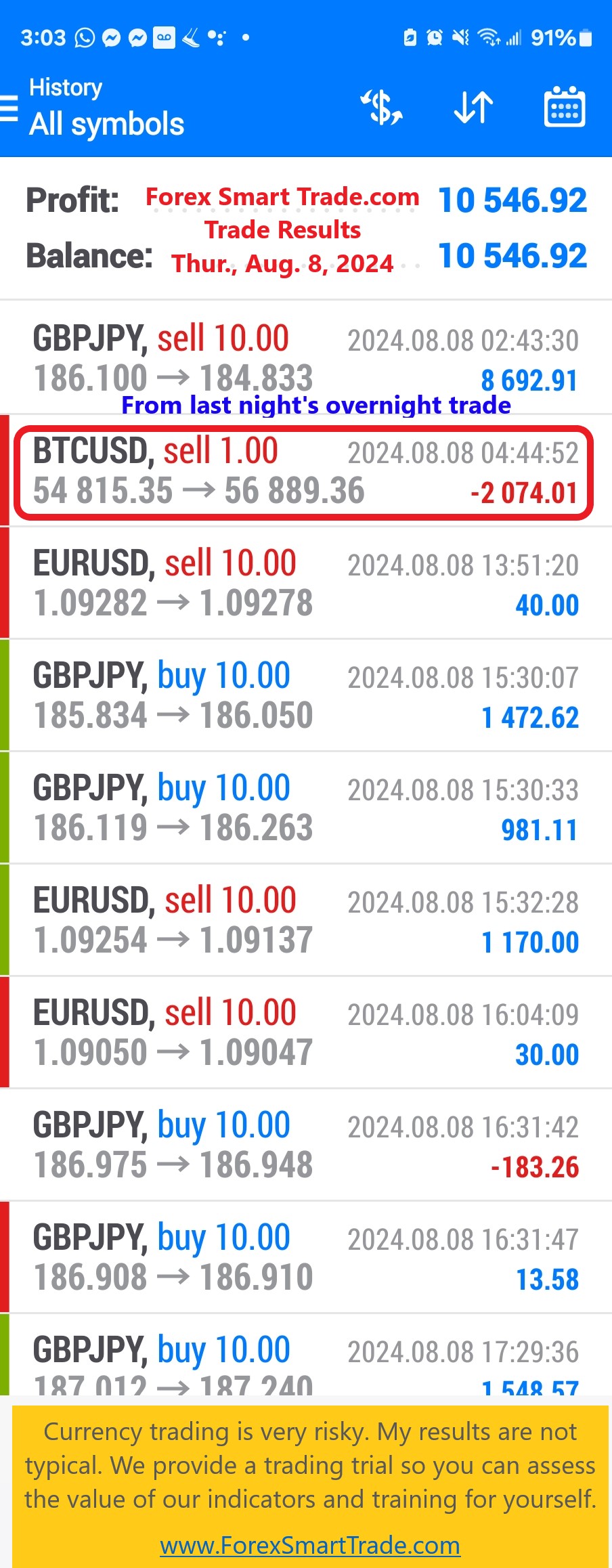

Forex Smart Trade Results, Thursday, August 8, 2024 – $10,546

What Moves the CAD? U.S. Economic Data U.S. economic data usually prints roughly at the same time as Canadian data. On the one hand, the negative […]

Forex Smart Trade Results, Wednesday, August 7, 2024 – $3,906

Getting to Know the CAD. You might be wondering why the CAD is nicknamed after Canada’s national bird, the Loonie… Well, that’s because that’s the engraved […]

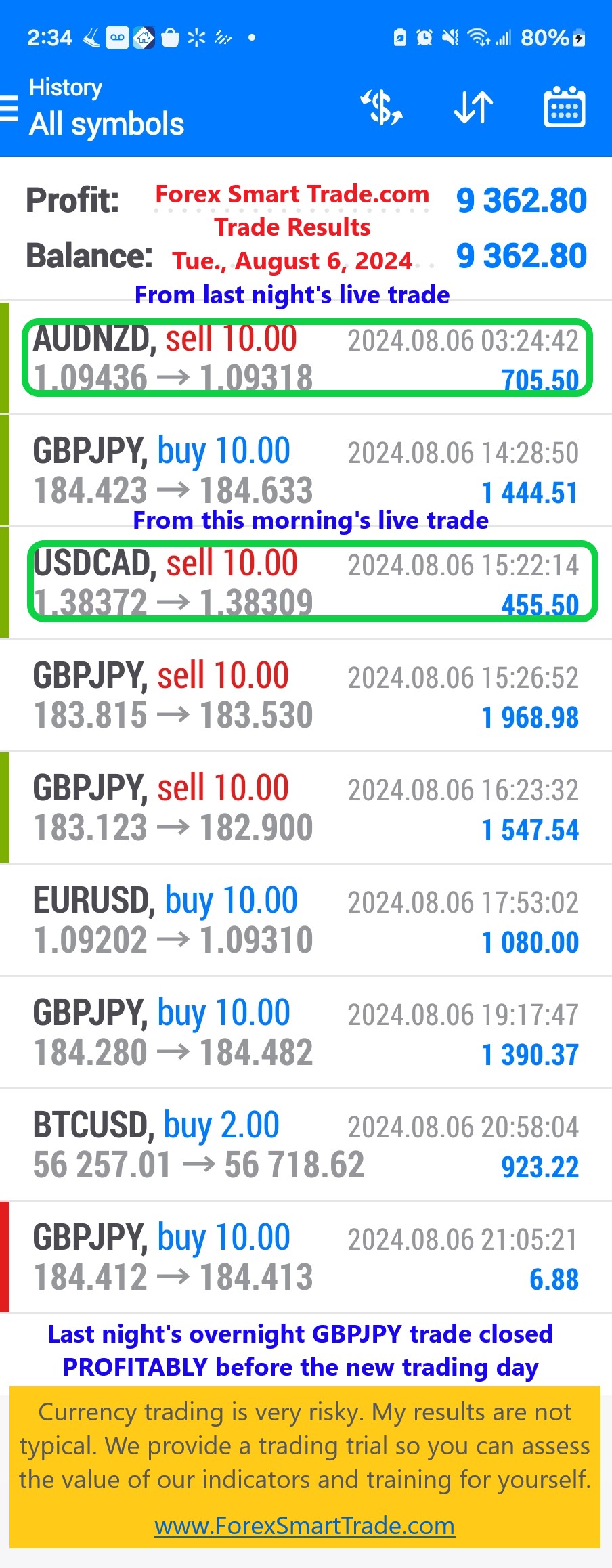

Forex Smart Trade Results, Tuesday, August 6, 2024 – $9,362

Canada – Monetary & Fiscal Policy. The Bank of Canada (BOC) is the main governing body when it comes to determining the country’s monetary policy. Decisions on the […]

Forex Smart Trade Results, Monday, August 5, 2024 – $10,551

Canada – Economic Overview. Canada is considered a resource-based country, which basically means that most of the economic growth it experienced early on came from the […]

Forex Smart Trade Results, Friday, August 2, 2024 – $0

Canada. Oh, Canada… Uncle Sam’s friendly, environment-loving, French-speaking, semi-frozen buddy up north. It is a place known to have created some of the most amazing things […]

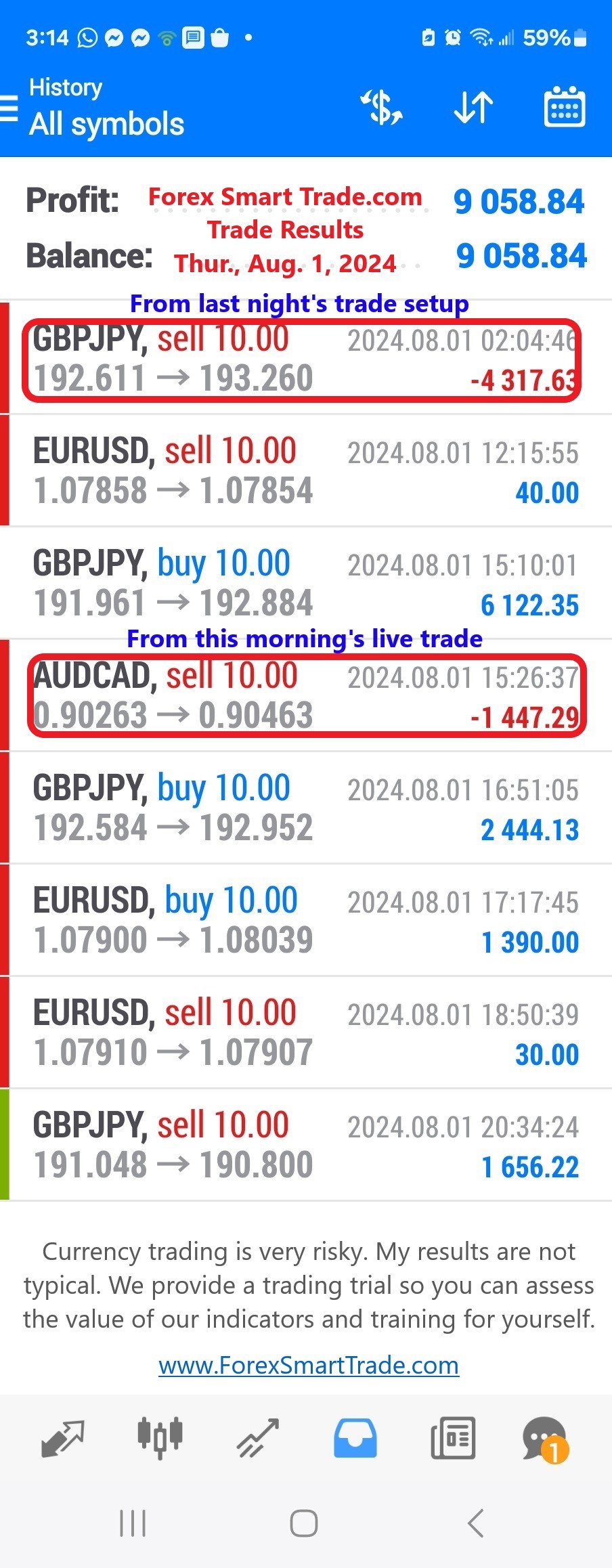

Forex Smart Trade Results, Thursday, August 1, 2024 – $9,058

Trading USD/JPY. USD/JPY is traded in amounts denominated by the base currency, the US Dollar. Standard lot sizes are 100,000 units of USD and mini lot […]