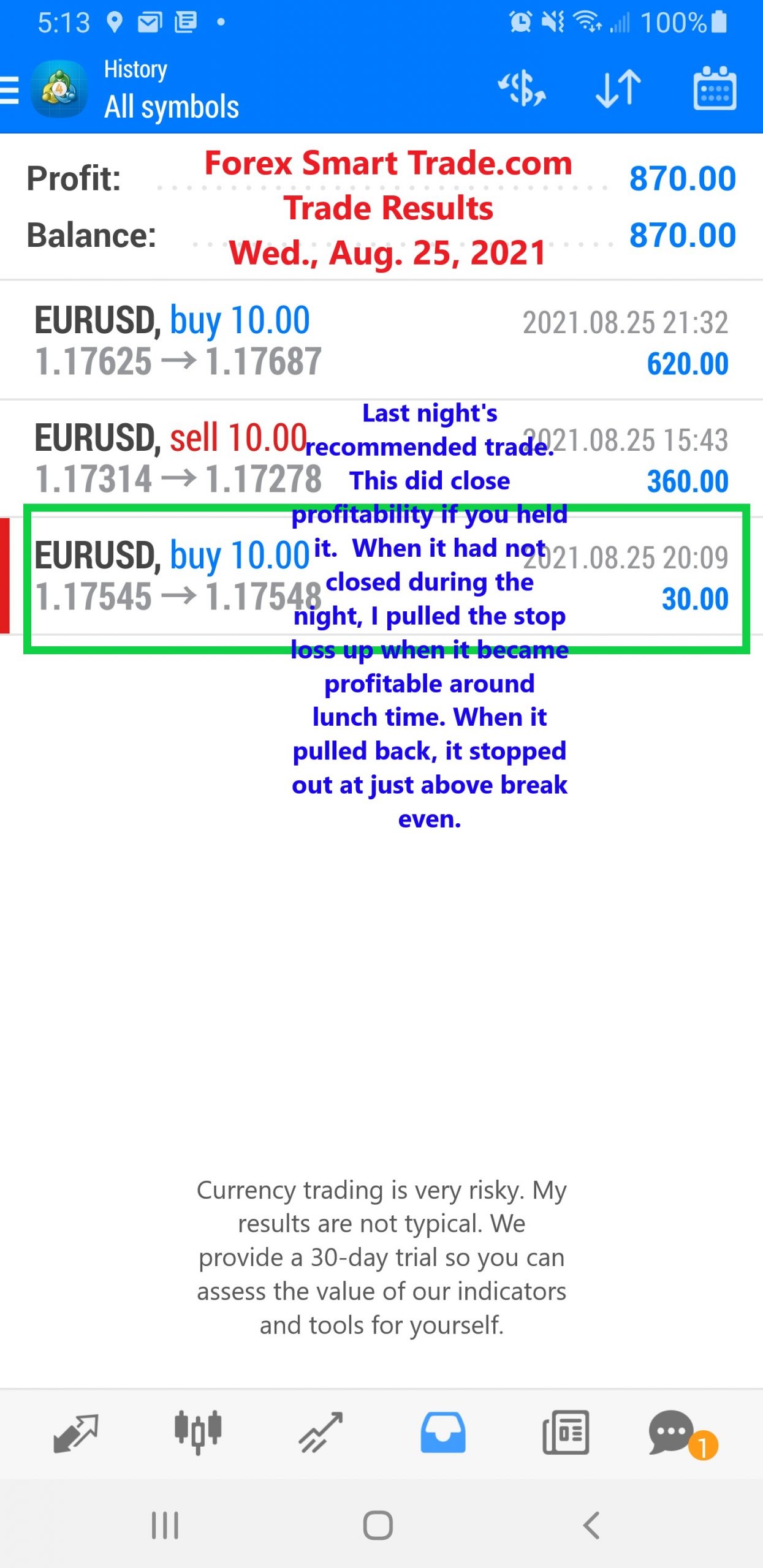

Trade Results August 25, 2021

Trade Results August 24, 2021

August 24, 2021

Forex Trade Results August 26, 2021

August 26, 2021Learn to Trade Forex – Forex Terminology 2

Contract for difference:

CFD is a contract that allows dealers to think over the price move for capital without possessing the basic asset. The trader will buy the CFDs only if he bets for the rise in the price of currency pairs. On the flip side, he will sell the CFDs if he believes that currency pair rates will decline. In forex trading, leverage refers to the wrong CFD trade that results in huge losses. Learn to trade forex with Forex Smart Trade.

Leverage:

Leverage is the borrowed money utilized for different trading purposes. The forex market is designated as the high leverage, which allows the traders to improve their positions.

For instance, based on the contract size, a trader may raise the 1,000usd of their own money, and for the trader against the Japanese Yen (JPY), they may borrow 9,000usd from a dealer to gamble against the euro (EUR).

As they have already utilized a minimal amount of their own money, the trader gets up to ensure the maximum profit if the trading occurs correctly. On the contrary, a high leverage environment increases the disadvantage and can lead to notable deprivation. In the example mentioned above, the trader’s losses will increase significantly if the trade occurs in the wrong direction.

Lot size:

The lot size is the standard size used for trading currencies. There are three types of lot sizes;

Standard lot size: Is 100,000 units of the currency pair.

Mini lot size: It comprises 10,000 units of currency pair.

Micro lot size: Contains 1,000 units of currency pair.

However, Nano lot sizes of the currencies are also frequently common among some brokers. Each Nano lot size contains 100 units of currency. The profit and the loss in trading hugely depend on the choice of the lot size. As the lot size gets bigger, one has greater chances for profits and losses.

Margin:

Margin is the total capital that you need to put aside to trade currency. The margin amount also guarantees the dealers that the trader will stay debt-free and satisfy the financial requirements even if the deal doesn’t occur as expected. The factors that affect the amount of margin are customer balance and the trader. In the forex market, the margin is related to the tandem with leverage for eCommerce.

PIP:

PIP stands for “price interest in point” or “percentage in point”. It is the lowest price movement equivalent to 4 decimal points built-in exchange market. The value of one pip is 0.0001, while 100 PIPs are equivalent to 1 cent. Similarly, the price quote for 10,000 PIPs is $1. The standard lot size as defined by the broker determines the PIP value. If $100,000 is the standard lot, then the value of every pip would be $10. Because the exchange rate on currency pairs utilizes proper leverage for trading, the lowest price movements in pips can significantly impact the trade.

Spread:

The difference between the asking price and the bid price for a currency pair is the spread. Forex traders don’t ask for the bonus; the spread is their primary source of making money. The spread size depends upon different factors such as

- Demand for the currency

- Trade size

- The volatility of the currency.

Sniping and hunting:

The buying and selling of the currencies close to the fixed points to increase profits are known as sniping and hunting. Traders get involved in this activity, and the best method to grab them is to team up with fellow brokers and notice their activities.

Learn How To Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar that shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just ONE dollar.