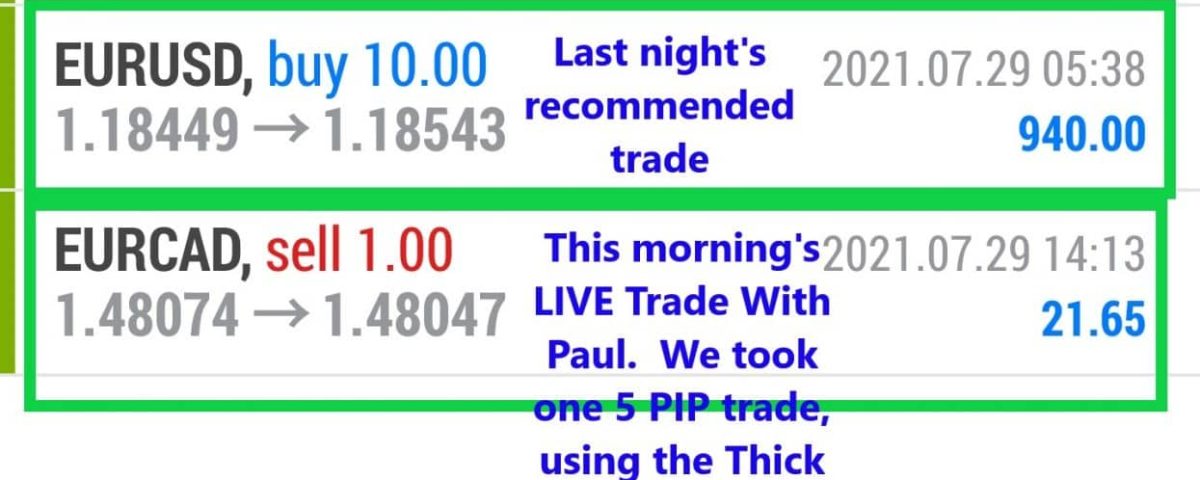

Forex Smart Trade Trade Results July 29, 2021

Forex Smart Trade Trade Results July 27, 2021

July 27, 2021

Forex Smart Trade Trade Results July 30, 2021

July 30, 2021Best Online Currency Trading Course

Why the Forex Market is Great to Trade as a Day Trader

Are you looking for an alternative way to day trade? Forget about the stock market and try the forex market instead. When you trade on the forex market, you buy one currency while selling another simultaneously. It offers so much potential to make profitable trades and investments by implementing clever short-term strategies.

Currencies always get traded in sets of two (e.g., EUR/USD). A successful day trader must accurately predict which currencies will rise and fall in value on a given day. The primary influencers of these values include national economies, banks, interest rates, and politics. Day traders must understand global affairs and what is happening in the news on an hourly basis worldwide.

Does this sound complicated? It does to many people at first, but it gets easier once you learn the basics of the forex market and how it works.

Below are the top 5 reasons to day trade on the forex marketplace.

1) Low Deposit Requirement

Most forex market brokers don’t require you to make a significant upfront deposit. In fact, many brokers will let you open an account with a minimum deposit of $100. Any new investor and day trader should be able to afford that.

2) An International Marketplace

The forex exchange is an international marketplace that exchanges national currencies. That means you are trading with people from all over the world rather than from your own country.

As a result, it creates more liquidity and opportunities in the market that you cannot find in any other financial exchange.

3) The Forex Market is Open 24/7

Traditional stock exchanges are only open on business days from 9:30 AM to 4:00 PM. On the other hand, the forex market is open 24/7. This gives day traders more opportunities to take advantage of the market at all hours of the day and night.

4) Free Demo Accounts Available

You don’t have to risk any money right off the bat. Most forex brokers allow you to practice trading currencies on a demo account. A demo forex account is the equivalent of paper trading on the stock market. You can make trades without risking any of your own money.

Of course, you cannot make money with a demo account either. But it is meant to give you practice trading on the forex market so that you can eventually feel comfortable risking actual money with a real forex account.

5) Government Regulated

Contrary to popular belief, forex trading is regulated by various government agencies. There are currently eight countries with government regulatory bodies that oversee forex trading practices, including the United States, the United Kingdom, Australia, Japan and Canada.

For example, the National Futures Association and the Commodities Futures Trading Commission are the regulatory bodies in the United States. Australia uses the Australian Securities and Investments Commission to regulate forex trading in its country, while the United Kingdom uses the Financial Conduct Authority.

Conclusion

There is always some level of risk when trading on any exchange. However, the forex market gives you more flexibility with how much you can invest and when you can invest. Forex has high volatility because the values of national currencies change every second of every day.

If you want to monitor the forex market and make trades on it, you can download forex mobile apps or use official forex brokerage services online.

If you’d like to learn more about currency trading with some super-accurate trading tools, watch this free webinar: #

Or if you’d like to try a 30-day trial to learn currency trading for only a DOLLAR, go to https://www.ForexSmartTrade.com/register

Best Online Currency Trading Course