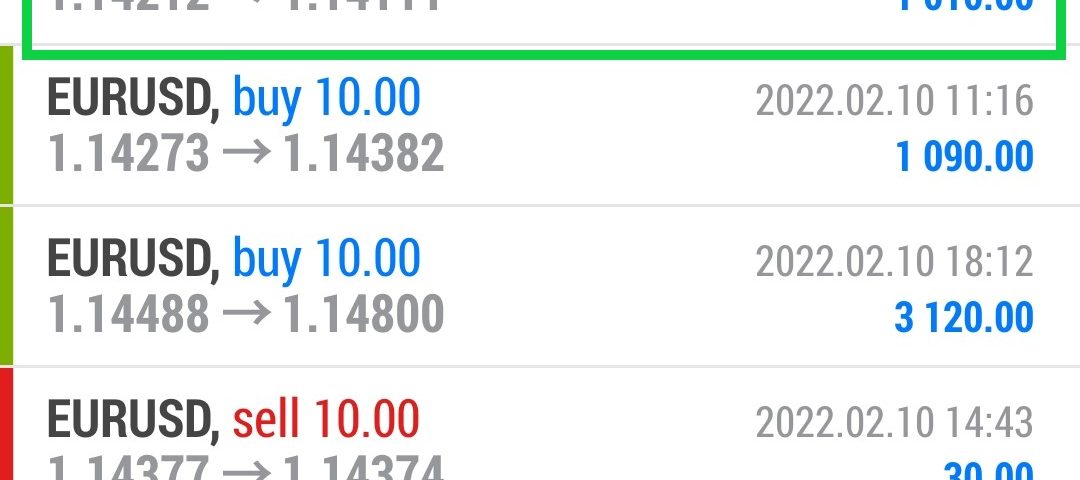

Forex Trade Results February 10, 2022

Forex Trade Results January 28, 2022

January 31, 2022

Forex Trade Results August 9, 2022 – $4,456

August 9, 2022Forex Micro Accounts

The forex market is hugh. Over $6 trillion is exchanged daily. Because of this, many traders will never worry about caps in terms of profitability. However, minimum balances still exist, usually at a relatively low rate. Many brokers offer what is called a “micro account.” With a micro account, traders are allowed to open a trading account for as little as five dollars. Because these offers usually charge more in spreads, they make trading available to just about anybody.

Typically, brokers prefer a normal account to start around $500. These accounts offer lower pip spreads, but keep in mind that profits are taken at the beginning. By setting you ‘however many pips behind’ your entry to pay the spread difference.

Now, consider the possible problem with the Futures market. It isn’t for everyone, because of a required minimum standard balance set by the Commodity Futures Trading Commission (CFTC).

It is important to remember that most brokers outside of Forex will not allow you to open an account with less than $5,000. In addition, contract margins can vary from $500 to $6,000 per contract traded. These account parameters are there to prevent losses that traders aren’t able to cover.

Forex Micro Accounts

Learn How To Currency Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar that shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just TEN dollars.