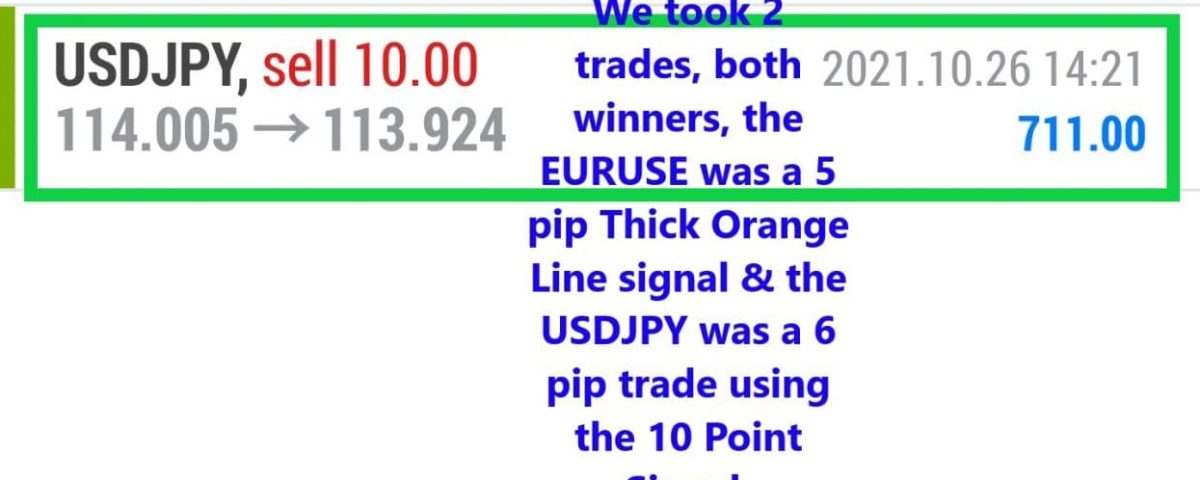

Forex Trade Results October 26, 2021

Trade Results October 25, 2021

October 25, 2021

Forex Trade Results October 27, 2021

October 27, 2021The pros and cons of forex trading

More and more speculative investors and traders are interested in foreign exchange trading. Before investing, consider the advantages and disadvantages of trading forex.

Who is Forex Trading Suitable for?

Who is Forex trading actually suitable for. Trading forex involves a high level of risk.

Because of the high leverage used in forex trading, you can lose your investment at any time.

Forex trading is only suitable for those customers who are willing to take a high risk.

Forex trading is absolutely unsuitable to build up a private pension plan or for those who want to invest a large part of their assets safely.

What are the benefits of forex trading?

Foreign exchange trading has enjoyed great popularity in recent years. Many speculative traders see advantages in forex trading that are only available in a few other financial products.

Some of the advantages that Forex trading include:

- Trading is possible with little capital investment.

- High profits are possible with lower capital expenditure.

- Extremely liquid market.

- Regulated Providers (Forex Brokers).

- Easy to use.

- Complete range of forex brokers.

The basic requirements to trade Forex are a computer, an internet connection, and, a brokerage account.

In Forex various entities participate including:

- Large banking institutions

- Central banks of various nations

- Currency speculators

- Multinational companies

- Governments

- Other markets and financial institutions

What are the disadvantages of forex trading?

Foreign exchange trading is not suitable for many for several reasons. Probably the biggest disadvantage is that losses are possible at any time. This can even include a total loss.

If your margin on the trading account is no longer sufficient, the broker closes the position.

Exchange rates can behave relatively irrationally.

Foreign exchange trading is characterized by a relatively high level of volatility.

The pros and cons of forex trading

Learn How To Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just TEN dollars.