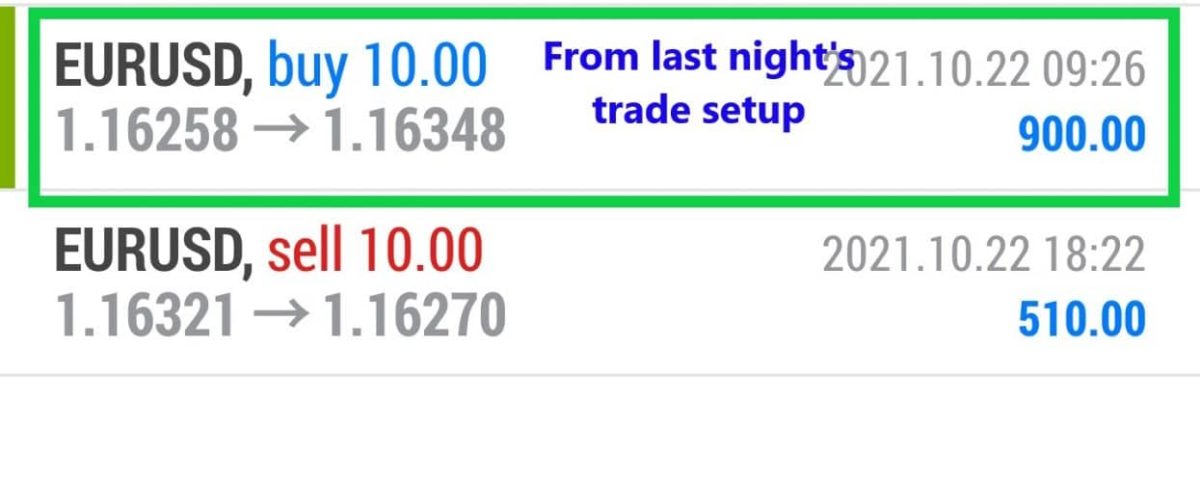

Forex Trade Results October 22, 2021

Forex Trade Results October 21, 2021

October 21, 2021

Trade Results October 25, 2021

October 25, 2021What is the forex? Is it risky to trade forex?

The word forex (or FX) is a contraction of the expression “foreign exchange,” which means exchange rates, and is the decentralized global market for the world’s currencies. Traders, investors, banks, and exchange houses buy, sell and speculate on these currencies, an activity that, in turn, determines the exchange rate.

What are currency pairs?

In the forex market, there is speculation about the fluctuations in the prices of the two countries’ currencies. These two currencies are called “currency pairs.” Each pair is made up of the base and quoted currency. The most traded currency pair is the euro against the dollar (or “against the dollar,” as many traders would say), which is usually represented by the EUR / USD notation.

What are currency pairs?

In the forex market, there is speculation about the fluctuations in the prices of the two countries’ currencies. These two currencies are called “currency pairs.” Each pair is made up of the base and quoted currency. The most traded currency pair is the euro against the dollar (or “against the dollar”, as many traders would say), which is usually represented by the EUR / USD notation.

How does forex trading work?

Trading forex is buying and selling currencies to make a profit. Forex trading is always done with two currencies at the same time: the base and the quote currency. The profit or loss comes from the difference in price.

Is it risky to trade forex?

All trading in the financial markets is risky, and it is essential to always keep it in mind. But it can also generate huge profits, and this is why it attracts so many people. Again, we insist that it is very convenient that you start trading on a demo account if you are a newcomer to the forex market. When you are prepared for a live account, you always have to consider the risks involved.

What is a position?

A position is an operation that is in progress. For example, in trading you can enter long positions and short positions:

- Long position: It is when the trader buys a currency with the hope that its price will increase. As soon as the currency is sold again, the long position is considered to have been closed.

- Short position: It is when the trader sells a currency in the hope that its price will decrease. As soon as the currency is bought again, the short position is considered to have been closed.

What currency pairs are the most popular in the forex market?

Although, in theory, it is possible to trade any currency pair, some are traded more consistently. They are the so-called “major pairs” or “majors,” and they form 80% of the forex market’s trading volume.

These major pairs are associated with stable economies and therefore offer little volatility and abundant liquidity. Some examples of majors are the aforementioned EUR / USD, USD / JPY (US dollar and Japanese yen), GBP / USD (British pound and US dollar), and USD / CHF (US dollar and Swiss franc). Another characteristic of the major currency pairs is that there is less risk that they can be manipulated and, in general, the spreads are quite small.

What are cross currency pairs?

Cross-currency pairs, also known as crosses, are those that do not include the US dollar, making them more volatile and less liquid compared to majors. While the US dollar is present in all major pairs, we have “minor” currencies in the crosses, such as the euro, the British pound, and so on. Some of the most traded pairs in the crossover family are the EUR / GBP, the GBP / JPY, and the EUR / JPY.

What are exotic pairs?

Exotic pairs are the currencies of smaller economies and so-called emerging markets. They are usually paired with a major currency. As these pairs are the ones with the least liquidity and the highest volatility of the three categories, they are considered the riskiest.

Some examples are USD / MXN, GBP / NOK, and CHF / NOK.

What is the forex

Learn How To Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 30-day introductory trial for just TEN dollars.