Margin can be classified as either “used” or “free”.

Used Margin, which is just the aggregate of all the Required Margin from all open positions.

Free Margin (FM) is the difference between Equity and Used Margin.

FM refers to the Equity in a trader’s account that is NOT tied up in margin for current open positions.

Free Margin is also known as “Usable Margin” because it’s the margin that you can “use”….it’s “usable”.

Usable or free margin is:

- The amount available to open NEW positions.

- The amount that EXISTING positions can move against you before you receive a Margin Call or Stop Out.

Don’t worry about what a Margin Call and Stop Out are. They will be discussed later.

For now, just know they’re bad things. Like acne breakouts, you don’t want to experience them.

Free Margin is also known as Usable Margin, Usable Maintenance Margin, Available Margin, and “Available to Trade“.

How to Calculate Free Margin

Here’s how to calculate Free Margin:

Free Margin = Equity - Used Margin

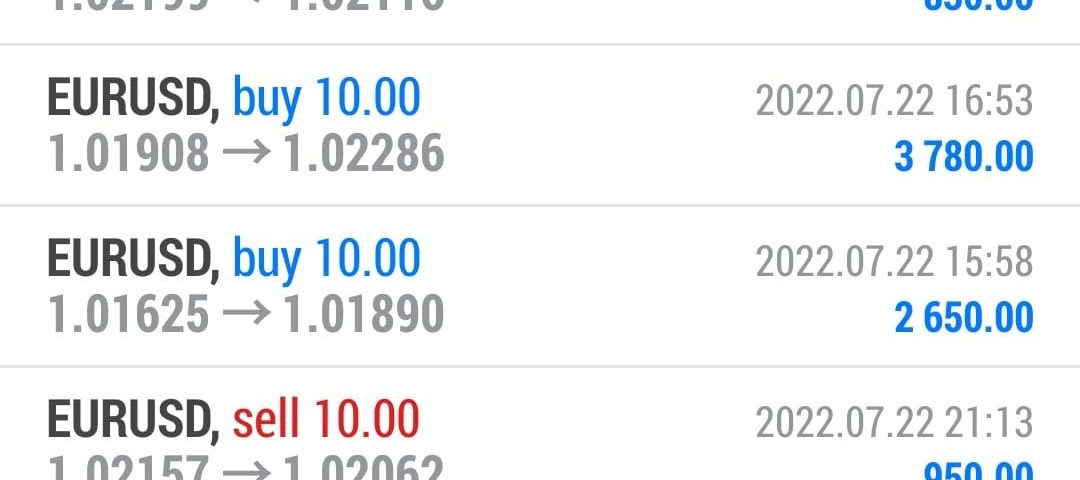

If you have open positions, and they are currently profitable, your Equity will increase, which means that you will have more Free Margin as well.

Floating profits increase Equity, which increases Free Margin.

If your open positions are losing money, your Equity will decrease, which means that you will also have less Free Margin as well.

Floating losses decrease Equity, which decreases Free Margin.