What is a pip in forex?

You’ve probably heard of the terms “pips,” “points“, “pipettes,” and “lots” thrown around, and now we’re going to explain what they are and show you how their values are calculated.

Take your time with this information, as it is required knowledge for all forex traders.

Don’t even think about trading until you are comfortable with pip values and calculating profit and loss.

What the heck is a Pip?

The unit of measurement to express the change in value between two currencies is called a “pip.”

If EUR/USD moves from 1.10503 to 1.10513, that .0001 USD rise in value is ONE PIP.

A pip is usually the FOURTH decimal place of a price quote.

Most pairs go out to 5 decimal places, but there are some exceptions like Japanese yen pairs (they go out to 3 decimal places).

For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

What is a Pipette?

There are forex brokers that quote currency pairs beyond the standard “4 and 2” decimal places to “5 and 3” decimal places.

They are quoting FRACTIONAL PIPS, also called “points” or “pipettes.”

If the concept of a “pip” isn’t already confusing enough for the new forex trader, let’s try to make you even more confused and point out that a “point” or “pipette” or “fractional pip” is equal to a “tenth of a pip“.

For instance, if GBP/USD moves from 1.30542 to 1.30543, that .00001 USD move higher is ONE PIPETTE.

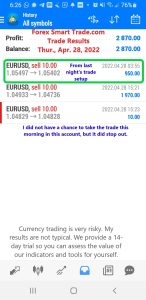

Here’s how fractional pips look like on a trading platform:

On trading platforms, the digit representing a tenth of a pip usually appears to the right of the two larger digits.

Here’s a pip “map” to help you to learn how to read pips…