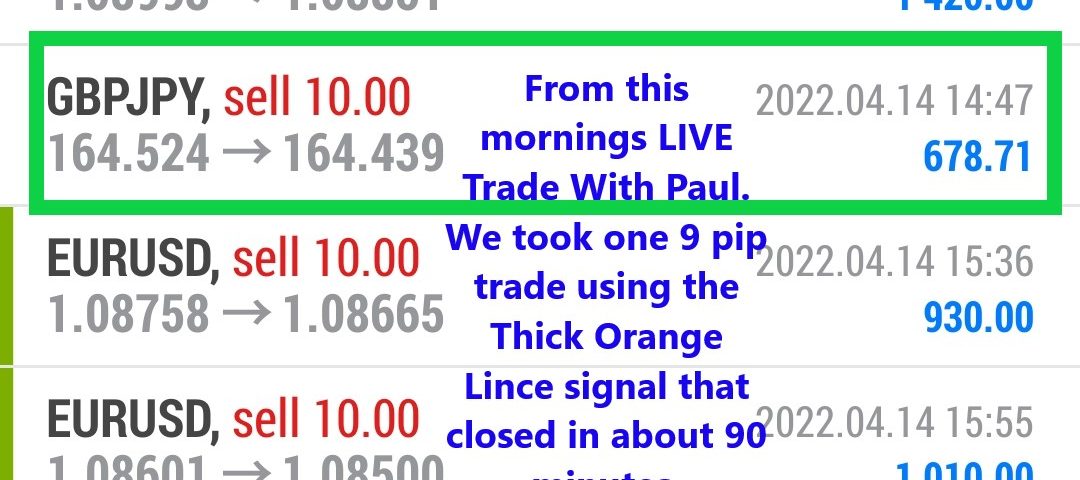

Forex Trade Results April 14, 2022 – $8,368.

Forex Trade Results April 13, 2022 – $4,930.

April 13, 2022

Forex Trade Results April 15, 2022 – $0 – No Trades Today

April 18, 2022Different Ways To Trade Forex.

Currency ETFs

A currency ETF offers exposure to a single currency or basket of currencies.

Currency ETFs allow ordinary individuals to gain exposure to the forex market through a managed fund without the burdens of placing individual trades.

Currency ETFs can be used to speculate on forex, diversify a portfolio, or hedge against currency risks.

ETFs are created and managed by financial institutions that buy and hold currencies in a fund.

They then offer shares of the fund to the public on an exchange allowing you to buy and trade these shares just like stocks.

Like currency options, the limitation in trading currency ETFs is that the market isn’t open 24 hours.

Also, ETFs are subject to trading commissions and other transaction costs.

Spot FX

The spot FX market is an “off-exchange” market, also known as an over-the-counter (“OTC”) market.

The off-exchange forex market is a large, growing, and liquid financial market that operates 24 hours a day.

It is not a market in the traditional sense because there is no central trading location or “exchange”.

In an OTC market, a customer trades directly with a counterparty.

Unlike currency futures, ETFs, and (most) currency options, which are traded through centralized markets, spot FX are over-the-counter contracts (private agreements between two parties).

Most of the trading is conducted through electronic trading networks (or telephone).

The primary market for FX is the “interdealer” market where FX dealers trade with each other.

A dealer is a financial intermediary that stands ready to buy or sell currencies at any time with its clients.

The interdealer market is also known as the “interbank” market due to the dominance of banks as FX dealers.

The interdealer market is only accessible to institutions that trade in large quantities and have a very high net worth.

This includes banks, insurance companies, pension funds, large corporations, and other large financial institutions that manage the risks associated with fluctuations in currency rates.

In the spot FX market, an institutional trader is buying and selling an agreement or contract to make or take delivery of a currency.

A spot FX transaction is a bilateral (“between two parties”) agreement to physically exchange one currency against another currency.

Spot Contract

This agreement is a contract. This means this spot contract is a binding obligation to buy or sell a certain amount of foreign currency at a price that is the “spot exchange rate” or the current exchange rate.

So if you buy EUR/USD on the spot market, you are trading a contract that specifies that you will receive a specific amount of euros in exchange for U.S dollars at an agreed-upon price (or exchange rate).

It’s important to point out that you are NOT trading the underlying currencies themselves, but a contract involving the underlying currencies.

Even though it’s called “spot”, transactions aren’t exactly settled “on the spot”.

In reality, while they do a spot FX trade at the current market rate, it does not settle the actual transaction until two business days after the trade date.

We know this as T+2 (“Today plus 2 business days”).

It means that delivery of what you buy or sell should be completed within two working days and is referred to as the value date or delivery date.

For example, an institution buys EUR/USD in the spot FX market.

The trade opened and closed on Monday has a value date on Wednesday. This means that it’ll receive euros on Wednesday.

Not all currencies settle T+2 though. For example, USD/CAD, USD/TRY, USD/RUB and USD/PHP value date is T+1, meaning one business day going forward from today (T).

Trading in the actual spot forex market is NOT where retail traders trade though.

Learn to Day Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.