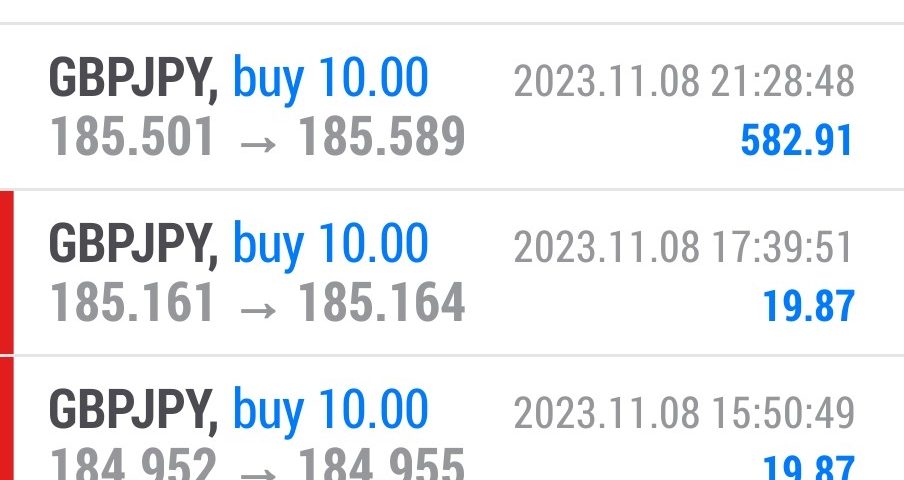

Forex Smart Trade Results, Wednesday, November 8, 2023 – $5,754

Forex Smart Trade Results, Tuesday, November 7, 2023 – $9,815

November 11, 2023

Forex Smart Trade Results, Thursday, November 9, 2023 – $5,352

November 11, 2023More on Rules for Trading Divergences.

Let’s continue with reviewing the last three rules for trading divergences.

6. Keep Price and Indicator Swings in Vertical Alignment

The highs or lows you identify on the indicator MUST be the ones that line up VERTICALLY with the price highs or lows.

Maintain vertical alignment with the PRICE’s swing highs and lows with the INIDCATOR’s swing highs and lows.

7. Watch the Slopes

Divergence only exists if the SLOPE of the line connecting the indicator tops/bottoms DIFFERS from the SLOPE of the line connection price tops/bottoms.

The slope must either be: Ascending (rising) Descending (falling) Flat (flat).

The image above provides you with two examples: one in pink and the other in blue.

In the “pink” example, the pink lines show where divergence is present. As you can see, the price made a lower low, while the indicator made a higher low. The slope of the price line is descending (or sloping down), while the indicator line is ascending (or sloping up).

In the ”blue” example, the blue lines show no divergence between price and indicator. They slope both lines in the same general direction, up.

8. If the ship has sailed, catch the next one.

If you spot divergence but the price has already reversed and moved in one direction for some time, the divergence should be considered played out.

You missed the boat this time. All you can do now is wait for another swing high/low to form and start your divergence search over.

9. Take a Step Back

Divergence signals tend to be more accurate on longer time frames.

You get fewer false signals.

This means fewer trades, but if you structure your trade well, then your profit potential can be huge.

Divergences on shorter time frames will occur more frequently but are less reliable.

We advise only looking for divergences on 1-hour charts or longer.

Other traders use 15-minute charts or even faster.

In those time frames, there’s just too much noise for our taste so we just stay away.

So there you have it!

Nine rules you MUST (should?) follow if you want to seriously consider trading using divergences.

Trust us, you don’t wanna be ignoring these rules.

Follow these rules, and you will dramatically increase the chances of a divergence setup leading to a profitable trade.

Now go scan the charts and see if you can spot some divergences that happened in the past as a great way to begin getting your divergence skills up to par!

Learn to Trade

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.