Let’s take a look at what is the best technical indicator in forex not counting the Forex Smart Trade indicators.

Now on to the good stuff: Just how profitable is each technical indicator on its own?

After all, forex traders don’t include these technical indicators just to make their charts look nicer. Traders are in the business of making money!

If these indicators generate signals that don’t translate into a profitable bottom line over time, then they’re simply not the way to go for your needs!

In order to give y’all a comparison of the effectiveness of each technical indicator, we’ve decided to backtest each of the indicators on their own for the past 5 years.

Backtesting involves retroactively testing the parameters of the indicators against historical price action.

You’ll learn more about this in your future studies. For now, just take a look at the parameters we used for our backtest.

Chart

| INDICATOR | PARAMETERS | RULES |

|---|---|---|

| Bollinger Bands | (30,2,2) | Cover and go long when the daily closing price crosses below the lower band. Cover and go short when the daily closing price crosses above the upper band. |

| MACD | (12,26,9) | Cover and go long when MACD1 (fast) crosses above MACD2 (slow). Cover and go short when MACD1 crosses below MACD2. |

| Parabolic SAR | (.02,.02,.2) | Cover and go long when the daily closing price crosses above ParSAR. Cover and go short when the daily closing price crosses below ParSAR. |

| Stochastic | (14,3,3) | Cover and go long when Stoch % crosses above 20. Cover and go short when Stoch % crosses below 80. |

| RSI | (9) | Cover and go long when RSI crosses above 30. Cover and go short when RSI crosses below 70 |

| Ichimoku Kinko Hyo | (9,26,52,1) | Cover and go long when the conversion line crosses above baseline. Cover and go short when conversion line crosses below base line |

Test Results

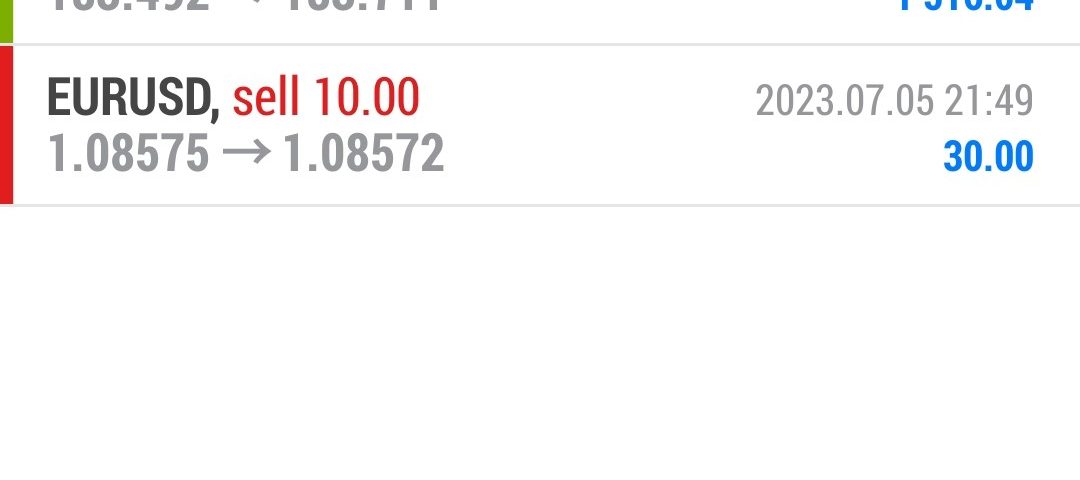

Using these parameters, we tested each of the technical indicators on its own on the daily time frame of EUR/USD over the past 5 years.

We are trading 1 lot (that’s 100,000 units) at a time with no set stop losses or take profit points.

We simply cover and switch positions once a new signal appears.

This means if we initially had a long position when the indicator told us to sell, we would cover and establish a new short position.

Also, we were assuming we were well capitalized (as suggested in our Leverage lesson) and started with a hypothetical balance of $100,000.

Aside from the actual profit and loss of each strategy, we included the total pips gained/lost and the max drawdown.