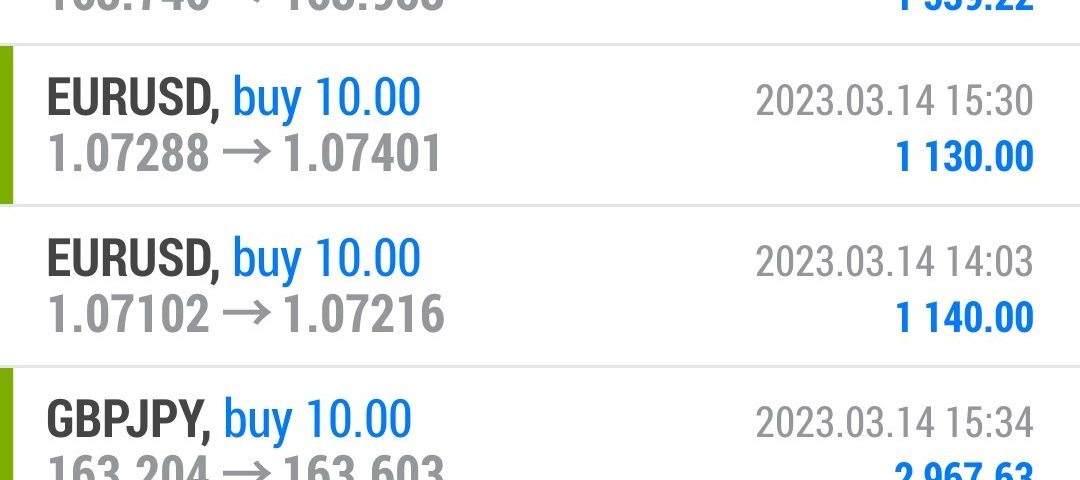

Forex Smart Trade Results, Tuesday, March 14, 2023 – $1,873

Forex Smart Trade Results, Monday, March 13, 2023 – $9,830

March 21, 2023

Forex Smart Trade Results, Wednesday, March 15, 2023 – $11,541

March 21, 2023More Fibonacci.

Let’s continue with more Fibonacci and take a look at Fibonacci retracement levels and extension levels.

Fibonacci Retracement Levels

0.236, 0.382, 0.618, 0.764

Fibonacci Extension Levels

0, 0.382, 0.618, 1.000, 1.382, 1.618

You won’t really need to know how to calculate all of this. Your charting software will do all the work for you.

However, it’s always good to be familiar with the basic theory behind the indicator, so you’ll have the knowledge to impress your date.

Fibonacci retracement levels work on the theory that, after a big price moves in one direction, the price will retrace or return partway back to a previous price level before resuming in the original direction.

Traders use the Fibonacci retracement levels as potential support and resistance areas.

Since so many traders watch these same levels and place buy and sell orders on them to enter trades or place stops, the support and resistance levels tend to become a self-fulfilling prophecy.

Traders use the Fibonacci extension levels as profit-taking levels.

Again, since so many traders are watching these levels to place buy and sell orders to take profits, this tool tends to work more often than not due to self-fulfilling expectations.

Most charting software includes both Fibonacci retracement levels and extension level tools.

Swing High and Low

In order to apply Fibonacci levels to your charts, you’ll need to identify Swing High and Swing Low points.

A Swing High is a candlestick with at least two lower highs on both the left and right of itself.

A Swing Low is a candlestick with at least two higher lows on both the left and right of itself.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.