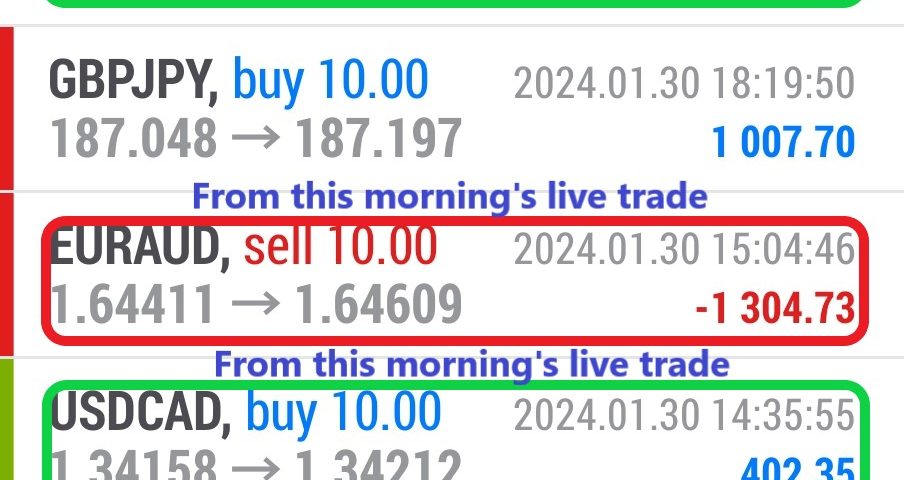

Forex Smart Trade Results, Tuesday, January 30, 2024 – $4,080

Forex Smart Trade Results, Monday, January 29, 2024 – $8,664

February 7, 2024

Forex Smart Trade Results, Wednesday, January 31, $7,535

February 12, 2024

Hawkish vs. Dovish Central Banks

Yes, you’re in the right place.

Tonight’s match puts the L.A. Hawks up against the N.Y. Doves.

You’re in for a treat. Wait, what?!

Whoops sorry, wrong subject.

We really just meant hawks versus doves, central bank hawks versus central bank doves that is.

Central bankers can be viewed as either hawkish or dovish, depending on how they approach certain economic situations.

What does it mean to be “hawkish”?

Central bankers are described as “hawkish” when they are in support of the raising of interest rates to fight inflation, even to the detriment of economic growth and employment.

They are known as “hawks” and use words like “tighten” and “heating up” will be used.

For example, “The Bank of England suggests the existence of a threat of high inflation.”

The Bank of England could be described as being hawkish if they made an official statement leaning towards increasing of interest rates to reduce high inflation.

What does it mean to be “dovish”?

On the other hand (or claw?), central bankers are described as “dovish” when they favor economic growth and employment over-tightening interest rates.

They also tend to have a more non-aggressive stance or viewpoint regarding a specific economic event or action.

They are known as “doves” and use words like “soften” and “cooling down” will be used.

And the winner is… It’s a tie!

Well, sort of.

You’ll find many a banker “on the fence”, exhibiting both hawkish and dovish tendencies. However, true colors tend to shine when extreme market conditions occur.

Learn to Day Trade Forex

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.[/vc_column_text][/vc_column][/vc_row]

Learn to Day Trade Forex

Learn to Day Trade Forex