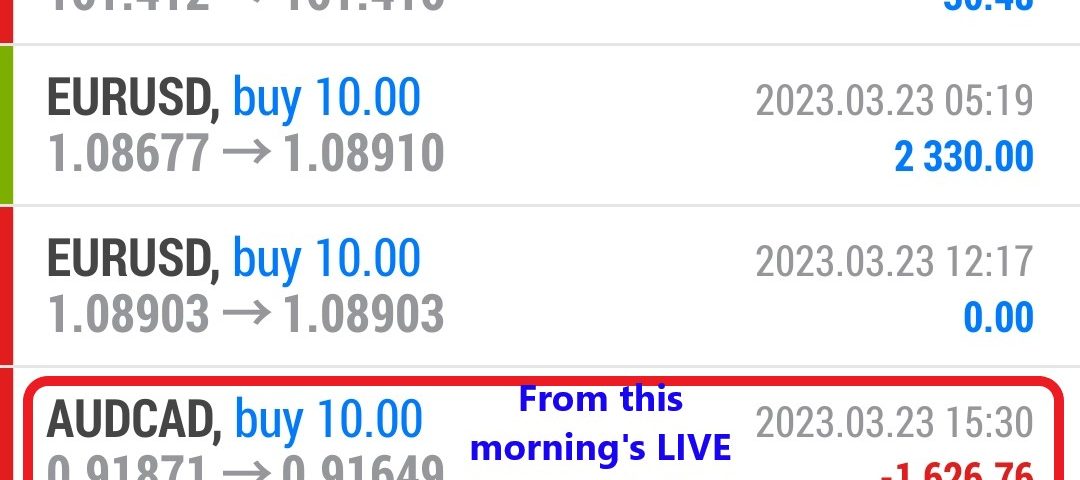

Forex Smart Trade Results, Thursday, March 23, 2023 – $7,828

Forex Smart Trade Results, Wednesday, March 22, 2023 – $12,887

April 8, 2023

Forex Smart Trade Results, Friday, March 25, 2023 – $2,740

April 8, 2023Fibonacci Retracement and Support and Resistance.

Let’s continue our discussion of Fibonacci retracement and support and resistance.

One of the best ways to use the Fibonacci retracement tool is to spot potential support and resistance levels and see if they line up with Fibonacci retracement levels.

If Fibonacci levels are already support and resistance levels, and you combine them with other price areas that a lot of other traders are watching, then the chances of price bouncing from those areas are much higher.

Example 1 – USDCHF

Let’s look at an example of how you can combine support and resistance levels with Fibonacci levels. Below is a daily chart of USD/CHF.

As you can see, it’s been on an uptrend recently. Look at all those green candles!

You decide that you want to get in on this long USD/CHF bandwagon.

But the question is, “When do you enter?”

You bust out the Fibonacci retracement tool, using the low at 1.0132 on January 11 for the Swing Low and the high at 1.0899 on February 19 for the Swing High.

Now your chart looks pretty sweet with all those Fibonacci retracement levels.

Finding a Good Entry Point

Now that we have a framework to increase our probability of finding a solid entry, we can answer the question “Where should you enter?”

You look back a little bit and you see that the 1.0510 price was a good resistance level in the past and it just happens to line up with the 50.0% Fibonacci retracement level.

Now that it’s broken, it could turn into support and be a good place to buy.

If you did set an order somewhere around the 50.0% Fib level, you’d be a pretty happy camper!

There would have been some pretty tense moments, especially on the second test of the support level on April 1.

Price tried to pierce through the support level but failed to close below it. Eventually, the pair broke past the Swing High and resumed its uptrend.

You can do the same setup on a downtrend as well. The point is you should look for price levels that seem to have been areas of interest in the past.

Bounces

If you think about it, there’s a higher chance that the price will bounce from these levels.

Why?

First, as we discussed in an earlier lesson, previous support or resistance levels are usually good areas to buy or sell because other traders will also be eyeing these levels like a hawk.

Second, since we know that a lot of traders also use the Fibonacci retracement tool, they may be looking to jump in on these Fib levels themselves.

With traders looking at the same support and resistance levels, there’s a good chance that there are a ton of orders at those price levels.

No Guarantees

While there’s no guarantee that the price will bounce from those levels, at least you can be more confident about your trade. After all, there is strength in numbers!

Remember that trading is all about probabilities.

If you stick to those higher probability trades, then there’s a better chance of coming out ahead in the long run.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.