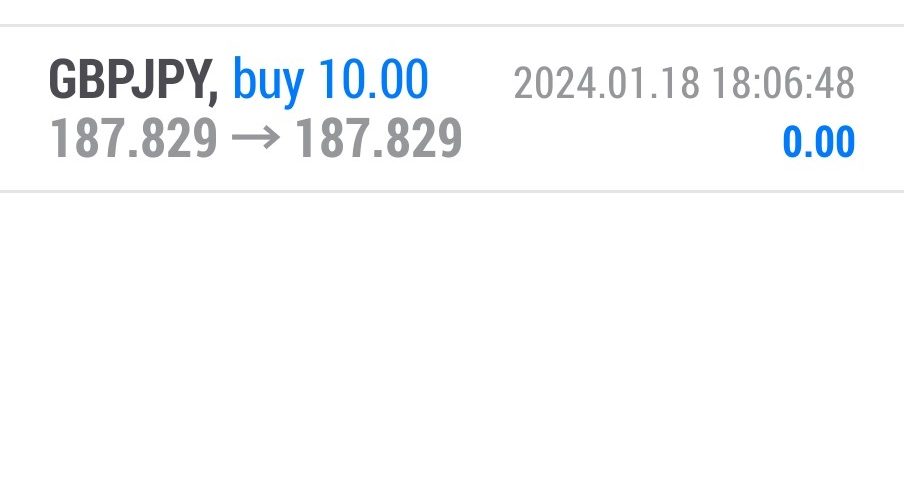

Forex Smart Trade Results, Thursday, January 18, 2024 – $940

Forex Smart Trade Results, Wednesday, January 17, 2024 – $9,301

January 20, 2024

Forex Smart Trade Results, Friday, January 19, 2024 – $5,075

January 20, 2024Consensus Market Expectations.

A consensus expectation, or just consensus, is the relative agreement on upcoming economic or news forecasts.

Various leading economists from banks, financial institutions, and other securities-related entities make economic forecasts.

Your favorite news personality gets into the mix by surveying her in-house economist and collection of financially sound “players” in the market.

All the forecasts get pooled together and averaged out, and it’s these averages that appear on charts and calendars designating the level of expectation for that report or event.

The consensus becomes ground zero; the incoming, or actual data is compared against this baseline number.

Incoming data normally gets identified in the following manner:

- “As expected” – the reported data was close to or at the consensus forecast.

- “Better-than-expected”– the reported data was better than the consensus forecast.

- “Worse-than-expected” – the reported data was worse than the consensus forecast.

Whether or not incoming data meets consensus is an important evaluation for determining price action.

Just as important is the determination of how much better or worse the actual data is than the consensus forecast.

Larger degrees of inaccuracy increase the chance and extent to which the price may change once the report is out.

However, let’s remember that forex traders are smart, and can be ahead of the curve. Well the good ones, anyway.

Learn to Trade Currency

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.