The U.S. has the largest economy in the world, and as a result, speculators react strongly to U.S. news reports, even if it doesn’t cause a huge fundamental shift in the long run.

What this means for your charts is that you will see several “spikes” even if there is a trend emerging. This can make it harder to spot trends or range conditions.

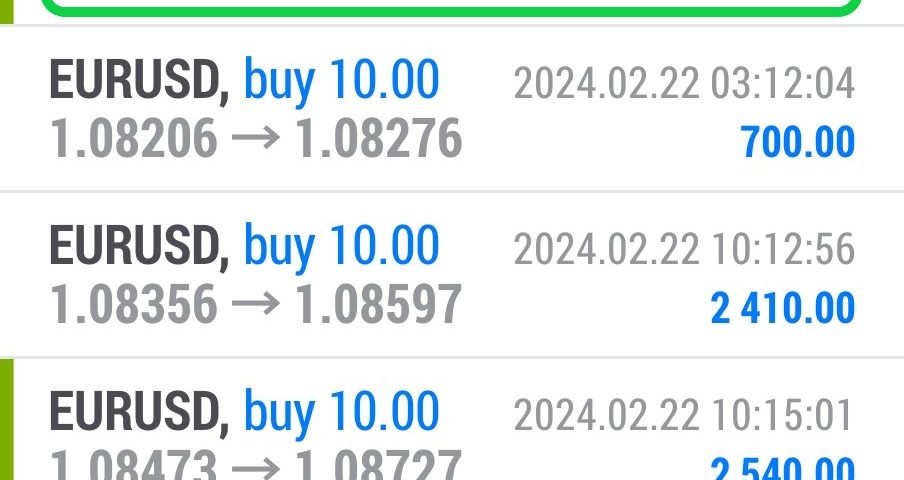

The day-to-day economic activities of the U.S. can keep U.S. dollar-based currencies such as EUR/USD (above) from making smooth trends.

Conversely, we can see that during the same date range, cross-currency EUR/JPY made a much, much smoother ride to the top.

This was probably due to fewer spikes that came from U.S. data.

So as you can see, both charts showed the euro rose during the same time period, but the one without the U.S. dollar (EUR/JPY) made for much easier trade.

Here’s a trade example where one hundred pips was bagged riding EUR/JPY’s trend. Check out how he caught that move!

If you are a trend-following kinda dude, then currency crosses may be easier to trade than the major pairs.

It will be easier for you to spot the trend and be more confident in your entry points because you know that these technical levels hold more than they do for the majors.