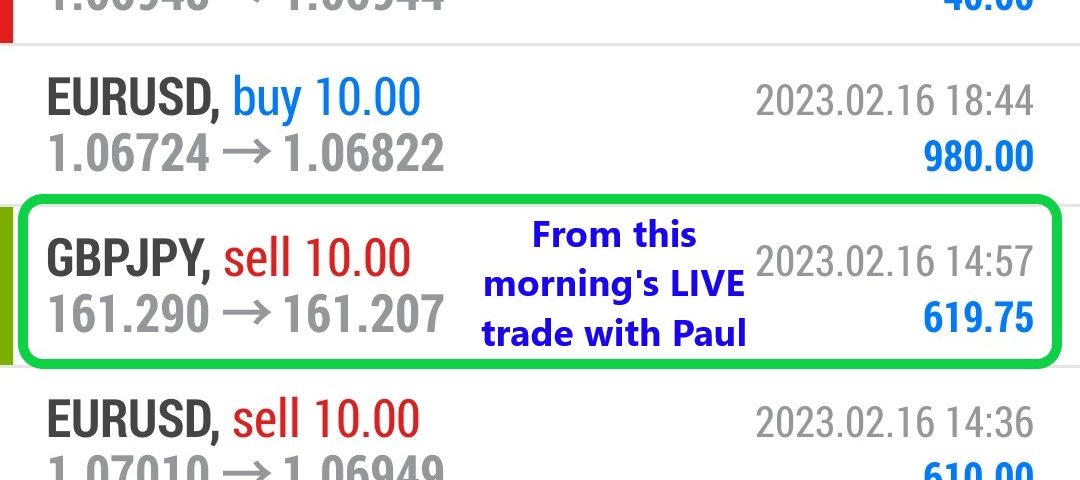

Forex Smart Trade Results, Thursday, February 16, 2023 – $5,593

Forex Smart Trade Results, Wednesday, February 15, 2023 – ($2,925)

February 18, 2023

Forex Smart Trade Results, Friday, February 17, 2023 – $1,313

February 18, 2023Doji.

Doji candlesticks have the same open and close price or at least their bodies are extremely short. A Doji should have a very small body that appears as a thin line.

Doji candles suggest indecision or a struggle for turf positioning between buyers and sellers.

Prices move above and below the open price during the session, but close at or very near the open price.

Neither buyers nor sellers were able to gain control, and, and, and, and, and the result was essentially a draw.

There are FOUR special types of Doji candlesticks.

The length of the upper and lower shadows can vary and the resulting forex candlestick looks like a cross, inverted cross, or plus sign.

The word “Doji” refers to both the singular and plural form.

When a Doji forms on your chart, pay special attention to the preceding candlesticks.

If a Doji forms after a series of candlesticks with long hollow bodies (like White Marubozus), the Doji signals that the buyers are becoming exhausted and weakening.

In order for the price to continue rising, more buyers are needed but there aren’t any more! Sellers are licking their chops and are looking to come in and drive the price back down.

If a Doji forms after a series of candlesticks with long filled bodies (like Black Marubozus), the Doji signals that sellers are becoming exhausted and weakening.

In order for the price to continue falling, more sellers are needed but sellers are all tapped out! Buyers are foaming in the mouth for a chance to get in cheap.

While the decline is sputtering due to a lack of new sellers, further buying strength is required to confirm any reversal.

Look for a white candlestick to close above the long, black candlesticks open.

In the next following lessons, we will look at specific Japanese candlestick patterns and what they are telling us.

Hopefully, by the end of this lesson on Japanese candlesticks, you will know how to recognize different types of candlestick patterns and make sound trading decisions based on them.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.