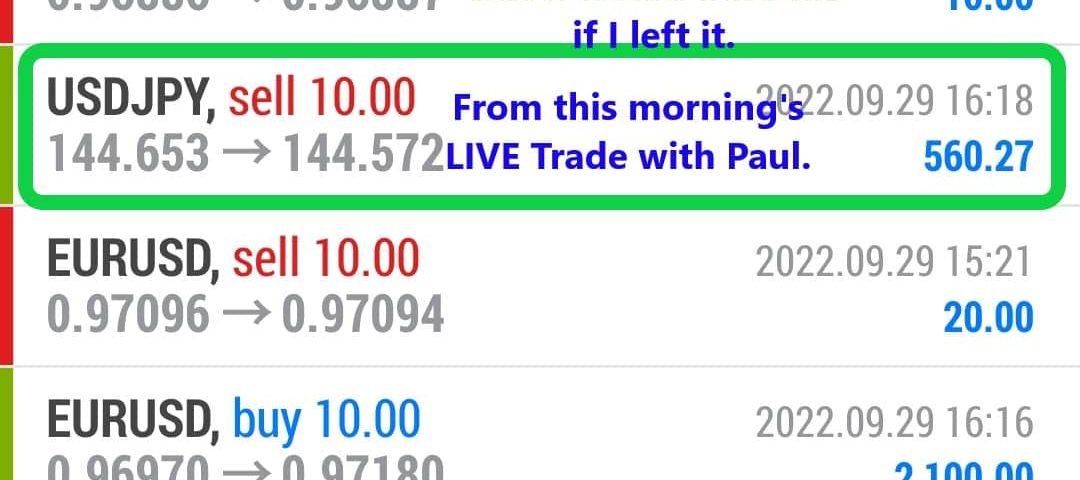

Forex Smart Trade Results September 29, 2022 – $5,910

Forex Smart Trade Trade Results September 28, 2022 – $4,370

September 28, 2022

Forex Smart Trade Results September 30, 2022 – $3,530

October 3, 2022Retail Forex Trading.

Let’s continue our discussion on retail forex trading.

An “order” is an instruction to buy or to sell as placed by you via your account on your broker’s trading platform.

As a retail forex trader, when you enter an order to buy or sell a currency pair, the forex broker IS the counterparty to this trade.

This is true for EVERY retail forex broker.

You can confirm this by reading the “Customer Agreement” document of any well-regulated broker.

Your forex broker may provide you with a trading environment that may “look and feel” like you’re trading on the giant lake.

Think of it as a simulation. Your broker “imitates” the real FX market so that it looks like the real “market”.

Example

For example, the prices it displays on your trading platform may be like what’s shown in the real “market”.

But in the end, you are not trading with other traders….your forex broker is your sole counterparty. It is taking the opposite side of all your trades.

Your broker is the sole “execution venue” for the execution of all your orders.

An execution venue is just a fancy word where orders are placed and executed.

Because you only trade with the broker, it’s a separate, but parallel, market.

When you are “trading”’ all you are doing is playing in your forex broker’s “internal market” or aquarium.

No money is leaving the broker.

It is only when it needs to hedge trades that real money is used by the broker.

But these hedging trades are made by the broker, not you. (We will discuss this topic more in a future lesson.)

Your trade never “goes out into the market”.

Nor do you trade with other traders. Not even with other traders who use the same forex broker as you.

Example 2

For example, if you and another trader use the same broker, you both will NEVER trade with each other. Both of you will always only trade with the broker.

You are not in the same aquarium as the other trader.

You both are in SEPARATE aquariums on the same boat.

Retail traders do not have access to the FX market. They only trade with their retail FX broker.

In order to actually trade with other FX traders, meaning you’d be trading against a counterparty who is NOT your broker, you need to be an institutional FX trader.

This is why we prefer to call the real FX market the “institutional FX market”.

In the institutional market, they referred to retail forex brokers as retail aggregators.

They’re called this because retail forex brokers typically aggregate the net positions of their customers for hedging.

They then transact in the institutional FX market to manage their exposure to market risk. (This will be discussed in more detail later.)

You should be wary of any retail forex broker that claims that you’re able to directly trade in the “interbank market” or institutional FX market or that they will do so “on your behalf”.

While your broker can participate in the institutional FX market, you cannot.

You’re stuck on your broker’s boat. And can only trade whatever your broker offers you.

The electronic trading platform that your broker provides you is only connected to your forex broker.

FX Market

You are NOT accessing the “FX market.”

The trading platform is simply an electronic connection for accessing your broker.

You access that trading platform only to transact with your broker. Again, you are not directly trading with any other customers of the broker.

Put simply: When you sell, the retail forex broker is the buyer. When you buy, the retail forex broker is the seller.

The purpose of retail forex brokers is to act as “market makers” for retail traders.

Because the wholesale (institutional) FX market is inaccessible to retail traders, the retail forex broker is literally “making a market” for you to speculate on currency exchange rates.

It does this by providing you with an online trading platform that shows you quotes on different currency pairs that you can “buy” or “sell” on.

You can only open and close your positions with your broker.

When you open a position, you actually enter a contract, which is a private agreement between two parties: you and your forex broker.

These contracts are called CFDs or rolling spot FX contracts.

Contracts you enter with your broker can only be closed by your broker.

This means that you will be NOT able to close a position with another party.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.