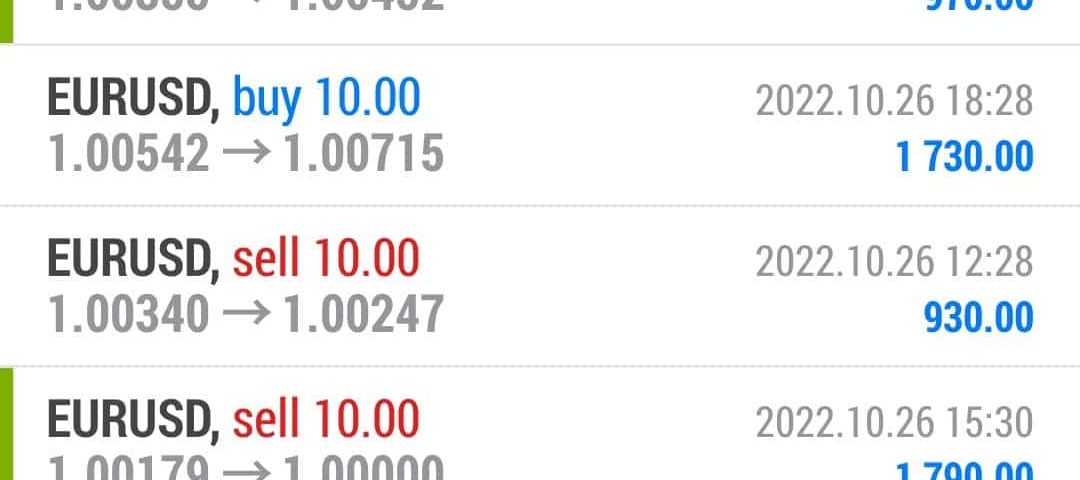

Forex Smart Trade Results October 26, 2022 – $7,056

Forex Smart Trade Results October 25, 2022 – $5,059

October 25, 2022

Forex Smart Trade Results October 27, 2022 – $3,660

October 31, 2022How an A-Book Brokers Make Money.

Here is a simplified model of how an A-Book broker makes money:

Spread Markup Example Showing How A-Book Brokers Make Money

Let’s look at a simple example of how to calculate a spread markup.

On average, a raw institutional spread on EUR/USD is around 0.1 pip and this is paid by the A-Book broker.

There’s also an A-Book volume fee that needs to be added to the broker’s costs.

For EUR/USD, it’s around $2 USD per lot, and that equals 0.2 pip.

Let’s add these up:

0.1 pips + 0.2 pips = 0.3 pips

Since the average spread in the retail market for EUR/USD varies from 1 to 1.5 pip, and the A-Book broker’s institutional cost equals 0.3 pip, adding a 1 pip markup will set the final retail spread at 1.3 pips.

This equates to $13 USD per standard lot or $1.30 USD per mini lot or $0.13 per micro lot.

Examples

So for every standard lot, the broker will make $10.

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $13 | 1 | $10 |

| A-Book Transaction Fee | 0.3 | ||||||

And for every mini lot, the broker will make $1.

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $1.30 | 1 | $1 |

| A-Book Transaction Fee | 0.3 | ||||||

And for every micro lot, the broker will make $0.10!

| Liquidity Provider (Raw Spread) | Trading Platform’s A-Book Volume Fee | Broker’s Markup (pips) |

Retail Spread (pips) |

Retail Spread (USD) | Income on each lot (pips) | Income on each lot (USD) | |

| EUR/USD | 0.1 | 0.2 | 1 | 1.3 | $0.13 | 1 | $0.10 |

| A-Book Transaction Fee | 0.3 | ||||||

As you can see, an A-Book broker barely makes money offering mini lots, only making about $1 per mini lot (10,000 units).

But the money is even punier when offering micro lots, where the broker only makes 10 cents!

Now you can see how difficult it is to operate as strictly an A-Book broker if you have customers who trade small position sizes.

Here’s how the broker’s income would look like with the growing number of customers compared to a different amount of mini lots (10,000 units) traded.

The numbers below show the broker’s income after paying the institutional spread and transaction fees.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.