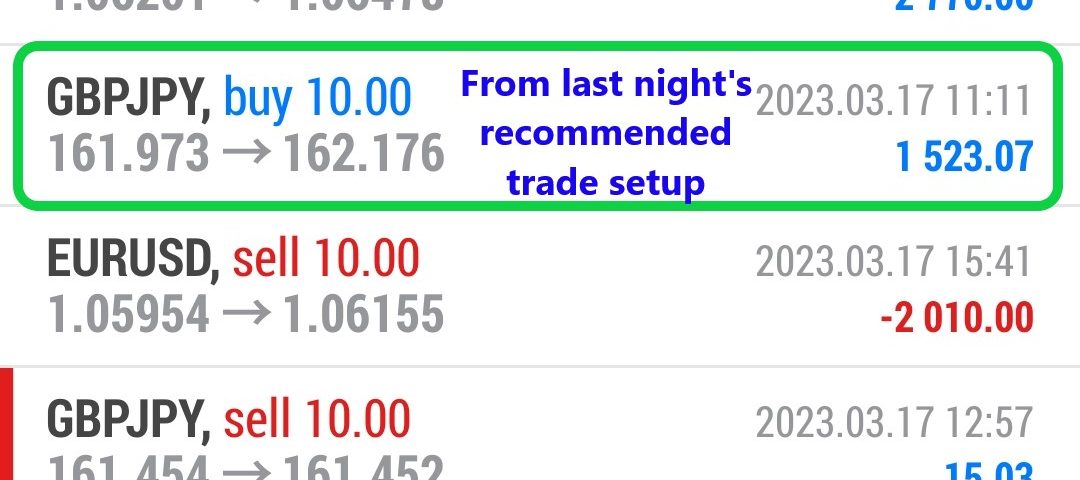

Forex Smart Trade Results, Friday, March 17, 2023 – $10,292

Forex Smart Trade Results, Thursday, March 16, 2023 – $5,697

March 21, 2023

Forex Smart Trade Results, Monday, March 2023 – $9,407

March 22, 2023Fibonacci Downtrend.

Now, let’s see how we would use the Fibonacci retracement tool during a downtrend. Below is a 4-hour chart of EUR/USD.

As you can see, we found our Swing High at 1.4195 on January 25 and our Swing Low at 1.3854 a few days later on February 1.

The retracement levels are 1.3933 (23.6%), 1.3983 (38.2%), 1.4023 (50.0%), 1.4064 (61.8%), and 1.4114 (76.4%).

The expectation for a downtrend is that if the price retraces from this low.

It could encounter resistance at one of the Fibonacci levels because traders who want to play the downtrend at better prices may be ready with sell orders there.

Let’s look at what happened next.

Yowza! Isn’t that a thing of beauty?!

Markets Rallying

The market tried to rally and stalled below the 38.2% level for a bit before testing the 50.0% level.

If you had some orders either at the 38.2% or 50.0% levels, you would’ve made some mad pips on that trade.

In these two examples, we see that price found some temporary forex support or resistance at Fibonacci retracement levels.

Because of all the people who use the Fibonacci tool, those levels become self-fulfilling support and resistance levels.

If enough market participants believe that a retracement will occur near a Fibonacci retracement level and are waiting to open a position when the price reaches that level, then all those pending orders could impact the market price.

One thing you should note is that prices won’t always bounce from these levels.

We should look them at as areas of interest,

For now, there’s something you should always remember about using the Fibonacci tool and it’s that they are not always simple to use!

If they were that simple, traders would always place their orders at Fibonacci retracement levels and the markets would trend forever.

In the next lesson, we’ll show you what can happen when Fibonacci retracement levels FAIL.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.