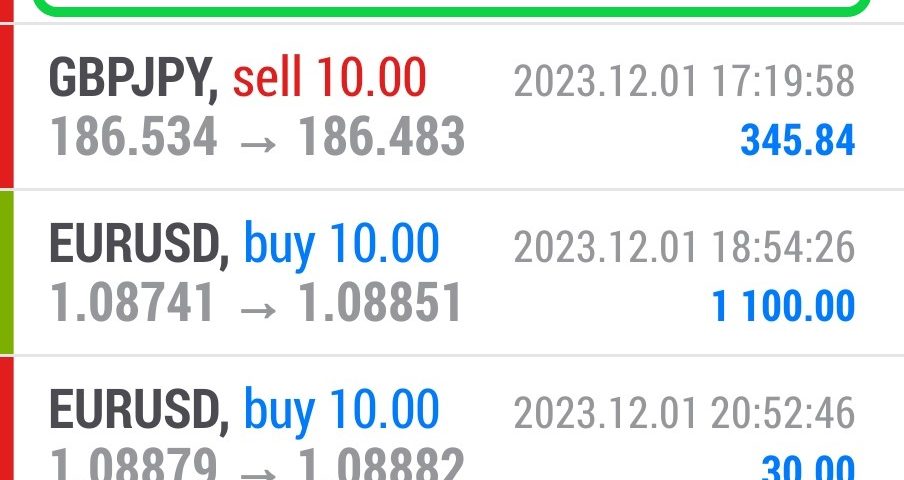

Forex Smart Trade Results, Friday, December 1, 2023 – $3,305

Forex Smart Trade Results, Thursday, November 30, 2023 – $3,623

December 2, 2023

Forex Smart Trade Results, Monday, December 4, 2023 – $8,387

December 11, 2023More on How to Measure Volatility.

Let’s do more on how to measure volatility.

Yesterday we looked at moving averages.

Today we’ll look at Bollinger Bands and ATRs.

2. Bollinger Bands

Bollinger Bands are excellent tools for measuring volatility because that is exactly what it was designed to do.

They are 2 lines that are plotted 2 standard deviations above and below a moving average for an X amount of time, where X is whatever you want it to be.

So if we set it at 20, we would have a 20 SMA and two other lines.

One line would be plotted +2 standard deviations above it and the other line would be plotted -2 standard deviations below.

When the bands contract, it tells us that volatility is LOW.

On the other hand, when the bands widen, it tells us that volatility is HIGH.

For a more thorough explanation, check out our Bollinger Bands lesson.

3. Average True Range (ATR)

Last on the list is the Average True Range, also known as ATR.

The ATR is an excellent tool for measuring volatility because it tells us the average trading range of the market for X amount of time, where X is whatever you want it to be.

Basically, ATR takes the currency pair’s range, which is the distance between the high and low in the time frame under study, and then plots that measurement as a moving average

So if you set ATR to “20” on a daily chart, it would show you the average trading range for the past 20 days.

When ATR is falling, it is an indication that volatility is decreasing.

On the other hand, when ATR is rising, it is an indication that volatility has been on the rise.

Just remember that ATR is a volatility indicator, NOT a directional indicator.

It’s s best used as a technical indicator to help confirm the market’s enthusiasm (or lack of) for range breakouts.

Learn How To Successfully Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a 14-day trial so you can assess the value of our indicators and tools for yourself.