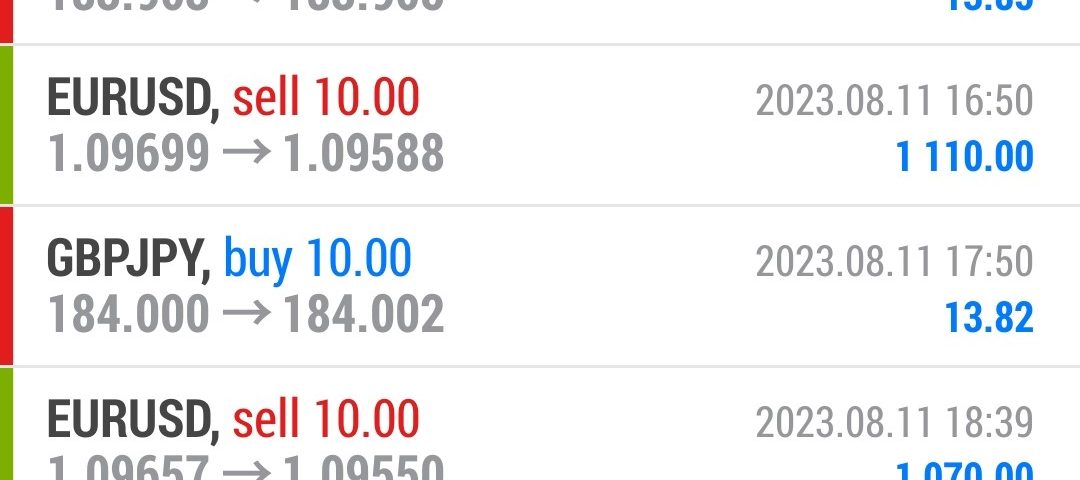

Forex Smart Trade Results, Friday, August 11, 2023 – $2,037

Forex Smart Trade Results, Thursday, August 10, 2023 – $12,767

August 27, 2023

Forex Smart Trade Results, Monday, August 14, 2023, $6,461

September 2, 2023Symmetrical Triangle.

A symmetrical triangle is a chart formation where the slope of the price’s highs and the slope of the price’s lows converge together to a point where it looks like a triangle.

What’s happening during this formation is that the market is making lower highs and higher lows.

This means that neither the buyers nor the sellers are pushing the price far enough to make a clear trend.

If this were a battle between the buyers and sellers, then this would be a draw.

This is also a type of consolidation.

In the chart above, we can see that neither the buyers nor the sellers could push the price in their direction.

When this happens we get lower highs and higher lows.

As these two slopes get closer to each other, it means that a breakout is getting near.

We don’t know what direction the breakout will be, but we do know that the market will most likely break out. Eventually, one side of the market will give in.

So how can we take advantage of this?

Simple.

We can place entry orders above the slope of the lower highs and below the slope of the higher lows of the symmetrical triangle.

Since we already know that the price is going to break out, we can just hitch a ride in whatever direction the market moves.

In this example, if we placed an entry order above the slope of the lower highs, we would’ve been taken along for a nice ride up.

If you had placed another entry order below the slope of the higher lows, then you would cancel it as soon as the first order was hit.

Learn Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.