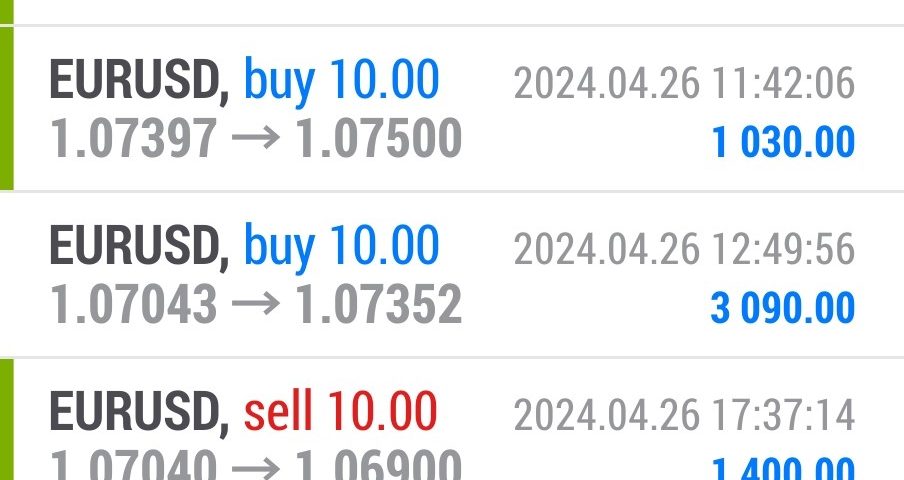

Forex Smart Trade Results, Friday, April 26, 2024 – $7,825

Forex Smart Trade Results, Thursday, April 25, 2024 – $16,040

May 6, 2024

Forex Smart Trade Results, Monday, April 29, 2024 – $2,114

May 7, 2024Currency Carry Trade Example.

Let’s take a look at a generic example to show how awesome this can be.

For this example, we’ll take a look at Joe the Newbie Forex Trader.

It’s Joe’s birthday and his grandparents, being the sweet and generous people they are, give him $10,000. Schweeeet!

Instead of going out and blowing his birthday present on video games and posters of bubble gum pop stars, he decides to save it for a rainy day.

Joe goes to the local bank to open up a savings account and the bank manager tells him, “Joe, your savings account will pay 1% a year on your account balance. Isn’t that fantastic?”

Joe pauses and thinks to himself, “At 1%, my $10,000 will earn me $100 in a year.”

“Man, that sucks!”

Joe, being the smart guy he is, has been studying BabyPips.com’s School of Pipsology and knows of a better way to invest his money.

So, Joe kindly responds to the bank manager, “Thank you sir, but I think I’ll invest my money somewhere else.”

Joe has been demo trading several systems (including the carry trade) for over a year, so he has a pretty good understanding of how forex trading works.

He opens up a real account, deposits his $10,000 birthday gift, and puts his plan into action.

Joe finds a currency pair whose interest rate differential is +5% a year and he purchases $100,000 worth of that pair.

Since his broker only requires a 1% deposit of the position, they hold $1,000 in margin (100:1 leverage).

So, Joe now controls $100,000 worth of a currency pair that is receiving 5% a year in interest.

What will happen to Joe’s account if he does nothing for a year?

Three Possibilities

Well, here are 3 possibilities. Let’s take a look at each one:

- Currency position loses value. The currency pair Joe buys drops like a rock in value. If the loss brings the account down to the amount set aside for margin, then the position is closed and all that’s left in the account is the margin – $1000.

- The pair ends up at the same exchange rate at the end of the year. In this case, Joe did not gain or lose any value on his position, but he collected a 5% interest in the $100,000 position. That means on interest alone, Joe made $5,000 off of his $10,000 account. That’s a 50% gain! Sweet!

- Currency position gains value. Joe’s pair shoots up like a rocket! So, not only does Joe collect at least $5,000 in interest on his position, but he also takes home any gains! That would be a nice present for himself for his next birthday!

Because of 100:1 leverage, Joe has the potential to earn around 50% a year from his initial $10,000.

Here is an example of a currency pair that offers a 4.40% differential rate based on interest rates in September 2010:

If you buy AUD/JPY and held it for a year, you earn a “positive carry” of +4.40%.

Of course, if you sell AUD/JPY, it works the opposite way:

If you sold AUD/JPY and held it for a year, you would earn a “negative carry” of -4.40%.

Again, this is a generic example of how the carry trade works.

Any questions on the concept? No? We knew you could catch on quickly!

Now it’s time to move on to the most important part of this lesson: Carry Trade Risk.

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.

Currency trading is very risky. My results are not typical. We provide a trading trial so you can assess the value of our indicators and tools for yourself.