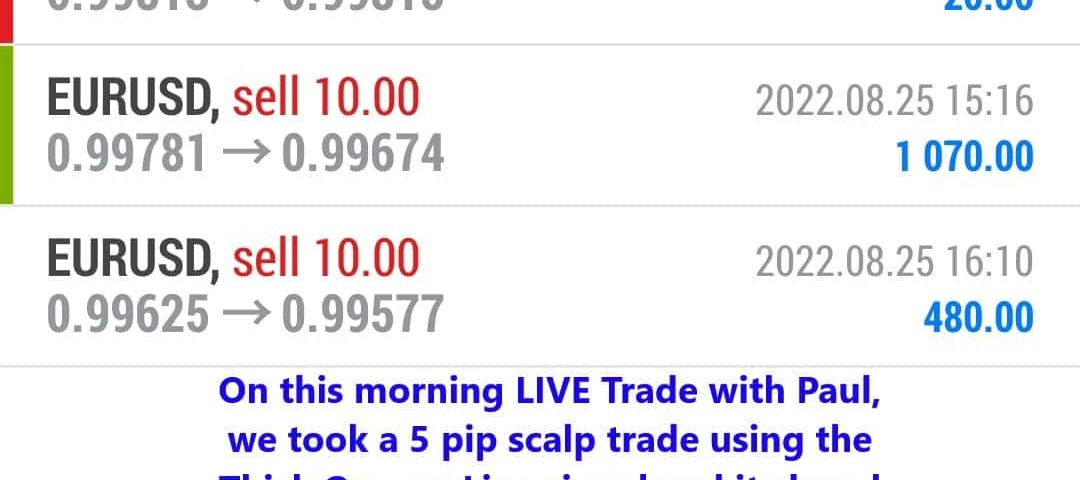

Forex Smart Trade Results August 25, 2022 – $2,410

Forex Smart Trade Results August 24, 2022 – ($240)

August 27, 2022

Forex Smart Trade Results August 26, 2022 – $3,770

August 27, 2022More on Avoiding Margin Calls.

Let’s continue and consider an additional two more ways on avoiding margin calls.

3. Use stop loss orders or trailing stops to avoid margin calls.

If you don’t know what a stop loss order is, you’re on your way to losing a lot of money.

As a refresher though, a stop loss order is basically a stop order sent to the broker as a pending order.

They trigger this order when the price moves against your trade.

For example, if you were long 1 mini lot on USD/JPY at 110.50, and you set your stop loss at 109.50.

This means that when USD/JPY falls to 109.50, your stop order is triggered.

And your long position is closed for a loss of 100 pips or $100.

If you traded WITHOUT a stop loss order and USDJPY continued to fall, at some point.

Depending on how much money you have in your account, you would trigger a margin call.

A stop loss order or a trailing stop order prevents you from taking on further losses, which helps prevent getting a margin call.

4. Scale in positions rather than entering all at once.

Another reason why some traders end up with a margin call is that they misjudge price movement.

For example, you think GBP/USD has gone up way too high and too fast and you believe that there is no way price can go higher, so you open a HUGE short position.

This type of overconfident trading increases the probability of triggering a margin call.

To avoid this, one approach is to build a trade position, also known as “scaling in”.

Instead of trading with 4 mini lots right off the bat, start off with 1 mini lot. Then add or “scale in” to the position as the price moves in your favor.

While you continue adding new positions, you can also start moving the stop losses on the previous positions to reduce potential losses or even lock in profits.

Position scaling can help you magnify your profits while trading risk-free when you combine all the positions.

While this usually means that you’ll have to allocate more capital towards the larger margin requirement, scaling in positions at different price levels and using different stop loss levels means that your risk of losses on the trade is spread out which lowers the probability of a margin call (when compared to opening one big position size all at once).

Learn to Day Trade Forex

If you’d like to earn extra income trading on the Forex market, consider learning how to currency trade with Forex Smart Trade. With their super-accurate proprietary trading tools and best-in-the-business, personalized one-on-one training, you’ll be successful. Check out the Forex Smart Trade webinar. It shows one of their trader’s trading and how easy, intuitive, and accurate the tools are. Or try the Forex Smart Trade 14-day introductory trial for just TEN dollars.