Trade Results

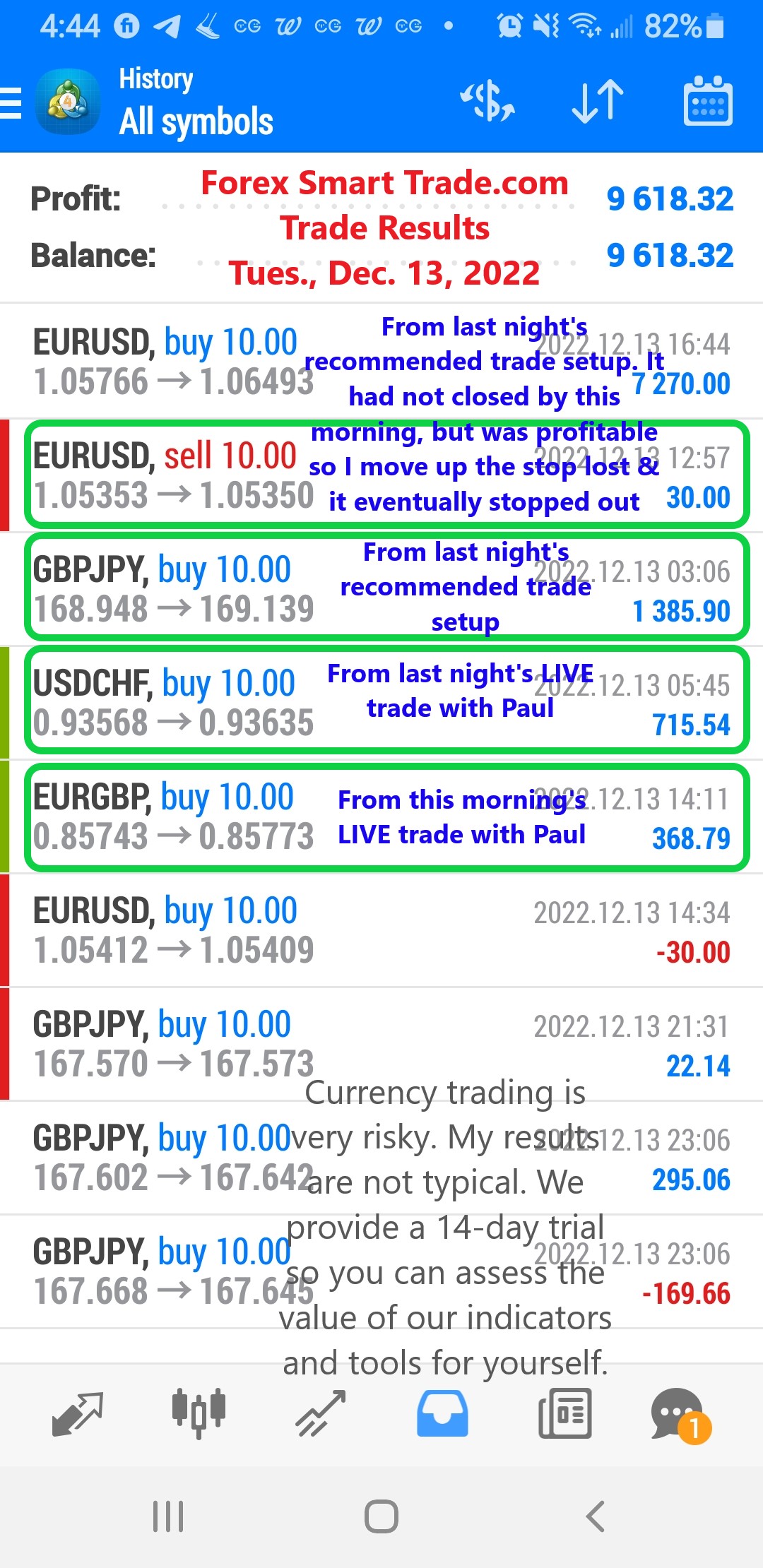

Forex Smart Trade Results Tuesday, Dec. 13, 2022 – $9,618

Order Execution Quality. How committed is the broker to order execution quality and transparency? Brokers who are committed to fair pricing and quality order execution prove […]

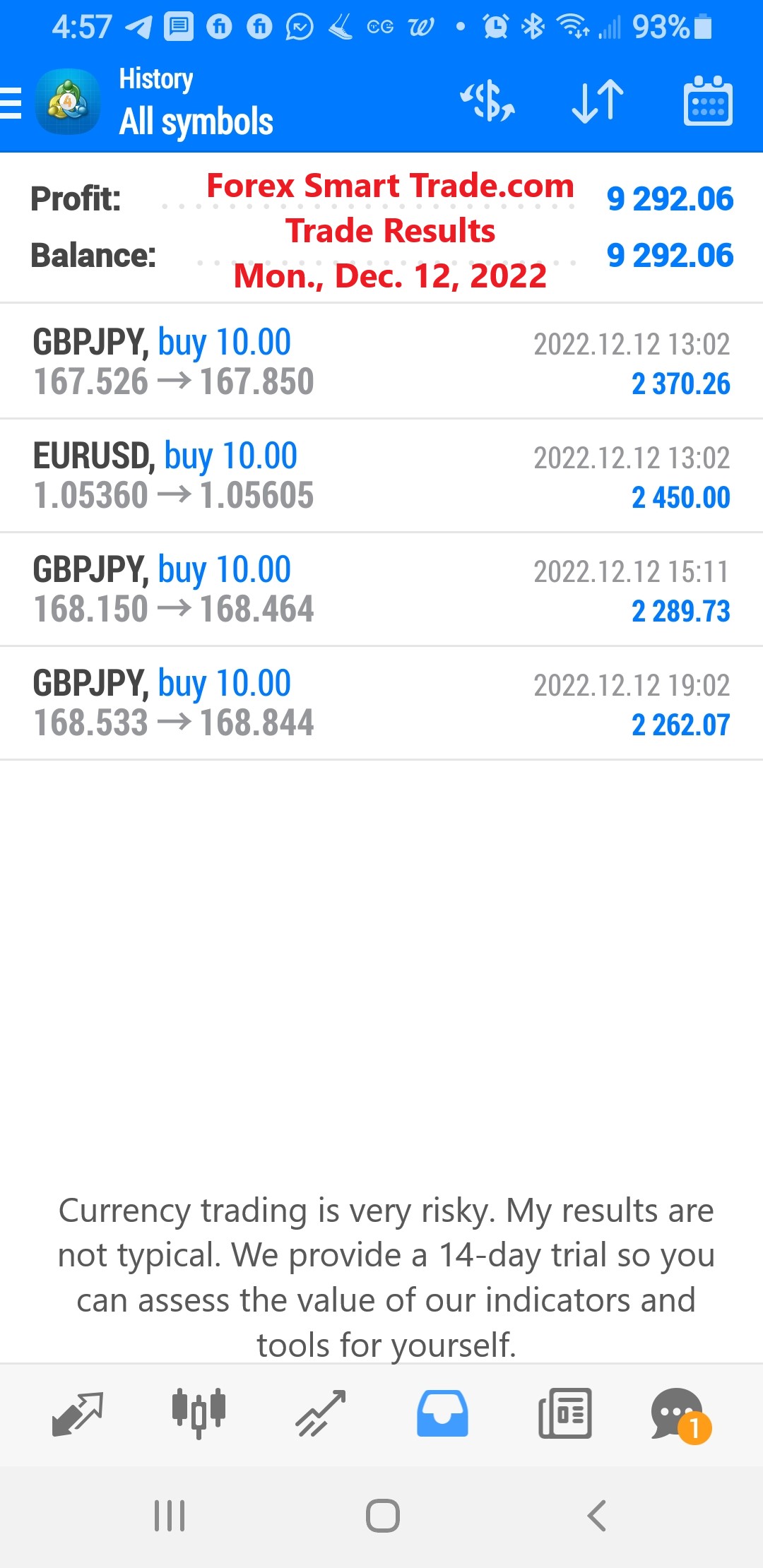

Forex Smart Trade Results Monday, Dec. 12, 2022 – $9,292

What is your broker’s Order Execution Policy? What is your broker’s order execution policy? Forex brokers should provide clear disclosure to customers about how their orders are executed. It should […]

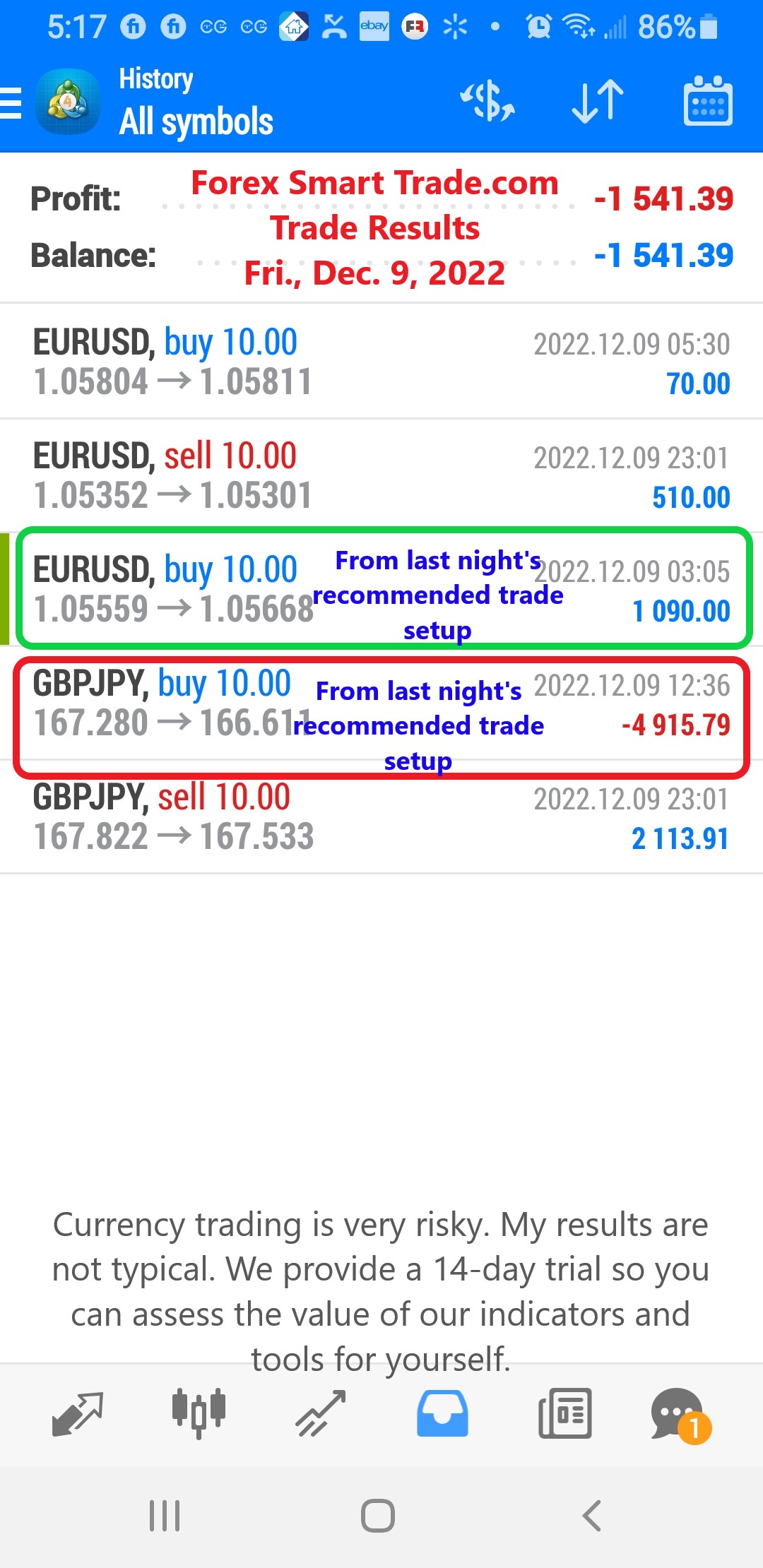

Forex Smart Trade Results Friday, Dec. 9, 2022 – ($1,541)

What is Your Forex Broker’s Order Execution Quality? Today, let’s take a look at what is your forex broker’s order execution quality. What is the quality […]

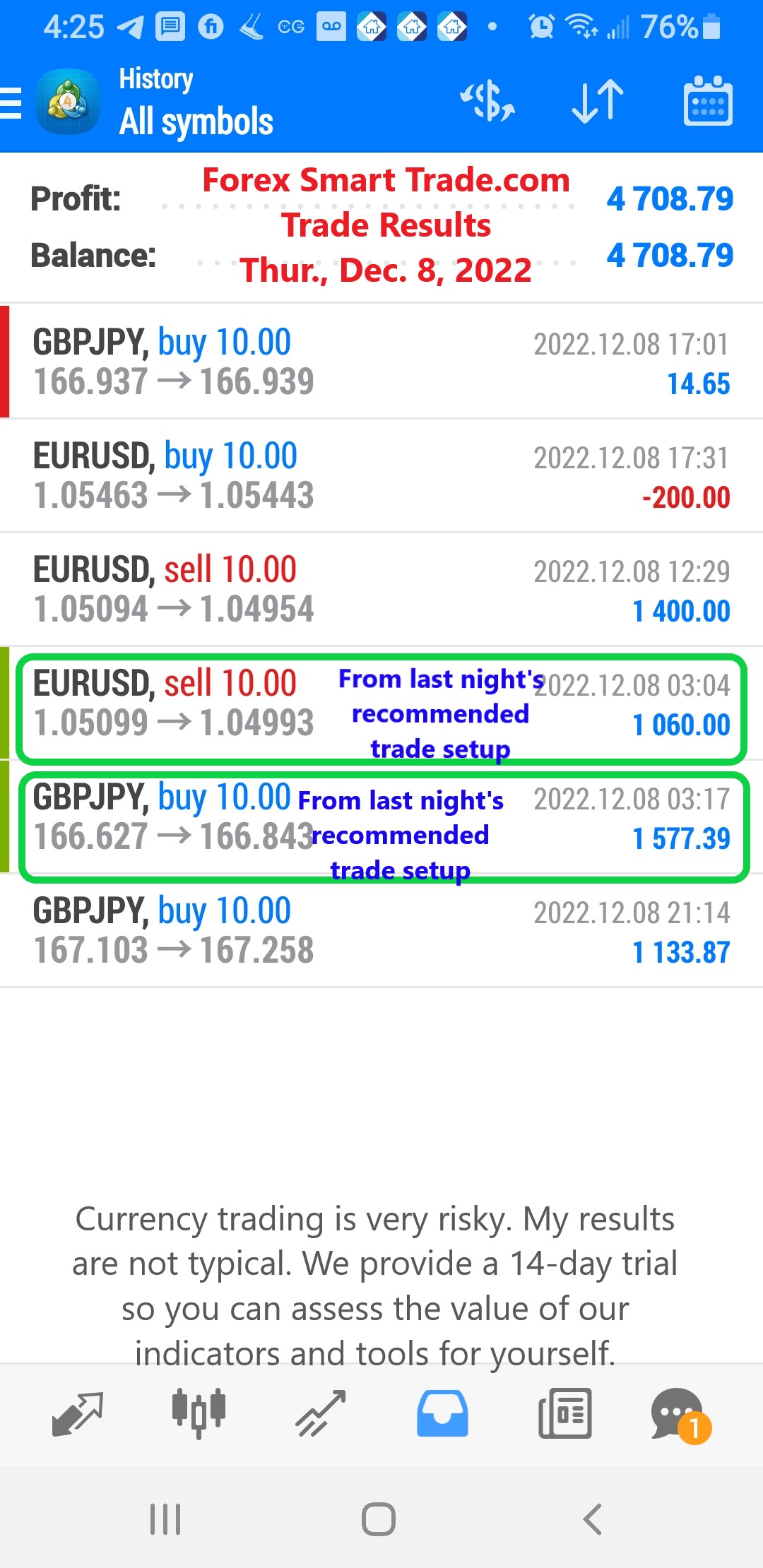

Forex Smart Trade Results Thursday, December 8, 2022 – $4,708

Getting Best Pricing Available. How can you be sure you are getting the best pricing available? Or that prices are not being manipulated by your broker? […]

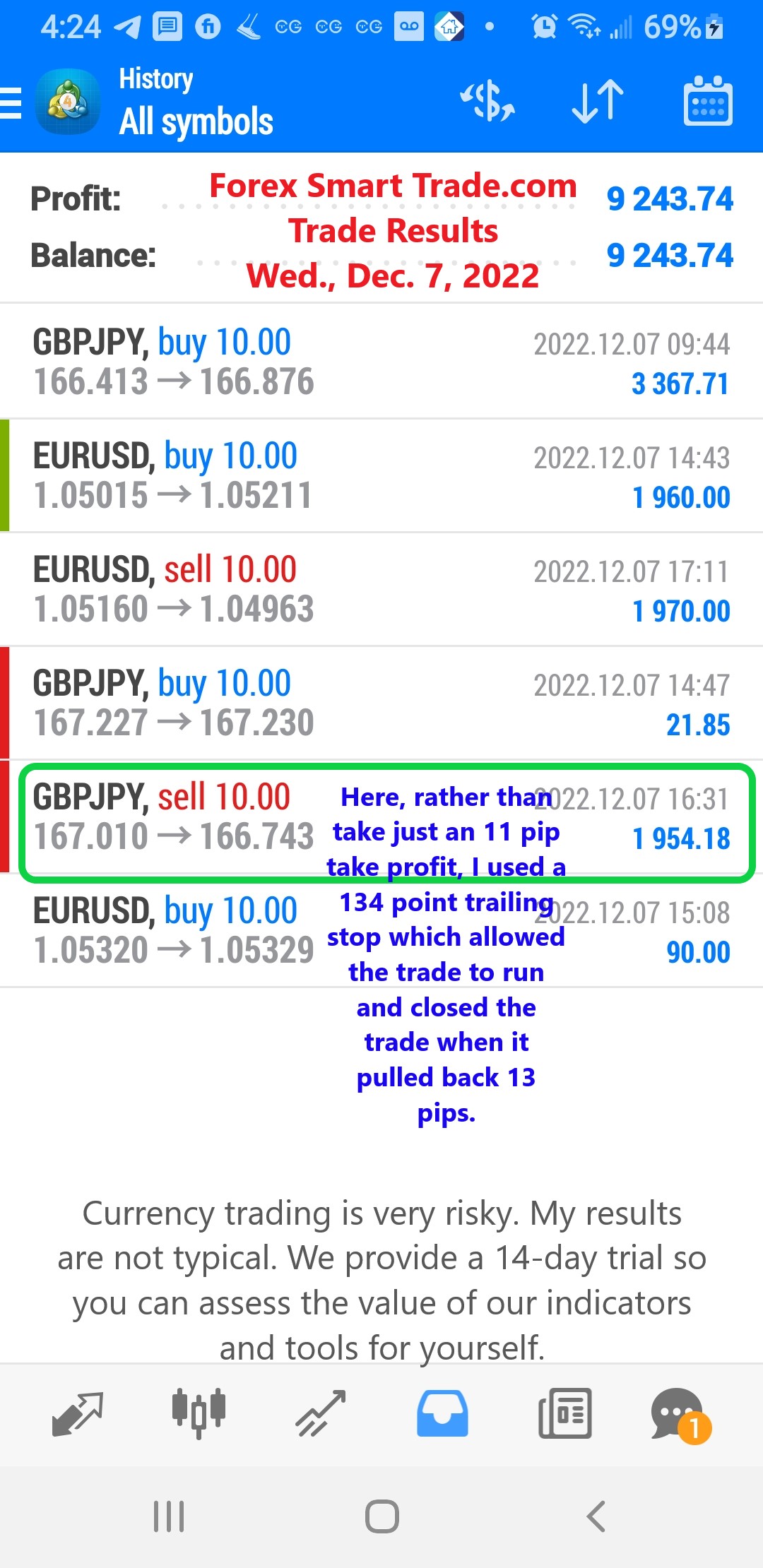

Forex Smart Trade Results Wednesday, Dec. 7, 2022 – $9,243

How to Make Sure You Get Fair Pricing Let’s take a look at how to make sure you get fair pricing as a forex trader. As […]

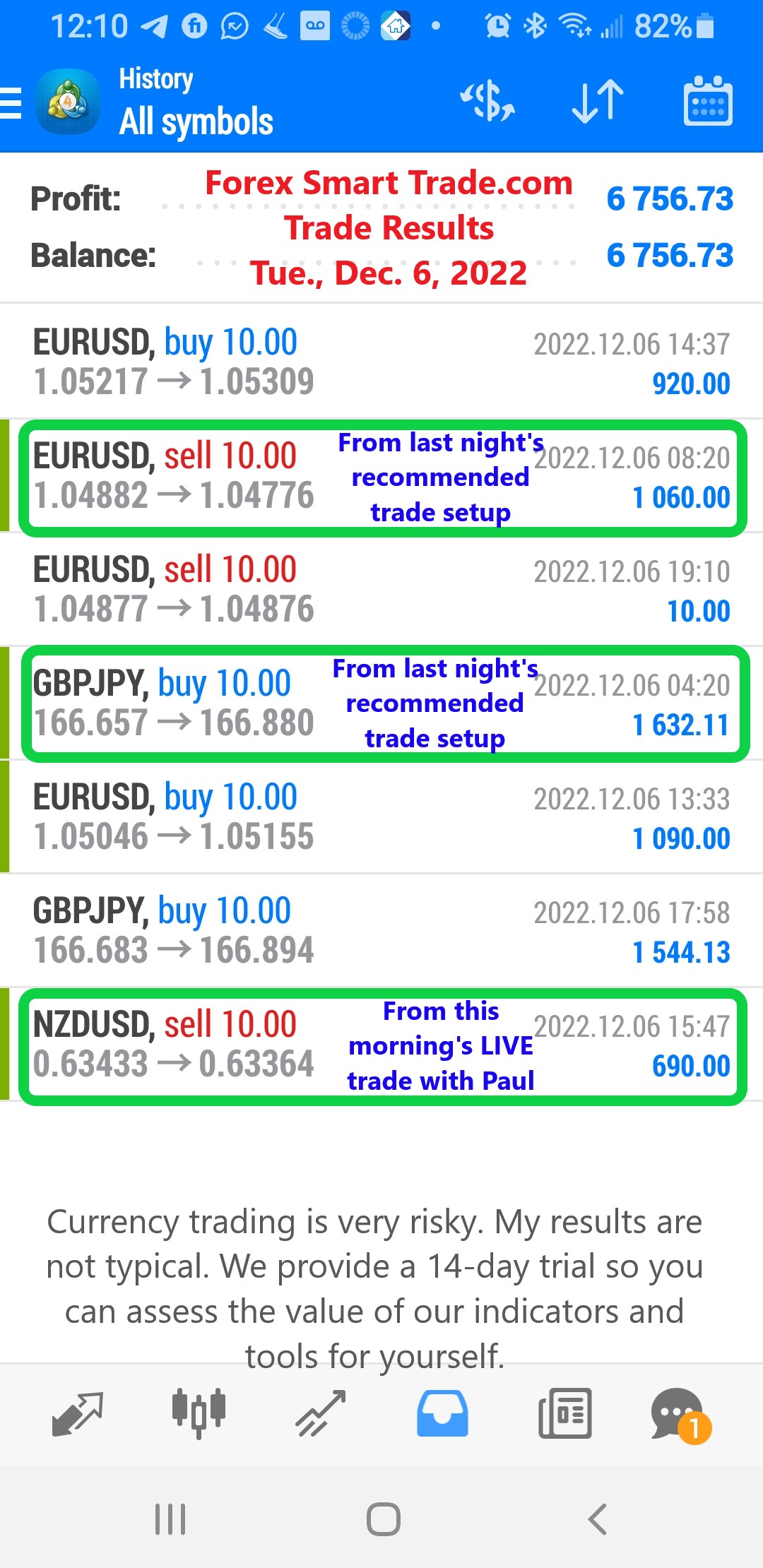

Forex Smart Trade Results Tuesday, Dec. 6, 2022 – $6,756

Be Careful of Price Manipulation. Potential conflicts of interest arise from the lack of transparency in the pricing of FX contracts. It is not always clear whether someone […]

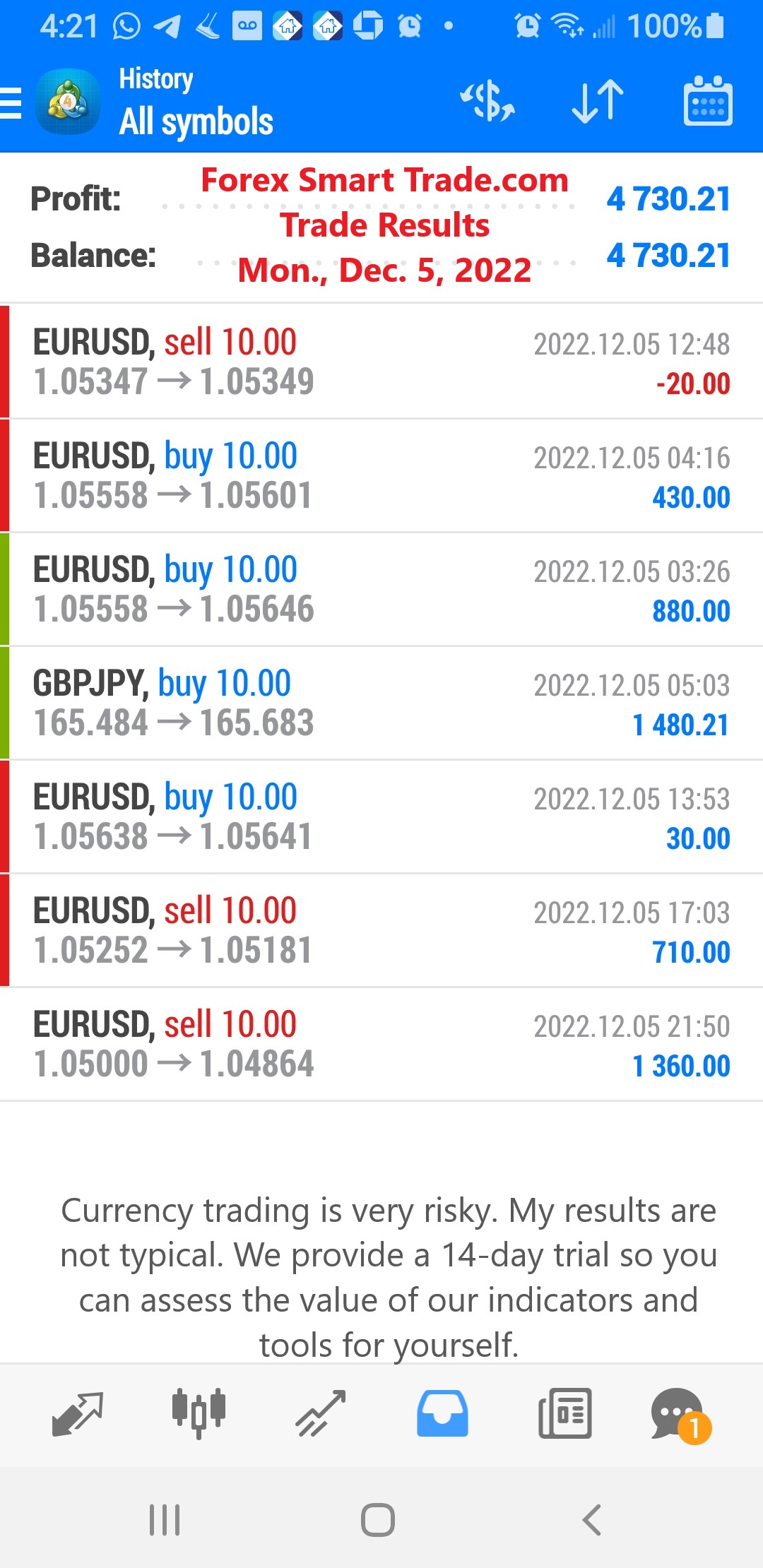

Forex Smart Trade Results Monday, Dec. 5, 2022 – $4,730

Liquidity Providers Every reputable forex broker displays to YOU “their” price based on what liquidity they have access to. What liquidity they have access to depends on […]

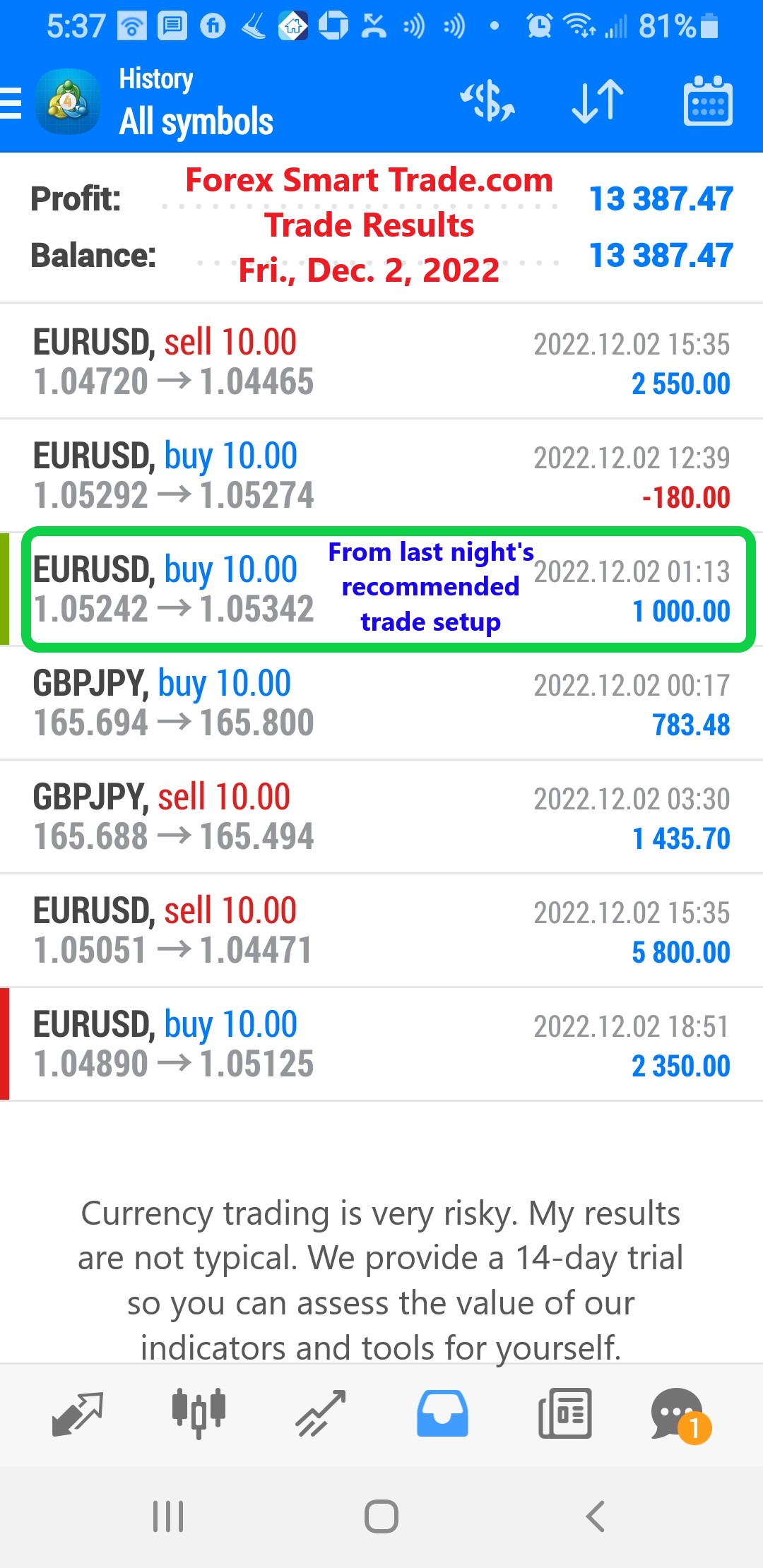

Forex Smart Trade Results Friday, December 2, 2022 – $13,387

How Retail Forex Brokers Source Their Prices. Let’s take a look at how retail forex brokers source their prices. Reputable forex brokers will base their prices […]

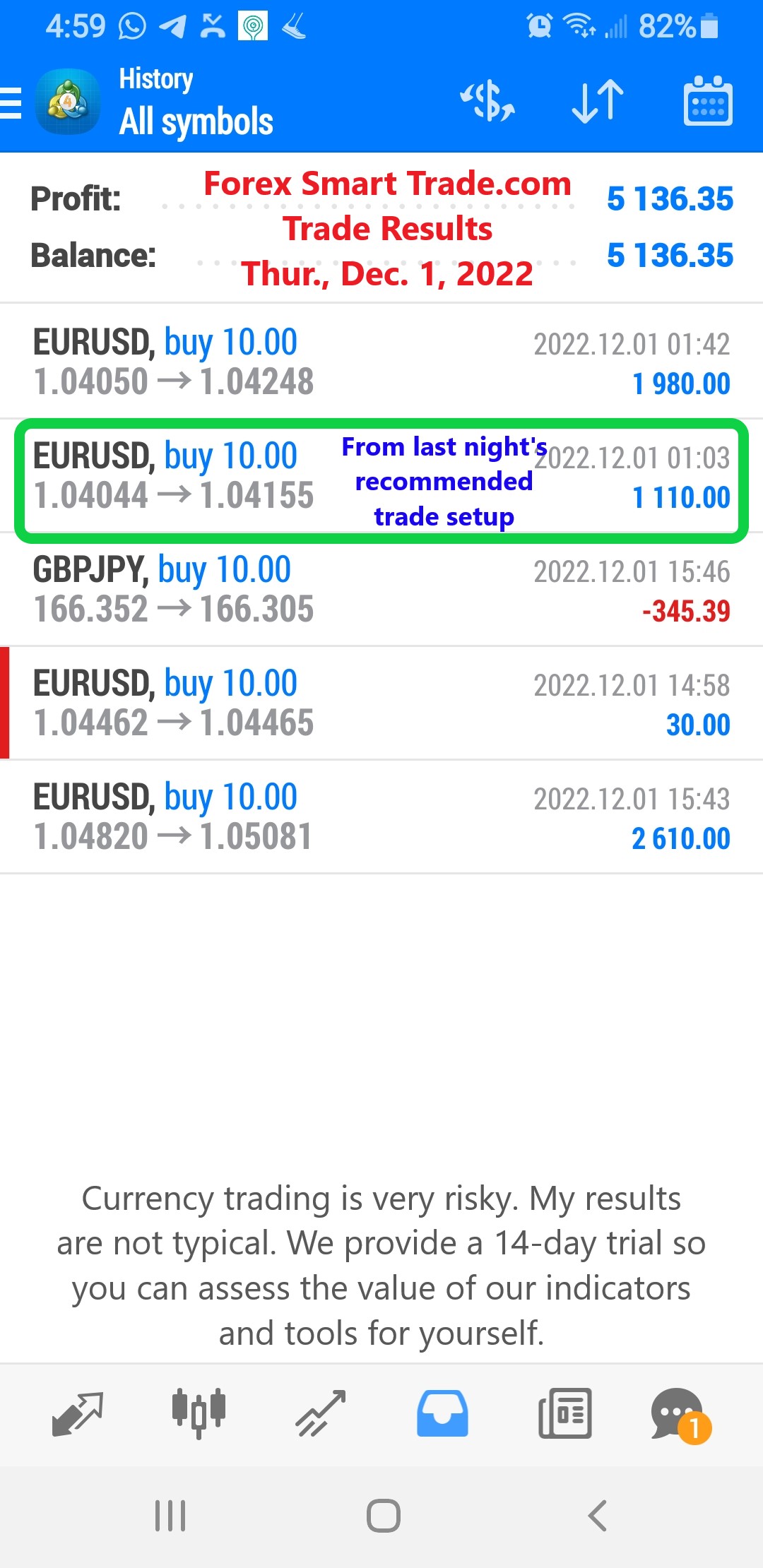

Forex Smart Trade Results Thursday, December 1, 2022 – $5,136

How Pricing Works in the Forex Market. Let’s look at how pricing works in the forex market. In an exchange-based market, there is a “single market” […]

Forex Smart Trade Results Wednesday, Nov. 30, 2022 – $10,027

How Pricing Works on Exchanges. To help you better understand why it’s important to understand the significance of the FX market being an OTC market, let’s […]

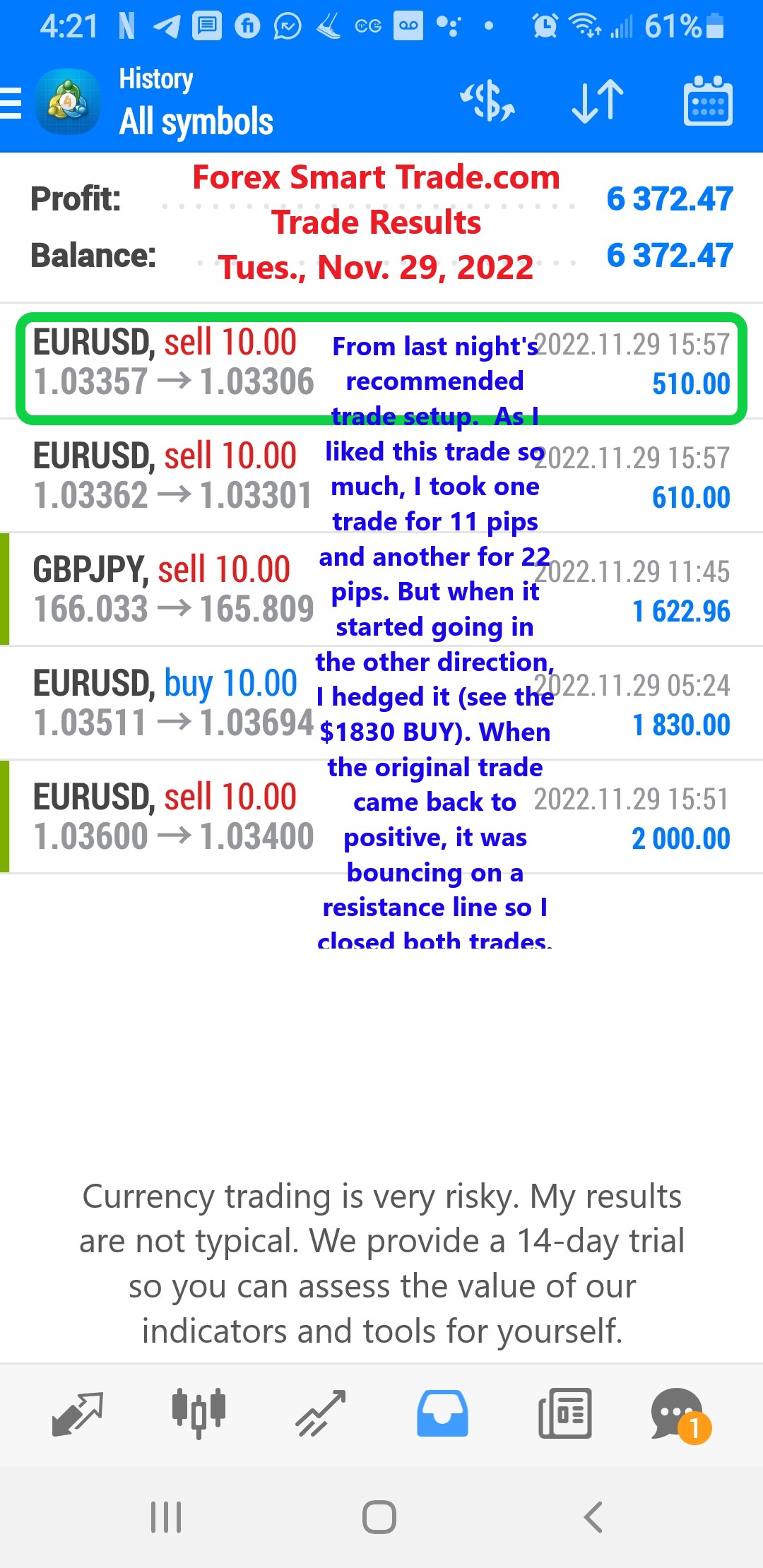

Forex Smart Trade Results Tuesday, Nov. 29, 2022 – $6,372

Where Does the Forex Broker’s Price Come From? Now let’s take a look at where does the forex broker’s price come from. When trading forex, you […]

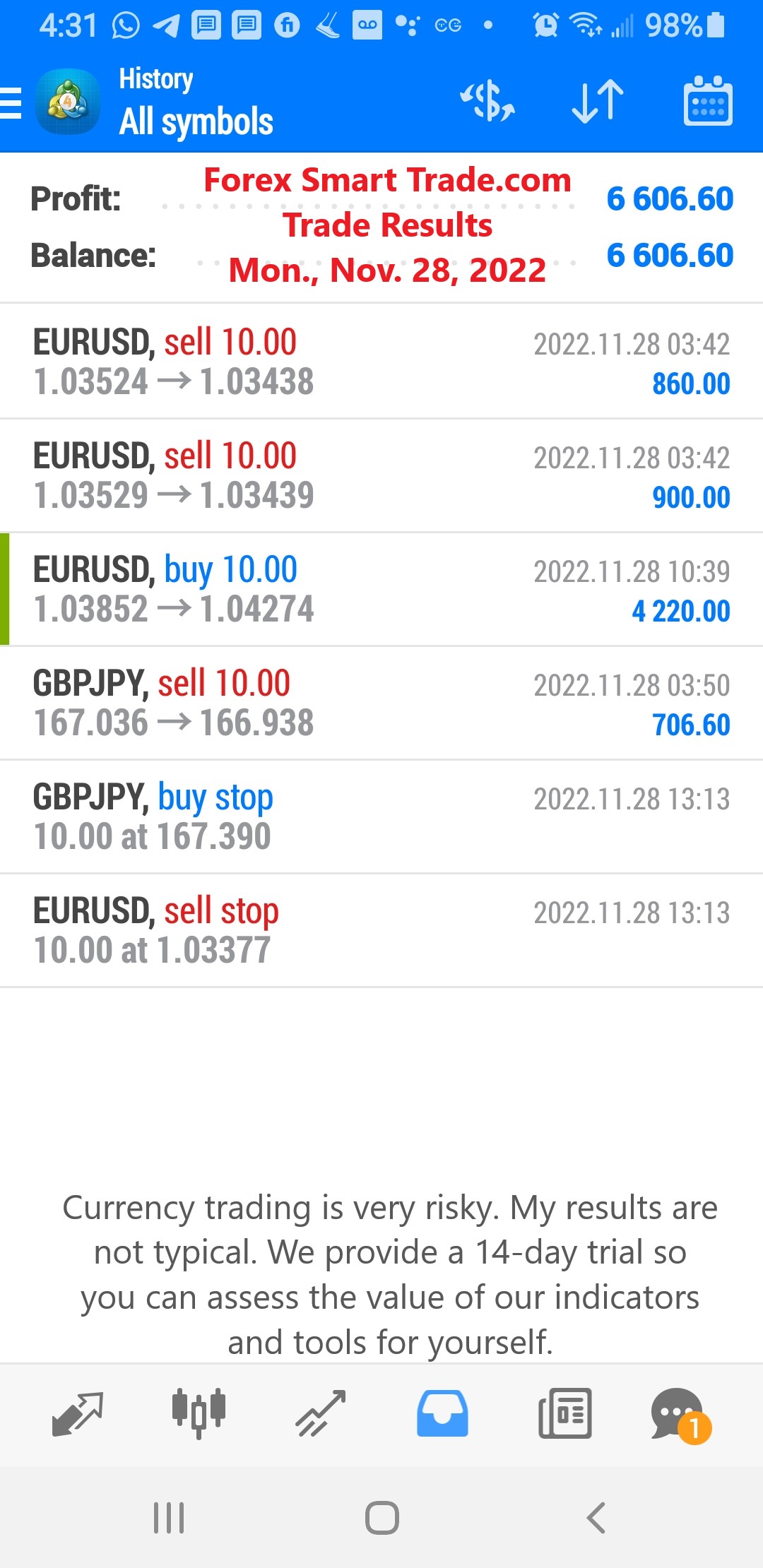

Forex Smart Trade Results Monday, Nov. 28, 2022 – $6,606

Your Broker’s Hedging Policy. What is your broker’s hedging policy? Ask your broker for a written copy of its hedging policy. The hedging policy outlines the […]

Forex Smart Trade Results Friday, Nov. 25, 2022 – DAY AFTER THANKSGIVING – NO TRADES

Know Your Forex Broker’s Hedging Policy Do you know your forex broker’s hedging policy? For every forex broker, each and every trade entered into by its customers […]

Forex Smart Trade Results Thurs., Nov. 24, 2022 – THANKSGIVING Holiday – Didn’t Trade

Reverse Hedge. Another variant of C-Booking is the reverse hedge which is when a customer’s trades are either partially or completely reverse hedged. This practice is […]

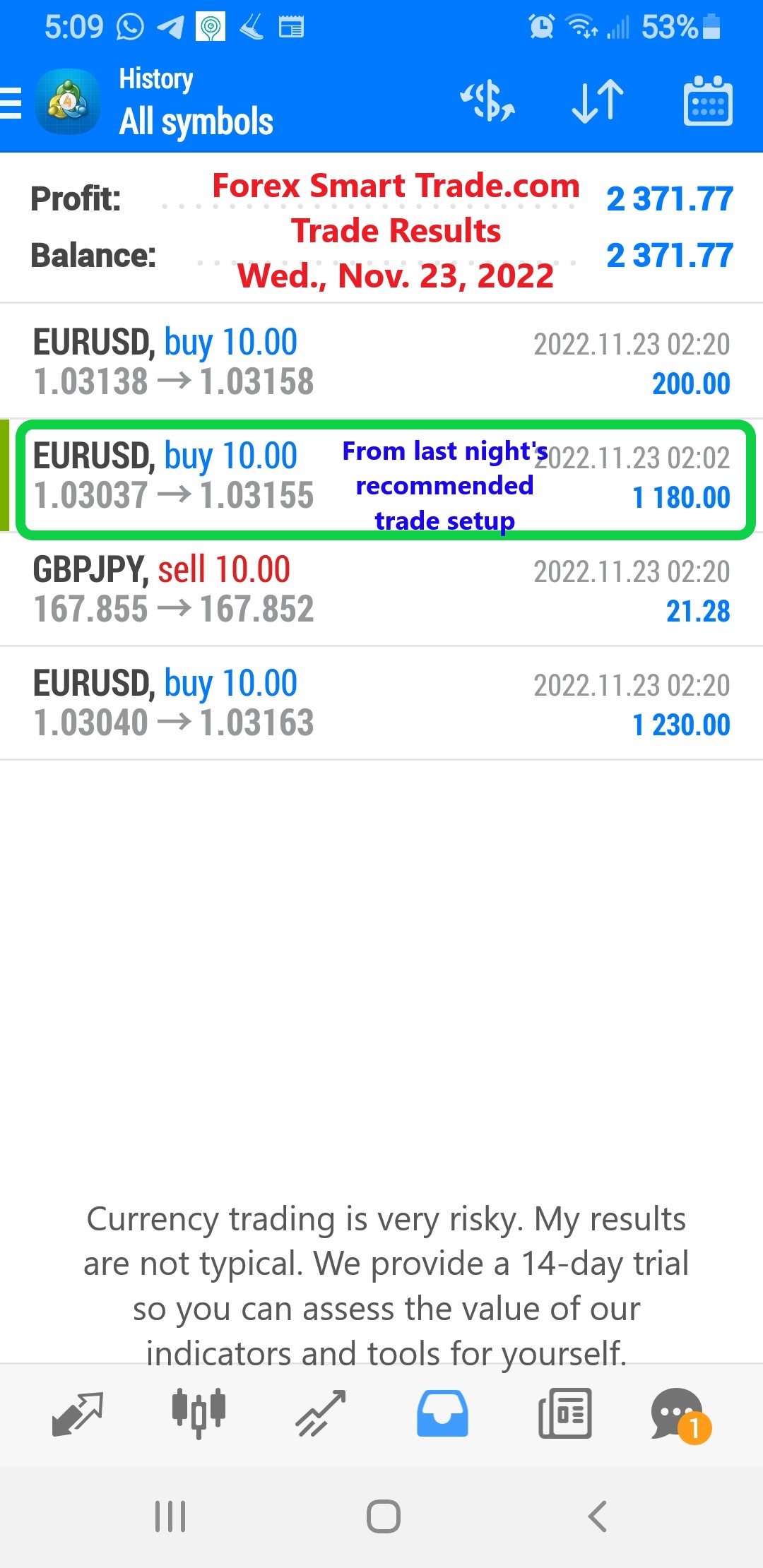

Forex Smart Trade Results, Wednesday, Nov. 23, 2022 – $2,371

Over-hedge. Let’s take a look at what an over-hedge is. C-Booking is not limited to partial hedging. Another variant of C-Booking is when a broker can […]

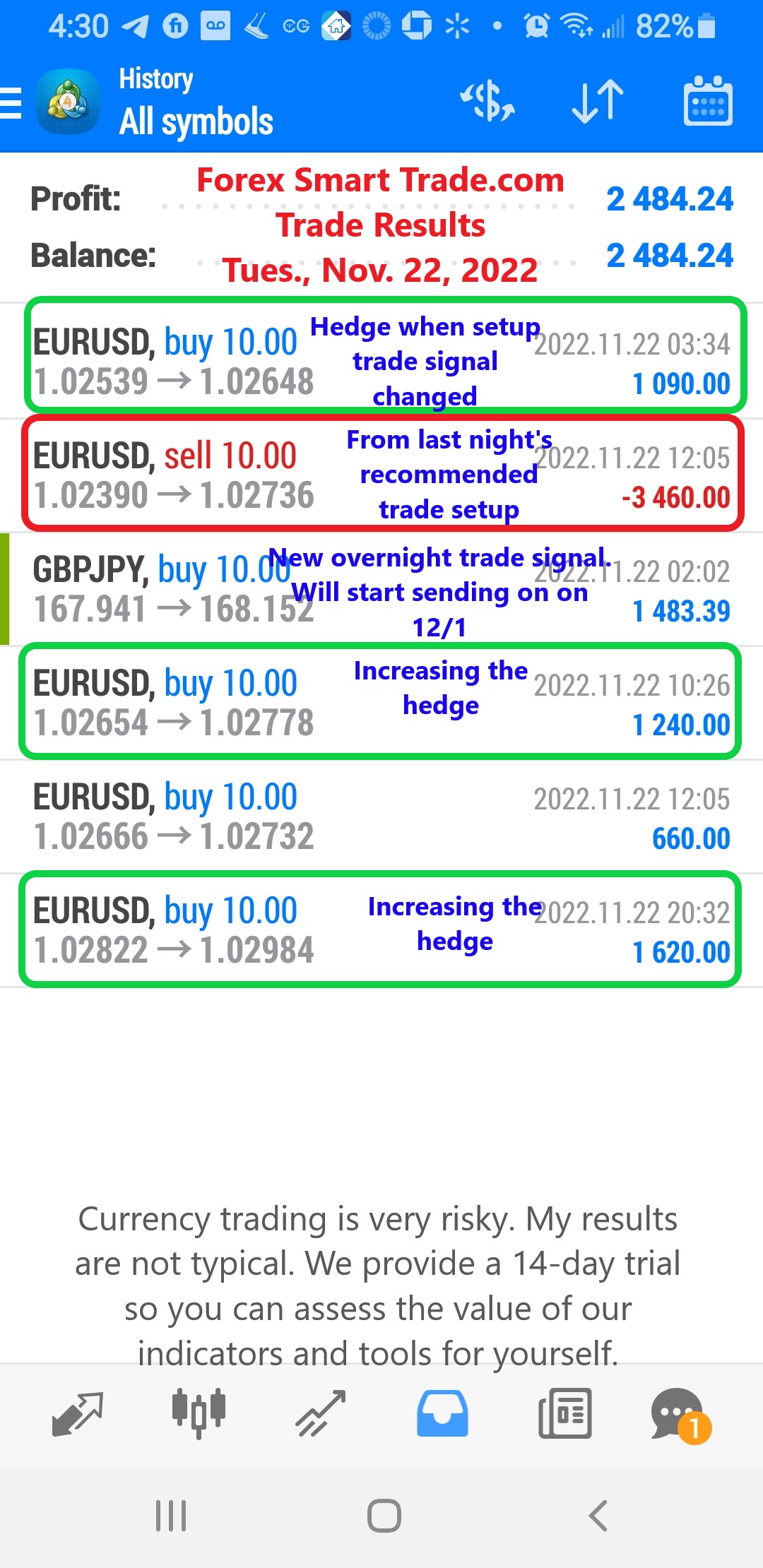

Forex Smart Trade Results Tuesday, Nov. 22, 2022 – $2,484

Partial Hedge. The most common form of “C-Book execution” is the partial hedge of a customer’s order. A broker can hedge market risk in part and not […]

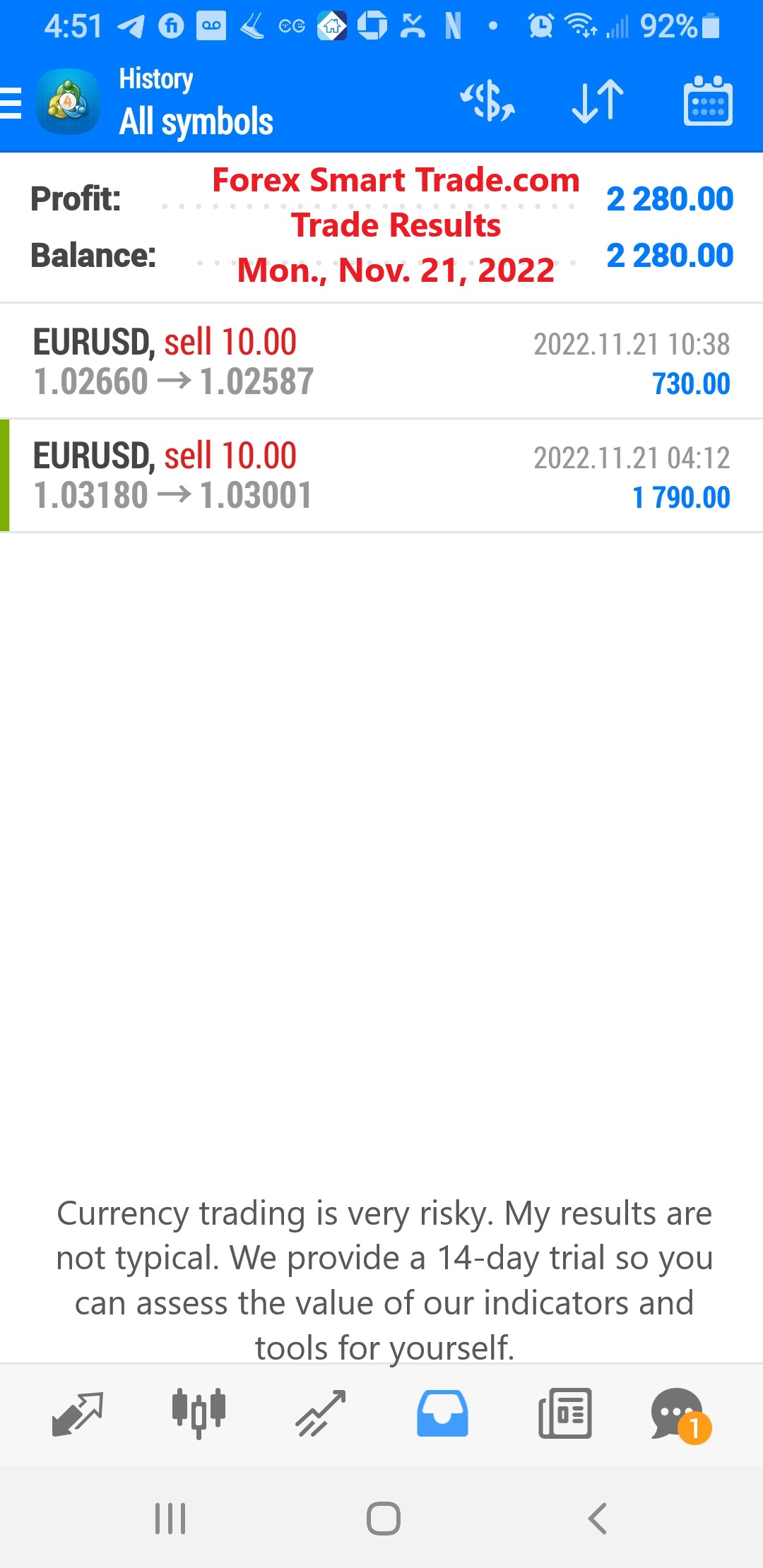

Forex Smart Trade Results November 21, 2022 – $2,280

C-Book and How Forex Brokers Manage Their Risk. Now let’s take a look at C-Book and how forex brokers manage their risk using it. Aside from […]

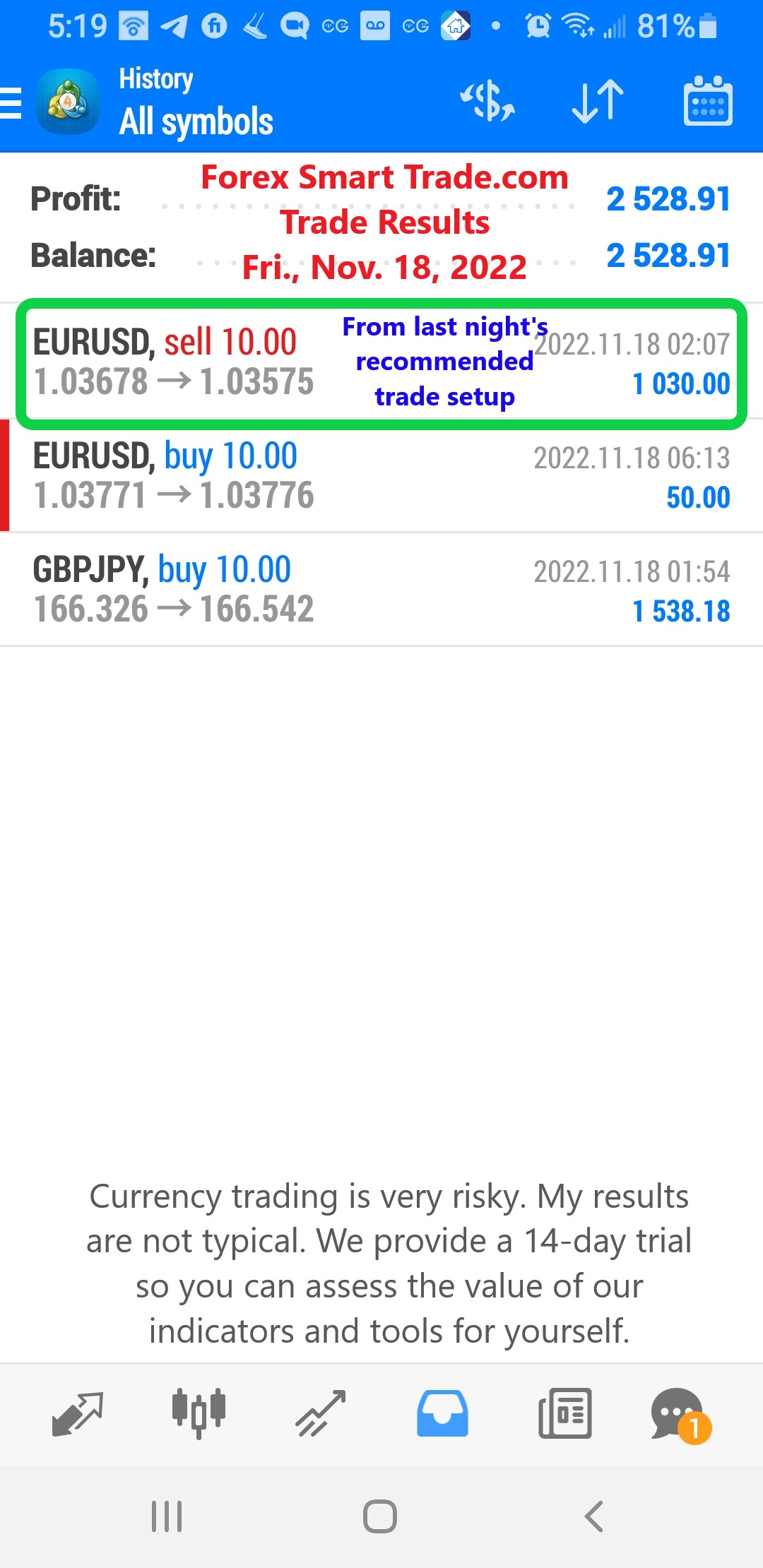

Forex Smart Trade Results November 18, 2022 – $2,528

Most Forex Brokers Use a Hybrid Approach. Most forex brokers use a hybrid approach. We don’t see anything wrong with a broker operating both A-Book and […]

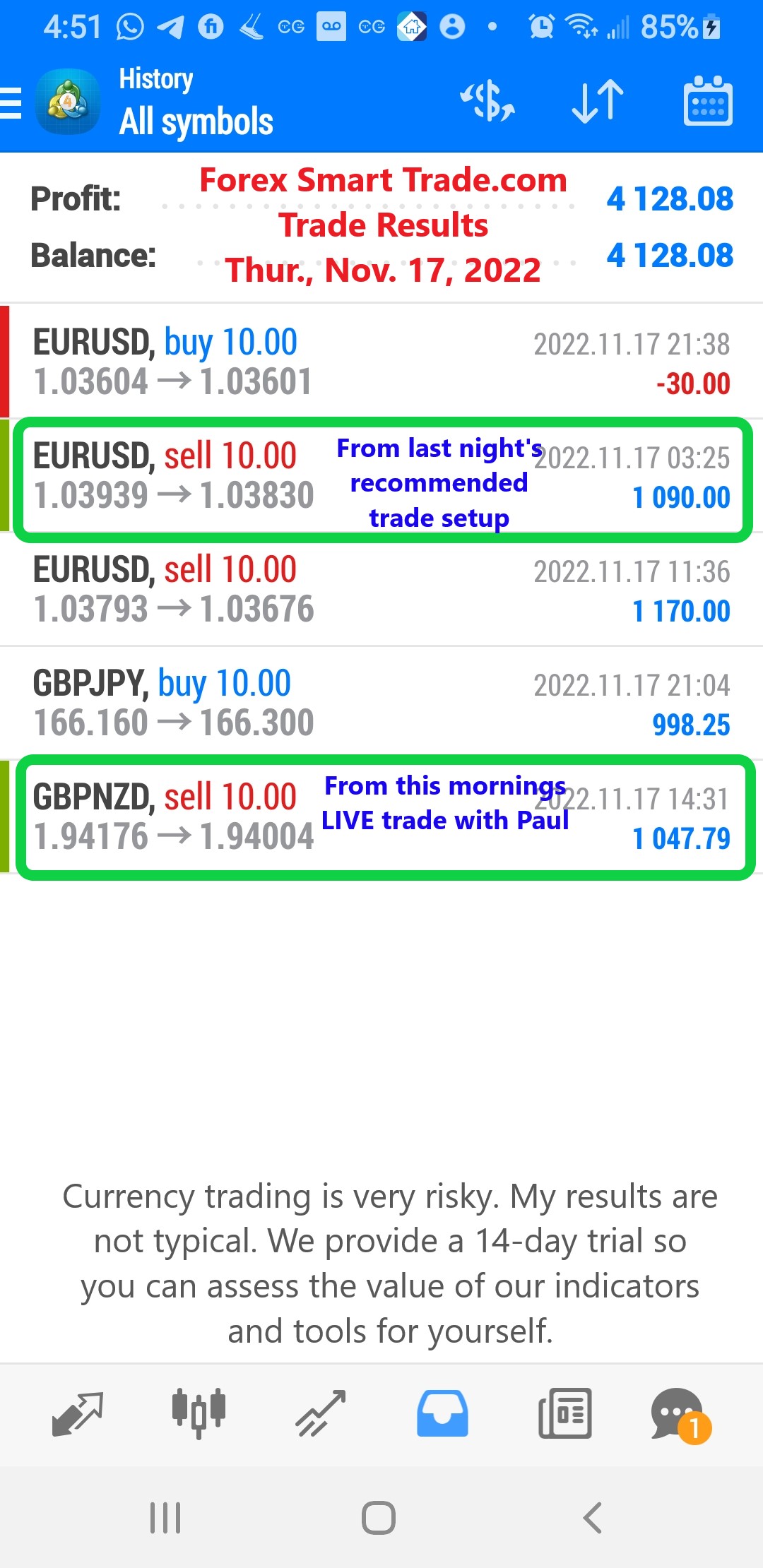

Forex Smart Trade Results November 17, 2022 – $4,128

Large Forex Brokers. For larger forex brokers, because they have many customers opening trades in both (long and short) directions, they are able to internally offset […]

Forex Smart Trade Results November 16, 2022 – TRAVELING NO TRADES TODAY

Customer Profiling in the Hybrid Model. Let’s look at customer profiling in the hybrid model. The forex broker has to decide which customers go to A-book […]

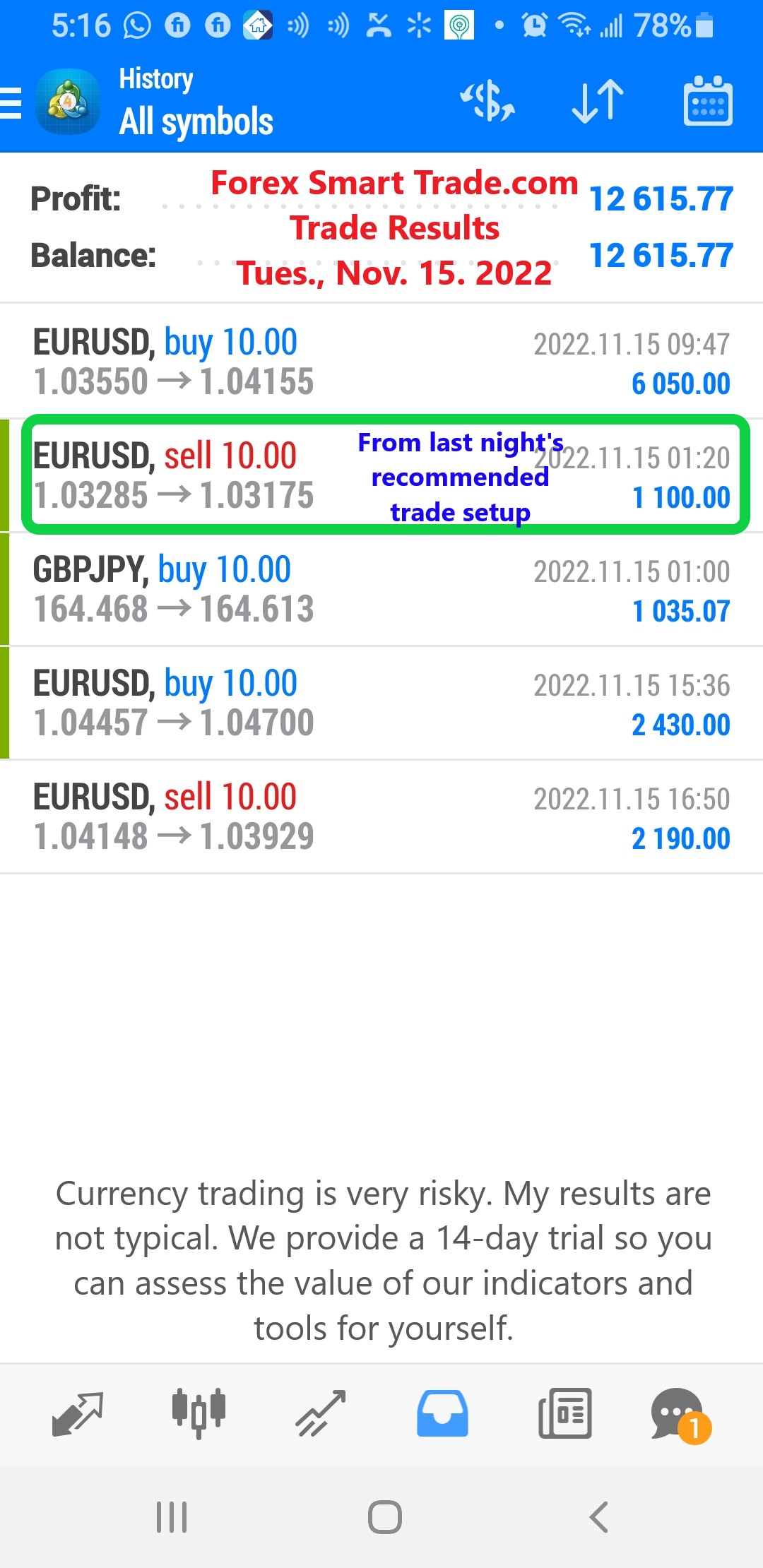

Forex Smart Trade Results November 15, 2022 – $12,615

The “Hybrid Model” Used By Forex Brokers. Let’s review the hybrid model used by forex brokers. In the previous lesson, we talked about why forex brokers are […]